FORM 1-A DISCLOSURE FORMAT

PART II

OFFERING CIRCULAR

Groundfloor Real Estate 1, LLC.

Fourteen Series of Limited Recourse Obligations

Totaling $1,812,530

Dated: February 14, 2020

This Post-Qualification Offering Circular Amendment No. 2 (this “PQA”), made on the Form 1-A disclosure format, amends the offering circular of Groundfloor Real Estate 1, LLC, dated November 15, 2019, as qualified on November 27, 2019, and as may be amended and supplemented from time to time (the “Offering Circular”), to add additional securities to be offered pursuant to the Offering Circular. This PQA relates to the offer and sale of up to an additional $1,812,530 in aggregate amount of Limited Recourse Obligations (the “LROs”) to be issued by Groundfloor Real Estate 1, LLC. (the “Company,” “we,” “us,” or “our”). Unless otherwise defined below, capitalized terms used herein shall have the same meanings as set forth in the Offering Circular. See “Incorporation by Reference of Offering Circular” below.

We make LROs available for investment on our web-based investment platform www.groundfloor.com (the “Groundfloor Platform”). Our principal offices and mailing address are located at 600 Peachtree Street, Suite 810, Atlanta, GA 30308. The phone number for these offices is (404) 850-9225.

We will issue the LROs in distinct series, each corresponding to a real estate development project (each, a “Project”) financed by a commercial loan from us (each, a “Loan”). The borrower for each Project is a legal entity (the “Borrower”) that owns the underlying property and has been organized by one or more individuals (each, a “Principal”) that own and operate the Borrower. This PQA relates to the offer and sale of each separate series of LROs corresponding to the Projects for which we extend Loans, as described below (the “Offering”).

The LROs will be unsecured special, limited obligations of the Company. The LROs are not listed on any national securities exchange or on the over-the-counter inter-dealer quotation system. There is no market for the LROs. Our obligation to make payments on a LRO is limited to an amount equal to each holder’s pro rata share of amount of payments, if any, actually received on the corresponding Loan, net of certain fees and expenses retained by us. See the sections titled “General Terms of the LROs,” “The LROs Covered by this Offering Circular,” and “Project Summaries” of the Offering Circular, as amended hereby, for the specific terms of the LROs covered by this PQA.

We do not guarantee payment of the LROs in the amount or on the time frame expected. The LROs are not obligations of the Borrowers or their Principals, and we do not guarantee payment on the corresponding Loans. We have the authority to modify the terms of the corresponding Loans which could, in certain circumstances, reduce (or eliminate) the expected return on your investment. See the “General Terms of the LROs—Administration, Service, Collection, and Enforcement of Loan Documents” section on page 106 of the Offering Circular.

The LROs are speculative securities. Investment in the LROs involves significant risk, and you may be required to hold your investment for an indefinite period of time. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 12 of the Offering Circular.

Generally, no sale may be made to you in this offering to the extent that the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

We will commence the offering of each series of LROs promptly after the date this PQA is qualified by posting on the Groundfloor Platform a separate landing page corresponding to each particular Loan and Project (each, a “Project Summary”). The offering of each series of LROs covered by this PQA will remain open until the earlier of (1) 30 days, unless extended, or (2) the date the offering of a particular series of LROs is fully subscribed with irrevocable funding commitments (the “Offering Period”); however, we may extend the Offering Period for a particular series of LROs in our sole discretion (with notice to potential investors) up to a maximum of 45 days. We will notify investors who have previously committed funds to purchase such series of LROs of any such extension by email and will post a notice of the extension on the corresponding Project Summary on the Groundfloor Platform.

This Offering is being conducted on a “best-efforts” basis, which means that our officers will use their commercially reasonable best efforts in an attempt to sell the LROs. Such officers will not receive any commission or any other remuneration for these sales. In offering the LROs on our behalf, the officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

| Offering price to the public |

Underwriting discounts and commissions |

Proceeds to issuer(1)(2) |

Proceeds to other persons |

|||||||||||

| Per Unit | $ | 10.00 | N/A | $ | 10.00 | N/A | ||||||||

| Total Minimum | $ | 0.00 | N/A | $ | 0.00 | N/A | ||||||||

| Total Maximum | $ | 1,812,530 | N/A | $ | 1,812,530 | N/A | ||||||||

(1) We estimate all expenses for this Offering to be approximately $1,000, which will not be financed with the proceeds of the Offering.

(2) Assumes no promotions or discounts applied to any offerings covered by this PQA.

Incorporation by Reference of Offering Circular

The Offering Circular, including this PQA, is part of an offering statement (File No. 024-11094) that we filed with the Securities and Exchange Commission. We hereby incorporate by reference into this PQA all of the information contained in the following:

| 1. | Part II of the Offering Circular, including the form of LRO Agreement beginning on page LRO-1 thereof to the extent not otherwise modified or replaced by offering circular supplement and/or post-qualification amendment. |

Note that any statement that we make in this PQA (or have made in the Offering Circular) will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement or post-qualification amendment.

The LROs Covered by the Offering Circular and Use of Proceeds

The following disclosure is added on pages 98 and 101 of the Offering Circular under the table included under “The LROs Covered by this Offering Circular” and “Use of Proceeds,” respectively:

The table below lists the additional Projects covered by this PQA. Each series of LROs is denominated by the corresponding Project’s name.

| Series of LROs/Project | Aggregate Purchase Amount/Loan Principal | ||

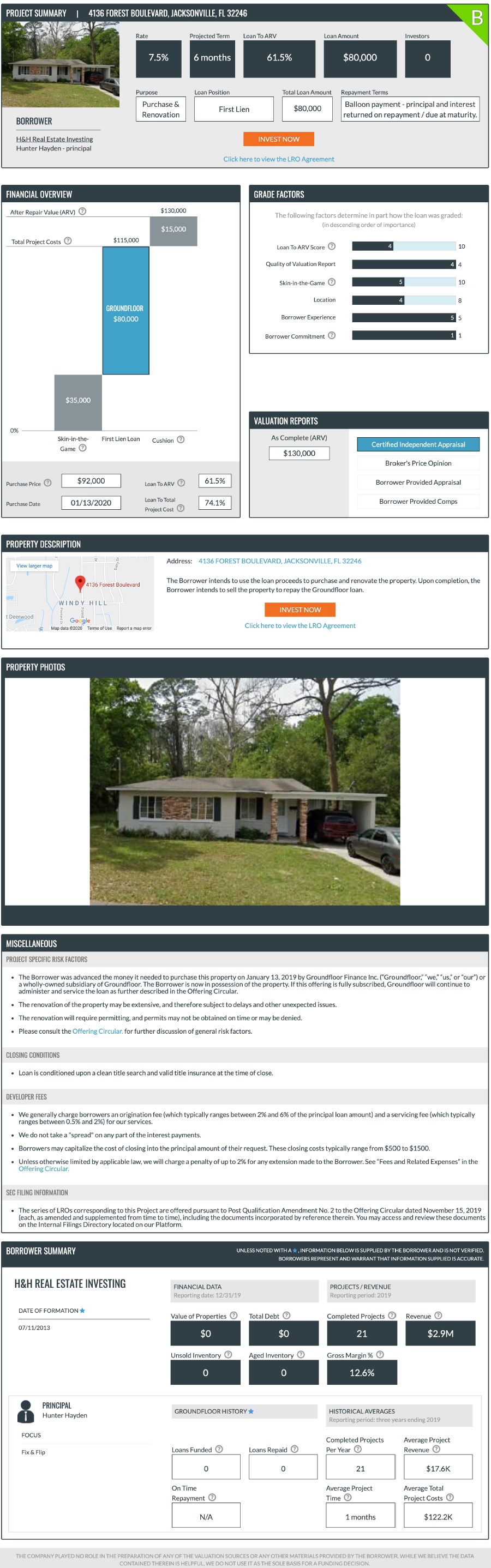

| 4136 FOREST BOULEVARD, JACKSONVILLE, FL 32246 | $ | 80,000 | |

| 509 TREMONT STREET, INTERLACHEN, FL 32148 | 82,440 | ||

| 17134 HUNTINGTON RD, DETROIT, MI 48219 | 89,320 | ||

| 9760 SOUTH AVALON AVENUE, CHICAGO, IL 60628 | 93,670 | ||

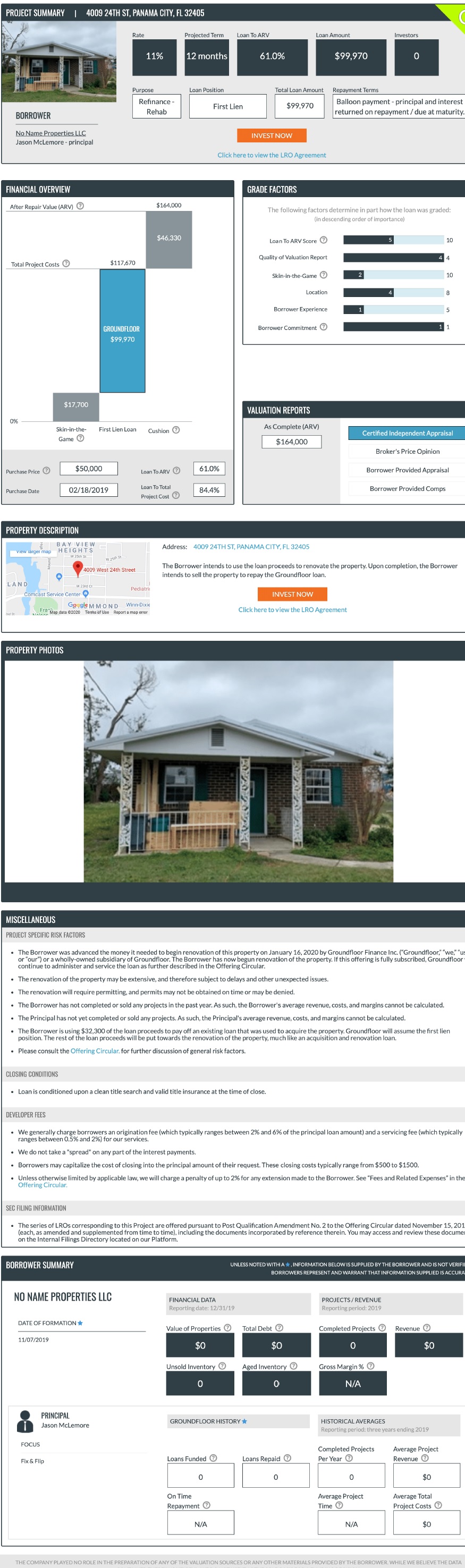

| 4009 24TH ST, PANAMA CITY, FL 32405 | 99,970 | ||

| 3450 TROUT RIVER BOULEVARD, JACKSONVILLE, FL 32208 | 100,800 | ||

| 3559 PEORIA ROAD, ORANGE PARK, FL 32065 | 109,200 | ||

| 296 CARIANN COVE TRAIL W, JACKSONVILLE, FL 32225 | 128,000 | ||

| 1310 & 1312 NORTH CHARLOTTE AVENUE, MONROE, NC 28110 | 143,480 | ||

| 75 OLIVER STREET NW, ATLANTA, GA 30314 | 146,890 | ||

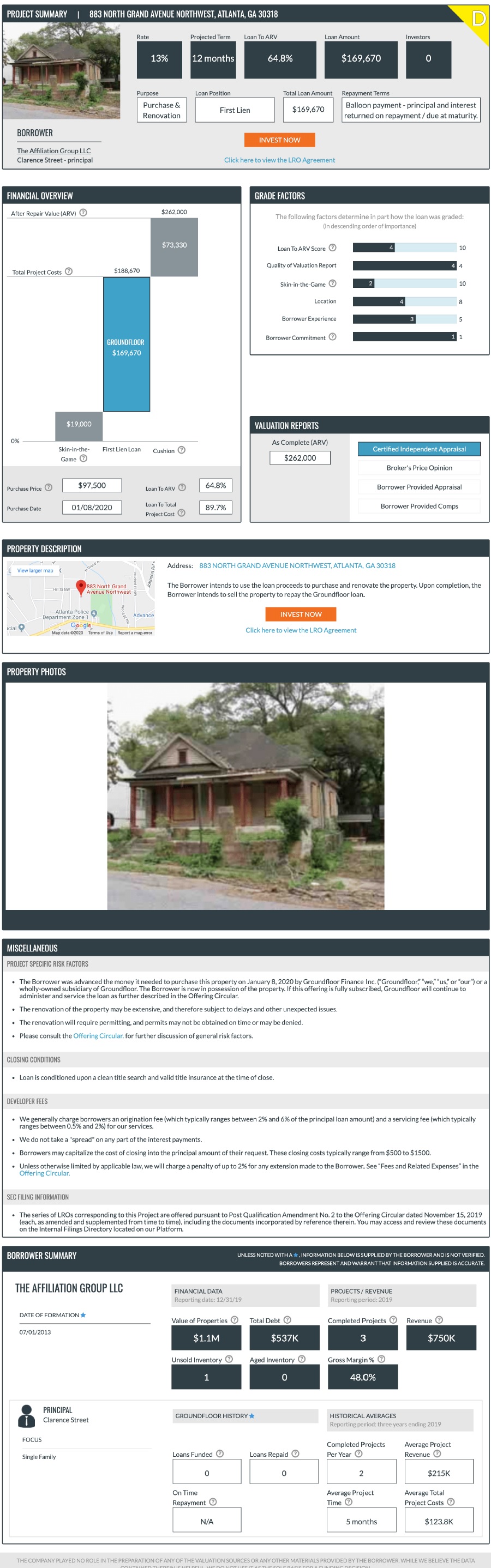

| 883 NORTH GRAND AVENUE NORTHWEST, ATLANTA, GA 30318 | 169,670 | ||

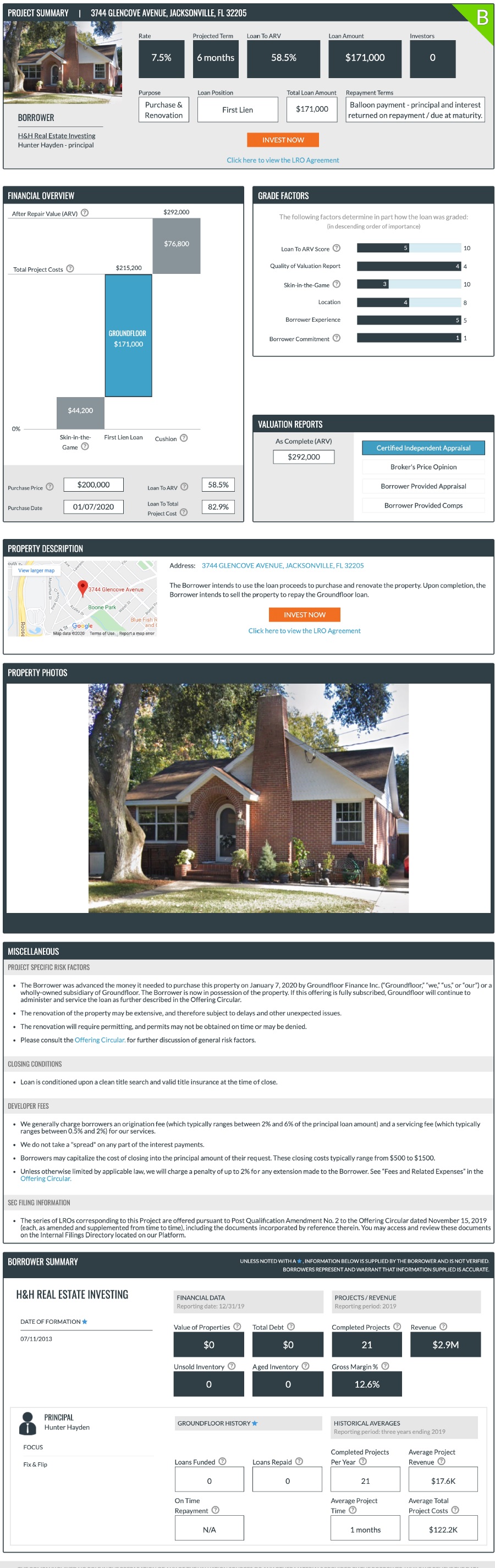

| 3744 GLENCOVE AVENUE, JACKSONVILLE, FL 32205 | 171,000 | ||

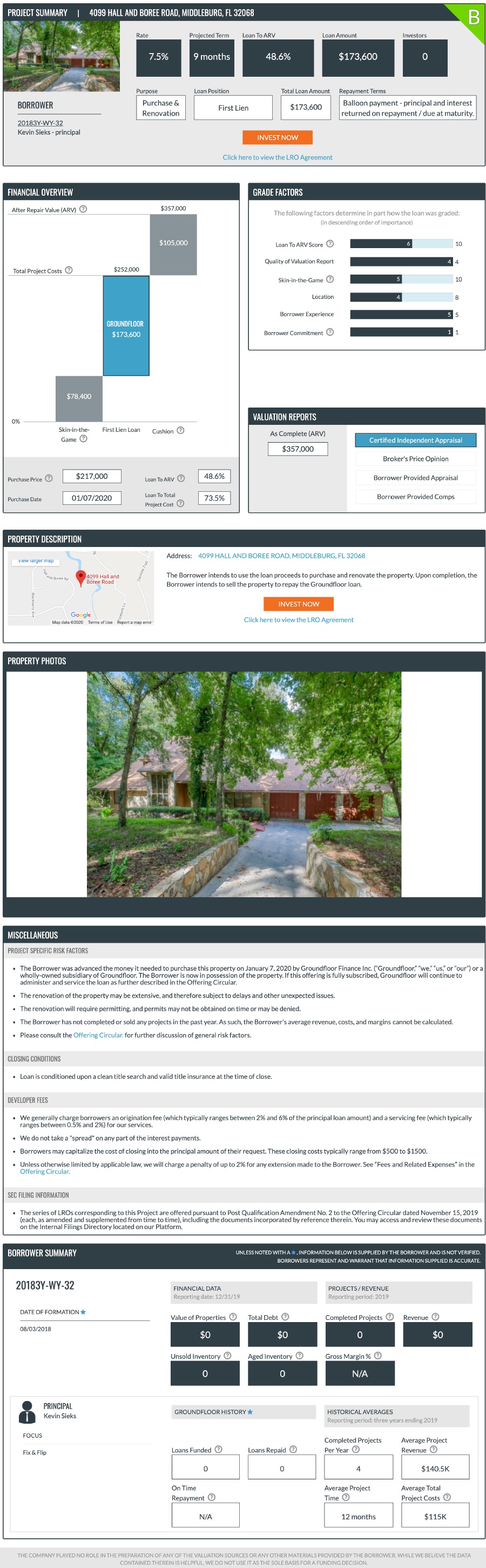

| 4099 HALL AND BOREE ROAD, MIDDLEBURG, FL 32068 | 173,600 | ||

| 3599 WOODBRIAR CIRCLE (4 UNITS), TUCKER, GA 30084 | 224,490 | ||

| Total | $ | 1,812,530 | |

Project Summaries

Each Project Summary attached below is included in the Offering Circular following page PS-21.

PROJECT SUMMARIES FOR PQA NO. 2

PS-21

PS-22

PS-23

PS-24

PS-25

PS-26

PS-27

PS-28

PS-29

PS-30

PS-31

PS-32

PS-33

* * *

Financial Statements

The following consolidated financial statements for the periods ended June 30, 2019, December 31, 2018 and December 31, 2017 and the notes thereto are added to the Offering Circular starting on page F-1:

GROUNDFLOOR REAL ESTATE 1, LLC

Condensed Financial Statements

June 30, 2019 and 2018

GROUNDFLOOR REAL ESTATE 1, LLC

Table of Contents

GROUNDFLOOR REAL ESTATE 1, LLC

Condensed Balance Sheets

| Unaudited | Audited | |||||||

| June 30, 2019 | December 31, 2018 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 20,100 | $ | 20,100 | ||||

| Loans to developers, net | 157,070 | 157,070 | ||||||

| Interest receivable on loans to developers | 9,903 | 9,903 | ||||||

| Other real estate owned | 23,569 | 23,569 | ||||||

| Total current assets | 210,642 | 210,642 | ||||||

| Total assets | $ | 210,642 | $ | 210,642 | ||||

| Liabilities and Member’s Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | - | $ | - | ||||

| Related party payable | - | - | ||||||

| Accrued interest on limited recourse obligations | 9,903 | 9,903 | ||||||

| Limited recourse obligations, net | 200,739 | 200,739 | ||||||

| Total current liabilities | 210,642 | 210,642 | ||||||

| Total liabilities | 210,642 | 210,642 | ||||||

| Member’s equity: | ||||||||

| Member’s capital | 100 | 100 | ||||||

| Member’s contribution receivable | (100 | ) | (100 | ) | ||||

| Retained earnings | - | - | ||||||

| Total member’s equity | - | - | ||||||

| Total liabilities and member’s equity | $ | 210,642 | $ | 210,642 | ||||

See accompanying notes to condensed financial statements

F-1

GROUNDFLOOR REAL ESTATE 1, LLC

Condensed Statements of Operations

| Unaudited | ||||||||

| Six Months Ended June 30, | ||||||||

| 2019 | 2018 | |||||||

| Loan servicing revenue | $ | - | $ | 5,200 | ||||

| Net interest income: | ||||||||

| Interest income | - | 95,899 | ||||||

| Interest expense | - | (95,899 | ) | |||||

| Net interest income | - | - | ||||||

| Net revenue | - | 5,200 | ||||||

| Cost of revenue | - | 3,250 | ||||||

| Gross profit | - | 1,950 | ||||||

| Operating expenses: | ||||||||

| General and administrative | - | 1,950 | ||||||

| Total operating expenses | - | 1,950 | ||||||

| Income from operations | - | - | ||||||

| Net income | $ | - | $ | - | ||||

See accompanying notes to condensed financial statements

F-2

GROUNDFLOOR REAL ESTATE 1, LLC

Condensed Statements of Member’s (Deficit) Equity

| Member’s | (Accumulated deficit) |

Total Member’s |

||||||||||||||

| Member’s | Contribution | Retained | (Deficit) | |||||||||||||

| Capital | Receivable | Earnings | Equity | |||||||||||||

| Member’s deficit as of December 31, 2017 (audited) | $ | 100 | $ | (100 | ) | $ | - | $ | - | |||||||

| Member contributions | - | - | - | - | ||||||||||||

| Net income | - | - | - | - | ||||||||||||

| Member’s equity as of December 31, 2018 (audited) | $ | 100 | $ | (100 | ) | $ | - | $ | - | |||||||

| Net income | - | - | - | - | ||||||||||||

| Member’s equity as of June 30, 2019 (unaudited) | $ | 100 | $ | (100 | ) | $ | - | $ | - | |||||||

See accompanying notes to condensed financial statements

F-3

GROUNDFLOOR REAL ESTATE 1, LLC

Condensed Statements of Cash Flows

| Unaudited | ||||||||

| Six Months Ended June 30, | ||||||||

| 2019 | 2018 | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | - | $ | - | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Interest receivable on loans to developers | - | (95,899 | ) | |||||

| Accounts payable and related party payable | - | - | ||||||

| Accrued interest on limited recourse obligations | - | 95,899 | ||||||

| Net cash provided by operating activities | - | - | ||||||

| Cash flows from investing activities | ||||||||

| Loan payments to developers | - | (299,644 | ) | |||||

| Repayments of loans from developers | - | 1,969,453 | ||||||

| Net cash provided by (used in) investing activities | - | 1,669,809 | ||||||

| Cash flows from financing activities | ||||||||

| Proceeds from limited recourse obligations | - | - | ||||||

| Repayments of limited recourse obligations | - | (2,001,109 | ) | |||||

| Issuance of membership interest | - | - | ||||||

| Net cash (used in) provided by financing activities | - | (2,001,109 | ) | |||||

| Net (decrease) increase in cash | - | (331,300 | ) | |||||

| Cash as of beginning of the period | 20,100 | 389,400 | ||||||

| Cash as of end of the period | $ | 20,100 | $ | 58,100 | ||||

| Supplemental disclosure of noncash investing and financing activities: | ||||||||

| Loans to developers transferred to other real estate owned | $ | - | $ | 23,569 | ||||

| Write-down of loans to developers and limited recourse obligations, net | - | 35,054 | ||||||

| Write-down of interest receivable on loans to developers and accrued interest on limited recourse obligations | - | 4,706 | ||||||

See accompanying notes to condensed financial statements

F-4

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

GROUNDFLOOR Real Estate 1, LLC (the “Company”), a Georgia limited liability company formed on December 16, 2016. The Company is a wholly-owned subsidiary of GROUNDFLOOR Finance Inc. (“GROUNDFLOOR”), a Georgia corporation.

Description of Business

GROUNDFLOOR has developed an online investment platform designed to crowdsource financing for real estate development projects, which GROUNDFLOOR utilizes to provide investment opportunities to investors. With this online investment platform, investors are able to choose between multiple real estate development investment opportunities, and developers of the projects are able to obtain financing. GROUNDFLOOR believes this method of financing real estate has many advantages including reduced project origination and financing costs, lower interest rates for real estate development financing, and attractive returns for investors. GROUNDFLOOR will identify which loans it seeks to originate, and will sell limited recourse obligations (“LROs”) which correspond to those loans. GROUNDFLOOR’s primary business is the sale of LROs and the Company’s primary purpose is the servicing of loans which correspond to those LROs.

Basis of Accounting and Liquidity

The Company’s condensed financial statements have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of business.

Operations since inception have consisted primarily of organizing the Company. The accompanying condensed financial statements have been prepared on a basis which assumes that the Company will continue as a going concern. The Company has earned limited revenue since its inception. The ultimate success of the Company is dependent on management’s ability to develop and market its products and services at levels sufficient to generate operating revenues in excess of expenses. Management evaluated the condition of the Company and has determined that until such sales levels can be achieved, management will need to secure additional capital to continue to fund product development and sales and marketing.

Management intends to fund operations by capital obtained from GROUNDFLOOR. However, there are no assurances that the Company can be successful in obtaining the additional capital or such financing will be on terms favorable or acceptable to the Company or GROUNDFLOOR. These matters raise substantial doubt about the ability of the Company to continue as a going concern.

The condensed financial statements do not include any adjustments that might result from the outcome of uncertainties described in the condensed financial statements. In addition, the condensed financial statements do not include any adjustments relating to the recoverability and classification of assets nor the amount and classification of liabilities that might result should the Company be unable to continue as a going concern.

Use of Estimates

The preparation of Condensed Financial Statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Condensed Financial Statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

Revenue primarily results from fees earned on the loans to the Developers (the “Loans”). Fees include “Loan servicing revenue” which are paid by the Developers.

F-5

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Loan Servicing Revenue

The loan servicing revenue is recognized by the Company, upon recovery, for costs incurred in servicing the Developer’s Loan, including managing payments to and from Developers and payments to Investors. The Company records loan servicing revenue as a component of revenue when collected.

Interest Income on Loans to Developers and Interest Expense on Limited Recourse Obligations

The Company recognizes “Interest income” on Loans and “Interest expense” on the corresponding LROs (if issued by GROUNDFLOOR Real Estate 1, LLC) using the accrual method based on the stated interest rate to the extent the Company believes it to be collectable. For the purposes of these Condensed Financial Statements, “Limited recourse obligations, net” refers to LROs. LROs are the Company’s currently registered securities.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. The Company had no cash equivalents as of December 31, 2018 and 2017. From time to time, the Company could maintain cash deposits in excess of federally insured limits. The Company believes credit risk related to its cash and cash equivalents to be minimal.

Loans to Developers and Limited Recourse Obligations

“Loans to developers, net” and the corresponding “Limited recourse obligations, net”, used to fund the Loans are originally recorded at outstanding principal. The interest rate associated with a Loan is the same as the interest rate associated with the corresponding LROs.

The Company’s obligation to pay principal and interest on an LRO is equal to the pro rata portion of the total principal and interest payments collected from the corresponding Loan. The Company obtains a lien against the property being financed and attempts reasonable collection efforts upon the default of a Loan. The Company’s lien may be senior or junior to the Borrower’s other financing obligations. The Company is not responsible for repaying “Limited recourse obligations, net” associated with uncollectable “Loans to developers, net”. Amounts collected related to a Loan default are returned to the Investors based on their pro rata portion of the corresponding LROs, if applicable, less collection costs incurred by the Company.

The Loan and corresponding LROs are recorded on the Company’s Condensed Balance Sheets to “Loans to developers, net” and “Limited recourse obligations, net”, respectively, once the Loan has closed. Loans are considered closed after the promissory note for that Loan has been signed and the security interest has been perfected.

Nonaccrual and Past Due Loans

“Interest income” is accrued on the outstanding principal balance. The accrual of interest on “Loans to developers, net” and corresponding “Limited recourse obligations, net” is discontinued when, in management’s opinion, the borrower may be unable to make payments as they become due, unless the Loan is well secured and in the process of collection. “Interest income” and “Interest expense” on the “Loans to developers, net” and the corresponding “Limited recourse obligations, net” are discontinued and placed on nonaccrual status at the time the Loan is 90 days delinquent unless the Loan is well secured and in process of collection. The “Loans to developers, net” and corresponding “Limited recourse obligations, net” are charged off to the extent principal or interest is deemed uncollectible. Non-accrual Loans and Loans past due 90 days still on accrual include both smaller balance homogeneous loans that are collectively evaluated for impairment and individually classified impaired loans. All interest accrued, but not collected for “Loans to developers, net” and “Limited recourse obligations, net” that are placed on nonaccrual or charged off, is reversed against “Interest income” and the corresponding LROs recorded “Interest expense”.

Interest income collected on nonaccrual Loans is applied against principal until the Loans are returned to accrual status. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

F-6

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Impaired Loans

Loans are considered impaired when, based on current information and events, it is probable the Company will be unable to collect all amounts due in accordance with the original contractual terms of the loan agreements. Impaired loans include Loans on nonaccrual status. When determining if the Company will be unable to collect all principal and interest payments due in accordance with the contractual terms of the loan agreement, the Company considers the borrower’s capacity to pay, which includes such factors as the borrower’s current financial position, an analysis of global cash flow sufficient to pay all debt obligations and an evaluation of secondary sources of repayment, such as collateral value and guarantor support. The Company individually assesses for impairment all nonaccrual Loans and all Loans in fundamental default. If a Loan is deemed impaired, a specific valuation allowance is allocated, if necessary, so that the Loan is reported net, at the present value of estimated future cash flows using the Loan’s existing rate or at the fair value of collateral if repayment is expected solely from the collateral. Interest payments on impaired loans are typically applied to principal unless collectability of the principal amount is reasonably assured, in which case interest is recognized on a cash basis.

Other Real Estate Owned

Foreclosed assets acquired through or in lieu of loan foreclosure are held for sale and are initially recorded at fair value less estimated cost to sell. Any write-down to fair value at the time of transfer to foreclosed assets is charged to the allowance for loan losses. Subsequent to foreclosure, valuations are periodically performed by management and the assets are carried at the lower of carrying amount or fair value less cost to sell. Costs of improvements are capitalized up to the fair value of the property, whereas costs relating to holding foreclosed assets and subsequent adjustments to the value are charged to operations.

Income Taxes

As a limited liability company, the Company is not a taxpaying entity for federal income tax purposes. Accordingly, its taxable income or losses are allocated to its member based on the provisions of the operating agreement and are included in the members’ income tax returns. The condensed financial statements, therefore, do not include a provision for income taxes. Similar provisions apply for state income tax purposes.

Management has assessed the effect of the guidance provided by U.S. GAAP on accounting for uncertainty in income taxes. Management has evaluated all tax positions that could have a significant effect on the condensed financial statements and determined the Company had no uncertain income tax positions at June 30, 2019 and December 31, 2018.

F-7

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Recent Accounting Pronouncements

The Company has evaluated the recent pronouncements issued since filing its annual audited Condensed Financial Statements for the year-ended December 31, 2018 and believes that none of them will have a material effect on the Company’s Condensed Financial Statements.

NOTE 2: LOANS TO DEVELOPERS, NET

The Company purchases notes that provide financing to borrowers for real estate-related loans. Real estate loans include loans for unoccupied single family or multifamily renovations costing between $20,000 and $2,000,000 over six months to a year.

The Company uses three performance states to better monitor the credit quality of outstanding loans. Outstanding loans are characterized as follows:

Current - This status indicates that no events of default have occurred, all payment obligations have been met or none are yet triggered.

Workout - This status indicates there has been one or more payment defaults on the Loan and the Company has negotiated a modification of the original terms that does not amount to a fundamental default.

Fundamental Default - This status indicates a Loan has defaulted and there is a chance the Company will not be able to collect 100% of the principal amount of the Loan by the extended payment date of the corresponding LROs. The Company has commenced a formal foreclosure process to secure the real estate property.

GROUNDFLOOR uses a proprietary grading algorithm to assign one of seven letter grades, from A to G, to each Loan. The letter grade generally reflects the overall risk of the Loan, with A indicating less risk and G indicating higher risk.

The following table presents the carrying amount of “Loans to developers, net” by letter grade and performance state as of June 30, 2019 and December 31, 2018, respectively:

| Current | Workout | Fundamental Default | Total | |||||||||||||

| Loan grades: | ||||||||||||||||

| A | $ | - | $ | - | $ | - | $ | - | ||||||||

| B | - | - | - | - | ||||||||||||

| C | - | - | 157,070 | 157,070 | ||||||||||||

| D | - | - | - | - | ||||||||||||

| E | - | - | - | - | ||||||||||||

| F | - | - | - | - | ||||||||||||

| G | - | - | - | - | ||||||||||||

| Carrying amount as of June 30, 2019 | $ | - | $ | - | $ | 157,070 | $ | 157,070 | ||||||||

| Current | Workout | Fundamental Default | Total | |||||||||||||

| Loan grades: | ||||||||||||||||

| A | $ | - | $ | - | $ | - | $ | - | ||||||||

| B | - | - | - | - | ||||||||||||

| C | - | - | 157,070 | 157,070 | ||||||||||||

| D | - | - | - | - | ||||||||||||

| E | - | - | - | - | ||||||||||||

| F | - | - | - | - | ||||||||||||

| G | - | - | - | - | ||||||||||||

| Carrying amount as of December 31, 2018 | $ | - | $ | - | $ | 157,070 | $ | 157,070 | ||||||||

F-8

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 2: LOANS TO DEVELOPERS, NET (continued)

Nonaccrual and Past Due Loans

A Loan is placed on nonaccrual status when, in management’s judgment, the collection of the interest income appears doubtful. “Interest receivable on loans to developers” that has been accrued and is subsequently determined to have doubtful collectability is charged to “Interest income” and the corresponding “Accrued interest on limited recourse obligations” that has been accrued and is subsequently determined to have doubtful collectability is charged to “Interest expense”. Interest income on Loans that are classified as nonaccrual is subsequently applied to principal until the Loans are returned to accrual status. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured. Past due Loans are loans whose principal or interest is past due 30 days or more. As of June 30, 2019, the Company placed Loans of $157,070 recorded to “Loans to developers, net” on nonaccrual status.

The following table presents an analysis of past due Loans as of June 30, 2019 and December 31, 2018:

| Carrying Amount | Allowance for Loan Losses | Total | ||||||||||

| Aging schedule: | ||||||||||||

| Current | $ | - | $ | - | $ | - | ||||||

| Less than 90 days past due | - | - | - | |||||||||

| More than 90 days past due | 157,070 | - | 157,070 | |||||||||

| Total as of June 30, 2019 | $ | 157,070 | $ | - | $ | 157,070 | ||||||

| Carrying Amount | Allowance for Loan Losses | Total | ||||||||||

| Aging schedule: | ||||||||||||

| Current | $ | - | $ | - | $ | - | ||||||

| Less than 90 days past due | - | - | - | |||||||||

| More than 90 days past due | 157,070 | - | 157,070 | |||||||||

| Total as of December 31, 2018 | $ | 157,070 | $ | - | $ | 157,070 | ||||||

Impaired Loans

The following is a summary of information pertaining to impaired loans as of June 30, 2019:

| Balance | ||||

| Nonaccrual loans | $ | 157,070 | ||

| Fundamental default not included above | - | |||

| Total impaired loans | 157,070 | |||

| Interest income recognized on impaired loans | $ | 9,903 | ||

The following table presents an analysis of information pertaining to impaired loans as of June 30, 2019:

| Balance | ||||

| Principal loan balance | $ | 157,070 | ||

| Recorded investment with no allowance | 157,070 | |||

| Recorded investment with allowance | - | |||

| Total recorded investment | $ | 157,070 | ||

| Related allowance | - | |||

| Average recorded investment | $ | 157,070 | ||

F-9

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 2: LOANS TO DEVELOPERS, NET (continued)

The following is a summary of information pertaining to impaired loans as of December 31, 2018:

| Balance | ||||

| Nonaccrual loans | $ | 157,070 | ||

| Fundamental default not included above | - | |||

| Total impaired loans | 157,070 | |||

| Interest income recognized on impaired loans | $ | 9,903 | ||

The following table presents an analysis of information pertaining to impaired loans as of December 31, 2018:

| Balance | ||||

| Principal loan balance | $ | 157,070 | ||

| Recorded investment with no allowance | 157,070 | |||

| Recorded investment with allowance | - | |||

| Total recorded investment | $ | 157,070 | ||

| Related allowance | - | |||

| Average recorded investment | $ | 157,070 | ||

F-10

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 2: LOANS TO DEVELOPERS, NET (continued)

Credit Quality Monitoring

The following table presents “Loans to developers, net” by performance state as of June 30, 2019 and December 31, 2018:

| Carrying Amount | Allowance for Loan Losses | Loans to Developers, Net | ||||||||||

| Performance states: | ||||||||||||

| Current | $ | - | $ | - | $ | - | ||||||

| Workout | - | - | - | |||||||||

| Fundamental default | 157,070 | - | 157,070 | |||||||||

| Total as of June 30, 2019 | $ | 157,070 | $ | - | $ | 157,070 | ||||||

| Carrying Amount | Allowance for Loan Losses | Loans to Developers, Net | ||||||||||

| Performance states: | ||||||||||||

| Current | $ | - | $ | - | $ | - | ||||||

| Workout | - | - | - | |||||||||

| Fundamental default | 157,070 | - | 157,070 | |||||||||

| Total as of December 31, 2018 | $ | 157,070 | $ | - | $ | 157,070 | ||||||

F-11

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Condensed Financial Statements

NOTE 3: OTHER REAL ESTATE OWNED

“Other real estate owned” in the Company’s Condensed Balance Sheet was $23,569 at June 30, 2019 and December 31, 2018.

NOTE 4: RELATED PARTY ARRANGEMENTS

GROUNDFLOOR Finance Inc.

GROUNDFLOOR will receive fees and compensation in connection with the Company’s Offering, and the servicing and sale of the Company’s LROs.

The Company will also reimburse GROUNDFLOOR for actual expenses incurred on behalf of the Company in connection with the servicing of a Loan, to the extent not reimbursed by the borrower. The Company will reimburse GROUNDFLOOR for out-of-pocket expenses paid to third parties in connection with providing services to the Company. This does not include GROUNDFLOOR’s overhead, employee costs borne by GROUNDFLOOR, utilities or technology costs. For the six months ended June 30, 2019 and 2018, GROUNDFLOOR incurred $0 and $5,100 of costs on the Company’s behalf, respectively. No such costs were due and payable to GROUNDFLOOR as of June 30, 2019 and December 31, 2018, respectively.

GROUNDFLOOR GA Holdings LLC

GROUNDFLOOR GA Holdings LLC may close and fund a Loan prior to it being acquired by the Company. The ability to warehouse Loans allows us the flexibility to deploy the offering proceeds as funds are raised. The Company then will acquire such LROs at a price equal to the fair market value of the Loan (including reimbursements for servicing fees and accrued interest, if any), so there is no mark-up (or mark-down) at the time of purchase.

NOTE 5: SUBSEQUENT EVENTS

Subsequent events were evaluated through September 27, 2019, the date the Condensed Financial Statements were available to be issued. On August 2, 2019, the Company recovered $23,569 in sale proceeds on real estate owned.

F-12

GROUNDFLOOR REAL ESTATE 1, LLC

Financial Statements

December 31, 2018 and 2017

GROUNDFLOOR REAL ESTATE 1, LLC

Table of Contents

To the Board of Directors

Groundfloor Real Estate 1, LLC

Atlanta, Georgia

We have audited the accompanying financial statements of Groundfloor Real Estate 1, LLC (the “Company”), which comprise the balance sheets as of December 31, 2018 and 2017, and the related statements of operations, member’s (deficit) equity, and cash flows for the years then ended, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

F-1

Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has not earned any significant revenues since its inception which result in substantial doubt about the ability of the Company to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans in regard to that matter also are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to that matter.

| Atlanta, | Georgia |

September 27, 2019

F-2

GROUNDFLOOR REAL ESTATE 1, LLC

Balance Sheets

| December 31, | ||||||||

| 2018 | 2017 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 20,100 | $ | 389,400 | ||||

| Loans to developers, net | 157,070 | 2,743,606 | ||||||

| Interest receivable on loans to developers | 9,903 | 148,218 | ||||||

| Other real estate owned | 23,569 | - | ||||||

| Total current assets | 210,642 | 3,281,224 | ||||||

| Total assets | $ | 210,642 | $ | 3,281,224 | ||||

| Liabilities and Member’s Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | - | $ | - | ||||

| Related party payable | - | - | ||||||

| Accrued interest on limited recourse obligations | 9,903 | 148,218 | ||||||

| Limited recourse obligations, net | 200,739 | 3,133,006 | ||||||

| Total current liabilities | 210,642 | 3,281,224 | ||||||

| Total liabilities | 210,642 | 3,281,224 | ||||||

| Member’s equity: | ||||||||

| Member’s capital | 100 | 100 | ||||||

| Member’s contribution receivable | (100 | ) | (100 | ) | ||||

| Retained earnings | - | - | ||||||

| Total member’s equity | - | - | ||||||

| Total liabilities and member’s equity | $ | 210,642 | $ | 3,281,224 | ||||

See accompanying notes to financial statements

F-3

GROUNDFLOOR REAL ESTATE 1, LLC

Statements of Operations

| Year Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Loan servicing revenue | $ | 5,200 | $ | 16,400 | ||||

| Net interest income: | ||||||||

| Interest income | 95,899 | 216,437 | ||||||

| Interest expense | (95,899 | ) | (216,437 | ) | ||||

| Net interest income | - | - | ||||||

| Net revenue | 5,200 | 16,400 | ||||||

| Cost of revenue | 3,250 | 10,250 | ||||||

| Gross profit | 1,950 | 6,150 | ||||||

| Operating expenses: | ||||||||

| General and administrative | 1,950 | 5,100 | ||||||

| Total operating expenses | 1,950 | 5,100 | ||||||

| Income from operations | - | 1,050 | ||||||

| Net income | $ | - | $ | 1,050 | ||||

See accompanying notes to financial statements

F-4

GROUNDFLOOR REAL ESTATE 1, LLC

Statements of Member’s (Deficit) Equity

Member’s Capital | Member’s Contribution Receivable | (Accumulated deficit) Retained Earnings | Total Member’s (Deficit) Equity | |||||||||||||

| Member’s deficit as of December 31, 2016 | $ | 100 | $ | (100 | ) | $ | (1,050 | ) | $ | (1,050 | ) | |||||

| Member contributions | - | - | - | - | ||||||||||||

| Net income | - | - | 1,050 | 1,050 | ||||||||||||

| Member’s equity as of December 31, 2017 | 100 | (100 | ) | - | - | |||||||||||

| Net income | - | - | - | - | ||||||||||||

| Member’s equity as of December 31, 2018 | $ | 100 | $ | (100 | ) | $ | - | $ | - | |||||||

See accompanying notes to financial statements

F-5

GROUNDFLOOR REAL ESTATE 1, LLC

Statements of Cash Flows

| Year Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | - | $ | 1,050 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Interest receivable on loans to developers | (95,899 | ) | (148,218 | ) | ||||

| Accounts payable and related party payable | - | (1,050 | ) | |||||

| Accrued interest on limited recourse obligations | 95,899 | 148,218 | ||||||

| Net cash provided by operating activities | - | - | ||||||

| Cash flows from investing activities | ||||||||

| Loan payments to developers | (299,644 | ) | (4,930,941 | ) | ||||

| Repayments of loans from developers | 3,057,065 | 2,187,335 | ||||||

| Net cash provided by (used in) investing activities | 2,757,421 | (2,743,606 | ) | |||||

| Cash flows from financing activities | ||||||||

| Proceeds from limited recourse obligations | - | 5,034,456 | ||||||

| Repayments of limited recourse obligations | (3,126,721 | ) | (1,901,450 | ) | ||||

| Issuance of membership interest | - | - | ||||||

| Net cash (used in) provided by financing activities | (3,126,721 | ) | 3,133,006 | |||||

| Net (decrease) increase in cash | (369,300 | ) | 389,400 | |||||

| Cash as of beginning of the period | 389,400 | - | ||||||

| Cash as of end of the period | $ | 20,100 | $ | 389,400 | ||||

| Supplemental disclosure of noncash investing and financing activities: | ||||||||

| Loans to developers transferred to other real estate owned | $ | 23,569 | $ | - | ||||

| Write-down of loans to developers and limited recourse obligations, net | 35,054 | - | ||||||

| Write-down of interest receivable on loans to developers and accrued interest on limited recourse obligations | 4,706 | - | ||||||

See accompanying notes to financial statements

F-6

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

GROUNDFLOOR Real Estate 1, LLC (the “Company”), a Georgia limited liability company formed on December 16, 2016. The Company is a wholly-owned subsidiary of GROUNDFLOOR Finance Inc. (“GROUNDFLOOR”), a Georgia corporation.

Description of Business

GROUNDFLOOR has developed an online investment platform designed to crowdsource financing for real estate development projects, which GROUNDFLOOR utilizes to provide investment opportunities to investors. With this online investment platform, investors are able to choose between multiple real estate development investment opportunities, and developers of the projects are able to obtain financing. GROUNDFLOOR believes this method of financing real estate has many advantages including reduced project origination and financing costs, lower interest rates for real estate development financing, and attractive returns for investors. GROUNDFLOOR will identify which loans it seeks to originate, and will sell limited recourse obligations (“LROs”) which correspond to those loans. GROUNDFLOOR’s primary business is the sale of LROs and the Company’s primary purpose is the servicing of loans which correspond to those LROs.

Basis of Accounting and Liquidity

The Company’s financial statements have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of business.

Operations since inception have consisted primarily of organizing the Company. The accompanying financial statements have been prepared on a basis which assumes that the Company will continue as a going concern. The Company has not earned limited revenue since its inception. The ultimate success of the Company is dependent on management’s ability to develop and market its products and services at levels sufficient to generate operating revenues in excess of expenses. Management evaluated the condition of the Company and has determined that until such sales levels can be achieved, management will need to secure additional capital to continue to fund product development and sales and marketing.

Management intends to fund operations by capital obtained from GROUNDFLOOR. However, there are no assurances that the Company can be successful in obtaining the additional capital or such financing will be on terms favorable or acceptable to the Company or GROUNDFLOOR. These matters raise substantial doubt about the ability of the Company to continue as a going concern.

The financial statements do not include any adjustments that might result from the outcome of uncertainties described in the financial statements. In addition, the financial statements do not include any adjustments relating to the recoverability and classification of assets nor the amount and classification of liabilities that might result should the Company be unable to continue as a going concern.

Use of Estimates

The preparation of Financial Statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Financial Statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

Revenue primarily results from fees earned on the loans to the Developers (the “Loans”). Fees include “Loan servicing revenue” which are paid by the Developers.

F-7

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Loan Servicing Revenue

The loan servicing revenue is recognized by the Company, upon recovery, for costs incurred in servicing the Developer’s Loan, including managing payments to and from Developers and payments to Investors. The Company records loan servicing revenue as a component of revenue when collected.

Interest Income on Loans to Developers and Interest Expense on Limited Recourse Obligations

The Company recognizes “Interest income” on Loans and “Interest expense” on the corresponding LROs (if issued by GROUNDFLOOR Real Estate 1, LLC) using the accrual method based on the stated interest rate to the extent the Company believes it to be collectable. For the purposes of these Financial Statements, “Limited recourse obligations, net” refers to LROs. LROs are the Company’s currently registered securities.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. The Company had no cash equivalents as of December 31, 2018 and 2017. From time to time, the Company could maintain cash deposits in excess of federally insured limits. The Company believes credit risk related to its cash and cash equivalents to be minimal.

Loans to Developers and Limited Recourse Obligations

“Loans to developers, net” and the corresponding “Limited recourse obligations, net”, used to fund the Loans are originally recorded at outstanding principal. The interest rate associated with a Loan is the same as the interest rate associated with the corresponding LROs.

The Company’s obligation to pay principal and interest on an LRO is equal to the pro rata portion of the total principal and interest payments collected from the corresponding Loan. The Company obtains a lien against the property being financed and attempts reasonable collection efforts upon the default of a Loan. The Company’s lien may be senior or junior to the Borrower’s other financing obligations. The Company is not responsible for repaying “Limited recourse obligations, net” associated with uncollectable “Loans to developers, net”. Amounts collected related to a Loan default are returned to the Investors based on their pro rata portion of the corresponding LROs, if applicable, less collection costs incurred by the Company.

The Loan and corresponding LROs are recorded on the Company’s Balance Sheets to “Loans to developers, net” and “Limited recourse obligations, net”, respectively, once the Loan has closed. Loans are considered closed after the promissory note for that Loan has been signed and the security interest has been perfected.

F-8

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Nonaccrual and Past Due Loans

“Interest income” is accrued on the outstanding principal balance. The accrual of interest on “Loans to developers, net” and corresponding “Limited recourse obligations, net” is discontinued when, in management’s opinion, the borrower may be unable to make payments as they become due, unless the Loan is well secured and in the process of collection. “Interest income” and “Interest expense” on the “Loans to developers, net” and the corresponding “Limited recourse obligations, net” are discontinued and placed on nonaccrual status at the time the Loan is 90 days delinquent unless the Loan is well secured and in process of collection. The “Loans to developers, net” and corresponding “Limited recourse obligations, net” are charged off to the extent principal or interest is deemed uncollectible. Non-accrual Loans and Loans past due 90 days still on accrual include both smaller balance homogeneous loans that are collectively evaluated for impairment and individually classified impaired loans. All interest accrued, but not collected for “Loans to developers, net” and “Limited recourse obligations, net” that are placed on nonaccrual or charged off, is reversed against “Interest income” and the corresponding LROs recorded “Interest expense”.

Interest income collected on nonaccrual Loans is applied against principal until the Loans are returned to accrual status. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

Impaired Loans

Loans are considered impaired when, based on current information and events, it is probable the Company will be unable to collect all amounts due in accordance with the original contractual terms of the loan agreements. Impaired loans include Loans on nonaccrual status. When determining if the Company will be unable to collect all principal and interest payments due in accordance with the contractual terms of the loan agreement, the Company considers the borrower’s capacity to pay, which includes such factors as the borrower’s current financial position, an analysis of global cash flow sufficient to pay all debt obligations and an evaluation of secondary sources of repayment, such as collateral value and guarantor support. The Company individually assesses for impairment all nonaccrual Loans and all Loans in fundamental default. If a Loan is deemed impaired, a specific valuation allowance is allocated, if necessary, so that the Loan is reported net, at the present value of estimated future cash flows using the Loan’s existing rate or at the fair value of collateral if repayment is expected solely from the collateral. Interest payments on impaired loans are typically applied to principal unless collectability of the principal amount is reasonably assured, in which case interest is recognized on a cash basis.

Allowance for Uncollectable Loans and Undeliverable Limited Recourse Obligations

Payments to holders of LROs, as applicable, depend on the payments received on the corresponding Loans; a reduction or increase of the expected future payments on Loans will decrease or increase the reserve for the associated LROs. The Company recognizes a reserve for uncollectable Loans and corresponding reserve for undeliverable LROs in an amount equal to the estimated probable losses net of recoveries. The allowance is based on management’s estimates and analysis of historical bad debt experience, existing economic conditions, current loan aging schedules, and expected future write-offs, as well as an assessment of specific, identifiable Developer accounts considered at risk or uncollectible. Expected losses and actual charge-offs on Loans are offset to the extent that the Loans are financed by LROs, as applicable, that effectively absorb the related Loan losses.

“Loans to developers, net” are presented net of a reserve for doubtful accounts of $0 and $0 as of December 31, 2018 and 2017, respectively. “Limited recourse obligations, net” are presented net of a reserve for doubtful accounts of $35,054 and $0 as of December 31, 2018 and 2017, respectively.

F-9

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (concluded)

Other Real Estate Owned

Foreclosed assets acquired through or in lieu of loan foreclosure are held for sale and are initially recorded at fair value less estimated cost to sell. Any write-down to fair value at the time of transfer to foreclosed assets is charged to the allowance for loan losses. Subsequent to foreclosure, valuations are periodically performed by management and the assets are carried at the lower of carrying amount or fair value less cost to sell. Costs of improvements are capitalized up to the fair value of the property, whereas costs relating to holding foreclosed assets and subsequent adjustments to the value are charged to operations.

Income Taxes

As a limited liability company, the Company is not a taxpaying entity for federal income tax purposes. Accordingly, its taxable income or losses are allocated to its member based on the provisions of the operating agreement and are included in the members’ income tax returns. The financial statements, therefore, do not include a provision for income taxes. Similar provisions apply for state income tax purposes.

Management has assessed the effect of the guidance provided by U.S. GAAP on accounting for uncertainty in income taxes. Management has evaluated all tax positions that could have a significant effect on the financial statements and determined the Company had no uncertain income tax positions at December 31, 2018 and 2017.

NOTE 2: RECENT ACCOUNTING PRONOUNCEMENTS

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”), which will be effective January 1, 2019, for the Company. The Company had the option to early adopt the ASU as of January 1, 2017. The guidance clarifies that revenue from contracts with customers should be recognized in a manner that depicts both the likelihood of payment and the timing of the related transfer of goods or performance of services. In March 2016, the FASB issued an amendment ASU 2016-12, Revenue from Contracts with Customers: Principal versus Agent Considerations (Reporting Revenue Gross versus Net) to the new revenue recognition guidance clarifying how to determine if an entity is a principal or agent in a transaction. In April 2016 ASU 2016-10, Revenue from Contracts with Customers: Identifying Performance Obligations and Licensing and May 2016 ASU 2016-12, Revenue from Contracts with Customers: Scope Improvements and Practical Expedients, the FASB further amended the guidance to include performance obligation identification, licensing implementation, collectability assessment and other presentation and transition clarifications. The effective date and transition requirements for the amendments is the same as for ASU 2014-09. The Company is currently evaluating the impact of this accounting standard update on its Financial Statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). ASU 2016-13 significantly changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. The standard will replace the current incurred loss approach with an expected loss model, referred to as the current expected credit loss (“CECL”) model. The new standard will apply to financial assets subject to credit losses and measured at amortized cost and certain off-balance-sheet credit exposures, which include, but are not limited to, loans, leases, held-to-maturity securities, loan commitments and financial guarantees. ASU 2016-13 simplifies the accounting for purchased credit-impaired debt securities and loans and expands the disclosure requirements regarding an entity’s assumptions, models, and methods for estimating the allowance for loan and lease losses. In addition, entities will need to disclose the amortized cost balance for each class of financial asset by credit quality indicator, disaggregated by the year of origination. ASU 2016-13 is effective for interim and annual reporting periods beginning after December 15, 2020. Early adoption is permitted for interim and annual reporting periods beginning after December 15, 2018. Upon adoption, ASU 2016-13 provides for a modified retrospective transition by means of a cumulative-effect adjustment to equity as of the beginning of the period in which the guidance is effective. The Company is currently evaluating the impact this standard will have on the Company’s Financial Statements.

F-10

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 3: LOANS TO DEVELOPERS, NET

The Company purchases notes that provide financing to borrowers for real estate-related loans. Real estate loans include loans for unoccupied single family or multifamily renovations costing between $20,000 and $2,000,000 over six months to a year.

The Company uses three performance states to better monitor the credit quality of outstanding loans. Outstanding loans are characterized as follows:

Current - This status indicates that no events of default have occurred, all payment obligations have been met or none are yet triggered.

Workout - This status indicates there has been one or more payment defaults on the Loan and the Company has negotiated a modification of the original terms that does not amount to a fundamental default.

Fundamental Default - This status indicates a Loan has defaulted and there is a chance the Company will not be able to collect 100% of the principal amount of the Loan by the extended payment date of the corresponding LROs. The Company has commenced a formal foreclosure process to secure the real estate property.

GROUNDFLOOR uses a proprietary grading algorithm to assign one of seven letter grades, from A to G, to each Project. The letter grade generally reflects the overall risk of the Loan, with A indicating less risk and G indicating higher risk. The following table presents the carrying amount of “Loans to developers, net” by letter grade and performance state as of December 31, 2018 and 2017, respectively:

| Fundamental | ||||||||||||||||

| Current | Workout | Default | Total | |||||||||||||

| Loan grades: | ||||||||||||||||

| A | $ | - | $ | - | $ | - | $ | - | ||||||||

| B | - | - | - | - | ||||||||||||

| C | - | - | 157,070 | 157,070 | ||||||||||||

| D | - | - | - | - | ||||||||||||

| E | - | - | - | - | ||||||||||||

| F | - | - | - | - | ||||||||||||

| G | - | - | - | - | ||||||||||||

| Carrying amount as of December 31, 2018 | $ | - | $ | - | $ | 157,070 | $ | 157,070 | ||||||||

| Fundamental | ||||||||||||||||

| Current | Workout | Default | Total | |||||||||||||

| Loan grades: | ||||||||||||||||

| A | $ | 57,335 | $ | - | $ | - | $ | 57,335 | ||||||||

| B | 1,957,175 | - | - | 1,957,175 | ||||||||||||

| C | 729,096 | - | - | 729,096 | ||||||||||||

| D | - | - | - | - | ||||||||||||

| E | - | - | - | - | ||||||||||||

| F | - | - | - | - | ||||||||||||

| G | - | - | - | - | ||||||||||||

| Carrying amount as of December 31, 2017 | $ | 2,743,606 | $ | - | $ | - | $ | 2,743,606 | ||||||||

F-11

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 3: LOANS TO DEVELOPERS, NET (continued)

Nonaccrual and Past Due Loans

A Loan is placed on nonaccrual status when, in management’s judgment, the collection of the interest income appears doubtful. “Interest receivable on loans to developers” that has been accrued and is subsequently determined to have doubtful collectability is charged to “Interest income” and the corresponding “Accrued interest on limited recourse obligations” that has been accrued and is subsequently determined to have doubtful collectability is charged to “Interest expense”. Interest income on Loans that are classified as nonaccrual is subsequently applied to principal until the Loans are returned to accrual status. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured. Past due Loans are loans whose principal or interest is past due 30 days or more. As of December 31, 2018, the Company placed Loans of $157,070 recorded to “Loans to developers, net” on nonaccrual status.

The following table presents an analysis of past due Loans as of December 31, 2018 and 2017:

| Carrying | Allowance for | |||||||||||

| Amount | Loan Losses | Total | ||||||||||

| Aging schedule: | ||||||||||||

| Current | $ | - | $ | - | $ | - | ||||||

| Less than 90 days past due | - | - | - | |||||||||

| More than 90 days past due | 157,070 | - | 157,070 | |||||||||

| Total as of December 31, 2018 | $ | 157,070 | $ | - | $ | 157,070 | ||||||

| Carrying | Allowance for | |||||||||||

| Amount | Loan Losses | Total | ||||||||||

| Aging schedule: | ||||||||||||

| Current | $ | 2,743,606 | $ | - | $ | 2,743,606 | ||||||

| Less than 90 days past due | - | - | - | |||||||||

| More than 90 days past due | - | - | - | |||||||||

| Total as of December 31, 2017 | $ | 2,743,606 | $ | - | $ | 2,743,606 | ||||||

Impaired Loans

The following is a summary of information pertaining to impaired loans as of December 31, 2018:

| Balance | ||||

| Nonaccrual loans | $ | 157,070 | ||

| Fundamental default not included above | - | |||

| Total impaired loans | $ | 157,070 | ||

| Interest income recognized on impaired loans | $ | 9,903 | ||

The following table presents an analysis of information pertaining to impaired loans as of December 31, 2018:

| Balance | ||||

| Principal loan balance | $ | 157,070 | ||

| Recorded investment with no allowance | 157,070 | |||

| Recorded investment with allowance | - | |||

| Total recorded investment | $ | 157,070 | ||

| Related allowance | - | |||

| Average recorded investment | $ | 157,070 | ||

F-12

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 3: LOANS TO DEVELOPERS, NET (continued)

The following is a summary of information pertaining to impaired loans as of December 31, 2017:

| Balance | ||||

| Nonaccrual loans | $ | - | ||

| Fundamental default not included above | - | |||

| Total impaired loans | $ | - | ||

| Interest income recognized on impaired loans | $ | - |

The following table presents an analysis of information pertaining to impaired loans as of December 31, 2017:

| Balance | ||||

| Principal loan balance | $ | - | ||

| Recorded investment with no allowance | - | |||

| Recorded investment with allowance | - | |||

| Total recorded investment | $ | - | ||

| Related allowance | - | |||

| Average recorded investment | $ | - |

F-13

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 3: LOANS TO DEVELOPERS, NET (continued)

Credit Quality Monitoring

The following table presents “Loans to developers, net” by performance state as of December 31, 2018 and 2017:

| Carrying Amount |

Allowance for Loan Losses |

Loans to Developers, Net |

||||||||||

| Performance states: | ||||||||||||

| Current | $ | - | $ | - | $ | - | ||||||

| Workout | - | - | - | |||||||||

| Fundamental default | 157,070 | - | 157,070 | |||||||||

| Total as of December 31, 2018 | $ | 157,070 | $ | - | $ | 157,070 | ||||||

| Carrying Amount |

Allowance for Loan Losses |

Loans to Developers, Net |

||||||||||

| Performance states: | ||||||||||||

| Current | $ | 2,743,606 | $ | - | $ | 2,743,606 | ||||||

| Workout | - | - | - | |||||||||

| Fundamental default | - | - | - | |||||||||

| Total as of December 31, 2017 | $ | 2,743,606 | $ | - | $ | 2,743,606 | ||||||

F-14

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 3: LOANS TO DEVELOPERS, NET (concluded)

Allowance for Loan Losses

The following table details activity in the allowance for loan losses for the years ended December 31, 2018 and 2017:

| Balance | ||||

| Balance, December 31, 2017 | $ | - | ||

| Allowance for loan loss | - | |||

| Loans charged off | - | |||

| Outstanding as of December 31, 2018 | $ | - | ||

| Period-end amount allocated to: | ||||

| Loans individually evaluated for impairment | $ | - | ||

| Loans collectively evaluated for impairment | - | |||

| Balance, December 31, 2018 | $ | - | ||

| Loans: | ||||

| Individually evaluated for impairment | $ | 157,070 | ||

| Collectively evaluated for impairment | - | |||

| Balance, December 31, 2018 | $ | 157,070 | ||

| Balance | ||||

| Balance, December 31, 2016 | $ | - | ||

| Allowance for loan loss | - | |||

| Loans charged off | - | |||

| Outstanding as of December 31, 2017 | $ | - | ||

| Period-end amount allocated to: | ||||

| Loans individually evaluated for impairment | $ | - | ||

| Loans collectively evaluated for impairment | - | |||

| Balance, December 31, 2017 | $ | - | ||

| Loans: | ||||

| Individually evaluated for impairment | $ | - | ||

| Collectively evaluated for impairment | - | |||

| Balance, December 31, 2017 | $ | - |

F-15

GROUNDFLOOR REAL ESTATE 1, LLC

Notes to Financial Statements

NOTE 4: OTHER REAL ESTATE OWNED

“Other real estate owned” in the Company’s Balance Sheet was $23,569 and $0 at December 31, 2018 and 2017, respectively. During the year ended December 31, 2018 the Company transferred $58,623 from “Loans to developers, net” to “Other real estate owned”. Other real estate owned met the held for sale criteria and have been recorded at the lower of carrying amount or fair value less cost to sell. There was no impact to the Company’s Statements of Operation from this transfer. The Company recorded a decrease of $35,054 to “Loans to developers, net” and an offsetting decrease to “Limited recourse obligations, net”.

NOTE 5: RELATED PARTY ARRANGEMENTS

GROUNDFLOOR Finance Inc.

GROUNDFLOOR will receive fees and compensation in connection with the Company’s Offering, and the servicing and sale of the Company’s LROs.

The Company will also reimburse GROUNDFLOOR for actual expenses incurred on behalf of the Company in connection with the servicing of a Loan, to the extent not reimbursed by the borrower. The Company will reimburse GROUNDFLOOR for out-of-pocket expenses paid to third parties in connection with providing services to the Company. This does not include GROUNDFLOOR’s overhead, employee costs borne by GROUNDFLOOR, utilities or technology costs. For the year ended December 31, 2018 and 2017, GROUNDFLOOR incurred $5,100 and $1,950 of costs on the Company’s behalf, respectively. No such costs were due and payable to GROUNDFLOOR as of December 31, 2018 and 2017, respectively.

GROUNDFLOOR GA Holdings LLC

GROUNDFLOOR GA Holdings LLC may close and fund a Loan prior to it being acquired by the Company. The ability to warehouse Loans allows us the flexibility to deploy the offering proceeds as funds are raised. The Company then will acquire such LROs at a price equal to the fair market value of the Loan (including reimbursements for servicing fees and accrued interest, if any), so there is no mark-up (or mark-down) at the time of purchase.

NOTE 6: SUBSEQUENT EVENTS

Subsequent events were evaluated through September 27, 2019, the date the Financial Statements were available to be issued. On August 2, 2019, the Company recovered $23,569 in sale proceeds on real estate owned.

F-16

GROUNDFLOOR FINANCE INC.

AND SUBSIDIARIES

Condensed Consolidated Financial Statements

June 30, 2019 and 2018

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Table of Contents

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

| Unaudited | Audited | |||||||

| June 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 2,047,549 | $ | 1,069,392 | ||||

| Loans to developers, net | 54,201,956 | 38,761,717 | ||||||

| Interest receivable on loans to developers | 2,752,228 | 1,821,073 | ||||||

| Other current assets | 85,604 | 484,391 | ||||||

| Total current assets | 59,087,337 | 42,136,573 | ||||||

| Property, equipment, software, website, and intangible assets, net | 847,081 | 813,104 | ||||||

| Other assets | 42,604 | 63,906 | ||||||

| Total assets | $ | 59,977,022 | $ | 43,013,583 | ||||

| Liabilities and Stockholders’ Deficit | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 1,714,598 | $ | 2,493,158 | ||||

| Accrued interest on limited recourse obligations | 2,064,367 | 1,372,474 | ||||||

| Limited recourse obligations, net | 44,126,772 | 31,719,205 | ||||||

| Revolving credit facility | 5,281,294 | 5,493,605 | ||||||

| Convertible notes | 645,000 | 1,800,000 | ||||||

| Short-term notes payable | 6,086,814 | 2,925,082 | ||||||

| Total current liabilities | 59,918,845 | 45,803,524 | ||||||

| Other liabilities | 139,693 | 60,765 | ||||||

| Total liabilities | 60,058,538 | 45,864,289 | ||||||

| Stockholders’ deficit: | ||||||||

| Common stock, no par, 5,000,000 shares authorized, 2,091,153 and 1,732,585 issued and outstanding | 10,830,464 | 6,125,264 | ||||||

| Series A convertible preferred stock, no par, 747,385 shares designated, 747,373 shares issued and outstanding (liquidation preference of $4,999,925) | 4,962,435 | 4,962,435 | ||||||

| Series seed convertible preferred stock, no par, 568,796 shares designated, issued and outstanding (liquidation preference of $2,960,583) | 2,609,091 | 2,609,091 | ||||||

| Additional paid-in capital | 1,259,821 | 1,083,572 | ||||||

| Accumulated deficit | (19,742,767 | ) | (17,630,508 | ) | ||||

| Stock subscription receivable | (560 | ) | (560 | ) | ||||

| Total stockholders’ deficit | (81,516 | ) | (2,850,706 | ) | ||||

| Total liabilities and stockholders’ deficit | $ | 59,977,022 | $ | 43,013,583 | ||||

See accompanying notes to condensed consolidated financial statements

F-1

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

| Unaudited | ||||||||

| Six Months Ended June 30, | ||||||||

| 2019 | 2018 | |||||||

| Non-interest revenue: | ||||||||

| Origination fees | $ | 1,216,642 | $ | 415,741 | ||||

| Loan servicing revenue | 752,162 | 416,892 | ||||||

| Total non-interest revenue | 1,968,804 | 832,633 | ||||||

| Net interest income: | ||||||||

| Interest income | 2,854,020 | 1,229,386 | ||||||

| Interest expense | (2,245,280 | ) | (1,008,149 | ) | ||||

| Net interest income | 608,740 | 221,237 | ||||||

| Net revenue | 2,577,544 | 1,053,870 | ||||||

| Cost of revenue | (328,706 | ) | (158,378 | ) | ||||

| Gross profit | 2,248,838 | 895,492 | ||||||

| Operating expenses: | ||||||||

| General and administrative | 940,396 | 971,678 | ||||||

| Sales and customer support | 1,264,973 | 1,012,967 | ||||||

| Development | 356,836 | 259,812 | ||||||

| Regulatory | 189,068 | 168,154 | ||||||

| Marketing and promotions | 591,799 | 916,830 | ||||||

| Total operating expenses | 3,343,072 | 3,329,441 | ||||||

| Loss from operations | (1,094,234 | ) | (2,433,949 | ) | ||||

| Interest expense | 1,018,025 | 411,413 | ||||||

| Net loss | $ | (2,112,259 | ) | $ | (2,845,362 | ) | ||

See accompanying notes to condensed consolidated financial statements

F-2

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Stockholder’s Deficit

| Series A | Series Seed | |||||||||||||||||||||||||||||||||||||||

| Convertible | Convertible | Additional | Stock | Total | ||||||||||||||||||||||||||||||||||||

| Preferred Stock | Preferred Stock | Common Stock | Paid-in | Accumulated | Subscription | Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Receivable | Deficit | |||||||||||||||||||||||||||||||

| Stockholders’ deficit as of December 31, 2017 (audited) | 747,373 | $ | 4,962,435 | 568,796 | $ | 2,609,091 | 1,136,406 | $ | 56,834 | $ | 677,929 | $ | (11,529,853 | ) | $ | (560 | ) | $ | (3,224,124 | ) | ||||||||||||||||||||

| Shares issued in the 2018 Common Stock Offering, net of offering costs | - | - | - | - | 468,764 | 4,562,634 | - | - | - | 4,562,634 | ||||||||||||||||||||||||||||||

| Shares issued in a private placement | - | - | - | - | 125,000 | 1,500,000 | - | - | - | 1,500,000 | ||||||||||||||||||||||||||||||

| Exercise of stock options | - | - | - | - | 2,415 | 5,796 | - | - | - | 5,796 | ||||||||||||||||||||||||||||||

| Share-based compensation expense and warrants | - | - | - | - | - | - | 405,643 | - | - | 405,643 | ||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (6,100,655 | ) | - | (6,100,655 | ) | ||||||||||||||||||||||||||||

| Stockholders’ deficit as of December 31, 2018 (audited) | 747,373 | $ | 4,962,435 | 568,796 | $ | 2,609,091 | 1,732,585 | $ | 6,125,264 | $ | 1,083,572 | $ | (17,630,508 | ) | $ | (560 | ) | $ | (2,850,706 | ) | ||||||||||||||||||||

| Shares issued in the 2019 Common Stock Offering, net of offering costs | - | - | - | - | 213,345 | 3,412,567 | - | - | - | 4,701,460 | ||||||||||||||||||||||||||||||

| Shares issued in the 2018 Common Stock Offering, net of offering costs | - | - | - | - | 143,223 | 1,288,893 | - | - | - | 4,562,634 | ||||||||||||||||||||||||||||||

| Exercise of stock options | - | - | - | - | 2,000 | 3,740 | - | - | - | 3,740 | ||||||||||||||||||||||||||||||

| Share-based compensation expense and warrants | - | - | - | - | - | - | 176,249 | - | - | 176,249 | ||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (2,112,259 | ) | - | (2,112,259 | ) | ||||||||||||||||||||||||||||

| Stockholders’ deficit as of June 30, 2019 (unaudited) | 747,373 | $ | 4,962,435 | 568,796 | $ | 2,609,091 | 2,091,153 | $ | 10,830,464 | $ | 1,259,821 | $ | (19,742,767 | ) | $ | (560 | ) | $ | (81,516 | ) | ||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements

F-3

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

| Unaudited | ||||||||

| Six Months Ended June 30, | ||||||||

| 2019 | 2018 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (2,112,259 | ) | $ | (2,845,362 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 254,269 | 154,311 | ||||||

| Share-based compensation | 74,634 | 152,400 | ||||||

| Noncash interest expense | 97,587 | 8,518 | ||||||

| Loss (gain) on sale of real estate owned | - | 20,585 | ||||||

| Origination of loans held for sale | (6,478,955 | ) | - | |||||

| Proceeds from sales of loans held for sale | 6,478,955 | - | ||||||

| Conversion of beneficial interests | 198,723 | 181,347 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Other current assets | 36,634 | (58,939 | ) | |||||

| Interest receivable on loans to developers | (2,769,347 | ) | (1,047,570 | ) | ||||