Post-Qualification Amendment No. 2

File No. 024-10671

PART II

OFFERING CIRCULAR

Groundfloor Real Estate 1, LLC

Eleven Series of Limited Recourse Obligations

Totaling $1,794,090

Dated: May 24, 2017

This Post-Qualification Amendment No. 2 (this “PQA”) amends the offering circular of Groundfloor Real Estate 1, LLC, dated April 14, 2017, as qualified on May 5, 2017, as may be amended and supplemented from time to time (the “Offering Circular”), to add additional securities to be offered pursuant to the Offering Circular. Unless otherwise defined below, capitalized terms used herein shall have the same meanings as set forth in the Offering Circular. See “Incorporation by Reference of Offering Circular” below.

This PQA relates to the offer and sale of up to an additional $1,794,090 in aggregate amount of Limited Recourse Obligations (the “LROs”) consisting of 11 separate series of LROs to be issued by Groundfloor Real Estate 1, LLC (the “Company,” “GRE 1,” “we,” “us,” or “our”).

We make LROs available for investment on a web-based investment platform www.groundfloor.com (the “Groundfloor Platform”) owned and operated by Groundfloor Finance Inc. (“Groundfloor” or “Groundfloor Finance”). We operate out of the same offices as Groundfloor Finance. Our principal offices are located at 75 Fifth Street, NW, Suite 2170, Atlanta, GA 30308. The phone number for these offices is (404) 850-9225. Our mailing address is PO Box 79346, Atlanta, GA 30357.

We will issue the LROs in distinct series, each corresponding to a real estate development project (each, a “Project”) financed by a commercial loan from GRE 1 (each, a “Loan”). The borrower for each Project is a legal entity (the “Borrower”) that owns the underlying property and has been organized by one or more individuals (each, a “Principal”) that own and operate the Borrower.

The LROs will be unsecured special, limited obligations of GRE 1. The LROs are not listed on any national securities exchange or on the over-the-counter inter-dealer quotation system. There is no market for the LROs. Our obligation to make payments on a LRO is limited to an amount equal to each holder’s pro rata share of amount of payments, if any, actually received on the corresponding Loan, net of certain fees and expenses retained by us. See the sections titled “General Terms of the LROs,” “The LROS Covered by this Offering Circular,” and “Project Summaries” of the Offering Circular, as amended hereby, for the specific terms of the LROs covered by this PQA.

We do not guarantee payment of the LROs in the amount or on the time frame expected. The LROs are not obligations of the Borrowers or their Principals, and we do not guarantee payment on the corresponding Loans. We have the authority to modify the terms of the corresponding Loans which could, in certain circumstances, reduce (or eliminate) the expected return on your investment. See the section titled “General Terms of the LROs—Administration, Service, Collection, and Enforcement of Loan Documents” of the Offering Circular.

The LROs are speculative securities. Investment in the LROs involves significant risk, and you may be required to hold your investment for an indefinite period of time. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 11 of the Offering Circular.

We will commence the offering of each series of LROs promptly after the date this PQA is qualified by posting on the Groundfloor Platform a separate landing page corresponding to each particular Loan and Project (each, a “Project Summary”). The offering of each series of LROs covered by this PQA will remain open until the earlier of (1) 30 days, unless extended, or (2) the date the offering of a particular series of LROs is fully subscribed with irrevocable funding commitments (the “Offering Period”); however, we may extend the Offering Period for a particular series of LROs in our sole discretion (with notice to potential investors) up to a maximum of 45 days. We will notify investors who have previously committed funds to purchase such series of LROs of any such extension by email and will post a notice of the extension on the corresponding Project Summary on the Groundfloor Platform.

This Offering is being conducted on a “best-efforts” basis, which means that the officers of our sole member and manager, Groundfloor Finance, will use their commercially reasonable best efforts in an attempt to sell the LROs. Such officers will not receive any commission or any other remuneration for these sales. In offering the LROs on our behalf, the officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

The LROs offered hereby may only be purchased by investors residing in California, Georgia, Illinois, Maryland, Massachusetts, Texas, Virginia, Washington, and the District of Columbia. We may also offer or sell LROs in other states by qualifying an offering statement covering the LROs in those states or in reliance on exemptions from registration requirements of the laws of those states. The Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state in which such offer, solicitation, or sale would be unlawful, prior to registration or qualification under the laws of any such state. In addition, the LROs are offered only to investors who meet certain financial suitability requirements. See the section titled “Investor Suitability Requirements” of the Offering Circular.

NO FEDERAL OR STATE SECURITIES COMMISSION HAS APPROVED, DISAPPROVED, ENDORSED, OR RECOMMENDED THIS OFFERING. YOU SHOULD MAKE AN INDEPENDENT DECISION WHETHER THIS OFFERING MEETS YOUR INVESTMENT OBJECTIVES AND FINANCIAL RISK TOLERANCE LEVEL. NO INDEPENDENT PERSON HAS CONFIRMED THE ACCURACY OR TRUTHFULNESS OF THIS DISCLOSURE, NOR WHETHER IT IS COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS ILLEGAL.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

| Offering price to the public |

Underwriting discounts and commissions |

Proceeds to issuer(1)(2) |

Proceeds to other persons |

|||||||||||||

| Per Unit | $ | 10.00 | N/A | $ | 10.00 | N/A | ||||||||||

| Total Minimum | $ | 57,300 | N/A | $ | 57,300 | N/A | ||||||||||

| Total Maximum | $ | 1,794,090 | N/A | $ | 1,794,090 | N/A | ||||||||||

(1) We estimate all expenses for this Offering to be approximately $4,500, which will not be financed with the proceeds of the Offering.

(2) Assumes no promotions or discounts applied to any offerings covered by this PQA.

Incorporation by Reference of Offering Circular

The Offering Circular, including this PQA, is part of an offering statement (File No. 024-10671) that we filed with the Securities and Exchange Commission. We hereby incorporate by reference into this PQA all of the information contained in the following:

| 1. | Part II of the Offering Circular, including the Financial Statements beginning on page F-1 thereof and the form of LRO Agreement beginning on page LRO-1 thereof, to the extent not otherwise modified or replaced by offering circular supplement and/or post-qualification amendment; and |

| 2. | Offering Circular Supplement No. 1 to the Offering Circular. |

Note that any statement that we make in this PQA (or have made in the Offering Circular) will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement or post-qualification amendment.

The LROs Covered by the Offering Circular and Use of Proceeds

The following disclosure is added under the tables in the sections titled “The LROs Covered by this Offering Circular” and “Use of Proceeds” on pages 99 and 100, respectively, of the Offering Circular:

The table below lists the additional Projects covered by this PQA for which we are offering separate series of LROs. Each series of LROs is denominated by the corresponding Project’s name.

| Series of LROs/Project | Aggregate Purchase Amount/Loan Principal | |||

| 2435 Hillcrest Drive, Atlanta, GA 30344 | $ | 57,300 | ||

| 2302 Anoka Avenue, Baltimore, MD 21215 | 76,840 | |||

| 2449 Lochmoor Place, Saginaw, MI 48603 | 77,360 | |||

| 231 DeMott Avenue, Clifton, NJ 07011 | 78,130 | |||

| 235 Bryan Street, McDonough, GA 30253 | 118,070 | |||

| 1402 Southwest 3rd Street, Delray Beach, FL 33444 | 132,870 | |||

| 33740 Cooley Road, Columbia Station, OH 44028 | 144,620 | |||

| 899 Long Iron Drive, Fayetteville, NC 28312 | 151,750 | |||

| 458 Sycamore Street, New Lenox, IL 60451 | 221,650 | |||

| 369 Nolan Street Southeast, Atlanta, GA 30315 | 241,860 | |||

| 822 Argonne Avenue Northeast, Atlanta, GA 30308 | 493,640 | |||

| Total | $ | 1,794,090 | ||

Project Summaries

Each Project Summary attached below is included in the Offering Circular following page PS-24.

| 1 |

PROJECT SUMMARIES FOR PQA NO. 2

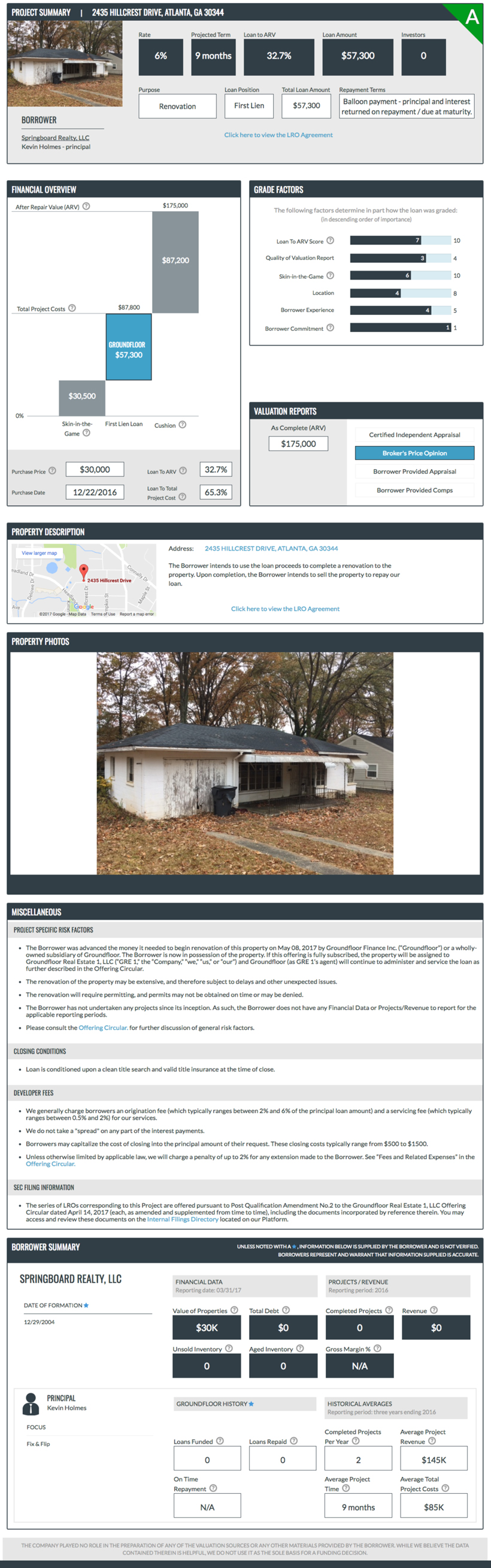

PROJECT SUMMARY | 2435 HILLCREST DRIVE, ATLANTA, GA 30344 A BORROWER Springboard Realty, LLC Kelvin Holmes - principal Rate Projected Term Loan to ARV Loan Amount Investors 6% 9 months 32.7% $57,300 0 Purpose Loan Position Total Loan Amount Repayment Terms Renovation First Lien $57,300 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $175,000 Total Project Costs $87,00 $87,200 GROUNDFLOOR $57,300 $30,500 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $30,000 Purchase Date 12/22/2016 Loan To ARV 32.7% Loan To Total Project Cost 65.3% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 7 10 Quality of Valuation Report 3 4 Skin-in-the-Game 6 10 Location 4 8 Borrower Experience 4 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $175,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 2435 HILLCREST DRIVE, ATLANTA, GA 30344 The Borrower intends to use the loan proceeds to complete a renovation to the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to begin renovation of this property on May 08,2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this is offering is fully subscribed, the property will be assigned to Groundfloor Real Estate 1, LLC (“GRE 1,” the “Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. The Borrower has not undertaken any projects since its inception. As such, the Borrower does not have any Financial Data or Projects/Revenue to report for the applicable reporting periods. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We do not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin, You, may access and review these documents on the Internal Filings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. SPRINGBOARD REALTY, LLC FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 12/29/2004 Value of Properties $30K Total Debt $0 Completed Projects 0 Revenue $0 Unsold Inventory 0 Aged Inventory 0 Gross Margin % N/A PRINCIPAL Kelvin Holmes GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix & Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 2 Average Project Revenue $145K On Time Repayment N/A Average Project Time 9 months Average Total Project Costs $85K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-25 |

PROJECT SUMMARY | 2302 ANOKA AVENUE, BALTIMORE, MD 21215 C BORROWER GoodH2O Property Management Tia Goodwater - principal Rate Projected Term Loan to ARV Loan Amount Investors 11% 12 months 57.8% $76,840 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $76,840 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $133,000 Total Project Costs $95,280 $37,720 GROUNDFLOOR $76,840 $18,440 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $29,200 Purchase Date 05/09/2017 Loan To ARV 57.8% Loan To Total Project Cost 80.6% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 5 10 Quality of Valuation Report 3 4 Skin-in-the-Game 3 10 Location 4 8 Borrower Experience 3 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $133,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 2302 ANOKA AVENUE, BALTIMORE, MD 21215 The Borrower intends to use the loan proceeds to purchase and renovate the property. Upon completion, the Borrower plans to refinance the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced money it needed to purchase this property on May 09, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this offering is fully subscribed, the property will be assigned to Groundfloor Real Estate1, LLC (“GRE 1,” the “Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The Borrower is a newly formed entity. As such, the Borrower has limited operating history. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. Please consult the Offering Circular, for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charge borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We does not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin. You, may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. GOODH2O PROPERTY MANAGEMENT FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 02/07/2017 Value of Properties $0 Total Debt $0 Completed Projects 0 Revenue $0 Unsold Inventory 0 Aged Inventory 0 Gross Margin % N/A PRINCIPAL Tia Goodwater GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Buy & Hold Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 1 Average Project Revenue $100K On Time Repayment N/A Average Project Time 3 months Average Total Project Costs $70K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-26 |

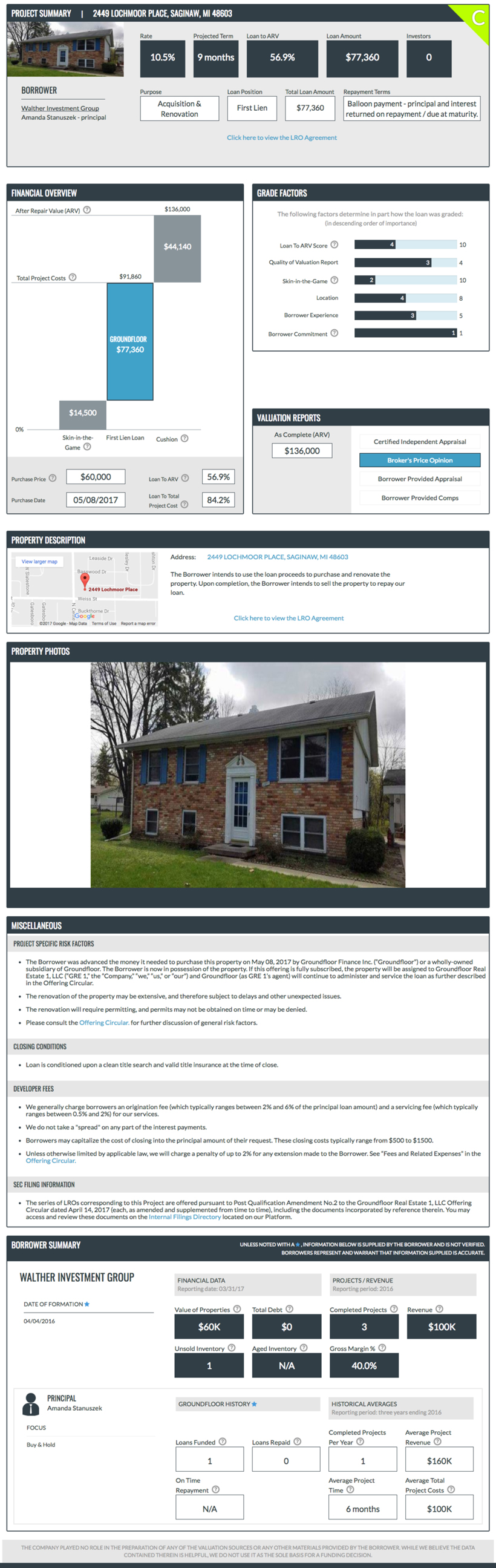

PROJECT SUMMARY | 2449 LOCHMOOR PLACE, SAGINAW, MI 48603 C BORROWER Walther Investment Group Amanda Stanuszek - principal Rate Projected Term Loan to ARV Loan Amount Investors 10.5% 9 months 56.9% $77,360 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $77,360 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $136,000 Total Project Costs $91,860 $44,140 GROUNDFLOOR $77,360 $14,500 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $60,000 Purchase Date 05/08/2017 Loan To ARV 56.9% Loan To Total Project Cost 84.2% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 4 10 Quality of Valuation Report 3 4 Skin-in-the-Game 2 10 Location 4 8 Borrower Experience 3 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $136,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 2449 LOCHMOOR PLACE, SAGINAW, MI 48603 The Borrower intends to use the loan proceeds to complete a renovate the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to Purchase this property on May 08, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this is offering is fully subscribed, the property will be assigned to Groundfloor Real Estate 1, LLC (“GRE 1,” the “Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We do not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin, You, may access and review these documents on the Internal Filings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. WALTHER INVESTMENT GROUP FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 04/04/2016 Value of Properties $60K Total Debt $0 Completed Projects 3 Revenue $100K Unsold Inventory 1 Aged Inventory N/A Gross Margin % 40.0% PRINCIPAL Amanda Stanuszek GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Buy & Hold Loans Funded 1 Loans Repaid 0 Completed Projects Per Year 1 Average Project Revenue $160K On Time Repayment N/A Average Project Time 6 months Average Total Project Costs $100K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-27 |

PROJECT SUMMARY | 231 DEMOTT AVENUE, CLIFTON, NJ 07011 A BORROWER Whitman, Price, and Bamebridge Holdings, LLC James Conticello - principal Rate Projected Term Loan to ARV Loan Amount Investors 5.5% 6 months 27.9% $78,130 0 Purpose Loan Position Total Loan Amount Repayment Terms Renovation First Lien $78,130 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $280,000 Total Project Costs $203,130 $76,870 GROUNDFLOOR $78,130 $125,000 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $185,000 Purchase Date 04/10/2017 Loan To ARV 27.9% Loan To Total Project Cost 38.5% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 8 10 Quality of Valuation Report 4 4 Skin-in-the-Game 10 10 Location 4 8 Borrower Experience 5 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $280,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 231 DEMOTT AVENUE, CLIFTON, NJ 07011 The Borrower intends to use the loan proceeds to complete a renovation to the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to begin renovation of this property on April 28, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this is offering is fully subscribed, the property will be assigned to Groundfloor Real Estate 1, LLC (“GRE 1,” “the Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. The Borrower has not undertaken any projects since its inception. As such, the Borrower does not have any Financial Data or Projects/Revenue to report for the applicable reporting periods. The property was purchased for $185,000. The Borrower intends to use $60,000 of the proceeds from our loan to offset the amount of the purchase price of the property. Therefore, the Borrower is only receiving a “Skin-in-the-Game” score for the remaining $125,000 that is tied up in the project after completion of our loan. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We do not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin. You may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. WHITMAN, PRICE, AND BAMEBRIDGE HOLDINGS, LLC FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 03/08/2013 Value of Properties $125K Total Debt $0 Completed Projects 0 Revenue $0 Unsold Inventory 0 Aged Inventory 0 Gross Margin % 0.0% PRINCIPAL James Conticello GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix & Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 1 Average Project Revenue $250K On Time Repayment N/A Average Project Time 12 months Average Total Project Costs $180K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-28 |

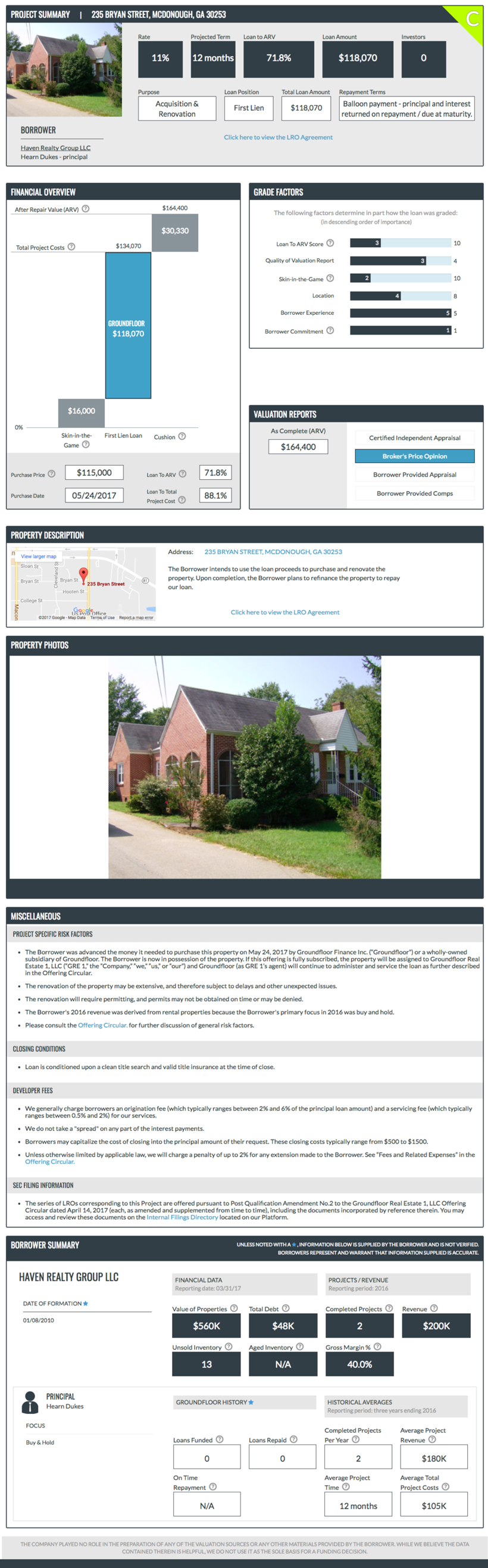

PROJECT SUMMARY | 235 BRYAN STREET, MCDONOUGH, GA 30253 C BORROWER Heaven Realty Group LLC Hearn Dukes - principal Rate Projected Term Loan to ARV Loan Amount Investors 11% 12 months 71.8% $118070 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $118,070 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $164,400 Total Project Costs $134,070 $30,330 GROUNDFLOOR $118,070 $16,000 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $115,000 Purchase Date 05/24/2017 Loan To ARV 71.8% Loan To Total Project Cost 88.1% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 3 10 Quality of Valuation Report 3 4 Skin-in-the-Game 2 10 Location 4 8 Borrower Experience 5 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $164,400 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 235 BRYAN STREET, MCDONOUGH, GA 30253 The Borrower intends to use the loan proceeds to purchase and renovate the property. Upon completion, the Borrower plans to refinance the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to purchase this property on May 24, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this offering is fully subscribed, the property will be assigned to Groundfloor Real Estate1, LLC (“GRE1,” “the Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. The Borrower’s 2016 revenue was derived from rental properties because the Borrower’s primary focus in 2016 was buy and hold. Please consult the Offering Circular, for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We does not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin, You, may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. HAVEN REALTY GROUP LLC FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 01/08/2010 Value of Properties $560K Total Debt $48K Completed Projects 2 Revenue $200K Unsold Inventory 13 Aged Inventory N/A Gross Margin % 40.0% PRINCIPAL Hearn Dukes GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Buy & Hold Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 2 Average Project Revenue $180K On Time Repayment N/A Average Project Time 12 months Average Total Project Costs $105K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-29 |

PROJECT SUMMARY | 1402 SOUTHWEST 3RD STREET, DELRAY BEACH, FL 33444 C BORROWER Peate Properties Thomas Peate - principal Rate Projected Term Loan to ARV Loan Amount Investors 11% 12 months 71.8% $132,870 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $132,870 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $185,000 Total Project Costs $147,190 $37,810 GROUNDFLOOR $132,870 $14,320 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $137,000 Purchase Date 05/16/2017 Loan To ARV 71.8% Loan To Total Project Cost 90.3% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 3 10 Quality of Valuation Report 3 4 Skin-in-the-Game 2 10 Location 4 8 Borrower Experience 5 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $185,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 1402 SOUTHWEST 3RD STREET, DELRAY BEACH, FL 33444 The Borrower intends to use the loan proceeds to purchase and renovate the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced money it needed to purchase this property on May 16, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this offering is fully subscribed, the property will be assigned to Groundfloor Real Estate1, LLC (“GRE 1,” the “Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. The Borrower is a new entity and does not have any assests or operating history. Please consult the Offering Circular, for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charge borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We do not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin. You, may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. PEATE PROPERTIES FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 04/11/2017 Value of Properties $0 Total Debt $0 Completed Projects 0 Revenue $0 Unsold Inventory 0 Aged Inventory 0 Gross Margin % N/A PRINCIPAL Thomas Peate GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix &Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 1 Average Project Revenue $200K On Time Repayment N/A Average Project Time 3 months Average Total Project Costs $170K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-30 |

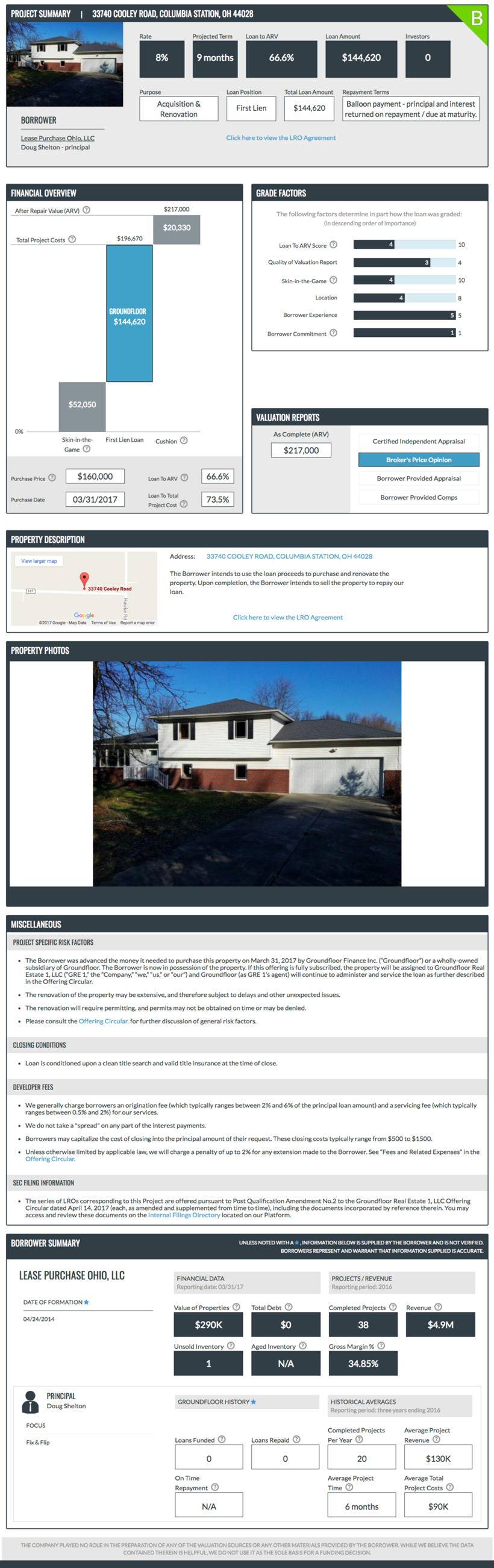

PROJECT SUMMARY | 33740 COOLEY ROAD, COLUMBIA STATION, OH 44028 B BORROWER Lease Purchase Ohio, LLC Doug Shelton - principal Rate Projected Term Loan to ARV Loan Amount Investors 8% 9 months 66.6% $144,620 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $144,620 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $217,000 Total Project Costs $196,670 $20,330 GROUNDFLOOR $144,620 $52,050 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $160,000 Purchase Date 03/31/2017 Loan To ARV 66.6% Loan To Total Project Cost 73.5% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 4 10 Quality of Valuation Report 3 4 Skin-in-the-Game 4 10 Location 4 8 Borrower Experience 5 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $217,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 33740 COOLEY ROAD, COLUMBIA STATION, OH 44028 The Borrower intends to use the loan proceeds to purchase and renovate the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to purchase this property on March 31, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this is offering is fully subscribed, the property will be assigned to Groundfloor Real Estate 1, LLC (“GRE 1,” the “Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. Please consult the Offering Circular, for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We do not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin. You may access and review these documents on the Internal Filings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. LEASE PURCHASE OHIO, LLC FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 04/24/2014 Value of Properties $290K Total Debt $0 Completed Projects 38 Revenue $4.9M Unsold Inventory 1 Aged Inventory N/A Gross Margin % 34.85% PRINCIPAL Doug Shelton GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix & Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 20 Average Project Revenue $130K On Time Repayment N/A Average Project Time 6 months Average Total Project Costs $90K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-31 |

PROJECT SUMMARY | 899 LONG IRON DRIVE, FAYETTEVILLE, NC 28312 B BORROWER Merrimack Enterprises, LLC Khaled Abdel – Fattah - principal Rate Projected Term Loan to ARV Loan Amount Investors 8.5% 12 months 60.7% $151,750 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $151,750 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $250,000 Total Project Costs $180,500 $69,500 GROUNDFLOOR $151,750 $28,750 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $149,734 Purchase Date 04/28/2017 Loan To ARV 60.7% Loan To Total Project Cost 84.1% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 5 10 Quality of Valuation Report 4 4 Skin-in-the-Game 2 10 Location 4 8 Borrower Experience 4 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $250,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 899 LONG IRON DRIVE, FAYETTEVILLE, NC 28312 The Borrower intends to use the loan proceeds to purchase and a renovate the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to purchase this property on April 28, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this offering is fully subscribed, the property will be assigned to Groundfloor Real Estate1, LLC (“GRE 1,” “the Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. Please consult the Offering Circular, for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charge borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We does not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin. You, may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. MERRIMACK ENTERPRICES, LLC FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 05/26/2016 Value of Properties $0 Total Debt $0 Completed Projects 1 Revenue $160K Unsold Inventory 0 Aged Inventory 0 Gross Margin % 37.5% PRINCIPAL Khaled Abdel-Fattah GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix &Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 7 Average Project Revenue $330K On Time Repayment N/A Average Project Time 4 months Average Total Project Costs $250K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-32 |

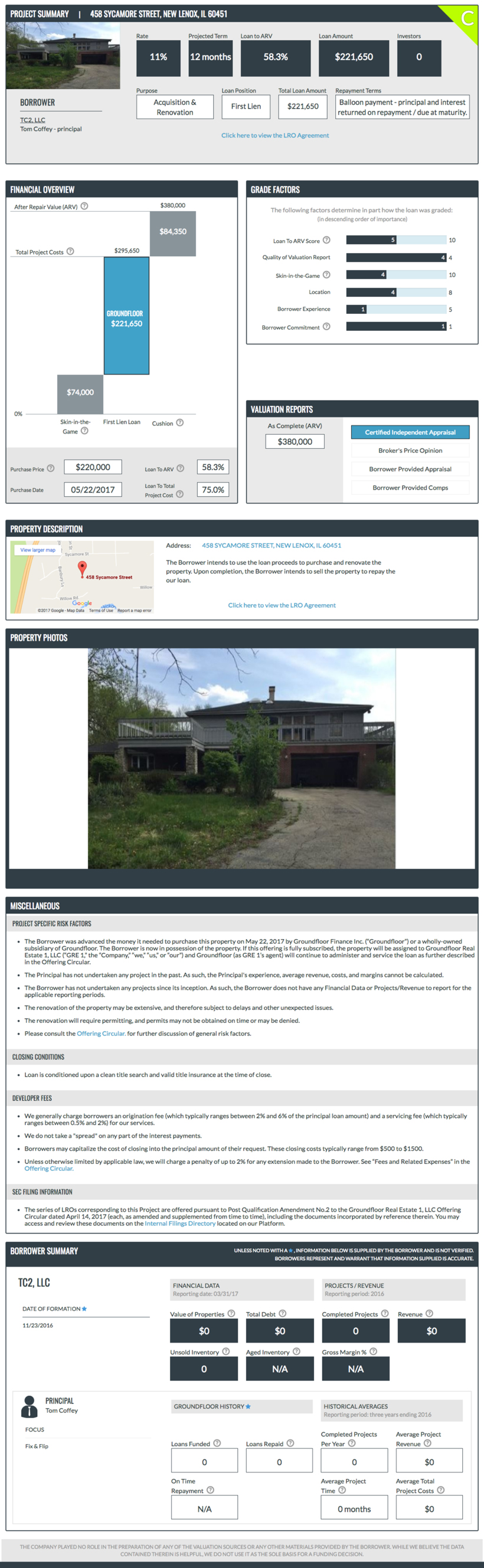

PROJECT SUMMARY | 458 SYCAMORE STREET, NEW LENOX, IL 60451 C BORROWER TC2, LLC Tom Coffey - principal Rate Projected Term Loan to ARV Loan Amount Investors 11% 12 months 58.3% $221,650 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $221,650 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $380,000 Total Project Costs $295,660 $84,350 GROUNDFLOOR $221,650 $74,000 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $220,000 Purchase Date 05/22/2017 Loan To ARV 58.3% Loan To Total Project Cost 75.0% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 5 10 Quality of Valuation Report 4 4 Skin-in-the-Game 4 10 Location 4 8 Borrower Experience 1 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $380,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 458 SYCAMORE STREET, NEW LENOX, IL 60451 The Borrower intends to use the loan proceeds to purchase and renovate the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to purchase this property on May 22, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this offering is fully subscribed, the property will be assigned to Groundfloor Real Estate1, LLC (“GRE 1”, “the Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The Principal has not undertaken any projects in the past. As such, the Principal’s experience average revenue, costs, and margins cannot be calculated. The Borrower has not undertaken any projects since its inception. As such, the Borrower does not have any Financial Data or Projects/Revenue to report for the applicable reporting periods. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. Please consult the Offering Circular, for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We does not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin. You, may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. TC2, LLC FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 11/23/2014 Value of Properties $0 Total Debt $0 Completed Projects 0 Revenue $0 Unsold Inventory 0 Aged Inventory N/A Gross Margin % N/A PRINCIPAL Tom Coffey GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix & Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 0 Average Project Revenue $0 On Time Repayment N/A Average Project Time 0 months Average Total Project Costs $0 THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-33 |

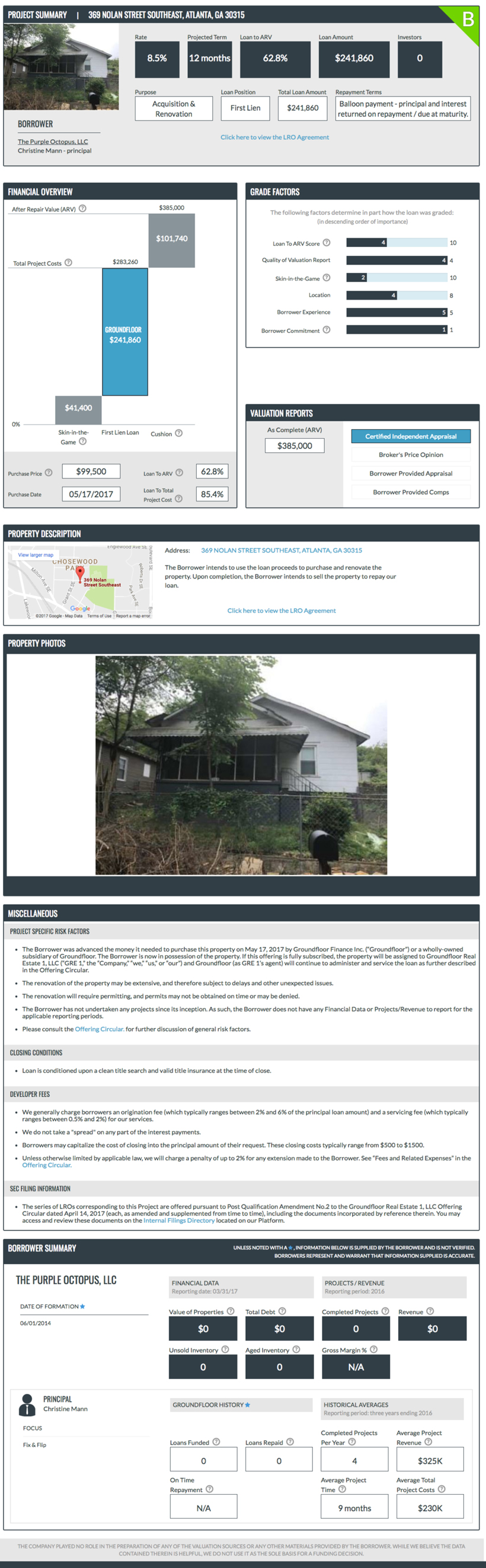

PROJECT SUMMARY | 369 NOLAN STREET SOUTHEAST, ATLANTA, GA 30315 B BORROWER The Purple Octopus, LLC Christine Mann - principal Rate Projected Term Loan to ARV Loan Amount Investors 8.5% 12 months 62.8% $241,860 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $241,860 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $385,000 Total Project Costs $283,260 $101,740 GROUNDFLOOR $241,860 $41,400 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $99,500 Purchase Date 05/17/2017 Loan To ARV 62.8% Loan To Total Project Cost 85.4% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 4 10 Quality of Valuation Report 4 4 Skin-in-the-Game 2 10 Location 4 8 Borrower Experience 5 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $385,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 369 NOLAN STREET SOUTHEAST, ATLANTA, GA 30315 The Borrower intends to use the loan proceeds to purchase and renovate the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to purchase this property on May 17, 2017 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this offering is fully subscribed, the property will be assigned to Groundfloor Real Estate 1, LLC (“GRE 1,” the “Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. The Borrower has not undertaken any projects since its inception. As such, the Borrower does not have any Financial Data or Projects/Revenue to report for the applicable reporting periods. Please consult the Offering Circular, for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We does not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin, You, may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. THE PURPLE OCTOPUS, LLC FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 06/01/2014 Value of Properties $0 Total Debt $0 Completed Projects 0 Revenue $0 Unsold Inventory 0 Aged Inventory 0 Gross Margin % N/A PRINCIPAL Christine Mann GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix & Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 4 Average Project Revenue $325K On Time Repayment N/A Average Project Time 9 months Average Total Project Costs $230K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-34 |

PROJECT SUMMARY | 822 ARGONNE AVENUE NORTHEAST, ATLANTA, GA 30308 B BORROWER WH Ventures Frank Iglesias - principal Rate Projected Term Loan to ARV Loan Amount Investors 11% 9 months 61.7% $493,640 0 Purpose Loan Position Total Loan Amount Repayment Terms Acquisition & Renovation First Lien $493,640 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $800,000 Total Project Costs $548,490 $251,510 GROUNDFLOOR $493,640 $54,850 0% Skin-in-the- Game First Lien Loan Cushion Purchase Price $400,000 Purchase Date 12/30/2016 Loan To ARV 61.7% Loan To Total Project Cost 90.0% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 4 10 Quality of Valuation Report 4 4 Skin-in-the-Game 2 10 Location 4 8 Borrower Experience 4 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $800,000 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 822 ARGONNE AVENUE NORTHEAST, ATLANTA, GA 30308 The Borrower intends to use the loan proceeds to purchase and renovate the property. Upon completion, the Borrower intends to sell the property to repay our loan. Click here to view the LRO Agreement PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The Borrower was advanced the money it needed to purchase this property on December 30, 2016 by Groundfloor Finance Inc. (“Groundfloor”) or a wholly-owned subsidiary of Groundfloor. The Borrower is now in possession of the property. If this is offering is fully subscribed, the property will be assigned to Groundfloor Real Estate 1, LLC (“GRE 1,” the “Company,” “we,” “us,” or “our”) and Groundfloor (as GRE 1’s agent) will continue to administer and service the loan as further described in the Offering Circular. The renovation of the property may be extensive, and therefore subject to delays and other unexpected issues. The renovation will require permitting, and permits may not be obtained on time or may be denied. The Borrower has not undertaken one project in the past, and has not sold it yet. As such, the Borrower’s average revenue, costs, and margins cannot be calculated Under our Grading Algorithm, the loasn was originally a B grade with an interest rate of 8.5%; however has elected to pay higher interest rate to make it more marketable and to help ensure that the Project receives funding. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES We generally charges borrowers an origination fee (which typically ranges between 2% and 6% of the principal loan amount) and a servicing fee (which typically ranges between 0.5% and 2%) for our services. We do not take a “spread” on any part of the interest payments. Borrowers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, we will charge a penalty of up to 2% for any extension made to the Borrower. See “Fees and Related Expenses” in the Offering Circular. SEC FILING INFORMATION The series of LROs corresponding to this Project are offered pursuant to Post Qualification Amendment No. 2 to the Groundfloor Real Estate 1, LLC Offering Circular dated April 14, 2017 (each, as amended and supplemented from time to time), including the documents incorporated by reference therin, You, may access and review these documents on the Internal Fillings Directory located on our Platform. BORROWER SUMMARY UNLESS NOTED WITH A ⋆ , INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWERS REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. WH VENTURES FINANCIAL DATA Reporting date: 03/31/17 PROJECTS / REVENUE Reporting period: 2016 DATE OF FORMATION ⋆ 04/01/2013 Value of Properties $400K Total Debt $0 Completed Projects 0 Revenue $0 Unsold Inventory 1 Aged Inventory 0 Gross Margin % N/A PRINCIPAL Frank Iglesias GROUNDFLOOR HISTORY ⋆ HISTORICAL AVERAGES Reporting period: three years ending 2016 FOCUS Fix & Flip Loans Funded 0 Loans Repaid 0 Completed Projects Per Year 7 Average Project Revenue $365K On Time Repayment N/A Average Project Time 3 months Average Total Project Costs $275K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION.

| PS-35 |

PART III — EXHIBITS

Exhibit Index

| Incorporated by Reference | ||||||||||||

| Exhibit Number |

Exhibit Description (hyperlink) |

Filed Herewith |

Form | File No. | Exhibit |

|

Filing Date | |||||

| 2.1 | Groundfloor Real Estate 1, LLC Articles of Organization | 1-A | 024-10671 | 2.1 | January 25, 2017 | |||||||

| 2.2 | Groundfloor Real Estate 1, LLC Operating Agreement | 1-A | 024-10671 | 2.2 | January 25, 2017 | |||||||

| 3.1 | Form of Investor Agreement | 1-A/A | 024-10671 | 3.1 | April 14, 2017 | |||||||

| 4.1 | Standard Form of LRO Agreement | 1-A/A | 024-10671 | 4.1 | April 14, 2017 | |||||||

| 6.1 | Form of Loan Agreement | 1-A/A | 024-10671 | 6.1 | April 14, 2017 | |||||||

| 6.2 | Form of Promissory Note | 1-A/A | 024-10671 | 6.2 | April 14, 2017 | |||||||

| 10.1 | Power of attorney | 1-A | 024-10671 | 10.1 | January 25, 2017 | |||||||

| 11.1 | Consent of Hughes Pitman & Gupton, LLP | 1-A/A | 024-10671 | 11.1 | April 14, 2017 | |||||||

| 11.2 | Consent of Robbins Ross Alloy Belinfante Littlefield LLC (included as part of Exhibit 12.1) | X | ||||||||||

| 12.1 | Opinion of Robbins Ross Alloy Belinfante Littlefield LLC | X | ||||||||||

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form 1-A and has duly caused this offering statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Atlanta, State of Georgia, on May 24, 2017.

| GROUNDFLOOR REAL ESTATE 1, LLC | ||

| By: | Groundfloor Finance Inc., its Manager | |

| By: | /s/ Nick Bhargava | |

| Name: | Nick Bhargava | |

| Title: | Executive Vice President, Secretary and Acting Chief Financial Officer | |

This offering statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature | Title | Date | ||

| * | President, Chief Executive Officer of Groundfloor Finance Inc. (Principal Executive Officer) | May 24, 2017 | ||

| Brian Dally | ||||

| /s/ Nick Bhargava | Executive Vice President, Secretary, and Acting Chief Financial Officer of Groundfloor Finance Inc. (Principal Financial Officer and Principal Accounting Officer) | May 24, 2017 | ||

| Nick Bhargava |

| *By: | /s/ Nick Bhargava | |

| Nick Bhargava | ||

| Attorney-in-fact | ||