UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

OFFERING CIRCULAR

FORM 1-A

OFFERING STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

ILS FIXED HORIZON LLC

Date: March 24, 2023

| Texas | 6500 | 88-1715867 |

|

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) |

(IRS Employer Identification No.) |

Tom Berry

Chief Executive Officer

PO Box 1227

210 Market Street

El Campo, TX 77437

Telephone: 979-541-1270

Please send copies of all correspondence to:

Pino Nicholson PLLC

99 S. New York Ave.

Winter Park, FL 32789

Telephone: 407-206-6577

Email: ljp@PinoNicholsonLaw.com

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION A.

PART I - NOTIFICATION

Part I should be read in conjunction with the attached XML Document for Items 1-6

PART I – END

| 1 of 57 |

Offering Statement First Submission

File No. _______

PART II – OFFERING CIRCULAR

ILS FIXED HORIZON LLC

$75,000,000 OF DEBT UNITS

$1,000 PAR VALUE PER DEBT UNIT

This Offering involves the purchase of Debt Units (“Units”) in ILS Fixed Horizon LLC (the “Company”), which was formed for the purpose of raising capital to engage in the business of investing in all forms of real estate, primarily by providing financing to affiliated and unaffiliated Borrowers (“Investment Activities”).

Purchasers of the Units will become owners of the Units (“Investors”) upon execution of the Subscription Agreement, submission of the Investor Qualification Questionnaire, delivery of the investment funds (“Capital Contribution”), and acceptance by the Manager, which is ILS Fixed Horizon MGMT Corp.

The Offering was initially filed with the SEC for qualification on February 3, 2023, and is a “Continuous Offering” under Rule 251(d)(3)(i)(F), which shall be commenced within two (2) days of the Offering being qualified by the SEC, and will terminate upon the earlier of: (i) the completion of the sale of all of the Shares, or (ii) at the discretion of the Manager. The Offering may be extended by the Company in its sole discretion (the "Offering Period"). The Company is offering a minimum of twenty-five (25) Units and a maximum of seventy-five thousand (75,000) Units. Each Unit is priced at One Thousand ($1,000) Dollars and a minimum purchase of twenty-five (25) Units is required, although the minimum number of Units may be offered in fractions at the discretion of the Manager. The executive management of the Company may purchase less. Any number of additional Units may be purchased.

The Debt Units have the following distinguishing characteristics:

Class

|

Interest |

Interest Rate/Lock-up |

Withdrawal Period |

Min. |

Class A1

|

monthly | 5% Interest Payment for 1 year, per annum | May withdraw 60 days after Initial Capital Contribution Received by Company | $25,000 |

Class A2

|

monthly | 6% Interest Payment for 1 year, per annum | May withdraw 60 days after Initial Capital Contribution Received by Company | $500,000 |

Class B1

|

monthly | 6% Interest Payment for 3 years, per annum | May withdraw 180 days after Initial Capital Contribution Received by Company | $25,000 |

Class B2

|

monthly | 7% Interest Payment for 3 years, per annum | May withdraw 180 days after Initial Capital Contribution Received by Company | $500,000 |

Class C1

|

monthly | 7% Interest Payment for 5 years, per annum | May withdraw 365 days after Initial Capital Contribution Received by Company | $25,000 |

Class C2

|

monthly | 8% Interest Payment 5 years, per annum | May withdraw 365 days after Initial Capital Contribution Received by Company | $500,000 |

Monthly distributions are subject to the Company having sufficient cash on hand to meet its obligations and remain solvent. The Manager, in its sole discretion, will make the determination whether or not Interest Payments for a particular month can be made. If the Manager elects to not make a payment in a particular month, the Interest Payment for that month accrues over to the following month.

Additionally, with respect to Item 14 of Form 1-A, we provide the following distinguishing characteristics of the Debt Units:

| a. | Provisions with respect to interest, conversion, maturity, redemption, amortization, sinking fund, or retirement. |

| i. | Interest Payment: Interest payments will be made monthly for each class, with interest rates varying from 5% to 8% depending on the class and the minimum capital contribution, as indicated in the table above. |

| 2 of 57 |

| ii. | Conversion: There are no conversion provisions. |

| iii. | Maturity: There is no specific maturity date mentioned in the table, but the lock-up periods range from 1 to 5 years, depending on the class. |

| iv. | Redemption: Investors may withdraw their capital contributions after the specified withdrawal periods, which range from 60 days to 365 days after the initial capital contribution has been received by the company, depending on the class. |

| v. | Amortization: There are no provisions for amortization of the Debt Units. |

| vi. | Sinking Fund: There is no sinking fund or retirement provision. |

| b. | Provisions with respect to the kind and priority of any lien securing the issue, together with a brief identification of the principal properties subject to such lien. |

| i. | The debt units are secured by the underlying notes that the company will purchase. The company cannot provide exact numbers for the amount of notes purchased, as that depends on the amount raised in the offering. To our knowledge, there are no liens on the security, and the priority of the lien is not mentioned. |

| c. | Material affirmative and negative covenants. |

| i. | Affirmative Covenants: The company guarantees interest payments for the lock-up period specified for each class, which range from 1 to 5 years. |

| ii. | Negative Covenants: The Company will purchase Notes from its affiliates, ILS Lending LLC and Pearl Funding LLC which are subject to the following restrictions: (1) LTV for borrowers will be limited to seventy-five (75%) percent; (2) the Notes will be secured by the physical collateral underlying the Notes, which the Company may repossess upon non-payment; (3) the ability of Borrower to pass the due diligence background check initiated by Company Affiliate Loan Source LLC, which is the entity issuing the loans and transferring the loans from Loan Source LLC to the Company |

| Price to Public | |

| Per Unit | $1,000 |

| Total Minimum | $25,000 |

These Units are offered to both “accredited” and “non-accredited” investors as described on page 2 of the Company’s Subscription Agreement, attached hereto as Exhibit 1A-4. However, non-accredited investors are restrained by the purchasing limits set by the SEC, which are as follows:

| 1. | Non-accredited investors may not purchase more than ten (10%) percent of the greater of annual income or net worth (for natural persons); or |

| 2. | Non-accredited investors may not purchase more than ten (10%) percent of the greater of annual revenue, or net assets at fiscal year-end (for non-natural persons). |

There is the possibility of conflicts of interest arising between the Debt Investors and the Manager that are described in the “Conflicts of Interest” section further below in this Offering circular. This Offering of Units involves substantial risks that are described in “Risk Factors and Disclosures”. There is the possibility that the proceeds of this Offering will be insufficient to meet the requirements described in “Investment Objectives, Policies, Debt Payments.” Before purchasing any of the Units offered through this Memorandum, consult with an attorney or a financial advisor to determine if this investment is suitable for you.

| Per Unit(1) | Minimum Offering Amount |

Maximum Offering Amount | ||||||||||

| Price to public | $ | 1000.00 | $ | N/A | $ | 75,000,000.00 | ||||||

| Commissions(1) | $ | (0.00 | ) | $ | N/A | $ | (0.00 | ) | ||||

| Proceeds, net of Commissions, before expenses, to the Company | $ | 1000.00 | $ | N/A | $ | 75,000,000.00 | ||||||

| Proceeds to other persons | $ | N/A | $ | N/A | $ | N/A | ||||||

| 3 of 57 |

INVESTMENT IN UNITS OF THE COMPANY INVOLVES SIGNIFICANT RISK, AND YOU MAY BE REQUIRED TO HOLD YOUR INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. YOU SHOULD PURCHASE THIS SECURITY ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 19 OF THIS OFFERING CIRCULAR.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10 PERCENT OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, THE COMPANY ENCOURAGES YOU TO REVIEW RULES 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, THE COMPANY ENCOURAGES YOU TO REFER TO WWW.INVESTOR.GOV.

The Company is following the “Offering Circular” format of disclosure under Regulation A.

The date of this Offering Circular is February 3, 2023.

| 4 of 57 |

IMPORTANT NOTICES TO INVESTORS

INVESTMENT IN REAL ESTATE FINANCING INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE OFFER MADE BY THIS OFFERING CIRCULAR, NOR HAS ANY PERSON BEEN AUTHORIZED TO GIVE ANY INFORMATION OR MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON. THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL OR ANY PERSON TO WHO IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE MADE HEREUNDER SHALL, UNDER ANY CIRCUMSTANCES, CREATE AN IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE ISSUER SINCE THE DATE HEREOF.

THIS OFFERING CIRCULAR MAY NOT BE REPRODUCED IN WHOLE OR IN PART. THE USE OF THIS OFFERING CIRCULAR FOR ANY PURPOSE OTHER THAN AN INVESTMENT IN SECURITIES DESCRIBED HEREIN IS NOT AUTHORIZED AND IS PROHIBITED.

THE OFFERING PRICE OF THE SECURITIES IN WHICH THIS OFFERING CIRCULAR RELATES HAS BEEN DETERMINED BY THE ISSUER AND DOES NOT NECESSARILY BEAR ANY SPECIFIC RELATION TO THE ASSETS, BOOK VALUE OR POTENTIAL EARNINGS OF THE ISSUER OR ANY OTHER RECOGNIZED CRITERIA OF VALUE.

IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF CERTAIN STATES AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF SAID ACT AND SUCH LAWS. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, ANY STATE SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY, NOR HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF THIS OFFERING OR THE ACCURACY OR ADEQUACY OF THE OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE COMPANY WILL BE PERMITTED TO MAKE A DETERMINATION THAT THE PURCHASERS OF UNITS IN THIS OFFERING ARE ACCREDITED INVESTORS OR ACCEPTABLE NON-ACCREDITED INVESTORS PER THE GUIDELINES LISTED ON PG. 3 OF THIS OFFERING CIRCULAR, IN RELIANCE ON THE INFORMATION AND REPRESENTATIONS PROVIDED BY THE PURCHASERS REGARDING THE PURCHASERS’ FINANCIAL SITUATION. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, THE COMPANY ENCOURAGES YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, THE COMPANY ENCOURAGES YOU TO REFER TO WWW.INVESTOR.GOV.

| 5 of 57 |

STATE LAW EXEMPTION AND INVESTOR SUITABILITY REQUIREMENTS

The Units are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 Offering pursuant to Regulation A under the Securities Act, this Offering will be exempt from state law “blue sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that the Units offered hereby are offered and sold only to “qualified purchasers” or at a time when the Units are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in the Units does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, the Company reserves the right to reject any investor’s subscription in whole or in part for any reason, including if the Company determines in its sole and absolute discretion such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who has:

| 1. | an individual net worth, or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; or |

| 2. | earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year. |

If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

| 6 of 57 |

The following Table of Contents has been designed

to help you find important information contained in this Offering Circular.

The Company encourages you to read the entire Offering Circular.

| 7 of 57 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Offering Circular Summary,” “Risk Factors,” “Description of Business”, “Plan of Operations,” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology. In this Offering Circular, unless the context indicates otherwise, references to “we”, “our”, and “the Company” refer to ILS FIXED HORIZON LLC.

The forward-looking statements are based on the Company’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to the Company or are within its control. If a change occurs, its business, financial condition, liquidity and results of operations may vary materially from those expressed in its forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to the Units, along with the following factors that could cause actual results to vary from the Company’s forward-looking statements:

| · | This is a blind pool Offering as the Company has yet to identify any specific loans to service with the Net Proceeds of this Offering. |

| · | The Company commenced operations on April 5, 2022, and is an affiliate of ILS RE Capital LLC, ILS Capital Management LLC, and ILS Legacy Holdings LLC (the “Common Member”) but has no prior track record otherwise. |

| · | The Company has made no investments to date. |

| · | Traditionally, the real estate loan industry is cyclical in nature, causing it to experience dramatic swings in value. Real estate has generally appreciated in value over time, allowing borrowers to repay back their loans, but the Company cannot assure that such appreciation will continue to occur. |

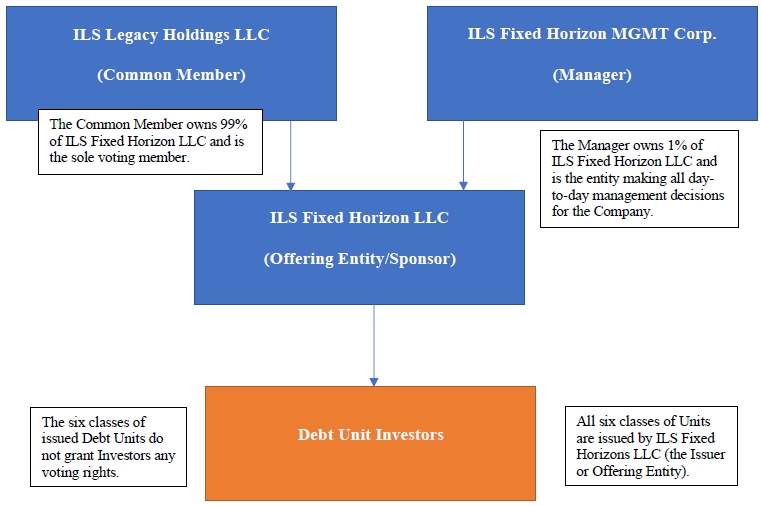

| · | The Debt Units are non-voting. As such, Debt Investors do not have a right to participate in the management of the Company’s affairs. Debt Investors cannot propose changes to the Manager or to the Operating Agreement. The Manager will make all decisions with respect to the management of the Company. Debt Investors will have no right or power to take part in the management of the Company. Therefore, they will be relying entirely on the Manager for management of the Company and the operation of its business. The Manager may not be removed under the Operating Agreement. |

| · | Manager will have an exclusive role in determining what is in the best interests of the Company. Since no individual other than the Manager has any direct control over management of the Company, it does not have the benefit of independent consideration of issues affecting its operations. Therefore, these individuals will determine the propriety of their own actions, which could result in a conflict of interest and a risk to the viability and success of the Company when they are faced with any significant decisions relating to the affairs of the Company. |

| · | The Company may need to raise additional capital to address liquidity needs caused by shortfalls in revenue or unanticipated expenses. There can be no assurance that additional financing will be available when needed on terms favorable to the Company or at all. The Manager reserves the right to add capital from their own individual accounts to make up for such shortfall if either so desire. |

| · | There is an inherent lack of control in the management of the properties to which the Company issues loans. The Company may provide financing to borrowers for “Borrower Projects” for which the Borrower may not have fee simple title. As such, Borrower properties may typically be controlled by, but not owned by the Borrower. As such, the Company’s source of Financing repayment is based on the Borrower’s perfection of its contractual rights under such agreements. |

| · | You will not have any interest in, and your investment will not be secured by any Company Loans. Any returns on your investment will depend solely on the results of operations of the Company Loans. |

| · | Your returns on an investment will depend on the successful development or acquisition, results of operations, and profitable disposition of Company Properties. |

| 8 of 57 |

| · | The Company intends to establish an operating reserve account with a portion of the proceeds raised from this Offering to pay anticipated operating, administrative and other expenses that shall be incurred as part of this Offering. If future expenses increase by unanticipated amounts, the Company may not have sufficient reserves to pay these obligations. The Company does not currently have any commitment or arrangement in place to obtain additional Funding, and there are no assurances that additional Funding can be obtained, if necessary, or that such additional Funding, if obtained, will be adequate for its financial needs. |

| · | The real estate market is affected by many factors, such as general economic conditions, the availability of financing, interest rates and other factors, including the supply and demand for real estate investments, all of which are beyond the control of the Company all of which could materially affect the Company and the Debt Units. There are no assurances that the Company can successfully achieve its investment goals and therefore, Debt Investors may have to hold their Units for an indefinite period of time, or have their Units sold or redeemed for less than the Debt Investors’ Capital Contribution. |

| · | Environmentally hazardous property. Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the cost of removal or remediation of hazardous or toxic substances on, under or in such property. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require expenditures. Environmental laws provide for sanctions in the event of noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. |

| · | There will be competing demands on the Manager, Employees, and Borrowers and as a result they will not devote all of their attention to the Company, which could have a material adverse effect on the Company’s business and financial condition. The officers of the Manager will experience conflicts of interest in managing the Company, because they also have management responsibilities for other companies, including companies that conduct the same Investment Activities as the Company. For these reasons, all of these individuals share their management time and services among those companies, and the Company, and will not devote all of their attention to the Company. |

| · | None of the agreements with the Manager were negotiated at arm’s length. Agreements with the Manager were not negotiated at arm’s length and accordingly may contain or omit different terms that would otherwise apply if the agreements were negotiated at arm’s length with third parties. |

| · | Debt Investors may not be able to withdrawal Units from the Company. Consequently, Debt Investors may not be able to liquidate their Debt Interests prior to the termination of the Company and must be prepared to bear the risks of owning Units for an extended period of time. |

| · | There is no present public trading market for the Units and the price at which the Units are being offered bears no relationship to conventional criteria such as book value or earnings per unit. |

| · | Company employees may change from time to time. Turnover may result in negative consequences to the Company’s Investment Activities. |

| · | The Manager will endeavor to communicate in advance any perceived exceeded risk based on the Manager’s anticipation of not meeting the required interest payouts, accrual, and/or withdrawal of Capital Contributions. The Manager will not communicate normal operational challenges including but not limited to construction delays, termination or reprimanding of Employees, and lawsuits as part of the Investment Activities. |

| · | The Company’s assessment of the merits of any identified projects under consideration may be inaccurate, which may negatively affect its results of operations. |

| · | Timing of development in real estate financing related projects is inherently uncertain and any delays in the development or acquisitions of Company Properties will adversely affect your investment. |

| · | There is a risk that no market for the Units will ever exist and as a result, the investment in the Company is illiquid in the event a Debt Investor desires to liquidate their interest. If a Debt Investor attempts to sell its Units prior to the dissolution of the Company, there is no certainty that they can be sold for full market value or that the Units may be sold at any price. |

| 9 of 57 |

| · | There is an investment risk of losing the whole investment. There can be no assurance that the Company will be able to achieve its investment objectives or that Investors will receive any return of their capital. Investment results may vary substantially over time and as a result, Investors should understand the results of a particular period will not necessarily be indicative of results in future periods. |

| · | The revenue and profit potential of the company are uncertain. If the Company meets its revenue expectations, there is no guarantee that the Company will be profitable or that costs will not exceed revenue. |

| · | The Company may not generate sufficient income to fund Debt Unit interest payments and there is a risk that the Company may never pay such interest. Additionally, the Company may use other sources including borrowings and sales of assets. If it pays interest on the Debt Units from sources other than its cash flow from operations, it will have less funds available for investments and your overall return may be reduced. |

| · | The Company’s future performance is difficult to evaluate as it has not commenced operations. |

| · | As ILS Fixed Horizon MGMT Corp. (“Manager”) will exercise complete control over the Company, it will have the ability to make decisions regarding (i) changes to unit classes without Member notice or consent, (ii) making changes to the Company’s Operating Agreement as to the issuance of additional debt units, or other shares, including to itself, (iii) employment decisions, including compensation arrangements; and (iv) the decision to enter into material transactions with related parties. |

| · | The Company’s Operating Agreement and Subscription Agreement, all provide mandatory binding arbitration provisions that, unlike in judicial proceedings, are subject to determination by an arbitrator, not a judge, who is not necessarily governed by the same standards. In light of that, there is a risk that an arbitrator will not view the contract or the law in the same way a judge would and may grant a remedy or award relief that the arbitrator deems just and equitable and within the scope of the agreement of the parties or based on simple notions of equity, rather than the facts or the relevant law. Furthermore, there is a risk that an arbitrator may interpret the relevant agreements or facts without regard to legal precedent. That risk is exacerbated by the fact that it is more difficult to overturn or vacate an arbitration award, because the law supports confirmation of an arbitration decision which is not otherwise arbitrary or capricious; therefore, investors should consider the difficulty of reversing an arbitration award, once made. |

| · | The Company’s long-term growth depends upon its ability to retain and grow its investor base by successfully identifying and financing projects with attractive returns on investment. If the Company is unable to find such projects or if Company Loans do not produce the expected returns, it may be unable to retain or grow its investor base, and its operations and business could be adversely affected. |

| · | There has been no public market for the securities of the Company. The Units will not be listed on any securities exchange. There will be no active market for the Units. |

| · | There is a risk that an audit of the Company’s records could trigger an audit of the individual Investor’s tax records. |

| · | There is a risk that the amount of capital to be raised by the Company will be insufficient to meet the investment objectives of the Company. If there is a shortage of capital, the Manager will use best efforts to obtain funds from a third party or advance the Company’s directly or through an affiliate. Obtaining funds from a third party or an advance directly or through an affiliate may require an increase in the amount of financing the Company will be obligated to repay. In addition, there is no certainty that such funds will be available at a reasonable cost, if available at all. |

| · | The incapacitation of key operational and management personnel could adversely affect the Company. |

| · | The Manager may invest a significant amount of the proceeds raised on behalf of the Company in ways that Investors may not agree or that do not yield maximum favorable return due to market cycles |

| · | There is a risk that budgets could be exceeded resulting in the Company needing additional financing, and that in the absence thereof the Company may not be able to make Debt Payments. |

| · | The acquisition, entitlement, and permitting of real estate entails various risks, including the risk that investments may not perform as expected. The prices paid, or to be paid, for any Borrower Property are based upon a series of market judgments, some of which may prove to be inaccurate. These risks could adversely affect the Borrower’s financial condition, results of operations, cash flow and ultimate ability to service or repay the Financing which are the basis of Debt Investors’ Debt Payments. |

| 10 of 57 |

| · | The success of the Investment Activities will depend largely on adapting to trends in the real estate industry, including competitive pressures, increased consolidation, industry overbuilding and changing demographics, the introduction of new concepts and products, availability of labor, changing tenant pricing levels and general economic conditions. Failures in adapting to the foregoing may affect the Company’s financial performance and thus the profits it receives. |

| · | The Company’s geographic focus consists of a sizable area of the United States that spans the United States. The Company’s overall performance is therefore largely dependent on real estate economic conditions in these geographic areas. Since there are no diversification requirements with regard to the Company’s investment activities the Company’s investment portfolio may include a small number of large positions, and at times, in one or two geographic markets. While such a portfolio concentration may enhance Company profits, if any large position has a material loss, then returns to Debt Investors may be lower than if the Company had invested in a more diversified and widespread portfolio of smaller positions. Such concentration may increase the volatility of the Company’s returns and may also expose the Company to significant risk of economic downturns in this sector to a greater extent than if its portfolio was further diversified. As a result, economic downturns in the real estate sector could have an adverse effect on the financial condition, results of operations and cash flow of the Company. |

| · | The SEC heavily regulates the manner in which “investment companies,” “investment advisors,” and “broker-dealers” are permitted to conduct their business activities. The Company firmly believes the Company has conducted business in a manner that does not result in the Company or its affiliates being characterized as an investment company, an investment advisor or a broker-dealer, as the Company does not believe that the Company engages in any of the activities described under Section 3(a)(1) of the Investment Company Act of 1940 or Section 202(a)(11) or the Investment Advisor’s Act of 1940 or any similar provisions under state law, or in the business of (i) effecting transactions in securities for the account of others as described under Section 3(a)(4)(A) of the Exchange Act or any similar provisions under state law or (ii) buying and selling securities for our own account, through a broker or otherwise as described under Section 3(a)(5)(A) of the Exchange Act or any similar provisions under state law. The Company intends to continue to conduct our business in such manner. If, however, the Company (or any of the Company’s affiliates) are deemed to be an investment company, an investment advisor, or a broker-dealer, the Company may be required to institute burdensome compliance requirements and our activities may be restricted, which would affect the Company’s operations to a material degree. |

| · | Any Debt Investor’s ability to bring legal action against the Manager for these actions is limited. |

| · | This Private Placement Memorandum, as well as other documents connected herewith, may contain “forward-looking statements,” such as statements related to financial condition and prospects, lending risks, plans for future business development and marketing activities, capital spending and financing sources, capital structure, the effects of regulation and competition, and the prospective business of the Company. Where used in this Private Placement Memorandum, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” as well as other or similar words and expressions, as they relate to the Company, identify forward-looking statements. All forward-looking statements, by their nature, are subject to risks and uncertainties. Results may differ materially from those set forth in the forward-looking statements. The Company’s ability to achieve financial objectives could be adversely affected by the factors discussed in detail in throughout the PPM as well as the following: |

| a. | Changes in the securities and real estate markets; |

| b. | The strength of the United States economy in general and the strength of the local economies in which we conduct operations; |

| c. | Changes in monetary and fiscal policies of the U.S. Government; |

| d. | Inflation, interest rate, market and monetary fluctuations; |

| e. | Legislative or regulatory changes; |

| f. | The accuracy of the Company’s Pro Forma estimates and assumptions; |

| g. | The loss of key personnel; |

| h. | The Company’s need and ability to incur additional debt or equity financing; |

| i. | The effects of harsh weather conditions, including hurricanes; |

| 11 of 57 |

| j. | The Company’s ability to comply with the extensive laws and regulations to which we are subject; |

| k. | Increased competition and its effect on pricing; |

| l. | Technological changes; |

| m. | The effects of security breaches and computer viruses that may affect our computer systems; |

| n. | Changes in consumer spending and saving habits; |

| o. | Changes in accounting principles, policies, practices or guidelines; |

| p. | Our ability to manage the risks involved in the foregoing. |

| 12 of 57 |

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before investing in Debt Units. You should carefully read the entire Offering Circular including the risks associated with an investment in the specific securities you are offered, which are discussed under the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section of this Offering Circular entitled “Cautionary Statement Regarding Forward-Looking Statements.” In this Offering Circular, unless the context indicates otherwise, references to “we”, “our”, and “the Company” refer to ILS Fixed Horizon LLC.

Overview

ILS Fixed Horizon LLC (“Company”) was organized as a Texas limited liability company on April 5, 2022.

The Company was formed for the purpose of raising capital to engage in the business of investing in all forms of real estate, primarily by providing financing to affiliated and unaffiliated Borrowers (“Investment Activities”).

The Company intends to provide Financing to various Borrowers, which typically operate in real estate investment. Borrowers may obtain financing for purposes of fix and flip investments, buy and hold investments, “wrap-around” loans, commercial loans, or hard money/bridge loans. The Company primarily intends to purchase Notes from an Affiliate, which will originate the Notes. The Company anticipates the majority of its Investment Activities will be providing the financing described herein, although the Company can provide additional types of financing to Borrowers at its discretion.

ILS Lending LLC, an affiliate of the Company, was founded by Tom Berry and Donald Sutton in December 2017; Loan Source LLC (D/B/A “Investor Loan Source) was formed as a partnership in January 2014 and Pearl Funding LLC, founded in October 2021. ILS Lending LLC and Pearl Funding LLC will act as the originators of the notes and will sell the notes to the Company. Loan Source LLC will service the loans and will also facilitate the transfer the notes from ILS Lending LLC and/or Pearl Funding LLC to the Company. The Company will purchase these notes and will pay a transfer fee of between $135 and $200 per note. The underlying purchased notes will have generally offer rates between eight (8%) percent and fourteen (14%) percent, with the Manager earning the spread on the difference between the rates of the notes and the interest paid out to Debt Unit Holders. The Manager is not taking any additional fees and will receive its distributions from this interest rate spread.

The Manager will use its best discretion in determining which notes will be sold to the Company and will only purchase notes which it believes will perform and will provide for the Interest Rate Payments outlined in this Offering Circular.

Collectively, Donald and Tom have been doing real estate investing and hard money lending for over 20 years. Their vision for Loan Source LLC, and all affiliated ILS entities is the following: "We are dedicated to our clients and pride ourselves on maintaining innovative - in demand loan products, quality customer service, and, above all, our fast approval process."

This is an initial Offering by the Company on a “best efforts” basis for its Class A, Class B, and Class C Debt Units, and all sub-units within each class. Company management (“Management”) will be making the investment decision about which loans to provide and to which borrowers such loans will go. The Manager is a Texas corporation, and an affiliate of the Company.

Substantially all of the Company’s assets will be held by, and substantially all of its operations will be conducted by the Company. Under this structure, the Common Member shall be ILS Legacy Holdings LLC, an affiliate of the Manager who shall receive all the fees due to the Manager under this Offering. Only ILS Legacy Holdings LLC shall have any voting rights as it relates to the Company.

The proceeds from the Offering may be used to (i) pay fees and expenses relating to the organization of the Company and the sale of Debt Units, (ii) invest in loans to made to Borrowers for various qualified properties and (iii) establish working capital reserves for the Company to fund operating and other expenses of the Company. The Company expects to use the Offering proceeds to pay such amounts at such time and in such order as the Manager deems, in its sole and absolute discretion, to be in the best interest of the Company.

The expenses of this Offering, including the preparation of this Offering Circular and the filing of this Offering Statement, are being paid for on behalf of the Company by the Sponsor, and will be repaid to Sponsor from the Company’s working capital reserves, the timing of which shall be as Management deems, in its sole and absolute discretion, to be in the best interest of the Company.

| 13 of 57 |

Classes of Units Offered: Class A, Class B, and Class C Non-Voting Debt Units

The Company has established non-voting classes of debt units, each with $1,000 par value per Unit (“Units”) and seeks to raise $75,000,000 through the sale of 75,000 Units. Units will have the right to Interest Payments, to be paid monthly, and subject to the availability of Company cash to meet distributions and maintain operations. The Manager will determine, in its sole discretion, if the Company has sufficient cash on hand to make the Interest Payments. Should the Manager determine that Interest Rate Payments will not be made in a particular month, the Interest Payment will accrue over to the following month. The payments are solely comprised of interest.

Importantly, no Debt Payments to holders of Units are assured, nor are any returns on, or of, a purchaser’s investment guaranteed. Debt Payments are subject to the Company’s ability to generate positive cash flow from operations. It is possible that the Company may have cash available for Debt Payments, but the Manager could determine that the reservation, and not distribution, of such cash by the Company would be in its best interest.

Class A Non-Voting Debt Units

Class “A” Units grant Debt Investors the option to earn interest at the following rate with a sixty (60) day Capital Commitment Period. Investors may request their Capital Contributions through a written request to the Manager, and the Manager will return the Capital Contribution to Investors of Class A Units within thirty (30) days of receiving the written request. The Class A Units have their respective Interest Rate Payments locked in (“Rate Lock Period”) for one (1) year, meaning that irrespective of the interest rate environment, Debt Unit Holders will receive the Interest Rate Payments listed here. There are two types of debt units within Class A, known as Class A1 Units and Class A2 Units, which are described more fully below.

Class A1 Non-Voting Debt Units

Class A1 Units are paid five (5%) percent per annum. Class A1 Units are available to Debt Investors who make a minimum Capital Contribution of twenty-five thousand ($25,000) dollars.

Class A2 Non-Voting Debt Units

Class A2 Units are paid six (6%) percent per annum. Class A2 Units are available to Debt Investors who make a minimum Capital Contribution of five hundred thousand ($500,000) dollars.

Class B Non-Voting Debt Units

Class “B” Units grant Debt Investors the option to earn interest at the following rate with a one hundred eighty (180) day Capital Commitment Period. Investors may request their Capital Contributions through a written request to the Manager, and the Manager will return the Capital Contribution to Investors of Class B Units within thirty (30) days of receiving the written request. The Class B Units have their respective Interest Rate Payments locked in (“Rate Lock Period”) for three (3) years, meaning that irrespective of the interest rate environment, Debt Unit Holders will receive the Interest Rate Payments listed here. There are two types of debt units within Class B, known as Class B1 Units and Class B2 Units, which are described more fully below.

Class B1 Non-Voting Debt Units

Class B1 Units are paid six (6%) percent per annum. Class B1 Units are available to Debt Investors who make a minimum Capital Contribution of twenty-five thousand ($25,000) dollars.

Class B2 Non-Voting Debt Units

Class B2 Units are paid seven (7%) percent per annum. Class B2 Units are available to Debt Investors who make a minimum Capital Contribution of five hundred thousand ($500,000) dollars.

Class C Non-Voting Debt Units

Class “C” Units grant Debt Investors the option to earn interest at the following rate with a three hundred sixty-five (365) day Capital Commitment Period. Investors may request their Capital Contributions through a written request to the Manager, and the Manager will return the Capital Contribution to Investors of Class C Units within thirty (30) days of receiving the written request. The Class C Units have their respective Interest Rate Payments locked in (“Rate Lock Period”) for five (5) years, meaning that irrespective of the interest rate environment, Debt Unit Holders will receive the Interest Rate Payments listed here. There are two types of debt units within Class C, known as Class C1 Units and Class C2 Units, which are described more fully below.

| 14 of 57 |

Class C1 Non-Voting Debt Units

Class C1 Units are paid seven (7%) percent per annum. Class C1 Units are available to Debt Investors who make a minimum Capital Contribution of twenty-five thousand ($25,000) dollars.

Class C2 Non-Voting Debt Units

Class C2 Units are paid eight (8%) percent per annum. Class C2 Units are available to Debt Investors who make a minimum Capital Contribution of five hundred thousand ($500,000) dollars.

Services Performed by, and Compensation Paid to Affiliates

The Manager and its Affiliates will be engaged by the Company to perform various services for day-to-day management of the Company including the identification of Borrowers, investment of its assets, and any other actions in furtherance of the Investment Activities. The Company and its Affiliates may receive compensation and profits for such services as described in this section. None of the agreements for such services are the result of arm’s-length negotiations. The Company believes, however, that the terms of such arrangements are reasonable and are comparable to those that could be obtained from unaffiliated entities. The timing and nature of the compensation could create a conflict between the interests of the Manager, its Affiliates, and those of Debt Investors. Services performed by Company Affiliates include the following:

Company Expenses. Company expenses such as Marketing expenses may be paid with the Company’s funds, however Company Expenses will have no impact on Debt Investor’s Capital Contribution or Debt Payments.

Referral Fees. The Company reserves the right to contract with and compensate third parties who bring Prospective Debt Investors to the attention of the Manager’s Executive Team.

Third Parties. Third parties may profit while working with the Company to facilitate Investment Activities.

Employees. The Company may employ employees to assist in the Company’s Investment Activities.

Conflicts of Interest

There are conflicts of interest between and among the Company, Manager, the Sponsor, and other Company Affiliates. The Manager may provide services to other affiliate companies in addition to the Company. All of the agreements and arrangements between and among Company Affiliates and the Company, including those related to compensation, are not the result of arm’s-length negotiations. The Company will try to balance the interests of Company Affiliates with the interests of the Company. However, to the extent that the Company takes actions that are more favorable to Company Affiliates than the Company, these actions could have a negative impact on the Company’s financial performance and, consequently, on the Debt Payments to holders of Units and the value of those securities. The Company has not adopted, and does not intend to adopt in the future, either a conflicts of interest policy or a conflicts resolution policy.

Some of the conflict-of-interest risks are listed here.

· Manager or Company May be Involved in Similar Investments. The Manager, the Company, or their affiliates, may act as managers in other limited liability companies engaged in making similar investments.

· Manager or Company May Have Interests in Similar Properties. The Manager, the Company, or their affiliates, own or may come to own an interest in properties that may compete with Borrower’s Properties.

· Manager or Company May Act on Behalf of Others. The Manager or the Company, or their affiliates, who may act as managers for the Company, may act in such capacities for other companies, partnerships or entities that may compete with the Properties.

· Manager or Company May Raise Capital for Others. The Manager or the Company, or their affiliates, who will raise investment Funds, may act in the same capacity for other companies, partnerships or entities that may compete with the Properties.

· Manager’s or Company’s Compensation May be a Conflict. The compensation plan for the Manager or the Company may create a conflict between the interests of the Manager, the Company, and the interests of the Company.

· Manager or Company Allocating Time and Resources to Affiliated Entities. The Manager or the Company may have a conflict in allocating their time and resources between the Company and other business activities they are involved with.

| 15 of 57 |

· Principals of Manager and Company May Provide for Affiliated Partnerships. The principals of the Manager and the Company are comprised of individuals who may be principals of other affiliated or non-affiliated organizations organized to promote other real estate investment.

· Principals of Manager and Company. The Manager and the Company are comprised of individuals who may be principals of other affiliated or non-affiliated entities. One or more principals of the Manager and Company may provide additional or subsequent private offerings or terms of offer different than herein.

Competitive Strengths

The Company’s competitive strengths stem from the Management’s experience and understanding of the intricacies of the real estate borrowing sector. The Manager has over twenty (20) years of experience in private lending and is able to leverage that knowledge and experience in underwriting the loans to be provided by the Company.

As of the date of this Offering Circular, ILS affiliated entities have closed on over one thousand seven hundred (1,700) loans, for a value of approximately three hundred fifty million ($350,000,000) dollars. To date, ILS affiliated funds have raised over sixty-three million ($63,000,000) dollars in investor capital, producing solid returns throughout.

Corporate Information

The Company’s executive offices are located at PO Box 1227, 210 Market Street, El Campo, TX 77437. The Company’s telephone number is (979) 541-1270.

Reporting Requirements Under Tier 2 of Regulation A

Following this Tier 2 Regulation A Offering, the Company has, and will continue to be required to comply with certain ongoing disclosure requirements under Regulation A. The Company has, and will be required to file (i) an annual report with the SEC on Form 1-K, (ii) a semi-annual report with the SEC on Form 1-SA, (iii) current reports with the SEC on Form 1-U, and (iv) a notice under cover of Form 1-Z. The necessity to file current reports will be triggered by certain corporate events. Parts I and II of Form 1-Z will be filed by the Company if and when it decides to and is no longer obligated to file and provide annual reports pursuant to the requirements of Regulation A.

| 16 of 57 |

| Issuer: | ILS Fixed Horizon LLC |

| Securities Offered: | Class A1, Class A2, Class B1, Class B2, Class C1, and Class C2. All Units are Non-Voting Debt Units (“Units”). |

| Par Value: | $1,000.00 per Unit of any class. |

| Minimum Purchase: | Class A1 – Twenty-Five (25) Units or Twenty-Five Thousand ($25,000) Dollars |

|

Class A2 – Five Hundred (500) Units or Five Hundred Thousand ($500,000) Dollars

Class B1 – Twenty-Five (25) Units or Twenty-Five Thousand ($25,000) Dollars

Class B2 – Five Hundred (500) Units or Five Hundred Thousand ($500,000) Dollars

Class C1 – Twenty-Five (25) Units or Twenty-Five Thousand ($25,000) Dollars

Class C2 – Five Hundred (500) Units or Five Hundred Thousand ($500,000) Dollars | |

| Minimum Offering Amount: |

N/A |

| Maximum Offering Amount: |

75,000 Units ($75,000,000) |

| Escrow: | Investment Funds will initially be placed into Escrow for an estimated three (3) to five (5) days until Investor Funds clear and are made available to the Company. |

|

ERISA: |

Investment in the Company is generally open to institutions, including pensions and other Funds subject to ERISA. The Company may require certain representations or assurances from investors subject to ERISA to determine compliance with ERISA provisions. |

| Offering Price: | $1,000 per Debt Unit (“Offering Price”) |

| Offering Period: | To begin upon qualification by the SEC and terminate at the discretion of the Manager. |

| The Offering Period may be extended, or the Offering terminated at any time by the Company in its sole discretion. | |

| Debt Payments: | No Debt Payments to holders of Units are assured, nor are any returns on, or of, a purchaser’s investment guaranteed. Debt Payments are subject to the Company’s ability to generate positive cash flow from operations. All Debt Payments are further subject to the discretion of the Manager. It is possible that the Company may have cash available for Debt Payments, but the Manager could determine that the reservation, and not distribution, of such cash by the Company would be in its best interest. |

| Voting Rights: | None |

| Dilution: | Not applicable |

| Liquidation Rights: | In the event of the Company liquidating its assets, the priority of distributions (“Liquidation Distributions”) shall be performed in the following manner:

1. First, to creditors of the Company, including holders of Debt Units who may be creditors, to the extent otherwise permitted by law, in satisfaction of all debts, liabilities, obligations and expenses of the Company, including, without limitation, the expenses incurred in connection with the liquidation of the Company; then |

| 17 of 57 |

|

2. Second, to the holders of Debt Units to the extent of and in proportion to their invested capital until the aggregate amount paid to such holders of Debt Units is sufficient to provide for a complete return of such holder of Debt Units’ invested capital; then

3. Third, to the holders of Debt Units to the extent of and in proportion to their respective unpaid Interest Payments until such Debt Unit holder’s unpaid Interest Payment has been paid in full; and

4. Fourth, to the Manager. | |

| Conversion Rights: | None |

| Pre-emptive Rights: | None |

| Sinking Fund Provision: |

None |

| Liability for Further Calls: |

None |

| Gross Proceeds: | The proceeds from this Offering prior to the payment of any commission, Offering expenses, Manager operating expenses, legal fees, Company management, supervisory and accounting services, and other working capital reserves (“Gross Proceeds”). |

| Net Proceeds: | Gross Proceeds, less organization and Offering expenses, Manager operating expenses (“Net Proceeds”). |

| Net Proceeds Allocation: |

Based on raising the Maximum Offering Amount, the Company intends to initially allocate ninety-five (95%) percent of Net Proceeds to the financing of Borrower loans, and five (5%) percent of Net Proceeds to legal fees, Company management, supervisory and accounting services, and other working capital reserves. Management may change this allocation at any time based on the actual Net Proceeds of the Offering and Management’s sole determination of what is in the best interests of the Company. |

| Risk Factors: | Investing in the Units involves a high degree of risk. See “Risk Factors” beginning on page 19. |

| Transfer Agent: | Signature Stock Transfer, Inc. will act as the Company’s transfer agent. |

| Liquidity: | There is no public market for the Units. |

|

Withdrawals: |

Holders of Class A Units shall be able, upon submission of a written request to the Manager, receive their Capital Contribution within sixty (60) days of the Manager receiving their written request.

Holders of Class B Units shall be able, upon submission of a written request to the Manager, receive their Capital Contribution within one hundred and eighty (180) days of the Manager receiving their written request.

Holders of Class C Units shall be able, upon submission of a written request to the Manager, receive their Capital Contribution within three hundred and sixty (360) days of the Manager receiving their written request. |

|

Rollover of Units: |

Investors may select automatic rollover of Debt Payments. In case interest on Debt Payments is rolled over as per the request of the Investors, Company will still send an IRS Form 1099 for tax reasons. The Company may redeem an Investor’s capital at any time. |

|

Closing: |

The Manager intends to keep the Offering open for a period of at least five (5) years. |

| 18 of 57 |

An investment in Units of the Company involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this Offering Circular, before purchasing securities offered by the Company. Any of the following factors could harm the Company’s business and future results of operations and could result in a partial or complete loss of your investment. This could cause the value of Units to decline significantly, and you could lose part or all of your investment. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

This Offering is being made pursuant to the rules and regulations under Regulation A of the Securities Act.

The legal and compliance requirements of these rules and regulations, including ongoing reporting requirements related thereto, are relatively untested.

Arbitrary Determination of the Offering Price.

The Offering Price has been arbitrarily determined by the Company and may not bear any relationship to assets acquired or to be acquired or the book value of the Company or any other established criteria or quantifiable indicia for valuing a business. Neither the Company nor Sponsor represents that the Units have or will have a market value equal to their Offering Price or that the Units could be resold (if at all) at their original Offering Price.

No market currently exists for the Units.

There is a risk that no market for the Units will ever exist and as a result, an investment in the Company would be illiquid in the event investors were to desire to liquidate their Unit interests. If investors were to attempt to sell their Units prior to the dissolution of the Company through secondary market sales or otherwise, they might have to sell them at a discount to their fair value as there is no certainty that they can be sold for full market value or that the Units may be sold at any price.

RISKS RELATED TO THE COMPANY’S BUSINESS PLAN

Debt Payments on the Units are Not Guaranteed.

Although Debt Payments on the Units are cumulative (but non-compounding), the Company’s Manager must approve the actual payment of the distributions. The Manager can elect at any time or from time to time, and for an indefinite duration, not to pay any or all accrued distributions. The Manager could do so for any reason, and may be prohibited from doing so in the following instances:

| • | poor historical or projected cash flows; |

| • | the need to make payments on the Company’s indebtedness; |

| • | concluding that payment of distributions on the Units would cause the Company to breach the terms of any indebtedness or other instrument or agreement; or |

| • | determining that the payment of distributions would violate applicable law regarding unlawful distributions. |

Adverse Economic Conditions in the Private Lending Space.

Adverse economic conditions may negatively affect the Company’s results of operations and, as a result, its ability to make distributions to Investors or to realize appreciation in the value of Company loans.

The Company’s operating results may be adversely affected by market and economic challenges, which may negatively affect its returns and profitability and, as a result, its ability to make distributions to Investors and the value of an investment in the Company. These market and economic challenges include, but are not limited to, any future downturn in the U.S. economy and the related uncertainty in the financial and credit markets.

The length and severity of any economic slow-down or downturn cannot be predicted. The Company’s operations and, as a result, its ability to make distributions to holders of the Units could be materially and adversely affected to the extent that an economic slow-down or downturn is prolonged or becomes severe.

| 19 of 57 |

General Risk of Investment in the Company.

The economic success of the Company will depend upon the results of operations of the Company loans issued to Borrowers. The results of operations are subject to those risks typically associated with the business of hard money lending, including the accuracy of underwriting said loans, and ensuring that Borrowers are able to repay the loans in a timely manner to ensure the Company can continue its operations. Although the experience of the Company’s Executive Team weighs favorably, the Company makes no assurances that the Borrowers will successfully pay back their Company-issued loans in a timely manner. The traditional risks associated with any entity operating in the business of lending are all present here. In addition, even if adverse operating results do not result in lease or financing defaults, they will likely reduce the ability of the Company to make Debt Payments to Debt Unit Holders.

Units Have No Voting Rights.

Management will have sole power and authority over the business and management of the Company. Investors will not have the right to vote on any matters, and, therefore, Investors will not have an active role in the Company’s management and will be unable to implement a change in the Management team or the Management team’s decisions.

The Company is a Blind Pool Investment without Operational Track Record prior to the Date of this Offering.

The Company has yet to identify any specific loans to finance with the Net Proceeds of this Offering and has no prior track record. While Company Affiliates have been in the private lending space for an extensive period of time, prior performance is not always indicative of future results, and Investors are cautioned that risk is an inherent part of the nature of any investment.

Investment Risk.

There can be no assurance that the Company will be able to achieve its investment objectives or that investors will receive any Debt Payment or any return of their capital. Investment results may vary substantially over time, and as a result, investors should understand that the results of a particular period will not necessarily be indicative of results in future periods.

Dependence Upon Key Management Personnel.

The Company will depend upon the efforts, experience, diligence, skill and network of business contacts of the Management team; therefore, the Company’s success will depend on their continued service. The departure of any of the Company’s key Management personnel could have a material adverse effect on performance. If any of the Company’s key personnel were to cease their employment, the Company’s operating results could suffer.

The Company believes its future success depends upon Management’s ability to hire and retain highly skilled managerial, operational and marketing personnel. Competition for such personnel is intense, and the Company cannot assure that it will be successful in attracting and retaining such skilled personnel. If the Company loses or is unable to obtain the services of key personnel, the Company’s ability to implement its investment strategies could be delayed or hindered, and the value of an investment in the Company may decline.

Reliance on Management.

The Company’s ability to achieve its investment objectives is largely dependent upon the performance of Management and the Sponsor, in selecting additional investments for the Company to acquire, securing financing arrangements, and financing the Company loans. The investors generally have no opportunity to evaluate the terms of transactions or other economic or financial data concerning any investments and must rely entirely on the ability of Management. Management may not be successful in identifying suitable investments on financially attractive terms, and the Company may not be successful in achieving its investment objectives.

There will be competing demands on the officers of the Manager, and they will not devote all of their attention to the Company, which could have a material adverse effect on the Company’s business and financial condition.

The officers of the Manager will experience conflicts of interest in managing the Company, because they also have management responsibilities for other companies, including companies that invest in the same types of assets as the Company. For these reasons, all of these individuals share their management time and services among those companies, and the Company, and will not devote all of their attention to the Company. Specifically, Officers of the Company are involved in the following entities:

| 1. | Loan Source LLC: Entity servicing the loans and facilitating the transfer of the notes to the Company for a fee of between $135 and $200 per note. |

| 2. | ILS Lending LLC: Entity originating the loans. |

| 20 of 57 |

| 3. | Pearl Funding LLC: Secondary entity originating the loans. |

| 4. | ILS Legacy Holdings LLC: The Common Member for the Company and ILS Fixed Horizon Management Corp. which receives the Manager fees. |

| 5. | ILS RE Capital I LLC: 506(b) Offering. |

| 6. | ILS RE Capital II LLC: 506(c) Offering. |

| 7. | ILS Equity Fund LLC: 506(c) Offering. |

| 8. | SVSM Growth Fund LLC: 506(c) Offering. |

| 21 of 57 |

RISKS RELATED TO INVESTMENTS IN REAL ESTATE LENDING

Legal Structure.

The Company shall provide Project Financing or Land Financing advances to the Borrower for Borrower Projects for which the Borrower does not have fee simple title. As such, Borrower Properties are typically controlled by, but not owned by the Borrower. As such, the Company’s source of Project Financing or Land Financing repayment is based on the Borrower’s perfection of its contractual rights under agreements to purchase the Borrower Property and subsequently sell it.

Risk of Borrower Inability to Obtain Financing.

The financial projections contained in this Memorandum assume that the Borrower will obtain other third-party financing. There is no guarantee that the Borrower will be able to obtain such financing.

Borrower Intends to Use Leverage.

The Company’s objectives are based on the Borrower’s use of leverage in the acquisition, development, construction, and operation of the Property. If the Borrower does obtain outside financing, the use of leverage increases the risk of an investment in the Units, as it is possible that the Borrower’s income from the Property, in any month, will be inadequate to make the Company’s Project Financing or Land Financing debt-service after servicing other Borrower financing obligations. A result of being unable to make the required financing payments could be that the lender could complete a foreclosure on the Borrower and all of the investment in the Units will be lost. There is also the risk that at the time of the refinancing or sale of the Property, the proceeds will not be greater than the amount needed to pay off the remaining balance of the Borrower’s other financing and, as a result, no cash will be available for repayment of the outstanding balance of the Project Financing, Land Financing, or any distribution to the Debt Unit Holders.

Financial projections.

All financial projections are prepared on the basis of assumptions and hypotheses. Future operating results are impossible to predict and no representation of any kind is made with respect to future accuracy or completeness of the forecast of projections as to income, expenses, costs, or other items. No representations or warranties of any kind are intended or should be inferred with respect to economic return which may accrue to a Member. An investment in the Company should be made only after adequate personal investigation of the merits of the Company and the Offering.

Lack of capital.

There is a risk that the amount of capital to be raised by the Company will be insufficient to meet the investment objectives of the Company. If there is a shortage of capital, the Manager will use best efforts to obtain funds from a third party or advance the Company’s directly or through an affiliate. Obtaining funds from a third party or an advance directly or through an affiliate may require an increase in the amount of financing the Company will be obligated to repay. In addition, there is no certainty that such funds will be available at a reasonable cost, if available at all.

Risks of having no control in management.

Under the Operating Agreement, Debt Unit Holders do not have a right to participate in the management of the Company’s affairs. Debt Unit Holders cannot propose changes to the Manager or to the Operating Agreement. Under the Operating Agreement, it may also be difficult for Debt Unit Holders to enforce claims against the Manager, which means that Debt Unit Holders may not be able to recover any losses they may suffer through their ownership of Units arising from acts of the Manager that harm the Company’s business.

The Manager and its management must discharge their duties with reasonable care, in good faith and in the best interest of the Company. Despite this obligation, the Operating Agreement limits management’s liability to the Company and all Debt Unit Holders. The Manager is not liable for monetary damages unless it involves receipt of an improper personal financial benefit, a willful failure to deal fairly with the Company on matters where there is a material conflict of interest, a knowing violation of law, or willful misconduct. Any Member’s ability to bring legal action against the Manager for these actions is also limited.

Limited Operating Reserves.

The Company intends to establish an operating reserve account with a portion of the proceeds raised from this Offering to pay anticipated operating, administrative and other expenses that shall be incurred following the Closing Date of this Offering. If future expenses increase by unanticipated amounts, the Company may not have sufficient reserves to pay these obligations. The Company does not currently have any commitment or arrangement in place to obtain additional funding, and there are no assurances that additional funding can be obtained, if necessary, or that such additional funding, if obtained, will be adequate for its financial needs.

| 22 of 57 |

General economic conditions may affect the value and the timing of the sale of Borrower Property or the ability to refinance the Borrower Property.

The real estate market is affected by many factors, such as general economic conditions, the availability of financing, interest rates and other factors, including the supply and demand for real estate investments, all of which are beyond the control of the Borrower. The Company cannot predict whether the Borrower will be able to sell the Borrower Property for a price or on terms which are acceptable. Further, the Company cannot predict the Borrower’s ability to obtain adequate funding from a third-party lender to refinance the Borrower Property. There are no assurances that the Company can successfully achieve its investment goals and therefore, Debt Unit Holders may have to hold their Units for an indefinite period of time, or have their Units sold or redeemed for less than the Debt Unit Holders’ Capital Contribution.

Environmentally hazardous property.

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the cost of removal or remediation of hazardous or toxic substances on, under or in such property. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require expenditures. Environmental laws provide for sanctions in the event of noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. In connection with the ownership of the Property, the Borrower may be potentially liable for such costs, and upon the Company repossessing the Property as part of the non-performing note, would then have to deal with these issues. The cost of defending against claims of liability, complying with environmental regulatory requirements or remediating any contaminated property could materially adversely affect the value of the Units.

Real estate investments are long-term investments and may be difficult to sell in response to changing economic conditions.

Virtually all real property investments are subject to certain inherent risks. Real estate investments are generally long-term investments which cannot be quickly converted to cash. Real property investments are also subject to adverse changes in general economic conditions or local conditions which may reduce the demand for commercial property. Since the Company purchases notes primarily related to real estate, a downturn in the real estate market could negatively impact the Company’s operations.

Adverse Trends in the Single-Family Housing Industry May Impact the Project.

The success of the Project will depend largely on the ability of the Borrowers to adapt to trends in the single-family housing industry, including competitive pressures, increased consolidation, industry overbuilding and changing demographics, the introduction of new concepts and products, availability of labor, changing tenant pricing levels and general economic conditions. Failures in adapting to the foregoing may affect the Borrower’s financial performance and thus the Company’s ability to receive funding from the notes underlying the Borrower’s property(ies).

Geographic Concentration and Sector Risk.

The Company’s geographic focus is not specifically limited other than to areas other than those in which ILS RE Capital LLC, an affiliate of the Company, has invested. Its sector focus is to provide Project Financing and Land Financing, enter into strategic relationships with real estate developers and builders. The Company’s overall performance is therefore largely dependent on real estate economic conditions in these geographic areas and real estate sectors. Since there are no diversification requirements with regard to the Company’s investment activities the Company’s investment portfolio may include a small number of large positions, and at times, may include only one or two Borrower Properties in one or two geographic markets. While such a portfolio concentration may enhance total returns to Investors, if any large position has a material loss, then returns to Investors may be lower than if the Company had invested in a more diversified and widespread portfolio of smaller positions. The Company’s investments will consist entirely of investments related to Investment Properties. Such concentration may increase the volatility of the Company’s returns and may also expose the Company to significant risk of economic downturns in this sector to a greater extent than if its portfolio also included other property types. As a result, economic downturns in the real estate sector could have an adverse effect on the financial condition, results of operations and cash flow of the Company.

| 23 of 57 |

Competition in the Market

The real estate borrowing industry is highly competitive on both a national and regional level. The Company faces competition from REITs, other hard-money providers, other public and private real estate companies, private real estate investors, and banks. Competition may prevent the Company from providing loans to Borrowers of desirable Qualified Properties, who can then either refinance and/or sell the property(ies) financed with the Company loans in order to make prompt repayment and keep up with the loan’s APR. If the Company offers lower interest rates to remain competitive, Investors may experience a lower return on investment and be less inclined to invest in the Company’s next project which may decrease its profitability. Increased competition for Borrowers may also preclude the Company from acquiring Borrowers that would generate the most attractive returns to Investors or may reduce the number of Borrowers the Company could acquire, which could have an adverse effect on its business.

Availability of Future Financing and Market Conditions.

Market fluctuations in real estate financing may affect the availability and cost of funds needed to successfully operate in the private lending space. Rising interest rates require Offerings to provide greater returns to be attractive to investors, and many Sponsors of such Offerings may require additional third-party financing for operation in the real estate industry, which is a highly capital intensive area.