Preliminary Offering Circular, dated February 27, 2025

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Securities and Exchange Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

2,222,222 Units

Consisting of an Aggregate of

2,222,222 Common Shares

and

2,222,222 Warrants to Purchase One Common Share

2,222,222 Common Shares Issuable upon the Exercise of the Warrants

Medicus Pharma Ltd.

We are offering on a “best efforts” basis a maximum of 2,222,222 units (each, a "Unit") at a fixed price between $3.50 to $5.50 per Unit (to be fixed by post-qualification supplement). Each Unit consists of one common share of Medicus Pharma Ltd. (the "Company"), no par value, and one warrant to purchase one common share (each, a "warrant"), for an aggregate offering of 2,222,222 common shares and 2,222,222 warrants, pursuant to Tier 2 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). Each warrant is immediately exercisable for one of our common shares at an exercise price of $ per share and will expire five years from the date of issuance. The Units will not be certificated and the common shares and warrants comprising the Units are immediately separable and will be issued separately in this offering. Pursuant to this offering circular, we are also offering the 2,222,222 common shares issuable from time to time upon the exercise of the warrants offered hereby.

______________________

Our common shares and public warrants, with an exercise price of $4.64 and expiration date of November 15, 2029 (the “Public Warrants”) are listed on The Nasdaq Capital Market (the “Nasdaq”), under the symbols "MDCX" and "MDCXW," respectively. The warrants offered hereby will not trade on any U.S. securities exchange and we will not apply for listing on any U.S. securities exchange. Therefore, without an active trading market for the warrants, the liquidity of such warrants will be limited.

The closing price of our common shares and Public Warrants on the Nasdaq on February 26, 2025 were $4.04 and $1.02, respectively.

We are an "emerging growth company" and a "smaller reporting company" under applicable U.S. Securities and Exchange Commission rules and will be eligible for reduced public company disclosure requirements. See "Offering Circular Summary-Implications of Being an Emerging Growth Company" and "Offering Circular Summary-Implications of Being a Smaller Reporting Company."

______________________

This offering is being conducted on a “best-efforts” basis, which means that there is no minimum number of Units that must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. None of the proceeds received will be placed in an escrow or trust account. All proceeds from this offering will become immediately available to us and may be used as they are accepted. Purchasers of the Units will not be entitled to a refund and could lose their entire investments.

We estimate that this offering will commence within two days of SEC qualification; this offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) one year from the date of SEC qualification, or (c) the date on which this offering is earlier terminated by us, in our sole discretion. See “Plan of Distribution”.

Investing in our securities involves risks. See "Risk Factors" beginning on page 9 of this offering circular.

| Per Unit | Total | ||

| Public offering price | $ | $ | |

| Commissions(1) | $ | $ | |

| Proceeds, before expenses | $ | $ |

(1) We have engaged Maxim Group LLC and Brookline Capital Markets, a division of Arcadia Securities, LLC (together, the “Placement Agents”) to act as placement agents for this offering, in exchange for a fee of 7.5% of the aggregate offering price of the Units sold in this offering.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the SEC; however, the SEC has not made an independent determination that the securities offered are exempt from registration.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This offering circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

______________________

|

Maxim Group LLC |

Brookline Capital Markets a division of Arcadia Securities, LLC |

The date of this offering circular is , 2025

TABLE OF CONTENTS

- i -

Neither we, nor the Placement Agents have authorized anyone to provide any information or to make any representations other than the information contained in this offering circular, any amendment or supplement to this offering circular or in any free writing offering circular prepared by or on behalf of us or to which we may have referred you. We and the Placement Agents take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Placement Agents have not authorized any other person to provide you with different or additional information. Neither we nor the Placement Agents are making an offer to sell the common shares or the warrants in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United States and elsewhere solely on the basis of the information contained in this offering circular. You should assume that the information appearing in this offering circular is accurate only as of the date on the front cover of this offering circular, regardless of the time of delivery of this offering circular or any sale of the common shares or the warrants. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this offering circular. This offering circular is not an offer to sell or the solicitation of an offer to buy the common shares or the warrants in any circumstances under which such offer or solicitation is unlawful.

For investors outside the United States: Neither we nor any of the Placement Agents have done anything that would permit this offering or the possession or distribution of this offering circular in any jurisdiction where action for those purposes is required, other than in the United States. Persons outside the United States who come into possession of this offering circular must inform themselves about, and observe any restrictions relating to, this offering of Units and the distribution of this offering circular outside the United States.

Unless the context otherwise requires, in this offering circular, the term(s) "we", "us", "our", "Company", "our company", "Medicus," and "our business" refer to Medicus Pharma Ltd. and our subsidiaries.

MARKET, INDUSTRY AND OTHER DATA

This offering circular contains estimates, projections and other information concerning our industry, our business, and the markets for our products. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data, and similar sources that we believe to be reasonable and reliable.

In addition, assumptions and estimates of our and our industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in "Risk Factors." These and other factors could cause our future performance to differ materially from our assumptions and estimates. See "Cautionary Statement Regarding Forward-Looking Statements."

TRADEMARKS AND TRADE NAMES

We own or have rights to certain trademarks that we use in conjunction with the operations of our business. Each trademark, trade name, service mark or copyright of any other company appearing or incorporated by reference in this offering circular belongs to its holder. Solely for convenience, trademarks, trade names, service marks and copyrights referred to in this prospectus may appear with or without the "©", "®" or "™" symbols, but the inclusion, or not, of such references are not intended to indicate, in any way, that we, or the applicable owner, will not assert, to the fullest extent possible under applicable law, our or their, as applicable, rights to these trademarks, trade names service marks or copyrights. We do not intend our use or display of other companies' trademarks, trade names, service marks or copyrights to imply a relationship with, or endorsement or sponsorship of us by, such other companies.

- ii -

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise indicated, the consolidated financial statements and related notes included in this offering circular have been prepared in accordance with the International Financial Reporting Standards, or IFRS ("IFRS"), as issued by the International Accounting Standards Board, or IASB ("IASB"). None of the consolidated financial statements in this prospectus were prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). Our functional currency is U.S. dollars.

EXCHANGE RATE INFORMATION

In this offering circular, all dollar amounts referenced, unless otherwise indicated, are expressed in U.S. dollars and are referred to as "$" or "U.S.$". Canadian dollars are referred to as "C$". The following table sets out, for the periods indicated, the high, low, and period end indicative rates of exchange for US$1.00 expressed in Canadian dollars as published by the Bank of Canada:

| Nine months ended September 30, 2024 (C$) |

Year ended December 31, 2024 (C$) |

Year ended December 31, 2023 (C$) |

Year ended December 31, 2022 (C$) |

|

| As at end of period | 1.3499 | 1.4389 | 1.3226 | 1.3544 |

| Low for the period | 1.3316 | 1.3316 | 1.3128 | 1.2451 |

| High for the period | 1.3858 | 1.4416 | 1.3875 | 1.3856 |

| Average rate for the period | 1.3604 | 1.3698 | 1.3497 | 1.3013 |

On February 26, 2025, the daily average exchange rate for Canadian dollars in terms of the U.S. dollar, as quoted by the Bank of Canada, was $1.00 = C$1.4339.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This offering circular includes forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this offering circular regarding our strategy, future operations, regulatory process, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. The words "believe", "anticipate", "intend", "expect", "target", "goal", "estimate", "plan", "assume", "may", "will", "predict", "project", "would", "could" and similar expressions or the negative of such terms are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this offering circular include, but are not limited to, statements about:

• our financial results, including our ability to generate earnings and achieve and sustain profitability, which may vary significantly from forecasts and from period to period;

• the progress, timing and completion of our research, development and preclinical studies and clinical trials for our products and product candidates;

• our ability to market, commercialize, achieve market acceptance for and sell our products and product candidates;

• our ability to develop, manage and maintain our direct sales and marketing organizations;

• our estimates regarding anticipated operating losses, future revenues, capital requirements and our needs for additional financing;

- iii -

• market risks regarding consolidation in the healthcare industry;

• the willingness of healthcare providers to purchase our products if coverage, reimbursement and pricing from third party payors for procedures using our products significantly declines;

• our ability to adequately protect our intellectual property and operate our business without infringing upon the intellectual property rights of others;

• the fact that product quality issues or product defects may harm our business;

• any product liability claims; and

• the regulatory, legal and certain operating risks that our operations subject us to.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this offering circular, particularly the factors described in the "Risk Factors" section of this offering circular, that could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make.

You should read this offering circular and the documents that we have filed as exhibits to this offering circular completely and with the understanding that our actual future results may be materially different from what we expect. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to risks, uncertainties and assumptions about us, including those listed in the sections of this offering circular entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in this offering circular.

Any forward-looking statement made by us in this presentation is based on information currently available to us and speaks only as of the date on which it is made. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

- iv -

OFFERING CIRCULAR SUMMARY

This summary highlights selected information contained elsewhere in this offering circular and is qualified in its entirety by the more detailed information and consolidated financial statements and the related notes thereto included elsewhere in this offering circular. This summary does not contain all the information you should consider before investing in our securities. You should read this entire offering circular carefully, including "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our consolidated financial statements and the related notes thereto included elsewhere in this offering circular, before making an investment decision.

Overview

Our Company

We are a biotech/life sciences company focused on accelerating the clinical development programs of novel and disruptive therapeutic assets. Currently, we are developing one product, SkinJectTM (the "Product"), with an indication for basal cell carcinoma.

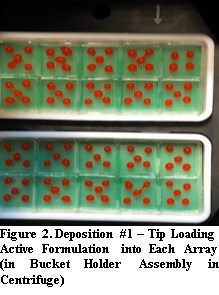

Through our wholly owned subsidiary, SkinJect, Inc. ("SkinJect"), we focus on the development of our in-licensed drug device combination product using novel dissolvable microneedle arrays for the treatment of non-melanoma skin cancers. Our combination product candidate is a doxorubicin tip-loaded D-MNA filed with the U.S. Food and Drug Administration (the "FDA") under an Investigational New Drug Application and is regulated by the Center for Drug Evaluation and Registration (CDER), Oncology Division.

Prior to the Company's acquisition of SkinJect, our business was undertaken by SkinJect as a stand-alone entity. References to our business as conducted at a date prior to the completion of the Business Combination (as defined below) relate to the business undertakings of SkinJect.

For information on the Business Combination, see "Corporate History and Information."

We are subject to significant risks and uncertainties, including those related to our limited operating history, our lack of historical earnings, and the fact that the Product is a novel technology for which regulatory approval might not be achieved. For more information, see "Risk Factors."

Our Strategy

Our principal purpose is to advance the clinical development program of the Product, a novel, minimally invasive treatment for basal cell carcinoma and potentially other common forms of non-melanoma skin cancer. We also seek to opportunistically identify, evaluate and acquire accretive assets, properties or businesses.

The Product is considered an Investigational New Drug ("IND") by the FDA. In January 2024, we submitted to the FDA a Phase 2 IND clinical protocol to non-invasively treat basal cell carcinoma of the skin using the Product. The clinical protocol was updated in July 2024.

We may also trial the Product on other forms of skin cancer beyond basal cell carcinoma. Specifically, it may be trialed against squamous cell carcinoma, cutaneous T-cell lymphoma, as well as pre-cancerous lesions, among other clinical indications, subject to the Company having the capital resources available to do so, without any need to amend or expand the scope of the Company's existing licenses.

In addition, our business strategy includes the opportunistic acquisition of other accretive clinical stage life sciences and biotechnology companies. We have not identified any potential acquisitions at this time, nor have we entered into any agreement, letter of intent or other similar document with respect to any proposed acquisition.

For additional information regarding the business of the Company and the regulatory environment in which it operates, please refer to the offering circular under the heading "Our Business."

Our Strengths

Our key competitive strengths include:

• A senior management team, led by Dr. Raza Bokhari, that has deep experience in medicine and pharmaceutical science as well as a proven track record in business development and entrepreneurship.

• Successful completion of a Phase 1 study of the Product.

• Potential to treat a range of other common non-melanoma skin cancers as well as pre-cancerous lesions.

Summary Risk Factors

Investing in our securities involves risk. Our ability to execute our strategy is also subject to certain risks. The risks described in "Risk Factors" in this offering circular may cause us to not realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant risks include the following:

• our financial results, including our ability to generate earnings and achieve and sustain profitability (as of September 30, 2024, we had an accumulated deficit of approximately US$27.8 million), may vary significantly from forecasts and from period to period;

• the progress, timing and completion of our research, development and preclinical studies and clinical trials for our products and product candidates

• our ability to market, commercialize, achieve market acceptance for and sell our products and product candidates, our ability to develop, manage and maintain our direct sales and marketing organizations;

• our estimates regarding anticipated operating losses, future revenues, capital requirements and our needs for additional financing;

• market risks regarding consolidation in the healthcare industry;

• the willingness of healthcare providers to purchase our products if coverage, reimbursement and pricing from third party payors for procedures using our products significantly declines;

• our ability to adequately protect our intellectual property and operate our business without infringing upon the intellectual property rights of others;

• the fact that product quality issues or product defects may harm our business, any product liability claims; and

• the regulatory, legal and certain operating risks that our operations subject us to.

Please see "Risk Factors" for a discussion of these and other factors you should consider before making an investment in our common shares and warrants.

Corporate Structure

An organizational chart showing our basic corporate structure is set forth below (both subsidiaries are 100% owned by Medicus Pharma Ltd.):

Corporate History and Information

Our company (formerly, Interactive Capital Partners Corporation) was incorporated pursuant to the Business Corporations Act (Ontario) on April 30, 2008 under the name Interactive Capital Partners Corporation. Prior to the Business Combination (as defined below), the Company existed as a shell company and had no business operations.

On September 29, 2023, the Company completed a business combination (the "Business Combination") with SkinJect, a company existing under the laws of Pennsylvania. The Business Combination was completed pursuant to a business combination agreement dated May 12, 2023, as amended, among the Company, SkinJect and RBx Capital, LP ("RBx"), an investment entity owned and managed by Dr. Raza Bokhari, and resulted in a reverse takeover of Interactive Capital Partners Corporation (the Company as it existed prior to the Business Combination) by the former shareholders of SkinJect, with SkinJect becoming a wholly owned operating subsidiary of the Company, and the Company being renamed "Medicus Pharma Ltd." The structure of the Business Combination is commonly used by companies seeking to become reporting issuers in Canada, as it allows the combined entity to be listed on the TSXV at relatively low cost while completing a concurrent equity financing. SkinJect and RBx structured the Business Combination as a reverse takeover for these reasons.

On October 11, 2023, the Company (as it exists after the Business Combination) commenced trading on the TSXV. On November 15, 2024, we completed our initial public offering in the United States and our common shares and Public Warrants began trading on the Nasdaq under the symbols "MDCX" and "MDCXW", respectively.

The Company's registered and head office is located at One First Canadian Place, 100 King Street West, Suite 3400, Toronto, Ontario M5X 1A4, Canada.

We lease U.S. office space in Conshohocken, Pennsylvania to operate the businesses of our U.S. subsidiaries, Medicus Pharma Inc. and SkinJect, Inc.

Our website address is www.medicuspharma.com. Information contained on our website is not incorporated by reference into this offering circular, and you should not consider information contained on our website to be part of this offering circular or in deciding whether to purchase our securities. Our agent for service of process in the United States is Medicus Pharma Inc.

Share Consolidation

In connection with our U.S. initial public offering, we effected a 1-for-2 consolidation, or reverse stock split (the "Share Consolidation"), of our issued and outstanding common shares. Except where otherwise indicated, all share and per share data in this offering circular have been retroactively restated to reflect the Share Consolidation.

Recent Developments

TSXV Delisting

On February 11, 2025, the Company announced that the Company's board of directors had approved the voluntary delisting of its common shares from the TSXV. The delisting was completed on February 21, 2025. The Company’s common shares will continue to be listed and trade on the Nasdaq under the symbol “MDCX”.

Standby Equity Purchase Agreement

On February 10, 2025, the Company also announced that it had entered into a Standby Equity Purchase Agreement (the “SEPA”) with YA II PN, Ltd. (“Yorkville”). Pursuant to the SEPA and subject to the satisfaction of certain conditions, Yorkville has committed to purchase the Company’s common shares, no par value, in increments (each purchase, an “Advance”) up to an aggregate gross sales price of up to $15,000,000 during the 36 months following the date of the SEPA. The common shares will be sold at the Company’s option pursuant to the SEPA at 97% of the Market Price (as defined pursuant to the SEPA) and purchases are subject to certain limitations set forth in the SEPA. The Company reserves the right to set a minimum acceptable price in connection with any Advance. The Company expects to use the net proceeds from any Advance, if any, to fund its Phase 2 proof of concept clinical trial for treatment of basal cell carcinoma using its doxorubicin tip loaded dissolvable microarray needle skinpatch. The Company may also use the net proceeds of the SEPA to expand its exploratory phase 2 clinical trial to a pivotal trial and/or to expand its trials to cover other non-melanoma skin diseases. The Company expects to use any remaining net proceeds for general corporate purposes and working capital.

Yorkville’s obligation to purchase common shares pursuant to the SEPA is subject to a number of conditions, including that the Company file a registration statement (the “Registration Statement”) with the SEC registering the resale of the Commitment Shares (as defined below) and the common shares. The Company is required to have a Registration Statement declared effective by the SEC before it can sell any common shares to Yorkville pursuant to the SEPA.

The total number of common shares issuable under the terms of the SEPA is limited to a number equivalent to 19.99% of the outstanding common shares as of the date of the SEPA unless certain pricing conditions are met, which could have the effect of limiting the total proceeds made available to the Company under the SEPA. The issuance of common shares under the SEPA is subject to further limitations, including that the common shares beneficially owned by Yorkville and its affiliates at any one time will not exceed 4.99% of the then-outstanding common shares.

As consideration for Yorkville’s commitment to purchase common shares pursuant the SEPA, the Company paid Yorkville a structuring fee in the amount of $25,000 and issued to Yorkville 105,840 common shares (the “Commitment Shares”).

Submission of Phase 2 Clinical Design (SKNJCT-004) to the United Arab Emirates Department of Health

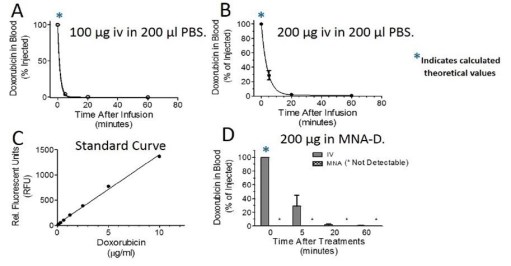

On February 27, 2025, the Company announced that it had submitted a clinical design (SKNJCT-004) to the United Arab Emirates Department of Health to non-invasively treat BCC of the skin. The clinical study, SKNJCT-004, is designed to be a randomized, double-blind, placebo-controlled (P-MNA), multi-center study enrolling up to 36 subjects presenting with BCC of the skin. The study will evaluate the efficacy of two dose levels of D-MNA compared to a placebo control. The participants will be randomized 1:1:1 to one of three groups: a placebo-controlled group receiving P-MNA, a low-dose group receiving 100μg of D-MNA, and a high-dose group receiving 200μg of D-MNA. The study is expected to randomize thirty-six (36) patients in four sites in the UAE.

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenues during our last fiscal year, we qualify as an "emerging growth company" as that term is defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). As an emerging growth company we expect to take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These reduced reporting requirements include, but are not limited to:

• not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended ("Sarbanes-Oxley Act");

• reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements; and

• an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or stockholder approval of any golden parachute arrangements.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a "large accelerated filer," our annual gross revenues exceed $1.235 billion or we issue more than $1 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

The JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. As an emerging growth company, we intend to take advantage of an extended transition period for complying with new or revised accounting standards as permitted by the JOBS Act. We have elected to take advantage of certain of the reduced disclosure obligations in this offering circular and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information in this offering circular and that we provide to our shareholders in the future may be different than what you might receive from other public reporting companies in which you hold equity interests.

Implications of Being a Smaller Reporting Company

Additionally, we are a "smaller reporting company," meaning that the market value of our common shares held by non-affiliates plus the proposed aggregate amount of gross proceeds to us as a result of this transaction is less than $700 million and our annual revenue is less than $100 million during the most recently completed fiscal year. As such, we are eligible for exemptions from various reporting requirements applicable to other public companies that are not smaller reporting companies, including, but not limited to, reduced disclosure obligations regarding executive compensation. We may continue to be a smaller reporting company as long as either (i) the market value of our common shares held by non-affiliates is less than $250 million or (ii) our annual revenue is less than $100 million during the most recently completed fiscal year and the market value of our common shares held by non-affiliates is less than $700 million.

THE OFFERING

This summary highlights information presented in greater detail elsewhere in this offering circular. This summary is not complete and does not contain all the information you should consider before investing in our securities. You should carefully read this entire offering circular before investing in our securities, including "Risk Factors" and our consolidated financial statements.

|

Issuer |

Medicus Pharma Ltd. |

|

Securities offered |

2,222,222 Units on a “best efforts” basis, each Unit consisting of one of our common shares and one warrant to purchase one of our common shares. Each warrant will have an exercise price of $ per share, will be exercisable immediately and will expire five years from the date of issuance. The Units will not be certificated or issued in stand‑alone form. The common shares and the warrants comprising the Units are immediately separable upon issuance and will be issued separately in this offering. Pursuant to this offering circular, we are also offering 2,222,222 common shares issuable from time to time upon the exercise of the warrants offered hereby. |

|

Offering price |

A price between $3.50 to $5.50 per Unit (to be fixed by post-qualification supplement). |

|

Common shares to be |

14,144,783 common shares. |

|

Investor Suitability |

The Securities are being offered and sold to "qualified purchasers" (as defined in Regulation A under the Securities Act of 1933, as amended (the "Securities Act"). "Qualified purchasers" include any person to whom securities are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. |

|

Use of Proceeds |

We intend to use the net proceeds from this offering to fund our Phase 2 proof of concept clinical trial for treatment of basal cell carcinoma using our doxorubicin tip loaded dissolvable microarray needle skinpatch. We may also use the net proceeds of this offering to expand our exploratory phase 2 clinical trial to a pivotal trial and/or to expand our trials to cover other non-melanoma skin diseases. We will use any remaining net proceeds for general corporate purposes and working capital. See "Use of Proceeds." |

|

Voting rights |

Each outstanding common share will be entitled to one vote on all matters submitted to a vote of shareholders. |

|

Listings |

Our common shares and Public Warrants are listed on the Nasdaq under the symbols "MDCX" and "MDCXW," respectively. The warrants offered hereby will not be listed on any U.S. securities exchange. |

|

Dividend policy |

We do not anticipate that we will declare or pay dividends in the foreseeable future on our common shares. Instead, we anticipate that all of our earnings will be used for the operation and growth of our business. Any future determination to declare cash dividends would be subject to the discretion of our board of directors and would depend upon various factors, including our results of operations, financial condition and liquidity requirements, restrictions that may be imposed by applicable law and our contracts and other factors deemed relevant by our board of directors. |

|

Risk factors |

See "Risk Factors" and the other information included in this offering circular for a discussion of factors you should consider before deciding to invest in our common shares and warrants. |

Except as otherwise noted, all information contained in this offering circular assumes:

• no purchase of common shares or warrants in this offering by directors, officers or existing shareholders; and

• no exercise of our outstanding options (as described herein) and Public Warrants, or the warrants offered in this offering.

The number of common shares that will be outstanding after this offering is based on 11,922,561 common shares outstanding as of February 26, 2025.

Continuing Reporting Requirements Under Regulation A

We are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Exchange Act. Our continuing reporting obligations under Regulation A are deemed to be satisfied as long as we comply with our Section 13(a) reporting requirements.

SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

The following tables set forth our selected historical consolidated financial information. You should read the selected historical consolidated financial information in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this offering circular.

We have derived the selected consolidated statement of operations information for the three and nine months ended September 30, 2024 and the selected consolidated balance sheet information as of September 30, 2024 from our unaudited consolidated interim financial statements included elsewhere in this offering circular. We have derived the selected consolidated statement of operations for the years ended December 31, 2023 and 2022 and the selected consolidated balance sheet information as of December 31, 2023 and 2022 from our audited consolidated financial statements included elsewhere in this offering circular. Our consolidated financial statements have been prepared in accordance with IFRS and our consolidated financial statements are presented in U.S. dollars, except where indicated otherwise. Our historical results are not necessarily indicative of the results that should be expected in any future period.

CONSOLIDATED STATEMENT OF OPERATIONS

| Three Months Ended September 30, |

Nine Months Ended September 30, |

Years Ended December 31, |

||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2023 | 2022 | |||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||

| Operating expenses | ||||||||||||||||||

| General and administrative | 2,201,911 | 186,418 | 6,008,493 | 725,957 | 2,366,202 | 332,032 | ||||||||||||

| Research and development | 777,514 | 40,395 | 2,162,680 | 159,083 | 193,578 | 646,384 | ||||||||||||

| Depreciation | 26,322 | - | 78,395 | - | - | - | ||||||||||||

| Share-based compensation | - | - | 580,629 | - | 146,671 | - | ||||||||||||

| Total operating expenses | 3,005,747 | 226,813 | 8,830,197 | 885,040 | 2,706,451 | 978,416 | ||||||||||||

| Loss from operations | (3,005,747 | ) | (226,813 | ) | (8,830,197 | ) | (885,040 | ) | (2,706,451 | ) | (978,416 | ) | ||||||

| Finance expense (income), net | (46,531 | ) | 186,214 | 50,738 | 500,579 | 500,579 | 713,966 | |||||||||||

| Listing expense | - | 2,550,665 | - | 2,550,665 | 3,271,462 | - | ||||||||||||

| Net loss and comprehensive loss for the period | (2,959,216 | ) | (2,963,692 | ) | (8,880,935 | ) | (3,936,284 | ) | (6,478,492 | ) | (1,692,382 | ) | ||||||

| Loss per share - basic and diluted | (0.31 | ) | (1.47 | ) | (0.98 | ) | (2.04 | ) | (1.86 | ) | (0.90 | ) | ||||||

| Weighted average number of common shares | ||||||||||||||||||

| outstanding - basic and diluted | 9,514,738 | 2,019,505 | 9,037,153 | 1,930,261 | 3,479,510 | 1,884,900 | ||||||||||||

CONSOLIDATED BALANCE SHEET DATA

| September 30, 2024 |

December 31, 2023 |

December 31, 2022 |

|||||||

| $ | $ | $ | |||||||

| Assets | |||||||||

| Current assets | |||||||||

| Cash and cash equivalents | 5,306,159 | 1,719,338 | 267,652 | ||||||

| Prepaids | 136,361 | 173,719 | 15,000 | ||||||

| Total Current assets | 5,442,520 | 1,893,057 | 282,652 | ||||||

| Non-current assets | |||||||||

| Right-of-use assets, net | 278,389 | - | - | ||||||

| Total assets | 5,720,909 | 1,893,057 | 282,652 | ||||||

| Liabilities | |||||||||

| Current liabilities | |||||||||

| Accounts payable and accrued liabilities | 1,879,834 | 781,609 | 99,794 | ||||||

| Note payable | - | - | 150,000 | ||||||

| Convertible promissory notes | - | - | 1,381,499 | ||||||

| Derivative liability | - | - | 774,074 | ||||||

| Preferred share liability | - | - | 10,075,317 | ||||||

| Lease obligations | 112,387 | - | - | ||||||

| Total current liabilities | 1,992,221 | 781,609 | 12,480,684 | ||||||

| Non-current liabilities | |||||||||

| Lease obligations | 236,584 | - | - | ||||||

| Total liabilities | 2,228,805 | 781,609 | 12,480,684 | ||||||

| Shareholders' equity (deficiency) | |||||||||

| Share capital | 30,516,801 | 19,835,839 | 194,538 | ||||||

| Contributed surplus | 727,300 | 146,671 | - | ||||||

| Deficit | (27,751,997 | ) | (18,871,062 | ) | (12,392,570 | ) | |||

| Total shareholders' equity (deficiency) | 3,492,104 | 1,111,448 | (12,198,032 | ) | |||||

| Total liabilities and shareholders' equity (deficiency) | 5,720,909 | 1,893,057 | 282,652 |

RISK FACTORS

You should carefully consider the risks described below and all other information contained in this offering circular before making an investment decision. If any of the following risks actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our securities could decline, and you may lose part or all of your investment. This offering circular also contains forward-looking information that involves risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors, including the risks described below and elsewhere in this offering circular.

We have a limited operating history, which may make it difficult to evaluation our current business and predict our future performance.

We have a limited operating history and, in particular, no history of earnings; we have not paid any dividends and we are unlikely to pay any dividends in the immediate or foreseeable future. Our success will depend to a large extent on the expertise, ability, judgement, discretion, integrity and good faith of our management.

As we are at an early stage of product development, we have not generated revenues to date. We expect to spend a significant amount of capital to fund research and development and clinical trials. As a result, we expect that our operating expenses will increase significantly and, consequently, we will need to generate significant revenues to become profitable. We cannot predict when, if ever, we will be profitable. Even if we do become profitable, we may not be able to sustain or increase profitability on a quarterly or annual basis. There can be no assurances that our products will be capable of being produced in commercial quantities at reasonable costs, or be successfully marketed.

We have a novel technology with uncertain market acceptance.

The Product is at an early stage of development, with uncertain market acceptance. Product approval, should this be achieved, does not infer that the Product will garner a good market price or be reimbursed by public or private insurers. Further, there are no guarantees that the Product will be positively received by the target patient population. The acceptability of the Product to regulators, payors and patients will depend on the relative risk versus benefit of the Product as proven in clinical trials, the acceptability of the price, and the relative attractiveness as compared to other treatments.

We could also suffer the consequences of non-compliance or breaches by licensors in connection with any license agreements we may enter into in the future. Such non-compliance or breaches by such third parties could in turn result in breaches or defaults under any agreements with other collaboration partners, and we could be found liable for damages or lose certain rights, including rights to develop and/or commercialize the Product. Loss of our rights to any license granted to us in the future, or the exclusivity rights provided therein, could harm our financial condition and operating results.

The University of Pittsburgh may terminate our license agreement in certain circumstances.

The License Agreement (as defined herein) is our main asset and the basis for the development of the Product. The University of Pittsburgh of the Commonwealth System of Higher Education (the "University of Pittsburgh") has the right to terminate the License Agreement if breaches are not cured within 30 days of our receipt of notice thereof from the University of Pittsburgh or in certain insolvency-related situations or if we cease to carry out our business. There can be no assurance that we will be able to comply with the License Agreement following the offering or that the University of Pittsburgh will grant any necessary waivers if we are unable to do so. The obligations under the License Agreement principally require the trial of the Product on specified timelines. If the University of Pittsburgh were to terminate the License Agreement our assets would essentially be rendered worthless and it would have a material adverse effect on our ability to pursue our business objective.

Our intellectual property is held under third-party licenses.

Our intellectual property is held under a third-party license and we may require additional third-party licenses to effectively develop and manufacture our key products or future technologies. There can be no assurance as to the availability or cost of such additional licenses. A substantial number of patents have already been issued to other biotechnology and pharmaceutical companies. To the extent that valid third-party patent rights cover our products or services, we or our strategic collaborators would be required to seek licenses from the holders of these patents in order to manufacture, use or sell these products and services, and payments under them would reduce our profits from these products and services. It is not possible to predict the extent to which we may wish or be required to acquire rights under such patents, the availability and cost of acquiring such rights, and whether a license to such patents will be available on acceptable terms or at all. There may be patents in the United States or in foreign countries or patents issued in the future that are unavailable to license on acceptable terms. Our inability to obtain such licenses may hinder or eliminate an ability to manufacture and market products.

If we breach any of the agreements under which we license rights to intellectual property, we could lose license rights that are important to our business. Our current license agreement may not provide an adequate remedy for any breach by the licensor.

For information on the License Agreement, see "Our Business - Patents and Proprietary Information."

Our technology may not be successful for its intended use.

Although the SkinJect Phase 1 study indicated that the patch is well-tolerated, there is no guarantee that the Phase 2 study will produce similar results or that the Product will ultimately be brought to market or, if it does, that it will be positively received or obtain favorable pricing, which would have a material adverse effect on our results of operations.

Future technology will require regulatory approval, which is costly and we may not be able to obtain it and we may fail to obtain regulatory approvals or only obtain approvals for limited uses or indications.

Market authorization of the Product falls under the regulatory purview of the FDA and other equivalent regulatory bodies worldwide. There can be no assurance that these regulatory bodies will approve the Product in the manner or time frame suggested. Although we intend to work with regulatory consultants and third parties knowledgeable in the area, we cannot ensure that the Product will obtain market authorization in a timely manner, or at all. Market authorization may also be contingent on a less competitive product label, which would negatively impact revenue.

Changes in methods of manufacturing or formulation may result in additional costs or delay.

As the Product is developed through further clinical trials towards approval and commercialization, it is common that various aspects of the development program, such as manufacturing methods and formulation, are altered along the way in an effort to optimize processes and results. Such changes carry the risk that they will not achieve these intended objectives. Any of these changes could cause the Product to perform differently and affect the results of future clinical trials conducted with the altered materials. This could delay completion of clinical trials, require the conduct of bridging clinical trials or the repetition of one or more clinical trials, increase clinical trial costs, delay approval of the Product and jeopardize our ability, or our strategic partners' ability, to commence product sales and generate revenue.

The manufacture of the Product is complex. We or our third-party manufacturers may encounter difficulties in production. If we encounters any such difficulties, our ability to supply the Product for clinical trials or, if approved, for commercial sale could be delayed or halted entirely.

The manufacture of biopharmaceutical products is complex and requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. The process of manufacturing the Product is susceptible to product loss due to contamination, equipment failure or improper installation or operation of equipment, vendor or operator error, contamination and inconsistency in yields, variability in product characteristics and difficulties in scaling the production process. Even minor deviations from normal manufacturing processes could result in reduced production yields, product defects and other supply disruptions. If microbial, viral or other contaminations are discovered in the Product or in the manufacturing facilities in which the Product is made, such manufacturing facilities may need to be closed for an extended period of time to investigate and remedy the contamination. Any adverse developments affecting manufacturing operations for the Product, if any are approved, may result in shipment delays, inventory shortages, lot failures, product withdrawals or recalls, or other interruptions in the supply of our products. We may also have to take inventory write-offs and incur other charges and expenses for products that fail to meet specifications, undertake costly remediation efforts or seek more costly manufacturing alternatives.

We rely on external contract research organizations to provide clinical and nonclinical research services and agreements with these organizations of which one agreement is currently in place.

The outsourcing of functions to contract research organizations involves the risk that third party providers may not perform to our standards, may not produce results in a timely manner or may fail to perform at all. If any contract research organization fails to comply with applicable regulatory requirements, the research and data generated may be deemed unreliable to regulatory authorities. Additional pre-clinical and clinical trials may be required before approval of marketing applications will be given. We cannot provide assurance that all third-party providers will meet the regulatory requirements for research and pre-clinical trials. Failure of third-party providers to meet regulatory requirements could result in repeat pre-clinical and clinical trials, which would delay the regulatory approval process or result in termination of pre-clinical and clinical trials. Any of the foregoing could have a material adverse effect on our business, prospects, results of operations and financial condition.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell the Product, if approved, we may be unable to generate any product revenue.

To successfully commercialize the Product, we will need to build out sales and marketing capabilities, either on our own or with others. The establishment and development of our own commercial team or the establishment of a contract field force to market the Product will be expensive and time-consuming and could delay launch. Moreover, we cannot be certain that we will be able to successfully develop this capability. We may seek to enter into collaborations with other entities to use their established marketing and distribution capabilities, but we may be unable to enter into such agreements on favorable terms, if at all. If any current or future collaborators do not commit sufficient resources to commercialize the Product, or we are unable to develop the necessary capabilities on our own, we may be unable to generate sufficient revenue to sustain our business. We may compete with many companies that currently have extensive, experienced and well-funded marketing and sales operations to recruit, hire, train and retain marketing and sales personnel. Without an internal team or the support of a third party to perform marketing and sales functions, we may be unable to compete successfully against these more established companies.

We rely on key personnel.

Our success depends in large measure on certain key personnel, including our chief executive officer, Dr. Raza Bokhari. The loss of the services of such key personnel could have a material adverse effect on us. The contributions of these individuals to our operations immediately after this offering are likely to be of central importance. In addition, the competition for qualified personnel in the biotech industry is intense and there can be no assurance that we will be able to continue to attract and retain all personnel necessary for the development and operation of our business. Investors must rely upon the ability, expertise, judgment, discretion, integrity and good faith of ours management. Other biotechnology companies with which we compete for qualified personnel have greater financial and other resources, different risk profiles and a longer history in the industry than we do. They also may provide more diverse opportunities and better chances for career advancement. Some of these characteristics may be more appealing to high-quality candidates than those that we have to offer. If we are unable to continue to attract and retain high-quality personnel, the rate of and success with which we can develop and commercialize the Product would be limited.

As a technology-driven company, intellectual input from key management and personnel is critical to achieve our business objectives. Consequently, our ability to retain these individuals and attract other qualified individuals is critical to our success. The loss of the services of key individuals might significantly delay or prevent achievement of our business objectives. In addition, because of a relative scarcity of individuals with the high degree of education and scientific achievement required for our business, competition among biotech companies for qualified employees is intense and, as a result, we may not be able to attract and retain such individuals on acceptable terms, or at all.

SkinJect also has relationships with scientific collaborators at academic and other institutions, some of whom conduct research at SkinJect's request or assist SkinJect in formulating the SkinJect's research and development strategies. These scientific collaborators are not SkinJect employees and may have commitments to, or consulting or advisory contracts with, other entities that may limit their availability to us. In addition, even though SkinJect's collaborators are required to sign confidentiality agreements prior to working, they may have arrangements with other companies to assist such other companies in developing technologies that may prove competitive to us.

Incentive provisions for our key executives include base salary and the granting of stock options that vest over time, designed to encourage such individuals to stay with us. However, a low share price could render such agreements of little value to our key executives. In such event, our key executives could be susceptible to being hired away by our competitors who could offer a better compensation package. If we are unable to attract and retain key personnel our business, financial conditions and results of operations may be adversely affected.

We may not be able to successfully execute our business strategy.

The execution of our business strategy poses many challenges and is based on a number of assumptions. If we experience significant regulatory delays, supply chain disruptions, cost overruns on our programs, or if our business plan is more costly than we anticipate, certain research and development activities may be delayed or eliminated, resulting in changes or delays to our commercialization plans, or we may be compelled to secure additional funding (which may or may not be available) to execute our business strategy. We cannot predict with certainty future revenues or results from operations. If the assumptions on which our revenue or expenditure forecasts are based change, the benefits of our business strategy may change as well.

We will require additional financing in the future, which may not be available on favorable terms or at all.

The development of our business is expected to require additional financing. Failure to obtain sufficient financing may result in the delay or indefinite postponement of our business plans. The initial primary source of funding available to us consists of equity financing. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable to us.

The ongoing volatility in global capital markets has generally made the raising of capital by equity or debt financing more difficult. Access to financing has been negatively impacted by ongoing global economic risks and increased inflation. We will require substantial additional funds for further research and development, and the marketing and sale of our technology. We may attempt to raise additional funds for these purposes through public or private equity or debt financing, collaborations with other therapeutic companies, government grants or other sources. There can be no assurance that additional funding or partnerships will be available on terms acceptable to us and which would foster the successful commercialization of the Product. If additional funds are raised through further issuances of equity or convertible debt securities, existing shareholders could suffer significant dilution, and any new equity securities issued could have rights, preferences and privileges superior to those of the common shares or terms superior to those of the warrants. Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital or to pursue business opportunities, including potential acquisitions. If adequate funds are not obtained, we may be required to reduce, curtail or discontinue operations.

We have had negative operating cash flows since inception and expect to incur losses for the foreseeable future.

We have had negative cash flow from operating activities and has incurred operating losses since its inception. We anticipate that we will continue to incur losses for the foreseeable future, and we expect these losses to increase as we continue our research and development of, and seek regulatory approvals for, our product candidates, prepare for and begin to commercialize any approved product candidates and add infrastructure and personnel to support our product development efforts and operations as a public company. The net losses and negative cash flows incurred to date, together with expected future losses, have had, and likely will continue to have, an adverse effect on our shareholders' deficit and working capital. As of September 30, 2024, we had an accumulated deficit of approximately US$27.8 million. The amount of future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenue.

To the extent that we have negative operating cash flow in future periods, we may need to allocate a portion of our cash reserves to fund such negative cash flow. We may also be required to raise additional funds through the issuance of equity or debt securities. There can be no assurance that we will be able to generate positive cash flow from our operations or that additional capital or other types of financing will be available when needed or on terms favorable to us.

We are in a highly competitive industry which is continuously evolving with technological changes.

We are engaged in an industry that is highly competitive, evolving and characterized by technological change. As a result, it is difficult for us to predict whether, when and by whom new competing technologies or new competitors may enter the market. We face competition from companies with strong positions in certain markets we are currently targeting, and in new markets and regions we may enter. Some of these companies have significantly greater financial, technical, human, research and development, and marketing resources than us. We cannot assure that we will be able to compete effectively against current and future competitors who may discover and develop products in advance of us that are more effective than those developed by us. As a consequence, our current and future technologies may become obsolete or uncompetitive, resulting in adverse effects on revenue, margins and profitability. In addition, competition or other competitive pressures may result in price reductions, reduced margins or loss of market share, any of which could have a material adverse effect on our business, financial condition or results of operations. To the extent that new or improved pharmaceutical drug treatments are introduced that demonstrate better long-term efficacy and safety, patients and physicians may further delay the introduction of patches, such as the Product, if approved, in the skin cancer treatment continuum. the Product could also face competition from other formulations or devices that deliver chemotherapeutic agents on an extended basis.

Many of our competitors have substantially greater financial, technical and other resources, such as larger research and development staffs and experienced commercial and manufacturing organizations. Mergers and acquisitions in the biotechnology and pharmaceutical industries may result in even more resources being concentrated in competitors. As a result, these companies may obtain regulatory approval more rapidly than us are able and may be more effective in selling and marketing their products as well. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors may succeed in developing, acquiring or licensing on an exclusive basis drug products or drug delivery technologies that are more effective or less costly than the Product.

We believe that our ability to compete effectively depends upon many factors both within and beyond our control, including:

• the usefulness, ease of use, performance and reliability of our technology compared to our competitors;

• the activity and tolerability of the Product, including relative to marketed products and product candidates in development by third parties;

• the ability to distinguish safety and efficacy from existing, alternative therapies;

• the timing for the Product to complete clinical development and receive market approval;

• acceptance of the Product by patients, physicians and other health providers,

• our ability to monetize our technology;

• the selection of licensing partners for our technology with the necessary skills and resources to drive uptake;

• our marketing and selling efforts;

• our financial condition and results of operations;

• the ability to maintain a good relationship with regulatory authorities;

• the price of our future products, including in comparison to branded or generic competitors;

• whether coverage and adequate levels of reimbursement are available under private and governmental health insurance plans,

• acquisitions or consolidations within our industry, which may result in more formidable competitors;

• our ability to protect our intellectual property rights,

• our ability to attract, retain and motivate talented employees;

• our ability to cost-effectively manage and grow our operations; and

• our reputation and brand strength relative to that of our competitors.

Our future success will depend on our ability to continually enhance and develop the Product.

There is a broad pipeline of potential new therapies for skin cancer. The market is characterized by rapid technological change and the possibility of frequent new product introductions. Accordingly, our future success depends upon our ability to enhance the Product and to develop, introduce and sell the most accurate products at competitive prices. The development of new technologies and products involves time, substantial costs and risks. Our ability to successfully develop new technologies depends in large measure on our ability to maintain a technically skilled research and development staff and to adapt to technological changes and advances in the industry.

The success of new product introductions depends on a number of factors including the efficacy and safety as demonstrated in clinical trials, the ability to demonstrate the impact of real world evidence, timely and successful product development, the timing and market introduction of competitive products, market acceptance, the effective management of purchase commitments and inventory levels in line with anticipated product demand, the availability of pharmaceutical components in appropriate quantities and costs to meet anticipated demand, the risk that new products may have quality or other defects in the early stages of introduction and our ability to manage distribution and production issues related to new product introductions, the clinical indications for which the product is approved, acceptance by physicians, the medical community and patients of the product as a safe and effective treatment, the ability to distinguish safety and efficacy from existing, less expensive alternative therapies, the convenience of prescribing, administrating and initiating patients on the product, the potential and perceived advantages and/or value of the product over alternative treatments, the cost of treatment in relation to alternative treatments, including any similar generic treatments, the availability of coverage and adequate reimbursement by third-party payors and government authorities to support the product's pricing, the prevalence and severity of adverse side effects and the effectiveness of sales and marketing efforts.

If we are unable, for any reason, to enhance, develop, introduce and sell new products in a timely manner, or at all, in response to changing market conditions or customer requirements or otherwise, our business would be harmed.

If we are unable to differentiate the Product from existing therapies for treatment of skin cancer, or if the FDA or other applicable regulatory authorities approve generic products that compete with the Product, the ability to successfully commercialize the Product would be adversely affected.

Although the Phase 1 study provides preliminary evidence of complete clinical response, it is possible that we will receive data from additional clinical trials or in a post marketing setting from physician and patient experiences with the commercial product that does not continue to support such interpretations. It is also possible that the FDA, physicians and healthcare payers will not agree with our interpretation of existing and future clinical trial data. If we are unable to demonstrate the value of the Product based on clinical data, patient experience, as well as real world evidence, the opportunity for the Product to maintain premium pricing and be commercialized successfully would be adversely affected.

Additionally, the FDA or other applicable regulatory authorities may approve other generic products that could compete with the Product if we cannot adequately protect it with our patent portfolio. For example, in the US, once an NDA is approved, the product covered thereby becomes a "listed drug" which can, in turn, be cited by potential competitors in support of approval of an abbreviated new drug application ("ANDA"). The Federal Food, Drug, and Cosmetic Act (the "FDCA"), FDA regulations and other applicable regulations and policies provide incentives to manufacturers to create modified, non-infringing versions of a drug to facilitate the approval of an ANDA or other application for generic substitutes. These manufacturers might only be required to conduct a relatively inexpensive study to show that their product has the same active ingredient(s), dosage form, strength, route of administration, conditions of use, or labeling as our product candidate and that the generic product is bioequivalent to us, meaning it is absorbed in the body at the same rate and to the same extent as the Product. These generic equivalents, which must meet the same quality standards as branded pharmaceuticals, would be significantly less costly than ours to bring to market and companies that produce generic equivalents are generally able to offer their products at lower prices. Thus, after the introduction of a generic competitor, a significant percentage of the sales of any branded product is typically lost to the generic product. Accordingly, competition from generic equivalents to our products would materially adversely impact our ability to successfully commercialize the Product.

A variety of risks associated with potential international business relationships could materially adversely affect our business.

We may enter into agreements with third parties for the development and commercialization of the Product in international markets. If we do so, we would be subject to additional risks related to entering into international business relationships, including:

● differing regulatory requirements in other countries including, among others, marketing approval, pricing, reimbursement and sales and marketing practices;

● potentially reduced protection for intellectual property rights;

● potential for so-called parallel importing, which is when a local seller, faced with higher local prices, opts to import goods from a foreign market with lower prices, rather than buying them locally;

● unexpected changes in tariffs, trade barriers and regulatory requirements, including the imposition of new tariffs by the U.S. government on imports to the U.S. and/or the imposition of retaliatory tariffs by foreign countries;

● economic weakness, including inflation, or political instability in foreign economies and markets;

● compliance with tax, employment, immigration and labor laws for employees traveling and working abroad;

● foreign taxes;

● foreign currency fluctuations, which could result in increased operating expenses and reduced revenues, and other risks incident to doing business in another country;

● workforce uncertainty in countries where labor unrest is more common than in Canada or the United States;

● production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad or supply chain disruptions; and

● business interruptions resulting from geo-political actions, including war and terrorism, or natural disasters, including earthquakes, volcanoes, typhoons, floods, tsunamis, hurricanes and fires.

These and other risks may materially adversely affect our ability to develop and commercialize products in international markets and may harm our business.

Collaboration arrangements we may enter into in the future may not be successful.

We may seek future partnerships, collaborations and other strategic transactions to maximize the commercial potential of the Product. We may enter into such arrangements on a selective basis depending on the merits of retaining commercialization rights for ourself as compared to entering into selective collaboration arrangements with leading pharmaceutical or biotechnology companies, both in the United States and internationally. We face competition in seeking appropriate collaborators. Moreover, collaboration arrangements are complex and time consuming to negotiate, document and implement. We may not be successful in our efforts to establish and implement collaborations or other alternative arrangements should we choose to enter into such arrangements. The terms of any collaborations or other arrangements that we may establish may not be favorable to us.

Any future collaborations that we enter into may not be successful. The success of our collaboration arrangements will depend heavily on the efforts and activities of our collaborators.

Collaborators generally have significant discretion in determining the efforts and resources that they will apply to these collaborations.

Disagreements between parties to a collaboration arrangement regarding clinical development and commercialization matters could lead to delays in the development process or commercialization of our product candidate and, in some cases, termination of the collaboration arrangement. These disagreements can be difficult to resolve if neither of the parties has final decision-making authority.

Collaborations with pharmaceutical or biotechnology companies and other third parties often are terminated or allowed to expire by the other party. Any such termination or expiration could adversely affect us financially and could harm our business reputation.

We may acquire businesses or products, or form strategic alliances in the future, and we may not realize the benefits of such acquisitions or alliances.

We may acquire additional businesses or products, form strategic alliances or create joint ventures with third parties that we believe will complement or augment our existing business. If we acquire businesses with promising markets or technologies, we may not be able to realize the benefit of acquiring such businesses if we are unable to successfully integrate them with our existing operations and company culture. We may encounter numerous difficulties in developing, manufacturing and marketing any new products resulting from a strategic alliance or acquisition that delay or prevent us from realizing their expected benefits or enhancing our business. We cannot assure you that, following any such acquisition, we will achieve the expected synergies to justify the transaction. In addition, we may require significant additional funds to either acquire such businesses or products or to commercialize them, which may result in significant dilution to shareholders or the incurrence of significant indebtedness by us.

We do not have any customer commitments.

We may negotiate clinical and/or commercial supply agreements for the Product or product sub-components. At the time of this offering circular, there are no commitments from customers for the Product. Because we do not have any contracts for the Product, management may not accurately predict future revenue streams and there may be no assurance that customers would continue to use our products, or that we would be able to replace departing potential customers with new potential customers that provide us with comparable revenue.

Our business and operations would suffer in the event of computer system failures, cyberattacks, or a deficiency in our cyber security.

Despite the implementation of security measures, our internal computer systems, and those of the third parties on which we rely, are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. If such an event were to occur and cause interruptions in our operations, it could result in a material disruption of our commercialization or further development of our technology. To the extent that any disruption or security breach were to result in a loss of or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the further development or the commercialization of our products could be delayed or disrupted.

We may fail to manage growth successfully which may adversely impact operating results.

Our failure to manage our growth successfully may adversely impact our operating results. Our ability to manage growth will require us to continue to build our operational, financial and management controls, contracting relationships, marketing and business development plans and controls and reporting systems and procedures. Our ability to manage our growth will also depend in large part upon a number of factors, including the ability for us to rapidly:

• expand our internal and operational and financial controls significantly so that we can maintain control over operations;

• attract and retain qualified technical personnel in order to continue to develop reliable and flexible products and provide services that respond to evolving customer needs;

• build a sales team to keep customers and channel partners informed regarding the technical features issues and key selling points of our products and services;

• develop support capacity for customers as sales increase; and

• build a channel network to create an expanding presence in the evolving marketplace for our products and services.

An inability to achieve any of these objectives could harm our business, financial condition and results of operations.