Post-Qualification Amendment No. 5

File No. 024-12351

This Post-Qualification Amendment No. 5 amends the Offering Statement of aShareX Series LLC originally qualified on November 27, 2023, as previously amended and supplemented on February 16, 2024, March 14, April 11, 2024 and May 12, 2025, to add to the offering circular contained within the offering statement the offering of additional series of the Company and update certain information in the offering circular.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

(Post-Qualification Amendment No. 5)

REGULATION A OFFERING STATEMENT

UNDER THE SECURITIES ACT OF 1933

| ASHAREX SERIES LLC |

| (Exact name of issuer as specified in its charter) |

| Delaware |

| (State of other jurisdiction of incorporation or organization) |

|

|

10990 Wilshire Blvd.

Suite 1150

Los Angeles, California 90024

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

J. Nicholson Thomas

General Counsel

aShareX Series LLC

10990 Wilshire Blvd., Suite 1150

Los Angeles, California 90024

(877) 358-8999

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Alison M. Pear, Esq.

Buchalter, A Professional Corporation

805 SW Broadway, Suite 1500

Portland, Oregon 97205

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this preliminary offering circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Securities and Exchange Commission is qualified. This preliminary offering circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a final offering circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the final offering circular or the offering statement may be obtained.

ASHAREX SERIES LLC

(A Delaware Series Limited Liability Company)

Offering Circular

September 16, 2025

Subject to Completion

Best Efforts Offering of Class A Shares

Representing Class A Limited Liability Company Membership Interests

aShareX Series LLC, formerly known as aShareX Fine Art, LLC (“we” or the “Company”) is a Delaware series limited liability company formed on January 13, 2023, to facilitate fractionalized investments in fine art, collectibles and other alternative assets. Effective July 31, 2025, the Company changed its name from aShareX Fine Art, LLC to aShareX Series LLC to better reflect broader potential Series Assets. This Offering Circular relates to the offer and sale on a best efforts basis of Class A membership interests (“Class A Shares”) of each series (each a “Series” and collectively, the “Series” as the context may require) of the Company as set forth in the Series Offering Table included as Appendix B. The Company intends to make subsequent offerings of Class A Shares in newly established Series of the Company to acquire additional fractionalized assets. See “Description of Shares” for additional information regarding the Class A Shares.

Each Series established by the Company will own museum quality, investment grade art or other artistic works (“Artwork”), collectibles such as classic cars, original movie props or sports memorabilia, or other alternative assets including music royalties or income streams from social media influencers or other notable individuals (and together with the Artwork, the “Series Asset”). A Series Asset may be comprised of one or more individual assets. Potential investors who are pre-registered and qualified with the Company on its affiliate’s website (the “Investor Platform”) will bid as an individual or a group to acquire the Series Asset through the Company’s proprietary, online platform (the “Auction Platform”). Series Assets in each Series are offered either via a traditional English auction (a “Traditional Auction”) or at a fixed price per share (a “Fixed Price Auction”), as identified in the Series Offering Table. Traditional Auctions and Fixed Price Auctions shall be collectively referred to herein as “Auctions.” Each potential investor may submit a bid to acquire a fractional interest in the Series Asset or to acquire entire ownership. See “Description of Business – Auction Platform” for a more detailed explanation.

In a Traditional Auction, fractional bidders (each a “Fractional Bidder”) will submit bids consisting of the amount of Class A Shares they are willing to purchase and the price they are willing to pay for the Class A Shares. If the Fractional Bidders as a group submit the Winning Bid (as defined below) in an Auction, they will be issued Class A Shares in the Series associated with the Series Asset in proportion to their fractional bids upon the closing of the Offering for such Series. Class A Shares represent, indirectly, a fractionalized ownership in the underlying Series Asset. The price of each Class A Share for a Traditional Auction will be equal to the amount of the price of the Series Asset represented by the aggregate of the Winning Bids (for Traditional Auctions, known as the “Hammer Price”), the standard fee paid to the Auction House (or the Asset Manager, when acting as auctioneer), known as the “Buyer’s Premium,” sales or similar taxes incurred on the purchase (although it is anticipated there will be none given the delivery and storage procedures the Company will implement), and the Sourcing Fee (collectively, the “Acquisition Cost”), divided by the number of Class A Shares issued by the Company for the Series.

In a Fixed Price Auction, the Company will set a specified price for each Class A Share. Fractional Bidders will submit their bids for a number of Class A Shares that, when multiplied by the specified per share price, will equal the fixed price established for the Series Asset (the “Fixed Price”). Once this number of Class A Shares are subscribed for within a set bid time period (the “Bid Period”), the Series will purchase the Series Asset and each Fractional Bidder that submitted a Winning Bid (as defined below) will be issued Class A Shares in the Series associated with the Series Asset. The Fixed Price will constitute the Acquisition Cost of the Series Asset and will include its Purchase Price, Sourcing Fee, and if applicable sales or transfer taxes. The Fixed Price and the per share price of each Class A Share will be set forth in the Series Offering Table. No additional bids will be accepted once sufficient bids have been received equal to the Acquisition Cost.

The Company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fee, consulting fee or filing fee payable by the Company to Dalmore. See “Plan of Distribution” for more details. To the extent that the Company’s officers and directors make any communications in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration contained in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of them is required to register as a broker-dealer.

We do not currently intend to list the Class A Shares for trading on a national securities exchange. Secondary transactions in Class A Shares (the “Secondary Market”) will be facilitated through the Public Private Execution Network Alternative Trading System, or PPEX ATS (the “Trading Platform”). When trading through the Trading Platform, Investors will submit bid and ask quotes on the Auction Platform to purchase or sell Class A Shares, with any transactions to be executed by the executing broker-dealer through the non-discretionary matching procedure established by the Trading Platform.

| 2 |

The Company and each Series is managed by aShareX Holdings, LLC (the “Managing Member”), a Delaware limited liability company wholly owned by aShareX, Inc. (“aShareX”). The Managing Member, either directly or through its affiliate aShareX Management, LLC (“Asset Manager”), will provide each Series with routine operational, administrative, management, advisory, consulting and other services with respect to their respective operations and routine services related to the Series Asset, including as applicable, authentication and valuation services, storage, transportation and insurance. The Managing Member will also provide extraordinary services such as positioning the Series Asset for sale, obtaining appraisals, and, as applicable, conservation, restoration or other work appropriate to increase the value of the Series Asset. For more information about the services provided by the Managing Member and the Asset Manager, see “Management” below. The Asset Manager is also bonded in California to act as an auctioneer and may perform such function at select Traditional Auctions. If the Asset Manager or any related party is to act as auctioneer at a Traditional Auction, its role will be clearly disclosed to the bidders and potential investors. The Asset Manager may contract with qualified and experienced third parties to perform its services.

The holders of the Class A Shares in a Series (the “Class A Members”), by a majority vote of those voting, control whether the associated Series Asset is to be sold prior to the seventh anniversary (Series 10 and Series 11) or fifth anniversary (Series 12) of its acquisition (referred to herein as the “Voting Years”, as applicable). The Company may also solicit the vote of Class A Members prior to such time if a materially compelling offer presents itself. During the eighth year (Series 10 and Series 11) or sixth year (Series 12) following the Series Asset’s acquisition date (referred to herein as the “Mandatory Sales Year”, as applicable), the Managing Member must sell the Series Asset using commercially reasonable efforts to achieve a favorable price and terms. Any sale must be for cash and the Managing Member intends to distribute the resulting net proceeds promptly following the sale. The Managing Member may, in its discretion, form an investor group to bid on the Series Asset should it be sold through a public auction, provided the Managing Member and its affiliates will not participate in the bidding. The Managing Member may allow a Series to vote on the disposition of one or more specific assets, representing less than the entirety of the Series Asset. None of aShareX, the Managing Member or the Asset Manager have offered prior investment programs which disclosed in the offering materials a date and time period for liquidating the investment program, except where such liquidation period is still at a future date.

In sum, the aShareX innovative approach and proprietary technology allows potential investors to participate in heretofore cost-prohibitive investments by (i) providing rarely available, fact based knowledge concerning the Series Asset, including as applicable, third party appraisals, (ii) enabling an Investor to participate directly in the purchase without expensive middlemen and with real-time, market based, competitive pricing, (iii) providing the Investor with a low-cost liquidity alternative to an investment that is otherwise illiquid, (iv) allowing the Investor to benefit from the experience, expertise and sourcing capabilities of the aShareX principals and its advisory board (the “Advisory Board”), (v) enabling the Investor group to cause the Series Asset to be sold in Voting Years, and (vi) assuring the Investor of an exit event no later than the Mandatory Sales Year.

In addition to the foregoing, an investment in the Series can offer attractive tax benefits. Subject to the more detailed discussion in “Material Federal Income Tax Considerations,” under current tax law, a sale of the Series Asset and a distribution of the resulting proceeds should not be subject to an entity level tax. Taxable gain recognized in such transaction by any Investor subject to U.S. tax who (i) owns, through its investment in the Company, less than 10% of the voting power or value of Cayman, (ii) has held its Class A Shares for more than 12 months, and (iii) has a timely filed IRS “QEF election” in effect for the year in which it acquired the Class A Shares, should be subject to tax at preferable long-term capital gain rates of a maximum 23.8% for individuals, trusts and estates if their Class A Shares are sold prior to year in which the all or a portion of Series Asset is sold. If such Investors hold their Class A Shares through the year in which the all or a portion of Series Asset is sold, the tax rate will be increased to a maximum of 31.8%. Non-U.S. Investors and tax-exempt investors will generally not be subject to tax on the sale of the Series Asset or upon an earlier sale of their Class A Shares. An investor subject to the tax laws of the United Kingdom should not be adversely affected by the manner in which the Series Asset is held and disposed.

No bids will be submitted or accepted until after the qualification of this Offering Statement by the SEC, and potential investors will not be permitted to participate in an Auction unless the Auction commences, within the two calendar days following the qualification of this Offering Statement by the SEC. To participate in an Auction, the investor must also have executed an Auction Agreement relevant to the Auction it is participating in (available for review on the Investor Platform). By executing the Auction Agreement, the investor confirms, among other matters, (i) its status as a “qualified purchaser” (as defined below), (ii) it has read and understands this Offering Statement and its exhibits, including the Company’s Limited Liability Company Agreement (the “Operating Agreement) and the rules for the Auction, and (iii) its commitment to fund its fractional share of the Acquisition Cost. Pursuant to the Auction Agreement, any bid submitted after qualification constitutes a binding offer to purchase an amount of Class A Shares as indicated in the bid, and an agreement to hold the offer open until the offer is accepted or rejected by the Company.

We do not anticipate that a Series will own any assets other than interests in the segregated portfolio (a “SP”) established for such purpose by the Company’s wholly owned subsidiary, aShareX Series SPC, a Cayman Islands segregated portfolio company (“Cayman”), which in turn will own the underlying Series Asset associated with such Series. The Series will be the sole owner of such segregated portfolio. The Investors in a particular Series are not expected to receive any economic benefit from the assets of, or be subject to the liabilities of, any other Series established by the Company. The interests of all Series described above may collectively be referred to herein as the “Class A Shares” and the offerings of the Class A Shares may collectively be referred to herein as the “Offerings.” See “Description of Shares” for additional information regarding the Class A Shares.

| 3 |

There will be a separate closing with respect to each Offering with respect to a Series (each, a “Closing”). The closing of an Offering will occur on the date determined by the Managing Member in its sole discretion, but it is expected to occur as soon as practicable after the conclusion of the Auction. Each Offering is being conducted on a “best efforts” basis pursuant to Regulation A of Section 3(6) of the Securities Act of 1933, as amended (the “Securities Act”), for Tier 2 offerings. The subscription funds advanced by prospective investors as part of the subscription process will be held in a non-interest bearing, segregated escrow account with the escrow facilitator engaged by the Company (the “Escrow Facilitator”) and will not be commingled with the monies of the Escrow Facilitator or any other Series. If a Closing does not occur, the funds will be returned to the investors without interest. The Managing Member will pay for all costs associated with an unsuccessful Offering (other than costs personally incurred by the potential investors for legal, investment or tax advice and wire fees incurred by the investors in transmitting their funds).

Series Membership Interests Overview

Not Yet Qualified

|

|

| Price to public |

|

| Underwriting discount and commissions1 |

|

| Proceeds to Issuer1,2 |

| |||

| aShareX Series, Series 12 |

|

|

|

|

|

|

|

|

| |||

| Per Interest |

| $ | 10.00 |

|

| $ | 0.10 |

|

| $ | 9.90 |

|

| Minimum Investment |

| $ | 2,500.00 |

|

| $ | 25.00 |

|

| $ | 2,475.00 |

|

| Total Maximum (22,700 Class A Shares3) |

| $ | 227,000.00 |

|

| $ | 2,270.00 |

|

| $ | 224,730.00 |

|

Series Membership Interests Overview

Active Offerings (Previously Qualified)

| aShareX Fine Art Series 11 |

|

|

|

|

|

|

|

|

| |||

| Per Interest |

| $ | 0.585 |

|

| $ | 0.006 |

|

| $ | 0.579 |

|

| Minimum Investment |

| $ | 500.00 |

|

| $ | 5.00 |

|

| $ | 495.00 |

|

| Total Maximum (250,000 Class A Shares4) |

| $ | 146,280.00 |

|

| $ | 1,463.00 |

|

| $ | 144,817.00 |

|

|

| (1) | The Company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fee, consulting fee and filing fee payable by the Company to Dalmore. In addition, the Managing Member has previously paid Dalmore a one-time advance set up fee of $5,000 to cover reasonable out-of-pocket accountable expenses actually anticipated to be incurred by Dalmore, such as, among other things, preparing the FINRA filing. Dalmore will refund any fee related to the advance to the extent it is not used, incurred or provided to the Company. The Managing Member also previously paid to Dalmore a one-time $20,000 consulting fee that was due after FINRA issued a No Objection Letter for our first offering associated with the Series and a $1,000 filing fee associated with each post-qualification amendment to the Company’s Offering Statement on Form 1-A. See “Plan of Distribution” for more details. To the extent that the Company’s officers and directors make any communications in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration contained in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of them is required to register as a broker-dealer. The fees and associated expenses of Dalmore will be paid by the Managing Member and will not be directly deducted from proceeds. The Class A Shares of each Series will be represented by unregistered certificates held in digital form by Vertalo, Inc., the Company’s transfer agent (the “Transfer Agent”). Each Investor’s Class A Shares will be recorded on the Investor Platform. See “Plan of Distribution” below for further details. |

|

|

|

|

| (2) | The Asset Manager served as auctioneer for the auction associated with the Artwork for aShareX Fine Art Series 11, and was compensated a commission equal to 15% of the Hammer Price. The Asset Manager would have received this fee regardless of whether the Artwork is purchased by aShareX Fine Art Series 11 or a 100% Bidder (as defined below). See “Management Compensation” below for further details. | |

|

|

|

|

| (3) | Class A Shares will be sold pursuant to a Fixed Price Auction. | |

|

|

|

|

|

| (4) | The Company’s Offering Statement on Form 1-A with respect to the offer and sale of 250,000 Class A Shares was qualified on April 30, 2024 and pricing was established pursuant to an auction held on May 2, 2024. This was a Traditional Auction. |

An investment in the Class A Shares involves a high degree of risk. See “Risk Factors” on page 17 for a description of some of the risks that should be considered before investing in the shares.

Generally, no sale may be made to you in any Offering if you are not an “accredited investor” and the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF ANY OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED BY THE COMPANY ARE EXEMPT FROM REGISTRATION.

| 4 |

WE ARE OFFERING TO SELL, AND SEEKING OFFERS TO BUY, OUR CLASS A SHARES ONLY IN JURISDICTIONS WHERE SUCH OFFERS AND SALES ARE PERMITTED. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH ANY INFORMATION OTHER THAN THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR. THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR IS ACCURATE ONLY AS OF ITS DATE, REGARDLESS OF THE TIME OF ITS DELIVERY OR OF ANY SALE OR DELIVERY OF OUR CLASS A SHARES. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE OR DELIVERY OF OUR CLASS A SHARES SHALL, UNDER ANY CIRCUMSTANCES, IMPLY THAT THERE HAS BEEN NO CHANGE IN THE COMPANY’S AFFAIRS SINCE THE DATE OF THIS OFFERING CIRCULAR. THIS OFFERING CIRCULAR WILL BE UPDATED AND MADE AVAILABLE FOR DELIVERY TO THE EXTENT REQUIRED BY THE FEDERAL SECURITIES LAWS.

Our principal office is located at 10990 Wilshire Blvd., Suite 1150, Los Angeles, California 90024, and our phone number is (877) 358-8999. Our corporate website address is located at www.asharex.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this Offering Circular.

This Offering Circular is following the Offering Circular format described in Part II of Form 1-A.

The date of this Offering Circular is September 16, 2025.

| 5 |

|

|

| Pages |

|

|

| 8 |

| |

|

| 8 |

| |

|

| 8 |

| |

|

| 9 |

| |

|

| 9 |

| |

|

| 9 |

| |

|

| 9 |

| |

|

| 9 |

| |

|

| 13 |

| |

|

| 17 |

| |

|

| 17 |

| |

|

| 28 |

| |

|

| 29 |

| |

|

| 34 |

| |

|

| 34 |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| 45 |

|

|

| 47 |

| |

|

| 53 |

| |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS |

| 55 |

|

|

| 56 |

| |

|

| 62 |

| |

|

| 62 |

| |

|

| 70 |

| |

|

| 71 |

| |

|

| 71 |

| |

|

| 72 |

|

| 6 |

| Table of Contents |

We have not authorized anyone to provide any information other than that contained, or incorporated by reference, in this Offering Circular. We do not take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Offering Circular is an offer to sell only the Class A Shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current only as of its date, regardless of the time of delivery of this Offering Circular or any sale of Class A Shares.

For investors outside the United States: We have not taken any action that would permit this Offering or possession or distribution of this Offering Circular in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to the Offering and the distribution of this Offering Circular.

| 7 |

| Table of Contents |

Certain data included in this Offering Circular is derived from information provided by third parties that we believe to be reliable. The discussions contained in this Offering Circular relating to the Series Asset and the Series Asset's market and industry are taken from third-party sources that the Company believes to be reliable and reasonable, and the Company believes that the factual information is fair and accurate. Certain data is also based on our good faith estimates which are derived from management’s knowledge of the applicable industry/market and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified such third-party information, nor have we ascertained the underlying economic assumptions relied upon therein. The statistical data relating to the market for a particular Series Asset may be difficult to obtain, may be incomplete, out-of-date, or inconsistent and you should not place undue reliance on any statistical or general information related to any Series Asset market included in this Offering Circular. The art market data used in this Offering Circular involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. While we are not aware of any material misstatements regarding any market, industry or similar data presented herein, such data was derived from third party sources and reliance on such data involves risks and uncertainties.

aShareX, the sole member of the Managing Member, owns or has applied for rights to trademarks or trade names that we use or intend to use in connection with the operation of our business, including our names, logos and website names. In addition, aShareX owns or has the rights to patent applications, copyrights, trade secrets and other proprietary rights that protect the intellectual property used in our business, including the Investor Platform and Auction Platform. We have the right to use such trademarks, trade names and other intellectual property rights under royalty free, non-exclusive licenses granted by aShareX. This Offering Circular may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this Offering Circular is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this Offering Circular are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “plan,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this offering circular. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this offering circular, whether as a result of new information, future events or otherwise.

| 8 |

| Table of Contents |

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Potential investors utilizing our Auction Platform to bid on the Series Asset, and subscribing to the Class A Shares pursuant to this Offering, must be “Qualified Purchasers” as defined under Regulation A. “Qualified Purchasers,” for purposes of Regulation A, generally consist of Accredited Investors, as such term is defined under Rule 501(a) of Regulation D, and all other investors so long as their investment in the Class A Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Benefit Plan Investors in the aggregate may not purchase more than 24.9% of the Class A Shares in any Series, and may not purchase any Class A Shares in a Series sold in the Secondary Market. A “Benefit Plan Investor” means (a) any “employee benefit plan” (as defined in Section 3(3) of ERISA) that is subject to Title I of ERISA, (b) any “plan” (as defined in Section 4975 of the Code) that is subject to Section 4975 of the Code, (c) any entity that is deemed to hold plan assets of any plan described in (a) or (b) by virtue of such plan’s investment in that entity.

As a Tier 2 offering pursuant to Regulation A, this Offering is exempt from state “Blue Sky” law review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Class A Shares offered hereby are offered and sold only to Qualified Purchasers or at a time when the Class A Shares are listed on a national securities exchange. Accordingly, we reserve the right to reject any potential investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such potential investor is not a Qualified Purchaser or its subscription exceeds its investment limitations for purposes of Regulation A.

USE OF CERTAIN TERMS AND DEFINITIONS

Throughout this Offering Circular, we will use certain defined terms. While these terms will generally be defined in context, for convenience, these terms will also be contained in a “Glossary” attached as Appendix A.

Key information related to the Offering of Class A Shares for each Series, as well as information with respect to previous Offerings of Class A Shares, is set forth in Appendix B. Please also refer to “Series Asset” and “Use of Proceeds” for further details.

SUMMARY OF RISKS

This summary highlights selected information contained elsewhere in this Offering Circular. This summary does not contain all of the information you should consider before investing in the Class A Shares. You should read this entire Offering Circular carefully, especially the risks of investing in the Class A Shares discussed under “Risk Factors,” before making an investment decision , including the following:

|

| • | Risks Related to Our Business Model. Our business model is relatively new and untested and we do not plan to generate any material amount of revenues. Our strategy is to own the Series Asset for an extended period of time and sell it at a profit, but no assurance can be given that we will be able to sell the Series Asset at a profit or the timing of any such sale. |

|

|

|

|

|

| • | Risks Associated with an Investment in a Company Owning Fine Art, Collectibles and Other Alternative Assets. The Series Asset can be highly illiquid and Investors must be prepared to hold their investment for an extended period of time. The Series Asset may decline in value or may not appreciate sufficiently to exceed their Acquisition Costs. There are a variety of other risks to investing, including, without limitation, the risk of claims that the Series Asset is not authentic, physical damage and market risks for any particular Series Asset. |

|

|

|

|

|

| • | Risks Relating to Our Relationship with the Asset Manager and Managing Member. Since we have minimal liquid assets, we are totally reliant on the Asset Manager and Managing Member to administer our business. If either were to cease operations for any reason it would be difficult for us to find a replacement administrator and we would likely be required to sell the Series Asset and dissolve the Company. In addition, since the Managing Member owns Class B shares, the Managing Member may have economic interests that diverge from your interests. The Managing Member may convert its Class B Shares into Class A Shares at any time in accordance with a formula set forth in the Operating Agreement, and may subsequently sell any Class A Shares without restrictions under our Operating Agreement. Any such secondary offering may make it more difficult for you to sell your Class A Shares and could adversely affect the price at which you can sell your Class A Shares on the secondary market. |

|

|

|

|

|

| • | Risks Related to Ownership of the Class A Shares and the Offering. Investors in this Offering will have limited voting rights and the Managing Member and its affiliates will have significant discretion to operate the business and sell the Series Asset. In addition, although the Company intends to facilitate secondary sales of Class A Shares on the PPEX ATS, the PPEX ATS will have significant limitations and the Class A Shares may be illiquid. |

Formation and Overview

We were formed as a Delaware series limited liability company on January 13, 2023 to facilitate an investment in museum quality, blue chip, fine art, and other artistic works, collectibles and other alternative assets, by allowing Investors to potentially acquire a fractional interest in the Series Asset through use of our proprietary Auction Platform, which is described in greater detail under “ Description of Business-Auction Platform” below. Effective July 31, 2025, the Company changed its name from aShareX Fine Art, LLC to aShareX Series LLC to better reflect broader potential Series Assets.

If the Investors are the successful bidder as a group at a Traditional Auction, or a sufficient number of bids are received for a Fixed Price Auction, the Series we establish will use the funds received from issuing its Class A Shares to such Investors to purchase the Series Asset. Title to the Series Asset will be held by a segregated portfolio (each an “SP” or “Segregated Portfolio”) established for such purpose by Cayman, the Company’s wholly owned subsidiary. Each Series’ sole asset will consist of its ownership of the SP, and the SP’s sole asset will be the Series Asset. Neither the Company nor Cayman are anticipated to use borrowings or leverage to purchase or hold the Series Asset or to incur any material indebtedness, except in extraordinary circumstances as described in greater detail under “Management-Asset Manager-Funding and Reimbursement of Expenses” below.

| 9 |

| Table of Contents |

The Series Asset for each Series will be held for appreciation and will be sold in the Voting Years if approved by a majority vote of those Class A Shares of that Series entitled to vote on such matter (“Majority Vote”), or in the Mandatory Sales Year if not previously sold. No material revenues or profits are expected to be realized, and no distributions are anticipated to be made, prior to the sale. Promptly following the sale of the Series Asset, the Net Sales Proceeds (as defined below under “Distribution Policy”) from the sale shall be distributed to the Holders of the Class A and B Shares of the associated Series in proportion to their respective interests. The Class B Shares, if not previously converted to Class A Shares, will receive distributions equal to 10% of the amount by which the Series Asset appreciated over its Purchase Price (as described in greater detail under “Description of Business – Art Market – Auction Sales”), and the remaining distributions will be distributed pro rata to the Holders of the Class A Shares. All of the Class B Shares will be held by the Managing Member. Accordingly, if there is no appreciation in the value of the Series Asset from its Purchase Price, all of the distributions will be made to the Holders of the Class A Shares (the “Class A Members”). There can be no assurance that the Series Asset will appreciate in value or that there will be significant or any distributions to be made to the Class A Members. Distributions to the Members are discussed in greater detail under “Description of Shares” below.

Related Parties

aShareX Inc. (“aShareX”) is the parent of the Managing Member and Asset Manager, as described below. Its core business is to enable investors and collectors to bid on and own, through fractionalized interests, previously unattainable artwork, jewelry, vintage automobiles and other collectibles and alternative assets, thereby bringing a new market of buyers to such investment domains. aShareX is essentially comprised of two functional exchanges – the Auction Platform, a primary market to bid on interests which indirectly represent a fractionalized share of Series Assets, and the Trading Platform, a match-based secondary market for ongoing investor-controlled liquidity - both of which are licensed for use by the Company on a royalty-free basis. Pursuant to the terms of a License Agreement attached as an Exhibit to the Offering Statement of which this Offering Circular is an integral part, aShareX will license to the Company, each Series and SP a non-exclusive, royalty free, worldwide right to utilize the aShareX trademarks and intellectual property rights associated with use of the Investor Platform. None of aShareX, the Managing Member or the Asset Manager have offered prior investment programs which disclosed in the offering materials a date and time period for liquidating the investment program, except where such liquidation period is still at a future date.

aShareX Holdings, LLC (“Managing Member”) is a Delaware limited liability company and a wholly-owned subsidiary of aShareX. It is the Managing Member of the Company and each Series, and, in such capacity, it will control all activities of the Series and its SP. The Managing Member acts through its Board of Directors currently comprised of two individuals, Alan Snyder and Nick Thomas. See “Management” below for more details. They will also serve as the members of Cayman’s Board of Directors. The Managing Member, either directly or through the Asset Manager or a qualified and experienced third party, will (i) provide factual information concerning the Series Asset, including, as applicable, its history and provenance, (ii) obtain third party valuations of the Series Asset, if applicable, (iii) oversee the Auction Fixed Price Auction process to facilitate the purchase of the Series Assets, (iv) provide strategic oversight to the Company to best position the Series Asset for appreciation and eventual sale, (v) negotiate and transact the sales terms for the Series Asset, and (vi) following such sale, attend to the distribution of the Net Sales Proceeds and liquidation of the Series and the SP. In the event Extraordinary Expenses are incurred (see discussion below under “Management-Asset Manager-Funding and Reimbursement of Expenses” ), the Managing Member shall use commercially reasonable efforts to find financing to pay for such expenses or it may elect to fund the Extraordinary Expenses itself by way of a loan bearing interest at the prime rate of interest published by the Wall Street Journal (“Prime Rate”) at the time the loan is funded , plus two percentage points. The Managing Member will be issued 1,000 Class B Shares by each Series in exchange for its funding the fees and other expenses payable to Dalmore (or any successor broker subsequently appointed by the Managing Member, the “Broker”) for each successful Offering or the costs and expenses incurred in connection with any failed Offering.

aShareX Management, LLC (the “Asset Manager”) is a Delaware limited liability company and a wholly-owned subsidiary of aShareX. Asset Manager, either directly or through qualified and experienced third parties, will attend to all of the day-to-day administrative and asset management functions associated with holding and preserving the Series Asset, including, as applicable, storage, security, transportation and insurance and the day-to-day costs of operating each Series and SP. As applicable the Asset Manager may exhibit or display the Series Asset with museums, galleries, other public venues or private parties to enhance its value. The Asset Manager will be paid by the Investors in each Series a sourcing fee equal to six percent (6%) of the Purchase Price of the Series Asset (Series 10 and Series 11) or fifteen percent (15%) of the Purchase Price of the Series Asset (Series 12), acquired by such Series (the “Sourcing Fee”). The Sourcing Fee is higher in the Series 12 Offering since an auction fee—typically in excess of 20% of the Purchase Price—will not be charged. The Asset Manager will then use the Sourcing Fee to pay for all Offering Expenses (other than the fees and other expenses payable to the Broker (“Broker Fees”) paid by the Managing Member) and Operating Expenses of the Series and SP for their day-to-day operations (including audit, accounting and tax preparation fees, SEC and state registration and filing fees, and as applicable, the costs of insuring, storing and transporting the Series Asset) prior to the date the Series Asset is sold. The services rendered by the Asset Manager and the Offering and Operating Expenses it is obligated to fund are discussed in greater detail under “Management – Asset Manager” below.

Alan Snyder is the founder and Chief Executive Officer (CEO) of aShareX. Alan is also the Managing General Partner of Shinnecock Partners, a family office investment boutique, and its investment funds, including ArtLending.com, which offers secured fine art lending for collectors and dealers. As part of ArtLending.com, Alan has forged relationships with the major auction houses, art dealers and fine art brokers around the world. Prior to forming aShareX, Alan was the founder, CEO, President and Chairman of Answer Financial Inc. and Insurance Answer Center, CEO of Aurora National Life Assurance, President/COO of First Executive Corporation, and Executive VP and Board Member at Dean Witter Financial (predecessor to Morgan Stanley), where, as part of a three-person team, he formulated the launch of Discover Card. He is also the former Chairman, President, and Board Member of the Western Los Angeles Boy Scout Council. Alan is a graduate of Georgetown University and Harvard Business School, where he was a Baker Scholar.

| 10 |

| Table of Contents |

Shinnecock entered the fine art lending space in 2015 as part of its specialty lending practice and its business is transacted through a California lender license.

Joel Parrish is the Chief Financial Officer (CFO) of aShareX. He has worked with aShareX founder Alan Snyder for 35 years, across multiple companies. Most notably, he has been responsible for financial and operational areas of Shinnecock Partners L.P., a private money manager, since 1998. Joel and Alan have launched seven investment funds (including fine art lending), plus a number of private deals amounting to over $100 million. He previously assisted with various aspects of aShareX’s formation and operations on a consultant basis. Joel has a Bachelor’s degree from Columbia College.

Kevin Hughes is Chief Information Officer (CIO) of aShareX. Prior to joining aShareX, Kevin was the founder and Managing Partner for h7i, a boutique consultancy leading enterprise-level I.T. and digital programs to facilitate fast and effective change, where he successfully implemented various technology solutions and programs for institutions including the State of California, Southern California Edison, the Judicial Branch, and the UK Ministry of Defense, as well major brands such as Adobe, Viking, Disney, Honda, Toyota, Axa, and Nestle. Kevin also served as a Subject-Matter Expert consultant for the Obama White House. Throughout his career at his and other notable UK-based global IT and tech companies, Kevin won a plethora of awards including an Addy, Andy, Webby, WOTM, and FWA. Kevin has a CS degree from Open University in England.

Gabriel Miller is Chief Marketing Officer (CMO) of aShareX. Gabe is a branding and marketing veteran with over 25 years of experience working across major industries and sectors. He is the former President of Landor, the world’s largest branding agency. Prior, he worked with IBM and sold them two companies – Resource and Ammirati. He has served as President for three successful marketing agencies on both the East and West Coasts. Gabriel has helped inspire groundbreaking design work for McDonald’s, Coca-Cola, Fox Sports, Toyota, Nestlé, Neutrogena, Jet Blue and Bacardi among many others. He has received many recent industry awards: 12 at the Transform Awards North America in 2023, 18 in 2022, 4 in 2021, and 1 in 2019. He was also awarded at the World Retail 2021, RDI 2021, German Design Awards 2023, The Drum 2022, Red Dot Design Awards 2022 and The One Show 2022. Gabriel holds a degree from California State University, Northridge.

| 11 |

| Table of Contents |

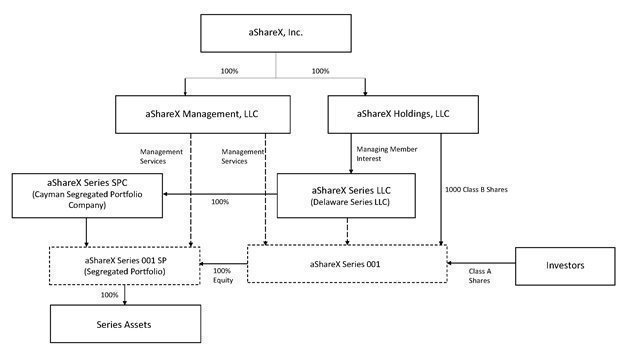

Organizational Structure

The following diagram reflects the planned organizational structure and the material relationships between the Company, each aShareX entity and each affiliate of the Series that will exist following the Offering:

*All entities are Delaware limited liability companies, except aShareX, Inc. which is a Delaware corporation, and aShareX Series SPC which is a Cayman Islands segregated portfolio company.

Further Information

For additional information, our principal office is located at 10990 Wilshire Blvd., Suite 1150, Los Angeles, California 90024, and our phone number is (877) 358-8999. Our corporate website address is at www.asharex.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this Offering Circular.

| 12 |

| Table of Contents |

| Securities Offered

| We will be offering Class A Shares in each Series on a “best efforts” basis. Investors in the Class A Shares will become members of the Series. In the event an issuance would result in an Investor holding a fractional number of Class A Shares, the number of Class A Shares to be received by such Holder will be rounded down to the nearest whole Class A Share, and the Investor’s purchase price for the Class A Shares will be appropriately adjusted. | ||

|

|

| ||

| Offering Price per Class A Share – Fixed Price Auction

| The Offering Price per Class A Share for a Fixed Price Auction is included in the Series Offering Table. Each Offering will commence within two calendar days following qualification for the associated Series. The Offering will be extended until the earlier of (i) the termination date set forth in the Series Offering Table, as may be extended by the Managing Member in its discretion, or (ii) the date aggregate bids are received for the fixed price set forth in the Series Offering Table, also referred to as the “Acquisition Cost.” | ||

| Offering Price per Class A Share – Traditional Auction

| The exact price for Class A Shares of a Series is set in a Traditional Auction held by the Company and utilizing the Company’s proprietary, online bidding platform (the “Auction Platform”). If Fractional Bidders are permitted to participate, the Auction will take place within two calendar days following qualification of the Offering for the associated Series. The price of each Class A Share will be equal to the amount of the price of the Series Asset represented by the Hammer Price, the standard fee paid to the Auction House (known as the “Buyer’s Premium”), sales or similar taxes incurred on the purchase (although it is anticipated there will be none given the delivery and storage procedures the Company will implement), and the Sourcing Fee (collectively, the “Acquisition Cost”), divided by the number of Class A Shares issued by the Company for the Series. The Auction process is described in greater detail under “Description of Business – Auction Platform” below. Until the offering price for Class A Shares for a Series has been set by a Traditional Auction, the Company will include an estimated price range for the Class A Shares of each Series in its Preliminary Offering Circular in the Series Offering Table. | ||

|

|

| ||

| Investor Platform

| aShareX owns, and has licensed to the Company on a royalty free basis, a web browser-based platform located at https://www.asharex.com (the “Investor Platform”). Once an Investor establishes a user profile on the Investor Platform, he or she can browse and screen potential investments, and sign contractual documents online, such as the Auction Agreement and Subscription Agreement. Investors can also post bid or ask requests concerning the potential trade of their Class A Shares. | ||

|

|

| ||

| Use of Proceeds | The gross proceeds from each Offering will be used exclusively to fund the Acquisition Cost of the Series Asset, including the Sourcing Fee and any applicable Buyer’s Premium. | ||

|

|

| ||

| Series Asset | For a Fixed Price Auction, the Series Asset will be purchased directly from the owner of the Series Asset after the successful conclusion of the Fixed Price Auction.

For a Traditional Auction, the Series Asset to be held will be sold through an auction to be conducted by an Auction House or by the Managing Member itself through a Series Asset it has sourced and has available on consignment. If the Series Asset is purchased through a third-party Auction House, it will be pursuant to such Auction House’s standard terms and conditions for such purchase. If the Series Asset is purchased through the Asset Manager, the Conditions of Sale (essentially the purchase terms) will be attached to the Offering Statement associated with that Series. The specific Series Asset associated with each Series will be described in an Appendix of this Offering Circular as identified in the Series Offering Table.

We do not anticipate that any Series will own any assets other than interests in the Segregated Portfolio holding the underlying Series Asset associated with such Series. The Series will be the sole owner of such Segregated Portfolio. | ||

|

|

| ||

| Capitalization and Outstanding Securities

| The Company’s Operating Agreement as it relates to each Series provides for two classes of equity: Class A Shares and Class B Shares. There will be no Class A Shares outstanding prior to the Offering for such Series.

The Managing Member is the sole member of the Company and will initially be the sole member of each Series, holding 1,000 Class B Shares that will be issued to it for paying the Broker Fee upon the Closing of an Offering and for any costs and expenses incurred in connection with any Offering that is not completed. Each Series has no other securities outstanding (or options to acquire same), nor will any other securities be issued other than Class A and B Shares.

The Class B Shares in each Series equate in value to 10% of the associated Series Asset’s appreciation in value over its Purchase Price. If there is no increase in the value of the Series Asset from its Purchase Price, the Class B Shares will have no value and the entire amount of Net Sales Proceeds distributable upon the sale of the Series Asset will be distributed solely to the Class A Members.

The Class B Shares in each Series are convertible into the Series’ Class A Shares prior to the sale of the Series Asset pursuant to a formula set forth in the Operating Agreement. The Class A Shares issued to the Managing Member in such conversion, assuming conversion of all of the Class B Shares, are intended to approximate 10% of the appreciation between the current market price of the Class A Shares at the time of conversion and their aggregate offering price. | ||

|

|

| ||

| Offering Amount | In a Traditional Auction, until the offering price for Class A Shares for a Series has been set, the Company will include an estimated Offering amount range for each Series in its Preliminary Offering Circular in the Series Offering Table. The final Offering amount will ultimately be determined at the auction for the Series Asset if the Fractional Bidders in the aggregate submit the Winning Bid. The price per share of a Winning Bid will be described by Offering Supplement after the auction for the Series Asset.

In a Fixed Price Auction, the Company will set a Fixed Price which represents the amount of aggregated bids that must be reached for the Series Asset to be purchased and any Class A Shares of that Series to be sold, and the amount of Class A Shares that will be sold in the Offering. These amounts will be set forth in the Series Offering Table. | ||

|

|

| ||

| Per Investor Minimum Investment Amount

| The minimum investment per Investor in each Series is typically $5,000 and is established by the Managing Member with respect to a Series. The minimum investment amount for Series 10 and Series 11 is $5,000, and the minimum investment amount for Series 12 is $2,500. Some Investors may have a maximum investment limit imposed at the time of the Offering based on their net worth or liquidity. Benefit Plan Investors may not acquire in the aggregate more than 24.9% of the Class A Shares in any Series. Investors that are not “accredited investors” as such term is defined under Rule 501(a) of Regulation D (“Accredited Investors”) may not acquire Class A Shares in an Offering that would result in their investment in the Company exceeding 10% of the greater of the individual’s annual income or net worth, or in the case of an entity, 10% of its net income or net worth, in each case as certified by the Investor in its Auction Agreement and Subscription Agreement. An Investor who purchases more than 10% of the Class A Shares in an Offering (i) will be subject to certain disclosure requirements in the Company’s SEC filings, and (ii) and may be considered an “affiliate” for purposes of Rule 405 of the Securities Act and hence subject to certain limitations on its ability to trade its Class A Shares absent an available exemption. | ||

|

|

| ||

| Subscribing Online

| Investors can review and execute their Auction Agreement and Subscription Agreement online by accessing the Investor Platform at https://www.asharex.com/. | ||

|

|

| ||

| Broker-Dealers

| Dalmore will act as the broker-dealer in connection with this Offering and in executing trades of the Class A Shares on the Trading Platform. Dalmore is a registered, broker-dealer with the SEC and FINRA and in each state where the Offering will be made. | ||

| 13 |

| Table of Contents |

| Payment for Class A Shares

| No money or other consideration is being solicited with respect to any Series until the qualification of this Offering Circular by the SEC with respect to such Series, and if sent in response, will not be accepted. No offer to buy the securities can be accepted and no part of the purchase price can be received until an offering statement with respect to a Series is qualified with the SEC, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind. Any bids submitted after qualification of this Offering Statement shall be deemed accepted by the Company, subject to the determination of the Winning Bids (as defined below), if applicable, and the Company’s right to reject a Subscription Agreement as outlined below. The Company in its sole discretion reserves the right to limit the times at which bids may be submitted or confirmed after qualification of this Offering Statement.

Investors can make payment for their Class A Shares in the form of ACH debit transfer by connecting their bank account via Plaid or wire transfer payment to a segregated non-interest bearing account held by the Escrow Facilitator. The Company will not accept payment by credit card and will only accept fiat currency. It will not, for example, accept any crypto currencies, including Bitcoin and Ethereum. On the Closing of the associated Offering, the funds in the escrow account will be released to acquire the Series Asset and the associated Class A Shares will be issued to the Investors. If the Closing does not occur for any reason, any funds deposited in the escrow account will be returned to the subscribers without interest. Investors will be required to reimburse the Company for costs incurred in receiving their funds, such as wire fees. |

|

|

|

| Worldwide

| While the Class A Shares of each Series will be offered worldwide, including in the United Kingdom, the Company may elect not to sell the securities in particular jurisdictions for regulatory or other reasons. No sale of Class A Shares will be made anywhere in the world prior to the qualification of this Offering Circular by the SEC in the United States and FINRA’s issuance of a “No Objections Letter.” All Class A Shares will be offered at the same U.S. dollar price. |

|

|

|

| Voting Rights; Sale of the Series Asset

| The Class A Shares issued by each Series have no voting rights other than to approve (i) amendments to the Operating Agreement that are materially adverse to their interests, (ii) the removal of the Managing Member and Asset Manager for “cause,” or (iii) the sale of the Series Asset in the Voting Years. See “Description of Shares” for more details. The Class A Members of each Series will be asked to vote on selling the Series Asset at any time in the Voting Years, and the Managing Member may solicit their approval in its discretion prior to such time if a materially compelling offer to purchase all or a portion of the Series Asset is tendered by a third party. During the Mandatory Sales Year, the Managing Member must sell the Series Asset using commercially reasonable efforts to achieve a favorable price and terms |

|

|

|

|

| Any Class A Member that beneficially owns 5% or more of the Class A Shares may irrevocably limit or eliminate its voting rights by providing an irrevocable certification to the Company in substantially the form Vote Limit Certificate filed as an Exhibit to this Offering Statement. In the event a member irrevocably limits or eliminates its voting rights, all of the Class A Shares beneficially owned by such member in excess of the voting limit applicable to such Class A Member shall no longer have any voting rights for so long as such shares are beneficially owned by such Class A Member or such Class A Member’s affiliates. |

|

|

|

| Risk Factors

| Investing in the Class A Shares involves risks. See the section entitled “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in the Class A Shares. |

|

|

|

| Expenses

| The Managing Member and Asset Manager will pay all of the Offering Expenses associated with each Offering, including the Broker Fee, and the ongoing Operating Expenses of each Series and its SP. See “Management-Asset Manager-Funding and Reimbursement of Expenses” for further details. |

| 14 |

| Table of Contents |

| Closing or Termination

| An initial Closing of each Offering for a particular Series will occur on the date determined by Dalmore and the Managing Member once the Investors execute their Subscription Agreements, certify they are “Qualified Purchasers” for purposes of Regulation A, and fund to the Escrow Facilitator a total amount equal to the Acquisition Cost of the Series Asset. “Qualified Purchasers” for these purposes mean Accredited Investors and all other investors so long as their investment in the Class A Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). The Closing shall occur as soon as possible following completion of the Auction and if via the involvement of an Auction House, is intended to occur within the timeframe fixed by the Auction House to acquire the Series Asset.

The Managing Member reserves the right to terminate an Offering for any reason at any time prior to its Closing, including, for example, because (i) the Offering is not qualified within two days prior to the commencement of the Auction, (ii) the potential investors submitting Fractional Bids do not win the bid because a single party submitting a 100% Bid wins the Auction, (iii) a Traditional Auction fails in that the bids do not exceed the minimum purchase price set by the Seller, or a Fixed Price Auction fails in that the Fixed Price is not reached within the Bid Period, or (iv) one or more potential investors do not timely fund amounts equating to their bids, they are determined not to meet the qualification requirements, or their bids exceed the financial limitations imposed by the Company, and in each case the Managing Member is unable to remedy the funding deficiency through other means.

If any of the Class A Shares offered remain unsold, the seller of the Series Asset will be asked to either reduce the Purchase Price or accept Class A Shares (assuming the seller is a Qualified Purchaser) for the deficient amount. To the extent there remains a deficient amount, the unsubscribed Class A Shares will be offered (i) first, to the Investors already participating in the Offering, (ii) second, to aShareX, the Managing Member, the Asset Manager and their respective directors, officers, associates and direct and beneficial owners (collectively, the “aShareX Parties”), and (iii) finally, to any other Qualified Purchaser (including an aShareX Party) with preference given to registered Investor Platform users. Notwithstanding the foregoing, none of the aShareX Parties may purchase Class A Shares in an Offering, and if offered shares pursuant to the procedure outlined in the immediately preceding sentence, they may not purchase more than 20% of the Class A Shares offered in the Offering (including shares purchased by an aShareX Party due to downward rounding). There can be no guarantee that any of these alternatives will successfully remedy the deficiency, and the Series may not be able to purchase the Series Asset. See “Plan of Distribution” for further discussion.

If a Closing has not occurred, an Offering shall be terminated upon (i) the date which is one year from the date such Offering Circular or amendment thereof, as applicable, is qualified by the SEC, which period may be extended with respect to a particular series by an additional six months by the Managing Member in its sole discretion, or (ii) any date on which the Managing Member elects to terminate the Offering for a particular Series in its sole discretion. The Company anticipates that, for a Traditional Auction, the Managing Member will terminate the Offering shortly after the Auction if (a) the Fractional Bidders have not collectively submitted the Winning Bid for the Series Asset, or (b) the Fractional Bidders have collectively submitted the Winning Bid for the Series Asset but are unable to complete the purchase of the Series Asset within the time frame fixed by an Auction House or for any other reason. The Company anticipates that for a Fixed Price Auction, the Managing Member will terminate the Offering shortly after the Bid Period if the Fractional Bidders have not submitted aggregate bids that meet the Fixed Price or if the Fractional Bidders are unable to complete the purchase of the Series Asset within the time frame fixed by the Managing Member or for any other reason, and the Managing Member has not determined other means to sell sufficient Class A Shares to meet the Fixed Price. If the Offering is terminated for any reason, the funds submitted by each potential investor shall be promptly returned to such potential investor, without interest, less any wire fees not previously paid by the potential investor. |

| 15 |

| Table of Contents |

| Transfer Restrictions

| The Class A Shares may only be transferred by operation of law, with the consent of the Managing Member or:

· To an immediate family member or an affiliate of the transferor, · To a trust or other entity for estate or tax planning purposes if the transferor maintains control of the trust or entity, · As a charitable gift, · On the Trading Platform.

An otherwise permitted transfer, to be effective, must be reported to the Managing Member and the Company’s Transfer Agent, and the transferee must have registered on the Auction Platform, passed “know your customer” (KYC) and anti-money laundering (AML) screening, and executed the documentation required of any transferee.

An Investor may pledge its Class A Shares as collateral for a loan, provided the lien is extinguished prior to the transfer of the shares, and the pledgor and lender agree that, if there is a foreclosure on the lien, the lender will notify the Managing Member and Transfer Agent of the transfer, register the lender (or other transferee) on the Auction Platform and execute the documentation required of any transferee |

|

|

|

| Transfer Agent

| Vertalo, Inc., an SEC-licensed transfer agent, has been engaged by the Company to act as “Transfer Agent” to register ownership of the Class A Shares for each Series and to record their transfer in the Company’s register for the Series. |

|

|

|

| Distributions

| The Company does not expect that any Series will generate material revenues or profits until its associated Series Asset is sold. At such time, the Net Sales Proceeds will be distributed (i) to the Managing Member in payment of the Class B Shares to the extent of 10% of the Series Asset's appreciation in value over its Purchase Price, and (ii) the balance of the proceeds will be distributed to the Class A Members in proportion to their Class A Shares in the Series. If there is no appreciation in value of the Series Asset because the proceeds from the sale are less than or equal to the Purchase Price for the Series Asset, the Class B Shares will not receive any distributions and the Net Sales Proceeds will be paid solely to the Class A Members. |

| 16 |

| Table of Contents |

We have not declared or paid distributions since our formation and do not anticipate paying distributions for any Series until the associated Series Asset is sold. At that point, we will apply the gross proceeds from the sale to pay (i) any loans made to the Company to fund Extraordinary Expenses, (ii) the costs incurred in connection with the sale, (iii) the costs of liquidating the Series and its SP, including any remaining payments due to a consigner upon liquidation, and (iv) the amount, if any, needed to fund a reserve for contingent liabilities (such net proceeds, the “Net Sales Proceeds”). The Net Sales Proceeds (together with any funds subsequently released from reserves) will be distributed to the Holders of the Class A and B Shares as their interests may appear. There can be no assurance as to the amount or timing of a liquidating distribution (although it is expected to occur by the applicable Mandatory Sale Year). There are no contractual restrictions on our ability to declare or pay distributions. The decision as to the amount and timing of the distributions will be at the discretion of the Managing Member and will depend on our then current financial condition and other relevant factors, but the intent is to distribute the proceeds as quickly as possible following the sale.

The purchase of the Class A Shares offered hereby involves a high degree of risk. Each prospective investor should consult his, her or its own counsel, accountant and other advisors as to the legal, tax, business, financial, and related aspects of an investment in the securities offered hereby. Prospective investors should carefully consider the following specific risk factors, in addition to the other information set forth in this Offering Circular, before purchasing the securities offered hereby.

Risks Related to our Business Model

The Company is Newly Formed and our Business Model is Untested. The Company is a new company that was formed on January 13, 2023 and has a limited operating history. We cannot make any assurance that our business model can be successful. Our operations will be dedicated to (i) sourcing potential, pre-qualified investors, (ii) engaging them in the Offering process, through each Series, to bid as a group to purchase the Series Asset associated with a specific Series we establish, (iii) if the bid from the Series is successful, issuing the Class A Shares to the Investors, and (iv) maintaining and preserving the Series Asset to facilitate its ultimate sale. We do not expect any Series to generate any material amount of revenues or cash flow until the Series Asset is sold and no profits will be realized by the Investors in such Series unless the Series Asset is sold for more than its Acquisition Cost plus any Extraordinary Expenses that may be incurred. Few companies have issued securities that represent indirect ownership in alternative assets with the sole goal of realizing appreciation in its value, and none to our knowledge have engaged in such an investment through an on-line bidding process. It is difficult to predict whether this business model will succeed or if there will ever be any profits realized from an investment in the Class A Shares.

We Do Not Expect to Generate any Material Amount of Revenues Until the Series Asset is Sold. We do not expect any Series to generate any material amount of revenues or cash flow until the associated Series Asset is sold. No profits can be realized by the Investors in such Series unless the Series Asset is sold for more than its Acquisition Cost plus any Extraordinary Expenses that may be incurred by the Series.

| 17 |

| Table of Contents |

Each Series Will Rely on the Asset Manager to Fund its Operations. We must rely on the Asset Manager to fund any Operating Expenses that exceed the Sourcing Fee and for the Managing Member or another aShareX affiliate to lend funds or find the financing necessary to pay any Extraordinary Expenses, which it has no obligation to do. Accordingly, we will be completely reliant on the Asset Manager and the Managing Member to fund or finance these items, and there is no assurance that they will maintain sufficient liquidity to fund these items.

We are Extremely Undiversified Since our Strategy is for each Series to Achieve Capital Appreciation from a Single Asset or Group of Related Assets . Each Series will be established to facilitate an investment in an individual asset or group of similar assets, such as a single work of art or group of collectible vehicles. The Series will not invest in any other assets or conduct any other operations that could generate income. Such lack of diversification creates a concentration risk that may make an investment in the Class A Shares riskier than an investment in a diversified pool of assets or a business with more varied, revenue generating operations. The aggregate returns realized by Investors will correlate to the change in value of the Series Asset, which may not correlate to changes in the relevant overall market or any segment thereof, or in the investment community at large.

An Investment in an Offering Constitutes only an Investment in a Particular Series and not in the Company, Another Series or the Underlying Series Asset . A purchase of Class A Shares in a Series does not constitute an investment in either the Company, another Series or the underlying Series Asset directly. Because the Class A Shares of a Series do not constitute an investment in the Company as a whole, or any other Series, Holders of Class A Shares in a particular Series of interests will not receive any economic benefit from, or be subject to the liabilities of, the assets of the Company or any other Series. In addition, the economic interest of a Holder of Class A Shares in a Series will not be identical to owning a direct, undivided interest in the underlying Series Asset due to the layer of entity ownership.

The Series Asset may be Sold at a Loss or at a Price that Results in a Distribution that is below the Purchase Price of the Class A Shares, or no Distribution at all. Any sale of the Series Asset by a Series could be affected at an inopportune time, at a loss or at a price that would result in a distribution of cash less than the amount paid by Investors to purchase their Class A Shares in the associated Series. A Series may be intended to hold its Series Asset for an extended period of time, although the Series will be required to sell the Series Asset by the applicable Mandatory Sale Year if there has not been a prior sale. Any sale at such times may be less than optimal due to market conditions. Although the value of the Series Asset may decline in the future, we have no current intention or economic incentive to cause a Series to sell the Series Asset at a loss, but will be required to do so if a sale is required . We may also be required to sell the Series Asset prior to the Mandatory Sale Year applicable to the Series without any vote by the Class A Shares if necessary to pay for Extraordinary Expenses that cannot be funded through loans under reasonable terms or to repay any such loans that mature and cannot be refinanced. In the future, we may recommend that the Class A Members of a Series approve a sale of the Series Asset prior to Mandatory Sale Year if we consider market conditions opportune, but there is no assurance that such approval will be obtained, or that the Series Asset will not decline in value thereafter. Circumstances may arise that may compel a Series to sell the Series Asset at an inopportune time and potentially at a loss, such as if it faces litigation, regulatory challenges or Extraordinary Expenses that cannot be financed or funded. There can be no assurance that the Class A Shares or the associated Series Asset can be sold at a price that results in proceeds in excess of the amount paid by an Investor for its Class A Shares, or any proceeds at all

The Timing and Potential Price of a Sale of the Series Asset is Impossible to Predict, so Investors Need to be Prepared to Own the Class A Shares for an Uncertain or Even Indefinite Period of Time. Each Series intends to hold the Series Asset for an indefinite period, though it is the Company’s intention that a sale will occur no later than the Mandatory Sale Year for the Series, and it will be sold sooner under the conditions set forth in the immediately preceding paragraph. Accordingly, a risk of investing in the Class A Shares is the unpredictability of the date the Series Asset will be sold and the amount of funds generated by such sale. Investors should be prepared for the possibility they will not receive a cash distribution for many years and hence they should be prepared to hold their Class A Shares for an indefinite period of time. There can be no assurance that the Class A Shares can be resold or that the Series Asset can be sold within any specific timeframe, or at all.

| 18 |

| Table of Contents |

Our Business Model Involves the Issuance of Class B Shares and Possibly Class A Shares that may have a Dilutive Effect on the Holders of the Class A Shares. Each Series will issue Class B Shares to the Managing Member that equate to 10% of the amount by which the Series Asset appreciates in value over its Purchase Price. In addition, the Class B Shares can be converted into Class A Shares based on a formula which is intended to represent 10% of the appreciation in the per share price of the Series’ Class A Shares from their Offering Price at the Closing. Moreover, if the Managing Member or a commercial lender makes a loan to a Series to pay for Extraordinary Expenses, the Managing Member may subsequently repay such loan from proceeds derived through the issuance of additional Class A Shares in the Series. Such transactions may have a dilutive effect on the Series’ Class A Shares depending on the value appreciation in the Class A Shares or the Series Asset, as applicable, or the amount of Extraordinary Expenses being funded, and may effectively reduce the tangible book value per Class A Share over time.