Table of Contents

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO (2) BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE OFFERING CIRCULAR MAY BE OBTAINED.

JUKEBOX HITS VOL. 1 LLC

Preliminary Offering Circular

October 5, 2023

Subject to Completion

Best Efforts Offering of Royalty Shares

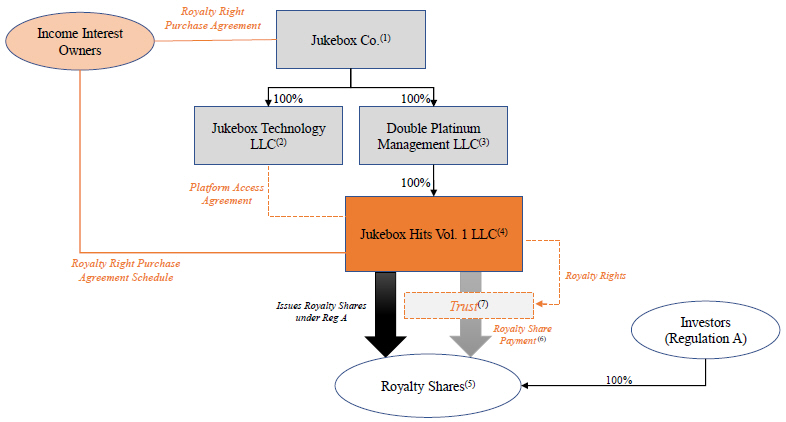

Jukebox Hits Vol. 1 LLC (which we refer to as the “Company,” “we,” “us,” or “our”) is a newly formed Delaware limited liability company established to facilitate and manage investors’ economic exposure to the Company’s contractual right to receive a portion of the royalties, fees, and other income streams (“Income Interests”) related to or derived from musical songs, compositions, sound recordings, portfolios or catalogs (“Music Assets”) from certain Purchase Agreements (including, without limitation, the schedule, exhibits and amendments thereto) described in this Preliminary Offering Circular (the “Offering Circular”) (each, a “Purchase Agreement,” collectively, the “Purchase Agreements”; and the rights of the Company under the Purchase Agreements, the “Royalty Rights”). The Company will facilitate and manage investors’ economic exposure to the Royalty Rights by issuing, for each series, the contractual right (the “Royalty Shares”) to receive a specified portion of royalties, fees, and other income streams embodied in the Income Interests we receive that relate to Royalty Rights for a specific Music Asset or a compilation of Music Assets (as applicable) set forth in the Royalty Shares Offering Table, to investors in this best-efforts offering of securities (this “Offering”) pursuant to Regulation A of the Securities Act of 1933, as amended (the “Securities Act”). The Company will convey, or cause to be conveyed, any Royalty Rights it receives pursuant to the Purchase Agreements and any Royalty Share Payments payable to Holders of Royalty Shares to a newly formed trust under state law (the “Trust”), which will hold the Royalty Rights for the benefit of Holders of Royalty Shares. We may collectively refer to the offerings of Royalty Shares in this Offering Circular as the “Offerings” and each, individually, as an “Offering.”

The Company will enter into one or more Purchase Agreements with Income Interest owners (“Income Interest Owners”). Royalty Shares will be issued in series, with each series relating to a specific Music Asset or a compilation of Music Assets (as applicable), and the Company’s corresponding Royalty Rights under the corresponding Purchase Agreement. Investors who hold Royalty Shares will be entitled to receive a pro rata portion of the amounts we actually receive from the specified Royalty Rights that correspond to such series of Royalty Shares (less any fees and expenses as further described herein), calculated based on the number of Royalty Shares of a particular series that an investor holds compared to the total outstanding number of Royalty Shares of such series (payment of such pro rata portion, “Royalty Share Payments”). Purchasing Royalty Shares does not confer to the investor any ownership in the Company, the Trust, or the underlying music portfolio containing the Music Assets.

The Company is managed by its sole member, Double Platinum Management LLC, a Delaware limited liability company (the “Manager”). The Manager is a single-member Delaware limited liability company wholly owned by Jukebox Co., a Delaware corporation (“Jukebox Holding”). The Manager will be deemed to be a statutory underwriter under Section 2(a)(11) of the Securities Act by virtue of any assistance it may provide in the offer and sale of the Company’s securities in connection with the Offering.

Table of Contents

The Royalty Shares will be made available for purchase through the Company’s associated persons on the web-based platform located at https://www.jkbx.com (the “JKBX Platform”). The JKBX Platform is owned by Jukebox Technology LLC, a Delaware limited liability company (“Jukebox Technology”) and a wholly-owned subsidiary of Jukebox Holding. An investor may view Offering details on the JKBX Platform and, after establishing a user profile, sign transactional documents for Offerings online.

This Offering is being conducted by the Company as a direct public offering (i.e., without the benefit of the services of an SEC-registered broker-dealer) on a “best efforts” basis in a “Tier 2” Regulation A offering by associated persons of ours through the JKBX Platform. We expect to offer Royalty Shares in this Offering until we raise the maximum amount being offered, but there is no guarantee that any amount will be sold. The offering of each series of Royalty Shares described in and qualified pursuant to this Offering Circular will commence on the date on which the Offering is qualified by the U.S. Securities and Exchange Commission (the “SEC”). Subscriptions will be accepted on a rolling basis. The Company will close sales of Royalty Shares to investors in the Offering on an ongoing, continuous basis and will purchase Income Interests pursuant to each applicable Purchase Agreement in the form of Royalty Rights as proceeds from the Offering are received by the Company from investors through the sale of Royalty Shares in the Offering that correspond to such Royalty Rights. The Company is seeking to qualify an amount of Royalty Shares that it reasonably expects to be able to sell within two (2) years from the date of initial qualification. In any event, however, the Offering will not exceed three (3) years from the date of commencement in accordance with Rule 251(d)(3)(F) of Regulation A. The Company reserves the right to terminate the Offering for any reason at any time prior to the final closing. The minimum purchase threshold to participate in this Offering per investor per series is one (1) Royalty Share. Subscriptions, once received, are irrevocable by investors but can be rejected by us.

The Company has not engaged commissioned sales agents or broker-dealers and, in conjunction with its associated persons, plans to conduct and distribute the Offering through the JKBX Platform. The Company’s Manager is deemed to be an underwriter in the Offering solely for purposes of Section 2(a)(11) of the Securities Act. No other affiliated entity involved in the offer and sale of the Royalty Shares is currently a member firm of the Financial Industry Regulatory Authority Inc. (“FINRA”) and no person associated with us will be deemed to be a broker solely by reason of his or her participation in the sale of the Royalty Shares. Where appropriate, in order to conduct the offering, the Company intends to register with state securities regulators as an Issuer-Dealer or register one or more of its associated persons, including the Manager, where required, with state securities regulators as an Issuer-Agent. See “Plan of Distribution” in this Offering Circular for additional information.

We will serve as our own transfer agent and registrar in connection with this Offering.

We do not currently intend to list the Royalty Shares for trading on a national securities exchange. We may, in the future, facilitate secondary sales of Royalty Shares on an alternative trading system owned by an SEC-registered broker-dealer and a member of FINRA and the Securities Investors Protection Corporation (“SIPC”), referred to as the “ATS.” Additionally, we may engage the services of an SEC-registered broker-dealer and a member of FINRA and SIPC to provide Holders of the Royalty Shares with access to the ATS through the JKBX Platform. No assurance can be given that the Company, the ATS or any such broker-dealer we engage will be in a position to facilitate sales of the Royalty Shares or, in the event they are able to facilitate such sales, provide an effective means of selling your Royalty Shares or that the price at which any Royalty Shares may be sold through any broker-dealer or ATS with the assistance of such broker-dealer (or otherwise) will be reflective of the actual value of the Royalty Shares or the underlying Royalty Rights. If secondary sales of Royalty Shares are possible on the ATS, such sales may be subject to fees imposed by the ATS and/or the broker-dealer we engage or other broker-dealers operating on the ATS.

No sales of Royalty Shares will be made prior to the qualification of an offering statement by the SEC. After qualification of an offering statement, the Company may add additional Royalty Shares or series of Royalty Shares by post-qualification amendment to the offering statement. All Royalty Shares will be offered in all jurisdictions at the same price that is set forth in this Offering Circular. The initial offering prices of the Royalty Shares were determined by the Manager on an arbitrary basis, and such prices bear no relationship to our book or asset values, or to any other established criteria for valuing Royalty Shares.

| Royalty Shares Offered by the Company(1) | Per Royalty Share Price to Public |

Per Royalty Share Broker-dealer Discounts and Commissions(2) |

Per Royalty Share Proceeds to Us |

Maximum Price to Public |

Maximum Broker-dealer Discounts and Commissions(2) |

Maximum Proceeds to Us |

||||||||||||||||||

| JKBX HITS VOL1 00005 |

$ | 2.23 | $ | — | $ | 2.23 | $ | 223,000.00 | $ | — | $ | 223,000.00 | ||||||||||||

| JKBX HITS VOL1 00006 |

$ | 9.05 | $ | — | $ | 9.05 | $ | 905,000.00 | $ | — | $ | 905,000.00 | ||||||||||||

| JKBX HITS VOL1 00007 |

$ | 1.65 | $ | — | $ | 1.65 | $ | 165,000.00 | $ | — | $ | 165,000.00 | ||||||||||||

| JKBX HITS VOL1 00008 |

$ | 1.32 | $ | — | $ | 1.32 | $ | 132,000.00 | $ | — | $ | 132,000.00 | ||||||||||||

| JKBX HITS VOL1 00009 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 38,400.16 | $ | — | $ | 38,400.16 | ||||||||||||

| JKBX HITS VOL1 00010 |

$ | 27.93 | $ | — | $ | 27.93 | $ | 3,713,572.80 | $ | — | $ | 3,713,572.80 | ||||||||||||

| JKBX HITS VOL1 00011 |

$ | 2.16 | $ | — | $ | 2.16 | $ | 216,000.00 | $ | — | $ | 216,000.00 | ||||||||||||

| JKBX HITS VOL1 00012 |

$ | 4.49 | $ | — | $ | 4.49 | $ | 449,000.00 | $ | — | $ | 449,000.00 | ||||||||||||

| JKBX HITS VOL1 00013 |

$ | 8.01 | $ | — | $ | 8.01 | $ | 801,000.00 | $ | — | $ | 801,000.00 | ||||||||||||

| JKBX HITS VOL1 00014 |

$ | 10.26 | $ | — | $ | 10.26 | $ | 1,026,000.00 | $ | — | $ | 1,026,000.00 | ||||||||||||

| JKBX HITS VOL1 00015 |

$ | 1.98 | $ | — | $ | 1.98 | $ | 198,000.00 | $ | — | $ | 198,000.00 | ||||||||||||

| JKBX HITS VOL1 00016 |

$ | 2.79 | $ | — | $ | 2.79 | $ | 279,000.00 | $ | — | $ | 279,000.00 | ||||||||||||

| JKBX HITS VOL1 00017 |

$ | 2.06 | $ | — | $ | 2.06 | $ | 206,000.00 | $ | — | $ | 206,000.00 | ||||||||||||

| JKBX HITS VOL1 00018 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 88,878.48 | $ | — | $ | 88,878.48 | ||||||||||||

| JKBX HITS VOL1 00019 |

$ | 1.02 | $ | — | $ | 1.02 | $ | 102,000.00 | $ | — | $ | 102,000.00 | ||||||||||||

| JKBX HITS VOL1 00020 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 54,688.77 | $ | — | $ | 54,688.77 | ||||||||||||

| JKBX HITS VOL1 00021 |

$ | 5.90 | $ | — | $ | 5.90 | $ | 590,000.00 | $ | — | $ | 590,000.00 | ||||||||||||

| JKBX HITS VOL1 00022 |

$ | 8.60 | $ | — | $ | 8.60 | $ | 860,000.00 | $ | — | $ | 860,000.00 | ||||||||||||

| JKBX HITS VOL1 00023 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 789.66 | $ | — | $ | 789.66 | ||||||||||||

| JKBX HITS VOL1 00024 |

$ | 1.92 | $ | — | $ | 1.92 | $ | 192,000.00 | $ | — | $ | 192,000.00 | ||||||||||||

| JKBX HITS VOL1 00025 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 65,122.34 | $ | — | $ | 65,122.34 | ||||||||||||

| JKBX HITS VOL1 00026 |

$ | 1.01 | $ | — | $ | 1.01 | $ | 101,000.00 | $ | — | $ | 101,000.00 | ||||||||||||

| JKBX HITS VOL1 00027 |

$ | 30.00 | $ | — | $ | 30.00 | $ | 6,276,750.00 | $ | — | $ | 6,276,750.00 | ||||||||||||

| JKBX HITS VOL1 00028 |

$ | 3.23 | $ | — | $ | 3.23 | $ | 323,000.00 | $ | — | $ | 323,000.00 | ||||||||||||

| JKBX HITS VOL1 00029 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 66,281.15 | $ | — | $ | 66,281.15 | ||||||||||||

| JKBX HITS VOL1 00030 |

$ | 3.47 | $ | — | $ | 3.47 | $ | 347,000.00 | $ | — | $ | 347,000.00 | ||||||||||||

| JKBX HITS VOL1 00031 |

$ | 1.09 | $ | — | $ | 1.09 | $ | 109,000.00 | $ | — | $ | 109,000.00 | ||||||||||||

| JKBX HITS VOL1 00032 |

$ | 3.09 | $ | — | $ | 3.09 | $ | 309,000.00 | $ | — | $ | 309,000.00 | ||||||||||||

| JKBX HITS VOL1 00033 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 434.42 | $ | — | $ | 434.42 | ||||||||||||

| JKBX HITS VOL1 00034 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 24,179.86 | $ | — | $ | 24,179.86 | ||||||||||||

| JKBX HITS VOL1 00035 |

$ | 1.05 | $ | — | $ | 1.05 | $ | 105,000.00 | $ | — | $ | 105,000.00 | ||||||||||||

| JKBX HITS VOL1 00036 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 20,505.48 | $ | — | $ | 20,505.48 | ||||||||||||

| JKBX HITS VOL1 00037 |

$ | 6.42 | $ | — | $ | 6.42 | $ | 642,000.00 | $ | — | $ | 642,000.00 | ||||||||||||

Table of Contents

| Royalty Shares Offered by the Company | Per Royalty Share Price to Public |

Per Royalty Share Broker-dealer Discounts and Commissions |

Per Royalty Share Proceeds to Us |

Maximum Price to Public |

Maximum Broker-dealer Discounts and Commissions |

Maximum Proceeds to Us |

||||||||||||||||||

| JKBX HITS VOL1 00038 |

$ | 3.34 | $ | — | $ | 3.34 | $ | 334,000.00 | $ | — | $ | 334,000.00 | ||||||||||||

| JKBX HITS VOL1 00039 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 43,745.88 | $ | — | $ | 43,745.88 | ||||||||||||

| JKBX HITS VOL1 00040 |

$ | 2.89 | $ | — | $ | 2.89 | $ | 289,000.00 | $ | — | $ | 289,000.00 | ||||||||||||

| JKBX HITS VOL1 00041 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 93,155.27 | $ | — | $ | 93,155.27 | ||||||||||||

| JKBX HITS VOL1 00042 |

$ | 14.51 | $ | — | $ | 14.51 | $ | 1,451,000.00 | $ | — | $ | 1,451,000.00 | ||||||||||||

| JKBX HITS VOL1 00043 |

$ | 6.78 | $ | — | $ | 6.78 | $ | 678,000.00 | $ | — | $ | 678,000.00 | ||||||||||||

| JKBX HITS VOL1 00044 |

$ | 13.09 | $ | — | $ | 13.09 | $ | 1,309,000.00 | $ | — | $ | 1,309,000.00 | ||||||||||||

| JKBX HITS VOL1 00045 |

$ | 5.03 | $ | — | $ | 5.03 | $ | 503,000.00 | $ | — | $ | 503,000.00 | ||||||||||||

| JKBX HITS VOL1 00046 |

$ | 1.79 | $ | — | $ | 1.79 | $ | 179,000.00 | $ | — | $ | 179,000.00 | ||||||||||||

| JKBX HITS VOL1 00047 |

$ | 1.98 | $ | — | $ | 1.98 | $ | 198,000.00 | $ | — | $ | 198,000.00 | ||||||||||||

| JKBX HITS VOL1 00048 |

$ | 1.56 | $ | — | $ | 1.56 | $ | 156,000.00 | $ | — | $ | 156,000.00 | ||||||||||||

| JKBX HITS VOL1 00049 |

$ | 9.76 | $ | — | $ | 9.76 | $ | 976,000.00 | $ | — | $ | 976,000.00 | ||||||||||||

| JKBX HITS VOL1 00050 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 92,208.32 | $ | — | $ | 92,208.32 | ||||||||||||

| JKBX HITS VOL1 00051 |

$ | 3.21 | $ | — | $ | 3.21 | $ | 321,000.00 | $ | — | $ | 321,000.00 | ||||||||||||

| JKBX HITS VOL1 00052 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 70,931.37 | $ | — | $ | 70,931.37 | ||||||||||||

| JKBX HITS VOL1 00053 |

$ | 10.43 | $ | — | $ | 10.43 | $ | 1,043,000.00 | $ | — | $ | 1,043,000.00 | ||||||||||||

| JKBX HITS VOL1 00054 |

$ | 28.96 | $ | — | $ | 28.96 | $ | 4,894,240.00 | $ | — | $ | 4,894,240.00 | ||||||||||||

| JKBX HITS VOL1 00055 |

$ | 1.17 | $ | — | $ | 1.17 | $ | 117,000.00 | $ | — | $ | 117,000.00 | ||||||||||||

| JKBX HITS VOL1 00056 |

$ | 22.49 | $ | — | $ | 22.49 | $ | 2,249,000.00 | $ | — | $ | 2,249,000.00 | ||||||||||||

| JKBX HITS VOL1 00057 |

$ | 1.22 | $ | — | $ | 1.22 | $ | 122,000.00 | $ | — | $ | 122,000.00 | ||||||||||||

| JKBX HITS VOL1 00058 |

$ | 5.27 | $ | — | $ | 5.27 | $ | 527,000.00 | $ | — | $ | 527,000.00 | ||||||||||||

| JKBX HITS VOL1 00059 |

$ | 1.88 | $ | — | $ | 1.88 | $ | 188,000.00 | $ | — | $ | 188,000.00 | ||||||||||||

| JKBX HITS VOL1 00060 |

$ | 1.05 | $ | — | $ | 1.05 | $ | 105,000.00 | $ | — | $ | 105,000.00 | ||||||||||||

| JKBX HITS VOL1 00061 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 45,074.82 | $ | — | $ | 45,074.82 | ||||||||||||

| JKBX HITS VOL1 00062 |

$ | 2.35 | $ | — | $ | 2.35 | $ | 235,000.00 | $ | — | $ | 235,000.00 | ||||||||||||

| JKBX HITS VOL1 00063 |

$ | 1.87 | $ | — | $ | 1.87 | $ | 187,000.00 | $ | — | $ | 187,000.00 | ||||||||||||

| JKBX HITS VOL1 00064 |

$ | 1.89 | $ | — | $ | 1.89 | $ | 189,000.00 | $ | — | $ | 189,000.00 | ||||||||||||

| JKBX HITS VOL1 00065 |

$ | 1.91 | $ | — | $ | 1.91 | $ | 191,000.00 | $ | — | $ | 191,000.00 | ||||||||||||

| JKBX HITS VOL1 00066 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 32,567.59 | $ | — | $ | 32,567.59 | ||||||||||||

| JKBX HITS VOL1 00067 |

$ | 4.38 | $ | — | $ | 4.38 | $ | 438,000.00 | $ | — | $ | 438,000.00 | ||||||||||||

| JKBX HITS VOL1 00068 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 23,605.27 | $ | — | $ | 23,605.27 | ||||||||||||

| JKBX HITS VOL1 00069 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 155.15 | $ | — | $ | 155.15 | ||||||||||||

| JKBX HITS VOL1 00070 |

$ | 14.63 | $ | — | $ | 14.63 | $ | 1,463,000.00 | $ | — | $ | 1,463,000.00 | ||||||||||||

| JKBX HITS VOL1 00071 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 92,415.90 | $ | — | $ | 92,415.90 | ||||||||||||

| JKBX HITS VOL1 00072 |

$ | 1.04 | $ | — | $ | 1.04 | $ | 104,000.00 | $ | — | $ | 104,000.00 | ||||||||||||

| JKBX HITS VOL1 00073 |

$ | 2.08 | $ | — | $ | 2.08 | $ | 208,000.00 | $ | — | $ | 208,000.00 | ||||||||||||

| JKBX HITS VOL1 00074 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 13,514.10 | $ | — | $ | 13,514.10 | ||||||||||||

| JKBX HITS VOL1 00075 |

$ | 3.67 | $ | — | $ | 3.67 | $ | 367,000.00 | $ | — | $ | 367,000.00 | ||||||||||||

| JKBX HITS VOL1 00076 |

$ | 3.07 | $ | — | $ | 3.07 | $ | 307,000.00 | $ | — | $ | 307,000.00 | ||||||||||||

| JKBX HITS VOL1 00077 |

$ | 7.11 | $ | — | $ | 7.11 | $ | 711,000.00 | $ | — | $ | 711,000.00 | ||||||||||||

| JKBX HITS VOL1 00078 |

$ | 18.90 | $ | — | $ | 18.90 | $ | 1,890,000.00 | $ | — | $ | 1,890,000.00 | ||||||||||||

| JKBX HITS VOL1 00079 |

$ | 1.38 | $ | — | $ | 1.38 | $ | 138,000.00 | $ | — | $ | 138,000.00 | ||||||||||||

| JKBX HITS VOL1 00080 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 64,422.56 | $ | — | $ | 64,422.56 | ||||||||||||

| JKBX HITS VOL1 00081 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 2,542.32 | $ | — | $ | 2,542.32 | ||||||||||||

| JKBX HITS VOL1 00082 |

$ | 2.29 | $ | — | $ | 2.29 | $ | 229,000.00 | $ | — | $ | 229,000.00 | ||||||||||||

| JKBX HITS VOL1 00083 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 20,208.02 | $ | — | $ | 20,208.02 | ||||||||||||

| JKBX HITS VOL1 00084 |

$ | 1.66 | $ | — | $ | 1.66 | $ | 166,000.00 | $ | — | $ | 166,000.00 | ||||||||||||

| JKBX HITS VOL1 00085 |

$ | 7.25 | $ | — | $ | 7.25 | $ | 725,000.00 | $ | — | $ | 725,000.00 | ||||||||||||

| JKBX HITS VOL1 00086 |

$ | 1.45 | $ | — | $ | 1.45 | $ | 145,000.00 | $ | — | $ | 145,000.00 | ||||||||||||

| JKBX HITS VOL1 00087 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 49,753.93 | $ | — | $ | 49,753.93 | ||||||||||||

| JKBX HITS VOL1 00088 |

$ | 6.13 | $ | — | $ | 6.13 | $ | 613,000.00 | $ | — | $ | 613,000.00 | ||||||||||||

| JKBX HITS VOL1 00089 |

$ | 27.73 | $ | — | $ | 27.73 | $ | 2,773,000.00 | $ | — | $ | 2,773,000.00 | ||||||||||||

| JKBX HITS VOL1 00090 |

$ | 3.71 | $ | — | $ | 3.71 | $ | 371,000.00 | $ | — | $ | 371,000.00 | ||||||||||||

| JKBX HITS VOL1 00091 |

$ | 6.92 | $ | — | $ | 6.92 | $ | 692,000.00 | $ | — | $ | 692,000.00 | ||||||||||||

| JKBX HITS VOL1 00092 |

$ | 3.26 | $ | — | $ | 3.26 | $ | 326,000.00 | $ | — | $ | 326,000.00 | ||||||||||||

| JKBX HITS VOL1 00093 |

$ | 2.17 | $ | — | $ | 2.17 | $ | 217,000.00 | $ | — | $ | 217,000.00 | ||||||||||||

| JKBX HITS VOL1 00094 |

$ | 6.89 | $ | — | $ | 6.89 | $ | 689,000.00 | $ | — | $ | 689,000.00 | ||||||||||||

| JKBX HITS VOL1 00095 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 45,050.21 | $ | — | $ | 45,050.21 | ||||||||||||

| JKBX HITS VOL1 00096 |

$ | 2.01 | $ | — | $ | 2.01 | $ | 201,000.00 | $ | — | $ | 201,000.00 | ||||||||||||

| JKBX HITS VOL1 00097 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 69,184.06 | $ | — | $ | 69,184.06 | ||||||||||||

| JKBX HITS VOL1 00098 |

$ | 2.38 | $ | — | $ | 2.38 | $ | 238,000.00 | $ | — | $ | 238,000.00 | ||||||||||||

| JKBX HITS VOL1 00099 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 62,355.32 | $ | — | $ | 62,355.32 | ||||||||||||

| JKBX HITS VOL1 00100 |

$ | 1.09 | $ | — | $ | 1.09 | $ | 109,000.00 | $ | — | $ | 109,000.00 | ||||||||||||

| JKBX HITS VOL1 00101 |

$ | 1.07 | $ | — | $ | 1.07 | $ | 35,801.13 | $ | — | $ | 35,801.13 | ||||||||||||

Table of Contents

| (1) | The Company is offering to sell to investors each of the series of Royalty Shares set forth in this table and as further described in the “Royalty Shares Offering Table” beginning on page 65. Please see the “Royalty Shares Offering Table” beginning on page 65 for additional details of each series of Royalty Shares offered hereby, including the corresponding Royalty Rights, the number of Royalty Shares offered of each series, the price per Royalty Share of each series and the maximum amount that may be raised by the offering of each series of Royalty Shares. |

| (2) | Each Offering is being conducted by the Company as a direct public offering (i.e., without the benefit of the services of an SEC-registered broker-dealer) on a “best efforts” basis in a “Tier 2” Regulation A offering by the Company and its associated persons through the web-based JKBX Platform. In conducting this offering, associated persons of the Company, including its Manager, which is acting as a statutory underwriter, intend to rely on the exemption from (securities) broker registration requirements provided in Securities and Exchange Act of 1934 (the “Exchange Act”) Rule 3a4-1. We expect to offer Royalty Shares in each Offering until we raise the maximum amount being offered, but there is no guarantee that any minimum amount will be sold. The Company has not engaged commissioned sales agents or broker-dealers. See the section entitled “Plan of Distribution” beginning on page 19 of this Offering Circular for additional information. |

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to https://www.investor.gov. We retain complete discretion to determine that subscribers are “qualified purchasers” (as defined in Regulation A under the Securities Act) in reliance on the information and representations provided to us regarding their financial situation.

An investment in the Royalty Shares involves a high degree of risk and should be made only by persons or entities able to bear the risk of and to withstand the total loss of their investment. Prospective investors should carefully consider and review the information under the heading “Risk Factors” beginning on page 3.

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

WE EXPECT THAT OUR OPERATIONS WILL NOT CAUSE US TO MEET THE DEFINITION OF AN “INVESTMENT COMPANY” UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “1940 ACT”), BECAUSE (1) THE COMPANY WOULD BE EXCLUDED FROM THE DEFINITION OF AN INVESTMENT COMPANY UNDER EACH OF SECTIONS 3(B)(1) AND/OR 3(C)(5)(A) OF THE 1940 ACT, (2) AT ALL TIMES OUR SOLE ASSETS WILL CONSIST ONLY OF CASH AND THE ROYALTY RIGHTS, REFERRED TO HEREIN AS THE “ROYALTY RIGHTS,” NEITHER OF WHICH IS DEEMED TO BE A “SECURITY” FOR PURPOSES OF THE 1940 ACT, AND (3) AT ALL TIMES WE WILL NOT BE ENGAGED PRIMARILY IN OWNING, HOLDING, INVESTING OR TRADING IN “SECURITIES” (AS SUCH TERM IS USED FOR PURPOSES OF THE 1940 ACT).

This Offering Circular is part of an offering statement that we filed with the SEC, using a continuous offering process pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities

Table of Contents

may happen sporadically over the term of the Offering. Further, the acceptance of subscriptions via the JKBX Platform may be briefly paused at times to allow us to process and settle subscriptions that have been received effectively and accurately. Periodically, we may provide an Offering Circular supplement that may add, update or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Where You Can Find More Information” below for more details.

Our principal office is located at 10000 Washington Blvd., Suite 07-134, Culver City, CA 90232 and our phone number is [ ]. Information about the Company and its affiliated entities may be found on the JKBX Platform at https://www.jkbx.com. Information contained on, or accessible through, the JKBX Platform is not a part of, and is not incorporated by reference into, this Offering Circular.

This Offering Circular follows the offering circular format described in Part II of Form 1-A.

Table of Contents

| i | ||||

| ii | ||||

| iii | ||||

| v | ||||

| vi | ||||

| xi | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 18 | ||||

| 19 | ||||

| 28 | ||||

| 29 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

34 | |||

| 37 | ||||

| 40 | ||||

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS |

41 | |||

| 42 | ||||

| 44 | ||||

| DESCRIPTION OF THE MUSIC ASSETS UNDERLYING THE ROYALTY SHARES |

47 | |||

| 65 | ||||

| 66 | ||||

| 68 | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this Offering Circular prepared by us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Offering Circular is an offer to sell only the Royalty Shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current only as of its date, regardless of the time of delivery of this Offering Circular or any sale of Royalty Shares.

For investors outside the United States: We have not done anything that would permit this Offering or possession or distribution of this Offering Circular in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to the Offering and the distribution of this Offering Circular.

Table of Contents

Certain data included in this Offering Circular is derived from information provided by third-parties that we believe to be reliable. The discussions contained in this Offering Circular relating to the Royalty Rights, the artists and songwriters associated with the Music Assets, the music royalties market, and the music industry are taken from third-party sources that the Company believes to be reliable and reasonable, and that the factual information is fair and accurate. Certain data is also based on our good faith estimates which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified such third-party information, nor have we ascertained the underlying economic assumptions relied upon therein. The statistical data relating to the music royalties market and music industry is difficult to obtain, may be incomplete, out-of-date, or inconsistent and you should not place undue reliance on any statistical or general and music industry information related to the music royalties market included in this Offering Circular. The music royalties market and music industry data used in this Offering Circular involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. While we are not aware of any material misstatements regarding any market, industry or similar data presented herein, such data was derived from third party sources and reliance on such data involves risks and uncertainties.

i

Table of Contents

We own or have applied for rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect our business. We do not own the copyright to any Music Assets or works underlying the Royalty Rights. This Offering Circular may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this Offering Circular is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this Offering Circular are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

ii

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains certain “forward-looking statements” that include, but are not limited to statements regarding the Company’s financial conditions, results of operations, plans, objectives, future performance, and business, and that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “plan,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” the negative of these terms, or other similar words or expressions, but the absence of these terms does not mean that a statement is not forward-looking.

Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans, operations or strategies is inherently uncertain. These statements are only predictions, and actual events or results may differ materially from such statements. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to those described under the section entitled Risk Factors and the following:

| • | our ability to attract investors to purchase Royalty Shares on the JKBX Platform; |

| • | difficulties in identifying and sourcing Royalty Rights to acquire and our ability to attract and maintain relationships with music catalogs, record labels and other parties from who we may purchase Royalty Rights; |

| • | our ability to successfully manage or administer the Royalty Shares and the acquired Royalty Rights; |

| • | our future financial performance, including our expectations regarding our net revenue, operating expenses, and our ability to achieve and maintain future profitability; |

| • | our business plan and our ability to effectively manage any growth; |

| • | the demand for investment in music royalties and changes in the music market generally; |

| • | the value of the Royalty Rights in the underlying Music Asset and how this will affect our business; |

| • | timing of the Royalty Share Payments; |

| • | the manner by which Income Interests will be treated in the case of bankruptcy by the owner of the underlying Music Asset; |

| • | anticipated trends, growth rates, and challenges in our business, the music industry, the price and market capitalization of music assets and in the markets in which we operate; |

| • | our ability to maintain, expand, and further penetrate our existing customer base; |

| • | our ability to grow our business in response to changing technologies, customer demand, and competitive pressures; |

| • | the effects of increased competition in our markets and our ability to compete effectively; |

| • | our expectations concerning relationships with third parties; |

| • | our ability to maintain, protect, and enhance our intellectual property; |

| • | our ability to stay in compliance with laws and regulations that currently apply or become applicable to our business both in the United States and internationally given the highly evolving and uncertain regulatory landscape; |

iii

Table of Contents

| • | general macroeconomic conditions, including interest rates, inflation, economic downturns and industry trends, projected growth, or trend analysis; |

| • | trends in revenue and operating expenses for us and the Manager, including technology and development expenses, sales and marketing expenses, and general and administrative expenses, and expectations regarding these expenses as a percentage of revenue; |

| • | our key business metrics used to evaluate our business, measure our performance, identify trends affecting our business, and make strategic decisions; |

| • | other statements regarding our future operations, financial condition, and prospects and business strategies. |

| • | legislative or regulatory changes impact our business or our assets (including SEC guidance related to Regulation A or the JOBS Act); |

| • | our ability to implement effective conflicts of interest policies and procedures among the Royalty Rights acquisition opportunities presented to us; |

| • | risks associated with breaches of our data security; and |

| • | changes to U.S. GAAP. |

Any of the assumptions underlying forward-looking statements could be inaccurate. Prospective investors are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this Offering Circular and the risk that actual results will differ materially from the expectations expressed in this Offering Circular will increase with the passage of time. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this Offering Circular, whether as a result of new information, future events or otherwise. In light of significant uncertainties inherent in the forward-looking statements included in this Offering Circular, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Offering Circular will be achieved.

iv

Table of Contents

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

The Royalty Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this Offering is exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that the Royalty Shares offered hereby are offered and sold only to “qualified purchasers” or at a time when the Royalty Shares are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D under the Securities Act and (ii) all other investors so long as their investment in the Royalty Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons) or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who:

| 1. | has a net worth, or joint net worth with the person’s spouse or spousal equivalent, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; or |

| 2. | had earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse or spousal equivalent exceeding $300,000 for those years and has a reasonable expectation of reaching the same income level in the current year; or |

| 3. | is holding in good standing one or more professional certifications or designations or credentials from an accredited educational institution that the SEC has designated as qualifying an individual for accredited investor status; or |

| 4. | is a “family client,” as defined by the Investment Advisers Act of 1940, of a family office meeting the requirements in Rule 501(a) of Regulation D and whose prospective investment in the issuer is directed by such family office pursuant to Rule 501(a) of Regulation D. |

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

USE OF CERTAIN TERMS AND DEFINITIONS

In this Offering Circular, unless the context indicates otherwise, the following terms have the following meaning:

| • | “Holder” refers to any beneficial owner of a Royalty Share. |

| • | “Jukebox Holding” refers to Jukebox Co., a Delaware corporation. |

| • | “Manager” refers to Double Platinum Management LLC, a Delaware limited liability company. |

| • | “Royalty Share” or “Royalty Shares” refers to the contractual right to receive a specified portion of Income Interests we receive that relate to Royalty Rights for a specific Music Asset or a compilation of Music Assets (as applicable) set forth in the Royalty Shares Offering Table beginning on page 65. |

| • | “we”, “our”, “ours”, “us”, “Jukebox Hits Vol. 1” or the “Company” refer to Jukebox Hits Vol. 1 LLC, a Delaware limited liability company, and, as the context requires, any wholly owned subsidiaries thereof and the Trust (if applicable). |

v

Table of Contents

This summary highlights selected information contained elsewhere in this Offering Circular. This summary does not contain all of the information you should consider before investing in the Royalty Shares. You should read this entire Offering Circular carefully, especially the risks of investing in the Royalty Shares discussed under “Risk Factors,” before making an investment decision. You are encouraged to seek the advice of your attorney, tax consultant and financial advisor with respect to the legal, tax and financial aspects of an investment in the Royalty Shares.

Overview

In the last eight years, the music industry has grown each consecutive year, with 2022 marking 9% growth from 2021, according to a 2022 report from the International Federation of the Phonographic Industry. The global music market forecasts for 2022 and 2023 are increasing by 7% and 5% respectively, while 2030 forecasts are increasing by 10%, as reported in Goldman Sachs, “Music in the Air,” Equity Research June 13th, 2022 report. The popularity of music streaming services such as Spotify are largely responsible for this growth, with 589 million users worldwide subscribing to a music streaming service. Streaming services make a variety of music more accessible to a listener, and the market has responded accordingly. However, while music has become increasingly more accessible to listeners, there are still no equally accessible methods for a listener to take part in investment opportunities for their favorite songs and albums.

Jukebox Technology, a wholly owned subsidiary of Jukebox Holding and affiliate of the Company, owns the online platform www.jkbx.com (the “JKBX Platform”). The JKBX Platform was formed to, among other things, provide users with new ways in which to engage with the content of their favorite artists and musicians and to address the lack of opportunities to invest in the music market and music-related assets. The JKBX Platform allows investors to hold interests in music-related investment opportunities that may have been historically difficult to access for some investors. Using the JKBX Platform, platform users can engage with artist-related content and opportunities, while users interested in investing in music-related assets can browse and screen related investment opportunities, view details of an investment and sign legal documents online.

The Company was formed as a Delaware limited liability company on April 3, 2023 to facilitate and manage investors’ economic exposure to Royalty Rights (as defined above on the Cover Page). The Company will facilitate and manage investors’ economic exposure to the Royalty Rights by issuing contractual rights (known as Royalty Shares) to receive a specified portion of Income Interests we receive that relate to Royalty Rights for a specific Music Asset or compilation of Music Assets (as applicable) set forth in the “Royalty Shares Offering Table” beginning on page 65 to investors in this Offering. By purchasing Income Interests relating to certain Music Assets from Income Interest Owners, we will have the Royalty Rights derived from a given set of Music Assets. We will be able to offer Royalty Shares related to recordings and compositions as an investment opportunity to investors through our associated persons on the JKBX Platform, thereby allowing them to indirectly participate in Royalty Rights associated with their favorite songs.

We plan to use the proceeds from this Offering to fund the acquisition costs of the Royalty Rights, ongoing costs and expenses associated with the Offering, and holding and managing the rights of investors in the Royalty Shares. We plan to achieve these goals by working with Jukebox Holding to source Music Assets and negotiate and enter into Purchase Agreements related to such Music Assets and their respective Income Interests. As referred to herein, Royalty Rights are the Company’s aggregate and specifically negotiated passive (non-operating) Income Interests in certain Music Assets obtained pursuant to the Company’s Purchase Agreements that provide the Company with the right to revenue generated from, among other things, the purchase, use, consumption, exploitation, and/or licensing of Music Assets by third parties as memorialized in each respective Purchase Agreement. This revenue may include revenue generated from activities including, but not limited to, streaming, downloads, physical album sales and other forms of usage in films, television and advertisements.

The Music Assets

A given musical asset, such as a composition or sound recording, is generally comprised of two copyrights: (1) the musical composition copyright and (2) the sound recording copyright. Typically, there are multiple people or entities that own and control portions of both the musical composition copyright and the sound recording copyright, including recording artists, songwriters, publishers, record labels, and investment firms and/or funds, or others.

Each copyright in a given song generates separate and distinct revenue streams for the copyright owner. Just as with copyright ownership, multiple people and entities typically own and control an Income Interest related to or derived from a Music Asset. Income Interests are generated by various sources.

As described further below, we will purchase a subset of an Income Interest Owner’s total Income Interests and accordingly will have the right to collect and receive a portion of the Income Interests related to or derived from a given set of Music Assets (i.e., the Royalty Rights). Copyright owners retain the copyright in and to the compositions and recordings but may separately retain a certain percentage of the Income Interest as well. Each series of Royalty Shares shall correspond to specific Royalty Rights and the Company shall distribute Royalty Share Payments related to such Royalty Rights to the Holders of the corresponding series of Royalty Shares on a pro rata basis (less any fees and expenses as further described herein).

vi

Table of Contents

The Purchase Agreements and Royalty Rights

We engage with Income Interest Owners to acquire Income Interests of Music Assets pursuant to one or more separately negotiated Purchase Agreements. The Company has entered into the Purchase Agreements described in “Description of the Music Assets Underlying the Royalty Shares.” Pursuant to the Purchase Agreements, the Income Interest Owners will sell their passive Income Interests (but not the copyright, administration, or distribution rights) in certain Music Assets to the Company, as well as a right, if available in certain cases, to use any artist or songwriter materials in the Company’s marketing and promotions.

The Company has entered into a Purchase Agreement, dated as of [ ] (the “Thacker Purchase Agreement”), with Sam Thacker pursuant to which Mr. Thacker has agreed to make a portion of his Income Interests in certain Compositions and Recordings available for purchase by the Company and the Company will have an option (but not an obligation) to acquire some or all of such portion of his Income Interests in accordance with the terms and conditions of the Thacker Purchase Agreement. Currently, Mr. Thacker serves as the President of the Manager and Chief Operating Officer of Jukebox Holding. The Thacker Purchase Agreement was not negotiated at arm’s-length. See “Description of the Music Assets Underlying the Royalty Shares—Thacker Purchase Agreement” and “Interest of Management and Others in Certain Transactions” for more information.

The Company has entered into a Purchase Agreement, dated as of [ ] (the “Coda Purchase Agreement”), with Coda Songs LLC, a Delaware limited liability company (“Coda”), pursuant to which Coda has agreed to make a portion of its Income Interests in certain Compositions and Recordings available for purchase by the Company and the Company will have an option (but not an obligation) to acquire some or all of such portion of its Income Interests in accordance with the terms and conditions of the Coda Purchase Agreement. The Coda Purchase Agreement was not negotiated at arm’s length. See “Description of the Music Assets Underlying the Royalty Shares—Coda Purchase Agreement” and “Interest of Management and Others in Certain Transactions” for more information.

The Company and the Royalty Shares

The Company is a Delaware limited liability company formed on April 3, 2023 by the filing of the Certificate of Formation with the Secretary of State of the State of Delaware in accordance with the provisions of the Delaware Limited Liability Company Act (the “Delaware LLC Act”). The Company will issue Royalty Shares on an ongoing basis to “qualified purchasers” within the meaning of Regulation A under the Securities Act. Royalty Shares represent the contractual right to receive a specified portion of Income Interests we receive that relate to a specific Music Asset as set forth in the “Royalty Shares Offering Table”. The Company will manage all entity-level administrative services relating to the Purchase Agreements, the Royalty Shares, and the Company. Royalty Shares are being issued to provide investors in this Offering with economic exposure to the corresponding Royalty Rights held by the Company, less the Company’s expenses and other liabilities. The Royalty Shares are intended to provide investors with a convenient way to obtain indirect exposure to Royalty Rights.

The Company will not conduct any business activities except for activities relating to an investment in, and maintenance and promotion of the Royalty Rights and the offering, issuance, and servicing of Royalty Shares. Besides the income derived from the Purchase Agreements, and any ongoing fees collected from our servicing of the Royalty Shares, we do not expect to generate any material amount of revenues or cash flow.

Royalty Shares purchased directly from the Company pursuant to this Offering Circular under Regulation A are not restricted securities that may be resold by the purchasers thereof in transactions exempt from registration under the Securities Act and state securities laws. See “Description of the Royalty Shares—Transfer Restrictions” for more information. There is no guarantee that an active trading market for the Royalty Shares will develop.

The Company will not operate a redemption program for the Royalty Shares. Royalty Shares are not redeemable by the Company. Because the Company will not operate a redemption program, there can be no assurance that the value of the Royalty Shares will reflect the value of the Royalty Rights, or the underlying Music Asset or compilation of Music Assets (as applicable), that such series of Royalty Shares relates to, and, in the event a trading market for the Royalty Shares develops, the Royalty Shares may trade at a substantial premium over, or discount to, the value of the Royalty Rights or the underlying Music Assets per Royalty Share. The Royalty Shares may also trade at a substantial premium over, or a substantial discount to, the value of the Royalty Rights or the underlying Music Assets per Royalty Share as a result of a number of reasons currently unforeseeable.

JKBX Hits Vol. 1 Trust

The Company will convey, or cause to be conveyed, any Royalty Rights it receives pursuant to the Purchase Agreements and any Royalty Share Payments payable to Holders of Royalty Shares to a newly formed statutory trust established under Delaware state law (the “Trust”), which will hold the Royalty Rights. The Trust will be created to acquire and hold Royalty Rights and Royalty Share Payments, pending distribution to Holders of Royalty Shares, for the benefit of the Holders of Royalty Shares pursuant to a trust agreement (the “Trust Agreement”) among the Company, in its separate and distinct capacities as grantor of the Trust and Management Trustee, and [ ], in its capacity as administrative trustee. For additional information, see “Description of the Trust Agreement.”

Manager, Administrative Services and Expenses

The Second Amended and Restated Limited Liability Company Agreement of the Company (as amended from time to time, the “Operating Agreement”) designates the Manager as the managing member of the Company for purposes of the Delaware LLC Act. The Manager, in its capacity as the sole member and manager of the Company and pursuant to the Operating Agreement, is responsible for managing and performing the various administrative functions necessary for our day-to-day operations, including managing relationships with vendors and third-party service providers. The Manager pays organizational and offering-related costs on our behalf in connection with the offering of Royalty Shares, as well as other costs and expenses on our behalf. The Company will reimburse the Manager for ordinary and necessary organizational and offering-related costs it incurs on our behalf, and for costs and expenses it incurs internally or from third-party service providers on our behalf. See “Estimated Use of Proceeds,” “Management,” and “Management Compensation” for further details. The Manager does not provide any services to the Company pursuant to any other agreement or arrangement.

vii

Table of Contents

Distributions

All monies associated with Income Interests received by us pursuant to the Purchase Agreements will be held in a designated bank account and generally distributed once per calendar quarter to the JKBX Platform accounts of the Holders of the corresponding Royalty Shares as further described below under the section entitled “Distribution Policy,” subject to the terms of the applicable Royalty Share Agreement. In addition, the terms of service of the JKBX Platform, which is included as Exhibit 6.4 to the offering statement, may include restrictions on a Holder’s ability to withdraw amounts in their JKBX Platform account to other financial institutions, including, but not limited to, a minimum withdrawal threshold.

Pursuant to the applicable Royalty Share Agreement, the Company shall receive a fee equal to 1.0% of the gross monies associated with Income Interests received by us in respect of the Royalty Rights (the “Royalty Fee”). The Royalty Fee shall be deducted from the gross monies associated with Income Interests received by us and retained by the Company before Royalty Share Payments are made to the Holders of the corresponding series of Royalty Shares. The Royalty Fee shall only be collected by the Company on gross monies associated with Income Interests actually received by us in relation to the corresponding series of Royalty Shares. If there are no gross monies associated with Income Interests received by us during a period, the Company will not collect this fee for such period (i.e., no such fee shall be charged to any Royalty Shares).

See the “Description of the Royalty Shares—Distributions” and “Distribution Policy” sections of this Offering Circular for more information.

About the JKBX Platform

The Company is also an affiliate of Jukebox Technology, the owner of the JKBX Platform, an online platform focused on providing music lovers and investors access to Music Asset-related content, investment and other opportunities, which may be found on the JKBX Platform at https://www.jkbx.com. Jukebox Technology LLC is a wholly-owned subsidiary of Jukebox Holding.

viii

Table of Contents

Organizational Structure

| (1) | Jukebox Co. is a Delaware corporation and the parent company of Jukebox Technology LLC and Double Platinum Management LLC. |

| (2) | Jukebox Technology LLC is a Delaware limited liability company which owns the JKBX Platform and associated website located at https://www.jkbx.com. |

| (3) | Double Platinum Management LLC is a Delaware limited liability company and the sole member and manager of the Company pursuant to the Operating Agreement. |

| (4) | Jukebox Hits Vol. 1 LLC is a Delaware limited liability company, the “Company” referred to in this Offering Circular and the issuer in the Offering. The Company is managed by the Manager pursuant to the Company’s Operating Agreement. |

| (5) | “Royalty Shares” refers to the contractual right to receive a specified portion of Income Interests we receive that relate to Royalty Rights for a specific Music Asset or a compilation of Music Assets (as applicable) set forth in the “Royalty Shares Offering Table” beginning on page 65. |

| (6) | “Royalty Share Payment” refers to payment of the pro rata portion of the amounts we receive from the specified Royalty Rights that correspond to such series of Royalty Shares (less any fees and expenses as further described herein) purchased by an investor. |

| (7) | “Trust” refers to the statutory trust established under the laws of the State of Delaware, which will hold the Royalty Rights and Royalty Share Payments, pending distribution to Holders of Royalty Shares, for the benefit of the Holders of Royalty Shares pursuant to trust agreement among the Company, in its separate and distinct capacities as grantor of the Trust and Management Trustee, and [ ], in its capacity as administrative trustee. |

ix

Table of Contents

Risk Factors

An investment in the Royalty Shares includes a number of risks and uncertainties which are described in the “Risk Factors” section of this Offering Circular, including, but not limited to, the following:

Risks Related to Our Business Model. There are few businesses that have pursued a strategy or investment objective similar to ours, which may make it difficult for the Company and the Royalty Shares to gain market acceptance.

Risks Related to the Music Industry. Income generated by Income Interests may be reduced if the recorded music industry fails to grow or streaming revenue fails to grow at a sufficient rate to offset download and physical sale declines. Changes in technology may also affect our ability to receive payments in respect of the Royalty Rights.

Risks Related to the Offering and Ownership of Royalty Shares. The investment in the Offering constitutes only an investment in the Royalty Shares and not in the Company or directly in any underlying Music Asset. Further, the initial offering prices of the Royalty Shares are established by the Manager on an arbitrary basis, and bear no relationship to our book or asset values or to any other established criteria for valuing Royalty Shares. There is currently no public trading market for the Royalty Shares and an active market may not develop or be sustained. Even if a public market does develop, it may not provide an effective means of selling your Royalty Shares and the market price could decline below the amount an investor paid for the Royalty Shares or fluctuate significantly for many reasons.

Risks Related to the Company. The value of the Royalty Shares may be influenced by a variety of factors unrelated to the performance of the underlying Music Asset, such as unanticipated problems or issues with the mechanics of the Company’s operations or the trading of the Royalty Shares.

Risks Related to Potential Conflicts of Interest. Potential conflicts of interest may arise among Jukebox Holding or its affiliates and the Company. Jukebox Holding and its affiliates have no fiduciary duties to the Company or Holders, which may permit them to favor their own interests to the detriment of the Company or Holders.

Company Information

Our principal office is located at 10000 Washington Blvd., Suite 07-134, Culver City, CA 90232 and our phone number is [ ]. Our website address is at https://www.jkbx.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this Offering Circular.

x

Table of Contents

| Royalty Shares Offered: |

Royalty Shares, issued in series, with each series of Royalty Shares representing the contractual right to receive a specified portion of Income Interests we receive that relate to Royalty Rights for a specific Music Asset or compilation of Music Assets (as applicable) set forth in the “Royalty Shares Offering Table” beginning on page 65. Holders of the Royalty Shares are entitled to Royalty Share Payments based on the monies associated with Income Interests received from a Royalty Right, which the Company shall acquire pursuant to the terms of the applicable Purchase Agreements relating to the Music Assets set forth in the “Composition and Recording Rights” table beginning on page 48 of this Offering Circular. The Royalty Shares are unsecured limited obligations of the Company, do not have any voting rights, and do not represent any ownership interest in the Company. The purchase of a series of Royalty Shares is an investment only related to the monies flowing from that particular Royalty Right of the Company and does not create any rights to payments from any other Royalty Rights of the Company. The Purchase Agreements gives the Company the right, but not the obligation, to purchase Income Interests relating to a specific Music Asset subject to the terms and conditions of such Purchase Agreements, through the proceeds of the Offering. After qualification of an offering statement, the Company may add additional Royalty Shares or series of Royalty Shares by post-qualification amendment to the offering statement. | |

| Offering Price per Royalty Share: |

The offering price per Royalty Share for each series of Royalty Shares offered hereby is set forth in the table presented on the Cover Page of this Offering Circular. | |

| Minimum Investment Amount: |

The minimum purchase threshold per investor per series of Royalty Shares is one (1) Royalty Share. However, we reserve the right to waive minimum purchase restrictions on a case-by-case basis in our sole discretion. Subscriptions, once received, are irrevocable by the investors but can be rejected by us prior to acceptance. | |

| Subscribing Online and Investment Documents: |

Jukebox Technology owns a web-based platform located at https://www.jkbx.com (the “JKBK Platform”). The Company licenses the JKBK Platform in order to facilitate, through its associated persons, investor acquisitions of the Royalty Shares. After establishing a user account on the JKBX Platform, an investor may view details of an investment, and sign contractual documents online. After the qualification by the SEC of the offering statement of which this Offering Circular is a part, the Offering will be conducted by the Company and its associated persons through the JKBX Platform, whereby investors will receive, review, execute and deliver subscription agreements (in substantially the form as attached hereto as Exhibit 4.1; the “Subscription Agreements”) electronically. For additional information, see “Plan of Distribution—Procedures for Subscribing.” | |

| In addition to the Subscription Agreement, each investor must agree to the Royalty Share Agreement, which governs the offer and sale of each particular series of Royalty Shares, as well as certain rights and obligations of a series of Royalty Shares and of the Company. The standard form of Royalty Share Agreement is attached as Exhibit 3.1 to this Offering Circular. Investors may review the form of Royalty Share Agreement applicable to a particular series of Royalty Shares by accessing the hyperlink accompanying the information provided about the corresponding Royalty Rights (and underlying Music Asset) on the JKBX Platform. | ||

xi

Table of Contents

| Broker: |

The Offering is being conducted by the Company as a direct public offering on a “best-efforts” basis through the web-based JKBX Platform. The Company has not engaged commissioned sales agents or broker-dealers and, in conjunction with its associated persons, plans to distribute the Offering through the JKBX Platform. | |

| Payment for the Royalty Shares: |

After the qualification by the SEC of the offering statement of which this Offering Circular is a part, investors can make payment of the purchase price in the manner described in the “Plan of Distribution” below. We may also permit payment to be made by credit cards, provided that such payments may be subject to additional restrictions. Investors contemplating using their credit card to invest are urged to carefully review “Risk Factors—Risks of investing using a credit card.” Upon the Company’s acceptance of a subscription, and the corresponding investor’s payment of the applicable purchase amount to the Company, the associated Royalty Shares will be issued to the investors in this Offering. | |

| Investment Amount Restrictions: |

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, you are encouraged to review Rule 251(d)(2)(i) of Regulation A. For general information on investing, you are encouraged to refer to www.investor.gov. | |

| Worldwide Royalty Shares: |

The Royalty Shares will be offered worldwide, provided that we may elect not to sell Royalty Shares in certain jurisdictions for regulatory or other reasons. No sales of the Royalty Shares will be made anywhere in the world prior to the qualification of the Offering Circular by the SEC in the United States. All Royalty Shares will be offered everywhere in the world at the same U.S. dollar price that is set forth in this Offering Circular. | |

| Estimated Use of Proceeds: |

The proceeds received in this Offering will be applied in the following order of priority of payment:

• Cash Consideration for the Acquisition of Royalty Rights: Actual cost the Company incurs in purchasing the Company’s relevant Royalty Rights pursuant to the Purchase Agreement(s) related to each of the corresponding series of Royalty Shares;

• Reimbursement of Organizational and Offering Costs: Reimbursement of Manager for ordinary and necessary costs it incurs in connection with our organization and the offering of Royalty Shares (“O&O Costs”) up to a maximum of 0.50% of the aggregate gross offering proceeds from this Offering. We anticipate that reimbursement payments for O&O Costs will be made to the Manager in monthly installments. The Manager may, at its sole discretion, decide to defer or waive any portion of the O&O Costs incurred. All or any portion of any deferred O&O Costs may be deferred without interest and payable when the Manager determines. See “Estimated Use of Proceeds” for more information about the types of costs that may be incurred, including expenses, “Plan of Distribution” for more information on the process by which Royalty Shares will be distributed, and “Management Compensation” for a description of fees and expenses that we pay Manager.

• Net Proceeds to Company: Remaining proceeds received go to Company for working capital and operating expenses related to the ongoing services the Company will provide to Royalty Share Holders, including the provision of ongoing administrative services related to the Royalty Shares. | |

| Offering Commissions: Note that purchasers of Royalty Shares in this Offering do not pay any commissions or transaction-based compensation to the Company, any of its associate persons, or otherwise in connection with the Offering. Additionally, investors do not pay any dealer manager fee or other service-related fee in connection with the offer and sale of Royalty Shares through the JKBX Platform. | ||

xii

Table of Contents

| Risk Factors: |

Investing in the Royalty Shares involves risks. See the section entitled “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in the Royalty Shares. | |

| Closings: |

The Company will close sales of Royalty Shares to investors in the Offering on an ongoing, continuous basis and will purchase Income Interests pursuant to each applicable Purchase Agreement in the form of Royalty Rights as proceeds from the Offering are received by the Company from investors through the sale of Royalty Shares in the Offering that correspond to such Royalty Rights. If any of the Royalty Shares offered remain unsold as of the final closing, such Royalty Shares shall remain unissued by the Company. The Company is seeking to qualify an amount of Royalty Shares that it reasonably expects to be able to sell within two (2) years from the date of initial qualification. In any event, however, the Offering will not exceed three (3) years from the date of commencement in accordance with Rule 251(d)(3)(F) of Regulation A. The Company reserves the right to terminate the Offering for any reason at any time prior to the final closing. | |

| Transfer Restrictions: |

The Royalty Shares may only be transferred by operation of law or on a trading platform approved by the Company, such as the ATS, or with the prior written consent of the Company. | |

| Transfer Agent and Registrar: |

We will serve as our own transfer agent and registrar in connection with this Offering. | |

| Distributions: |

The Royalty Share Agreements shall provide that all monies associated with Income Interests received by us pursuant to the Purchase Agreements will generally be distributed once per calendar quarter to the JKBX Platform accounts of the Holders of the corresponding Royalty Shares, subject to a fee equal to 1.0% of the gross monies associated with Income Interests received by us in respect of the Royalty Rights (the “Royalty Fee”), which fee shall be deducted from the gross monies associated with Income Interests received by us and retained by the Company before Royalty Share Payments are made to Holders of the corresponding series of Royalty Shares. If there are no gross monies associated with Income Interests received by us during a period, the Company will not collect this fee for such period (i.e., no such fee shall be charged to any Royalty Shares). See the section entitled “Distribution Policy” and the form of Royalty Share Agreement attached as Exhibit 3.1 to this Offering Circular. | |

xiii

Table of Contents

Table of Contents

All monies associated with Income Interests received by us pursuant to the Purchase Agreements will be held in a designated bank account and generally distributed once per calendar quarter to the JKBX Platform accounts of the Holders of the corresponding Royalty Shares as further described below, subject to the terms of the applicable Royalty Share Agreement. In addition, the terms of service of the JKBX Platform, which is included as Exhibit 6.4 to the offering statement, may include restrictions on a Holder’s ability to withdraw amounts in their JKBX Platform account to other financial institutions, including, but not limited to, a minimum withdrawal threshold.

The Royalty Share Agreements shall provide that, during each full calendar quarter that begins following the six-month anniversary of the original issue date of a series of Royalty Shares, the Company shall declare with respect to such series (a) the amount of distributions payable per Royalty Share of such series on the next designated payment date and (b) a record date and payment date for such distributions. Each designated payment date shall be no later than ninety (90) calendar days after the end of the calendar quarter in which such payment date is declared by the Company. On each payment date, the amount of distributions payable per Royalty Share of the applicable series shall be paid to the person in whose name each Royalty Share is registered at the close of business on the applicable record date designated by the Company.

Pursuant to the applicable Royalty Share Agreement, the Company shall receive a fee equal to 1.0% of the gross monies associated with Income Interests received by us in respect of the Royalty Rights (the “Royalty Fee”). The Royalty Fee shall be deducted from the gross monies associated with Income Interests received by us and retained by the Company before Royalty Share Payments are made to the Holders of the corresponding series of Royalty Shares. The Royalty Fee shall only be collected by the Company on gross monies associated with Income Interests actually received by us. If there are no gross monies associated with Income Interests received by us during a period, the Company will not collect this fee for such period (i.e., no such fee shall be charged to any Royalty Shares).

In some instances, Income Interest payments made in respect of the Royalty Rights may be made more or less frequently than quarterly. If multiple Income Interest payments are made in a single quarter, we will accrue those Income Interest payments and make one single Royalty Share Payment to Holders of the applicable series of Royalty Shares following the end of the calendar quarter in which we received those Income Interest payments. Conversely, if Income Interest payments are made less frequently than quarterly (for example, bi-annually), then there will be no Royalty Share Payment made until a distribution is declared following the end of the calendar quarter in which the Income Interest payment is received.

Prior to the distribution of the Royalty Share Payment to the applicable Holders in accordance with the process described above, the Company shall manage any monies associated with Income Interests received by investing them in cash, cash equivalents and other high credit quality, short-term investments in accordance with our investment policy designed to protect the principal investment. Our investment policy is to manage investments to achieve the financial objectives of preservation of principal, liquidity and return on investment. A portion of the investment portfolio shall be held in cash and cash equivalents. Investments may also be made in U.S. bank securities and bank deposits, U.S. government securities and commercial paper of U.S. bank or industrial companies, and highly rated and well-diversified money market funds. Any interest and other investment income generated by these investing activities shall be retained by the Company and shall not be distributed to Holders. Distributions to Holders pursuant to the Royalty Share Agreements shall be limited, in all circumstances, to an amount equal to the net monies associated with Income Interests received by us after deduction of the Royalty Fee. While the Company’s investment policy is to manage investments to preserve principal, there is always a risk that principal may be lost in any investment made by the Company and, if so, the Company may lack the funds necessary to make some or all of the distributions of the Royalty Share Payment as required by the Royalty Share Agreements.

The above discussion regarding the Royalty Shares and Royalty Share Agreements is qualified in its entirety by the form of Royalty Share Agreement, which is included as Exhibit 3.1 to the offering statement of which this Offering Circular forms an integral part.

2

Table of Contents

The purchase of the Royalty Shares offered hereby involves a high degree of risk. Each prospective investor should consult his, her or its own counsel, accountant and other advisors as to legal, tax, business, financial, and related aspects of an investment in the securities offered hereby. Prospective investors should carefully consider the following specific risk factors and the other information set forth in this Offering Circular before purchasing the securities offered hereby.

Risks Related to our Business Model

The Company was recently formed, and has no track record or operating history from which you can evaluate this investment. Our business model is untested.

The Company was formed on April 3, 2023 and has no operating history. We cannot make any assurance that our business model can be successful. Since inception, the scope of our operations has been limited to our formation. Our operations will be dedicated to holding and managing the Royalty Rights. It is difficult to predict whether this business model will succeed or if there will ever be any profits realized from an investment in the Royalty Shares. No guarantee can be given that the Company will successfully employ the Royalty Rights to create return for investors in the Royalty Shares.

We currently are not generating sufficient revenue to carry out our planned business operations. We expect our operations to continue to consume substantial amounts of cash.