As filed with the Securities and Exchange Commission on November 20, 2017

PART II - INFORMATION REQUIRED IN OFFERING CIRCULAR

Preliminary Offering Circular dated November 20, 2017

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

OFFERING CIRCULAR

NY RESIDENTIAL REIT, LLC

Sponsored by

Commencement Capital LLC

Maximum Offering of $50,000,000 in Common Shares

Minimum Offering of $1,000,000 in Common Shares

We are a newly organized Delaware limited liability company that has been formed for the purpose of acquiring residential properties in the borough of Manhattan in New York City. We have not identified any acquisition targets, so we are considered a “blind pool.” We expect to use substantially all the net proceeds from this offering to invest in or acquire residential properties in Manhattan including condominium and cooperative, or co-op, interests, single-family homes or multifamily properties, which we collectively refer to as our targeted investments.

We are externally managed by Commencement NY LLC, or our Manager. We intend to elect to qualify and be taxed as a real estate investment trust for U.S. federal income tax purposes, or REIT, commencing with the taxable year ending December 31, 2018.

We are offering up to $50,000,000 in our common shares, which represent certain of our limited liability company interests in our company, to the public at $10.00 per share. The minimum investment in our common shares for initial purchases is 100 shares, or $1,000. We expect to offer common shares in this offering until we raise the maximum amount being offered, unless terminated by our Manager at an earlier time.

We have engaged W.R. Hambrecht + Co., LLC, or the Underwriter, a registered broker-dealer and a member of the Financial Industry Regulatory Authority, or FINRA, to offer our common shares to prospective investors on a best-efforts basis, and the Underwriter will have the right to engage such other FINRA member firms as it determines to assist in the offering, or Selling Group Members. As compensation, our Underwriter will receive a fee equal to up to 6.0% of gross offering proceeds, which it may reallow in part to Selling Group Members. As a best-efforts offering, there is no commitment on the part of the Underwriter or anyone else to purchase any of our common shares.

All funds paid by subscribers in the offering will be deposited in an escrow account with Prime Trust, LLC, or Prime Trust, as escrow agent. Prime Trust has not investigated the desirability or advisability of investment in our common shares or approved, endorsed or passed upon the merits of purchasing them.

| i |

Prior to the completion of the offering, we intend to apply either (a) to list our common shares on the NASDAQ Capital Market, or the NASDAQ, or the NYSE MKT, or the NYSE, or (b) for the quotation of our common shares with OTC Markets Group, or the OTC, on one of the OTCQX, OTCQB or OTC Pink. If we apply to list our common shares on the NASDAQ or the NYSE, there is no guarantee that we will meet the listing standards of either organization. If we choose to apply for quotation of our common shares with the OTC, our common shares may be quoted only to the extent that there is interest by broker-dealers in acting as a market maker.

Investing in our common shares is speculative and involves substantial risks. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 15 to read about the more significant risks you should consider before buying our common shares. These risks include the following:

| ● | We depend on our Manager to select our investments and conduct our operations. We will pay fees and expenses to our Manager and its affiliates that were not determined on an arm’s length basis, and therefore we do not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss. | |

| ● | We have no operating history, and as of the date of this offering circular, our total assets consist of $1,000 in cash. There can be no assurance that we will achieve our investment objectives. | |

| ● | This is a “blind pool” offering because we have not identified any investments to acquire with the net proceeds of this offering. You will not be able to evaluate our investments prior to purchasing shares. | |

| ● | Our Manager’s executive officers are also officers, managers and/or key professionals of our sponsor and its affiliates. As a result, they will face conflicts of interest, including time constraints, allocation of investment opportunities and significant conflicts created by our Manager’s compensation arrangements with us and other affiliates of our sponsor. | |

| ● | Our sponsor may sponsor other companies that compete with us, and our sponsor does not have an exclusive management arrangement with us; however, our sponsor has adopted a policy for allocating investments between different companies that it sponsors with similar investment strategies. | |

| ● | Our advisory board members are incentivized to recommend their own services (or actions that otherwise may financially benefit them) and to maximize their estimation of our need for such services or actions which otherwise benefit them, and as a result, they face conflicts of interest. | |

| ● | This offering is being made pursuant to recently adopted rules and regulations under the newly revised Regulation A rules (commonly referred to as “Regulation A+”) of the Securities Act of 1933, as amended, or the Securities Act. The legal and compliance requirements of these rules and regulations, including ongoing reporting requirements related thereto, are relatively untested. | |

| ● | If we raise substantially less than the maximum offering amount, we may not be able to acquire a diverse portfolio of investments and the value of your shares may vary more widely with the performance of specific assets. We may commence operations with as little as $1,000,000 (including proceeds from common shares purchased by affiliates of our Manager). | |

| ● | If we internalize our management functions, your interest in us could be diluted and we could incur other significant costs associated with being self-managed. | |

| ● | We may change our investment guidelines without shareholder consent, which could result in investments that are different from those described in this offering circular. | |

| ● | We do not expect to declare any distributions until the proceeds from our public offering are invested and generating operating cash flow. While our goal is to pay distributions from our cash flow from operations, we may use other sources to fund distributions, including offering proceeds, borrowings or sales of assets. We have not established a limit on the amount of proceeds we may use to fund distributions. If we pay distributions from sources other than our cash flow from operations, we will have less funds available for investments and your overall return may be reduced. | |

| ● |

Our common shares will not be listed at the time of purchase and you will have no liquidity until such time as our common shares either (a) become listed on the NASDAQ or NYSE, or (b) become quoted with the OTC. There is no guarantee that our common shares will become so listed or quoted. |

|

| ● | Real estate investments are subject to general downturns in the industry as well as downturns in specific geographic areas. We cannot predict what the occupancy level will be in a particular building or that any tenant will remain solvent. We also cannot predict the future value of our properties. Accordingly, we cannot guarantee that you will receive cash distributions or appreciation of your investment. | |

| ● | If we reimburse our Manager for organization and offering expenses in an amount that is substantial in relation to the net proceeds raised, our company may incur an immediate loss and the value of your common shares will be immediately and substantially reduced. |

| ii |

The United States Securities and Exchange Commission, or the SEC, does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the SEC; however, the SEC has not made an independent determination that the securities offered are exempt from registration.

The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment in our common shares.

| Per Share | Total Minimum | Total Maximum | ||||||||||

| Public Offering Price | $ | 10.00 | $ | 1,000,000 | (1) | $ | 50,000,000 | |||||

| Underwriting Fee(2) | $ | 0.60 | $ | 60,000 | $ | 3,000,000 | ||||||

| Total Proceeds to Us (Before Expenses)(3) | $ | 9.40 | $ | 940,000 | (1) | $ | 47,000,000 | |||||

(1) This is a “best efforts” offering. We will not start operations or draw down on investors’ funds and admit investors as shareholders until we have raised at least $1,000,000 in this offering (including proceeds from common shares purchased by affiliates of our Manager.) Until the minimum threshold is met, investors’ funds will remain in an escrow account at Prime Trust. If we do not raise $1,000,000 by May 1, 2018, subject to our right to extend by up to 60 days with the consent of the Underwriter, we will cancel the offering and the escrow agent will promptly return to each subscriber all funds provided by such subscriber without interest or deduction. See “Underwriting and Plan of Distribution.”

(2) The Underwriter will receive a fee, or the Underwriting Fee, equal to 6.0% of gross offering proceeds from the sale of the common shares, except that the Underwriter will receive (i) a reduced fee of 2.0% of the gross offering proceeds from the sale of the common shares to investors sourced or introduced to us or the Underwriter by our sponsor or by any third party that is not a broker-dealer and is engaged by our sponsor or us, and (ii) no fee from gross offering proceeds from the sale of the common shares to our sponsor or any affiliate of our sponsor. The Underwriter may reallow part of the Underwriting Fee, up to 4.0% of the offering price per offered share sold in the offering, to Selling Group Members. We have also agreed to reimburse certain offering expenses to the Underwriter.

(3) The table assumes the payment of the maximum Underwriting Fee of 6.0% of gross offering proceeds. We will reimburse our Manager for organization and offering costs, which will be capped at $500,000. As of the date of this offering circular, our Manager has incurred approximately $100,000 of expenses in connection with our organization and the offering. See “Management Compensation” for a description of additional fees and expenses that we will pay our Manager. In addition to the Underwriting Fee and expense reimbursements, we anticipate that the Underwriter will have the right to acquire warrants to purchase common shares equal to 5% of the aggregate common shares sold in this offering, or the Underwriter Warrants. The Underwriter Warrants have an exercise price of $12.00 per share.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This offering circular follows the Form S-11 disclosure format.

The date of this offering circular is November , 2017

| iii |

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as the offering circular. You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with different information. This offering circular may only be used where it is legal to sell these securities. You should not assume that the information contained in this offering circular is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

This offering circular is part of an offering statement that we filed with the SEC using a continuous offering process. Periodically, as we make material investments or have other material developments, we will provide an offering circular supplement that may add, update or change information contained in this offering circular. Any statement that we make in this offering circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this offering circular. You should read this offering circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Additional Information” below for more details.

The offering statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov, or on our website at www.wrhambrecht.com/ipos/ny-residential-reit-regulation-a-ipo. The contents of our website (other than the offering statement, this offering circular and the appendices and exhibits thereto) are not incorporated by reference in or otherwise a part of this offering circular.

Our sponsor and the Underwriter will be permitted to make a determination that the purchasers of shares in this offering are “qualified purchasers” in reliance on the information and representations provided by the shareholder regarding the shareholder’s financial situation. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This offering circular does not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of, interests in any jurisdiction in which such offer, solicitation or sale is not authorized.

| iv |

Table of Contents

| v |

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our common shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our common shares offered hereby are offered and sold only to “qualified purchasers” or at a time when our common shares are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our common shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

| 1 |

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

The following questions and answers about this offering highlight material information regarding us and this offering that is not otherwise addressed in the “Offering Summary” section of this offering circular. You should read this entire offering circular, including the section entitled “Risk Factors,” before deciding to purchase our common shares.

Q:

What is NY Residential REIT, LLC?

A:

We were recently formed as a Delaware limited liability company to invest in, acquire and manage a portfolio of residential real estate properties in Manhattan, a borough of New York City. We expect to use substantially all the net proceeds from this offering to structure a portfolio of residential properties including condominium and co-op interests, single-family homes or multi-family properties, which we refer to collectively as our targeted investments. The use of the terms “NY Residential REIT,” the “company,” “we,” “us” or “our” in this offering circular refer to NY Residential REIT, LLC unless the context indicates otherwise.

Q:

Who will choose which investments you make?

A:

We are externally managed by Commencement NY LLC, a New York limited liability company, or our Manager. Our Manager is wholly owned by Commencement Capital LLC, a New York limited liability company, or our sponsor. Our Manager will make all of our investment decisions.

Q:

What competitive advantages do we achieve through our relationship with our sponsor?

A:

Our Manager will utilize the personnel and resources of our sponsor to select our investments and manage our day-to-day operations, and will thereby benefit from the following:

- Experienced Management — Our Manager, through its relationship with our sponsor, retains highly experienced real estate professionals, including Jesse Stein, its Chief Executive Officer, and Jonathan Morris, its President. These executive officers provide stability in the management of our business and allow us to benefit from the knowledge and industry contacts they have gained through numerous real estate cycles. Please see “Management —Executive Officers of our Manager” for biographical information regarding these individuals.

- Advisory Board — Our sponsor has formed an advisory board to our company consisting of three experienced residential real estate or REIT professionals. Each member of our advisory board is an employee of our company, will be available to us on an as-needed basis for purposes of assisting us with strategic and operational questions and will be expected to attend periodic meetings of our advisory board, either in person or by conference call. We expect that the members of our advisory board will provide value to our company by sourcing investment and strategic opportunities, providing insight on the New York City real estate market, or by providing services to the company that they individually specialize in.

- Market Knowledge and Industry Relationships — Through their active and broad participation in the real estate capital markets, our sponsor and advisory board benefit from market information that enables them to identify attractive real estate investment opportunities and to make informed decisions with regard to the relative valuation of financial assets and capital allocation. We believe that our sponsor’s and advisory board’s extensive industry relationships with a wide variety of real estate owners and operators, brokers and other intermediaries will provide us with a competitive advantage in sourcing attractive investment opportunities to meet our investment objectives.

Q:

What kind of offering is this?

A:

We are offering a maximum of $50,000,000 in our common shares to the public on a “best efforts” basis at $10.00 per share. This offering is being conducted as a continuous offering pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities may happen sporadically over the term of the offering. Further, the acceptance of subscriptions may be briefly paused at times to allow us to effectively and accurately process and settle subscriptions that have been received.

Q:

What is the purchase price for your common shares?

A:

Our Manager set our offering price at $10.00 per share, an arbitrary number chosen for ease of calculations.

Q:

What fees and expenses will you pay to our Manager?

A:

We will pay our Manager acquisition fees, asset management fees, and exit fees. We will reimburse our Manager for the organization and offering expenses that our Manager has paid or will pay on our behalf, up to a maximum of $500,000. We will also reimburse our Manager for out-of-pocket expenses in connection with our operations and the acquisition of our investments and for out-of-pocket expenses paid to third parties in connection with providing services to us. This does not include our Manager’s overhead, employee costs borne by our Manager, utilities or technology costs. The payment by us of fees and expenses will reduce the cash available for investment and distribution and will directly impact the market value of our common shares. See “Management Compensation” for more details regarding the fees that will be paid to our Manager.

| 2 |

Q:

Will you use leverage?

A:

Yes, we intend to use leverage. Our targeted portfolio-wide leverage, after we have acquired a substantial portfolio, is between 30-60% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. During the period when we are acquiring our initial portfolio, we may employ greater leverage on individual assets (that will also result in greater leverage of the interim portfolio) in order to quickly build a diversified portfolio of assets. Please see “Investment Objectives and Strategy” for more details.

Q:

How will you structure the ownership and operation of your assets?

A:

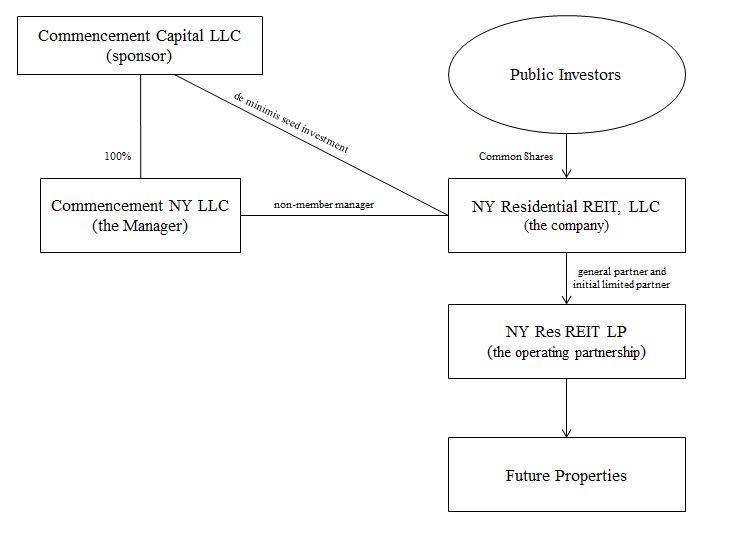

We plan to own substantially all of our assets and conduct our operations through NY Res REIT LP, a Delaware limited partnership, which we refer to as our operating partnership. Because we plan to conduct substantially all our operations through the operating partnership, we are considered an UPREIT. UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” Using an UPREIT structure may give us an advantage in acquiring properties from persons who may not otherwise sell their properties because of certain unfavorable U.S. federal income tax consequences.

Q:

How often will I receive distributions?

A:

We do not expect to declare any distributions until some of the proceeds from our public offering are invested and generating operating cash flow. Once we begin to make distributions, we expect that our Manager will declare and make them on a quarterly basis, or less frequently as determined by our Manager, in arrears. Any distributions we make will be at the discretion of our Manager, and will be based on, among other factors, our present and reasonably projected future cash flow. We expect that our Manager will set the rate of distributions at a level that will be reasonably consistent and sustainable over time. See “Description of Our Common Shares — Distributions.”

Q:

What will be the source of your distributions?

A:

While our goal is to pay distributions from our cash flow from operations, we may use other sources to fund distributions. Until the proceeds from our public offering are invested and generating operating cash flow, some or all of our distributions may be paid from other sources, including the net proceeds of this offering, cash advances by our Manager, cash resulting from a waiver of fees or reimbursements due to our Manager, borrowings in anticipation of future operating cash flow and the issuance of additional securities. Use of some of or all these sources may reduce the amount of capital we invest in assets and negatively impact the return on your investment and the value of your investment. We have not established a limit on the amount of proceeds we may use to fund distributions. We can provide no assurances that future cash flow will support payment of distributions or maintaining distributions at any particular level or at all.

Q:

Will the distributions I receive be taxable as ordinary income?

A:

Unless your investment is held in a qualified tax-exempt account or we designate certain distributions as capital gain dividends, distributions that you receive generally will be taxed as ordinary income to the extent they are from current or accumulated earnings and profits. The portion of your distribution in excess of current and accumulated earnings and profits is considered a return of capital for U.S. federal income tax purposes and will reduce the tax basis of your investment, rather than result in current tax, until your basis is reduced to zero. Return of capital distributions made to you in excess of your tax basis in our common shares will be treated as sales proceeds from the sale of our common shares for U.S. federal income tax purposes. Distributions we designate as capital gain dividends will generally be taxable at long-term capital gains rates for U.S. federal income tax purposes. However, because each investor’s tax considerations are different, we recommend that you consult with your tax advisor. You also should review the section of this offering circular entitled “U.S. Federal Income Tax Considerations,” including for a discussion of the special rules applicable to distributions in redemption of shares and liquidating distributions.

| 3 |

Q:

Are there any risks involved in buying your shares?

A:

Investing in our common shares involves a high degree of risk. If we are unable to effectively manage the impact of these risks, we may not meet our investment objectives, and therefore, you should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” for a description of the risks relating to this offering and an investment in our shares.

Q:

How does a “best efforts” offering work?

A:

When common shares are offered to the public on a “best efforts” basis, the Underwriter is only required to use its best efforts to sell our common shares. Neither the Underwriter nor any other party has a firm commitment or obligation to purchase any of our common shares.

Q:

What fees and expenses will be paid to the Underwriter from offering proceeds?

A:

The Underwriter will receive the Underwriting Fee equal to 6.0% of gross offering proceeds from the sale of the common shares, except that the Underwriter will receive (i) a reduced fee of 2.0% of the gross offering proceeds from the sale of the common shares to investors sourced or introduced to us or the Underwriter by our sponsor or by any third party that is not a broker-dealer and is engaged by our sponsor or us, and (ii) no fee from gross offering proceeds from the sale of the common shares to our sponsor or any affiliate of our sponsor. The Underwriter may reallow part of the Underwriting Fee, up to 4.0% of the offering price per offered share sold in the offering, to Selling Group Members. We have also agreed to reimburse certain offering expenses to our Underwriter. In addition to the Underwriting Fee and expense reimbursements, we anticipate that the Underwriter will have the right to acquire Underwriter Warrants to purchase common shares equal to 5% of the aggregate common shares sold in this offering at an exercise price of $12.00 per share.

Q:

Who can buy shares?

A:

Generally, you may purchase shares if you are a “qualified purchaser” (as defined in Regulation A under the Securities Act). “Qualified purchasers” include:

● “accredited investors” under Rule 501(a) of Regulation D; and

● all other investors so long as their investment in our common shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons).

Net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles. We reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A. Please refer to the section above entitled “State Law Exemption and Purchase Restrictions” for more information.

Q:

How do I buy shares?

A:

You will need to fill out a subscription agreement like the one included as an exhibit to the offering statement of which this offering circular forms a part for a certain investment amount and pay for the shares at the time you subscribe.

Q:

Is there any minimum investment required?

A:

Yes. You must initially purchase at least 100 shares in this offering, or $1,000. There is no minimum investment requirement on additional purchases after you have purchased a minimum of 100 shares.

Q:

May I make an investment through my IRA or other tax-deferred retirement account?

A:

Yes. You may make an investment through your IRA or other tax-deferred retirement account. In making these investment decisions, you should consider, at a minimum, (1) whether the investment is in accordance with the documents and instruments governing your IRA, plan or other retirement account, (2) whether the investment would constitute a prohibited transaction under applicable law, (3) whether the investment satisfies the fiduciary requirements associated with your IRA, plan or other retirement account (including whether your fiduciary can satisfy the Independent Fiduciary requirements discussed under “ERISA Considerations – New Fiduciary Rules by the Department of Labor”), (4) whether the investment will generate unrelated business taxable income, or UBTI, to your IRA, plan or other retirement account, and (5) whether there is sufficient liquidity for such investment under your IRA, plan or other retirement account. You should note that an investment in our common shares will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code of 1986, as amended, or the Code.

| 4 |

Q:

Is there any minimum initial offering amount required to be sold?

A:

Yes. We will not start operations until we have raised at least $1,000,000 in this offering (including proceeds from common shares purchased by affiliates of our Manager). Until the minimum threshold is met, investors’ funds will remain in an escrow account at Prime Trust and investors will not be admitted as shareholders. The funds will be drawn by us only after the $1,000,000 minimum threshold has been met.

Q:

What happens to my subscription if you don’t raise at least the $1,000,000 minimum threshold in this offering?

A:

If the minimum threshold is not met by May 1, 2018, subject to our right to extend by up to 60 days with the consent of the Underwriter, we will cancel the offering and the escrow agent will promptly return to each subscriber all funds provided by such subscriber without interest or deduction.

Q:

What will you do with the proceeds from your offering?

A:

We expect to use substantially all the net proceeds from this offering (after paying or reimbursing organization and offering expenses) to invest in and manage a portfolio of residential real estate properties in Manhattan. We expect that any expenses or fees payable to our Manager for its services in connection with managing our daily affairs, including but not limited to, the selection and acquisition of our investments, will be paid from cash flow from operations. If such fees and expenses are not paid from cash flow (or waived) they will reduce the cash available for investment and distribution and will directly impact the market value of our common shares. See “Management Compensation” for more details regarding the fees that will be paid to our Manager and its affiliates.

We may not be able to promptly invest the net proceeds of this offering in our targeted assets. In the interim, we may invest in short-term, highly liquid or other authorized investments. Such short-term investments will not earn as high of a return as we expect to earn on our real estate-related investments.

Q:

How long will this offering last?

A:

We currently expect that this offering will remain open for investors until we raise the maximum amount being offered, unless terminated by us at an earlier time. We reserve the right to terminate this offering for any reason at any time.

Q:

Will I be notified of how my investment is doing?

A:

Yes, we will provide you with periodic updates on the performance of your investment in us, including:

● an annual report;

● a semi-annual report;

● current event reports for specified material events within four business days of their occurrence;

● supplements to the offering circular, if we have material information to disclose to you; and

● other reports that we may file or furnish to the SEC from time to time.

We will provide this information to you by posting such information on the SEC’s website at www.sec.gov, on our website at www.nyresidentialreit.com, via e-mail, or, upon your consent, via U.S. mail.

Q:

When will I get my detailed tax information?

A:

Your Form 1099-DIV tax information, if required, will be provided by January 31 of the year following each taxable year.

| 5 |

Q:

Who can help answer my questions about the offering?

A:

If you have more questions about the offering, or if you would like additional copies of this offering circular, you should contact us by email at IR@commencementcapital.com or by mail at:

NY

Residential REIT, LLC

c/o Commencement Capital LLC

555 Madison Avenue, 6th Floor

New York, NY 10022

Attn: Investor Relations

| 6 |

This offering summary highlights material information regarding our business and this offering that is not otherwise addressed in the “Questions and Answers About this Offering” section of this offering circular. Because it is a summary, it may not contain all the information that is important to you. To understand this offering fully, you should read the entire offering circular carefully, including the “Risk Factors” section, before making a decision to invest in our common shares. Except where the context suggests otherwise, the terms “company,” “we,” “us” and “our” refer to NY Residential REIT, LLC, a Delaware limited liability company; references to “our operating partnership” refer to NY Res REIT LP, the subsidiary through which we will conduct substantially all our business; references to “our Manager” refer to Commencement NY LLC, a subsidiary of Commencement Capital LLC. Unless indicated otherwise, the information in this offering circular assumes the common shares to be sold in this offering are to be sold at an initial public offering price of $10.00 per common share.

NY Residential REIT, LLC

NY Residential REIT, LLC is a newly organized Delaware limited liability company formed to invest in, acquire and manage a portfolio of residential real estate properties in the borough of Manhattan in New York City. We intend to conduct substantially all of all business through our operating partnership, NY Res REIT LP, a Delaware limited partnership. We intend to elect to qualify and be taxed as a real estate investment trust for U.S. federal income tax purposes, or REIT, commencing with our taxable year ending December 31, 2018.

Our office is located at 555 Madison Avenue, 6th Floor, New York, NY 10022. Our telephone number is 212-692-5540. Information regarding our company is also available on our website at www.nyresidentialreit.com.

Investment Strategy and Objectives

We intend to focus on the sector that complements our executive officers’ and our advisory board’s expertise in the acquisition and management of real estate. We further intend to capitalize on the ability of our Manager to source, evaluate, negotiate, structure, close and manage acquisitions of residential properties in Manhattan.

We intend to focus on acquiring properties that we believe (1) are likely to generate stable cash flows in the long term and (2) have significant possibilities for short-term capital appreciation, such as those requiring development, redevelopment or repositioning, those located in neighborhoods with what we see as high growth potential and those available from sellers who are distressed or face time-sensitive deadlines. We will also seek to generate cash flow through the leasing of properties to residential tenants. Our primary investment objectives are to:

- preserve, protect and return invested capital; and

- realize cash flow and capital appreciation in the value of our investments over the long term.

We expect to use substantially all the net proceeds from this offering to acquire properties that are appropriate for our investment strategy and our investment objectives, including:

- Acquiring or investing in properties in need of large-scale or cosmetic renovation.

- Acquiring or investing in properties encumbered by existing tenancy.

- Acquiring or investing in properties quickly from sellers with timing restrictions.

- Acquiring or investing in bulk condominium and co-op units.

- Acquiring or investing in condominium units in advance of completion.

Acquisitions through Contributions of Property

We may accept contributions of property to our operating partnership in exchange for units in our operating partnership, or OP Units, in accordance with Code Section 721(a). This structure is used because a sale of property directly to a buyer is generally a taxable transaction to the selling property owner. In a contribution structure, a seller of a property who desires to defer taxable gain on the sale of his, her or its property may transfer the property to our operating partnership exchange for OP Units and thereby defer taxation of gain until the seller later elects to exchange his, her, or its OP Units for common shares or, at our election, cash. This structure also provides a property owner the ability to diversify his, her or its holdings, increase cash flow and reduce management responsibilities. Using a contribution structure may give us an advantage in acquiring properties from persons who may not otherwise be able to realize certain benefits of a contribution transaction from other buyers.

| 7 |

Our Strengths

- Management & Advisory Board- Our Manager's executive officers and our advisory board have extensive experience in the New York City real estate industry and a well-established network of relationships with public and private lending institutions, attorneys and brokers, from which we expect to generate attractive acquisition opportunities. We have constructed our advisory board to include members that can support our acquisition strategies through the services that they provide

- Investor Accessibility- It is difficult for smaller investors to participate directly in investments in the New York City residential real estate market. Our common shares provide accessibility for individual investors to own interests in high-quality Manhattan residential real estate in the form of a public security.

- “Pure Play Investment”- We intend to only acquire or invest in residential properties in Manhattan, providing investors with an allocation to a specific region of the residential real estate market.

Market Opportunity

We believe that Manhattan residential properties represent a good investment opportunity at this time due to a softening of the luxury condominium market that has occurred primarily due to an increase in supply. We expect that as an institutional buyer in a specific sector of real estate that is traditionally non-institutional, we can take advantage of what we believe is becoming a buyer’s market and acquire or invest in properties at attractive valuations that have the potential for significant long-term capital appreciation.

Market Data

We use market data and industry forecasts and projections throughout this offering circular. We have obtained substantially all of this information from streeteasy.com, or StreetEasy, a New York City-focused listing and market information website. In addition, we have obtained certain market and industry data from publicly available industry publications, including the Douglas Elliman Report, which is prepared by Miller Samuel Inc., a residential real estate appraisal and consulting company covering the New York City metro area. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there is no assurance that any of the projected amounts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information.

Manhattan Residential Market Information

According to the StreetEasy Q2 2017 Market Report:

- Manhattan’s resale home prices rose from 2016 levels, except within the luxury tier. Manhattan’s median resale price increased by 1.2 percent year-over-year to $1,173,119. Home prices at the bottom end of the market rose the most, at 4.7 percent, while luxury prices dropped by 3.5 percent since Q2 of last year.

- Upper Manhattan prices cooled. Strong price appreciation in Upper Manhattan finally slowed in Q2 2017, maintaining its stronghold as the most affordable submarket in the borough with a median home resale price less than half of the borough median, at $496,881.

- Prices increased the most in the Upper West Side. Median resale prices for homes in the Upper West Side increased almost 2.6 percent since Q2 of last year.

- Inventory in Manhattan remained tight. The amount of homes listed for sale in Manhattan dropped by nearly a quarter (21.9 percent) since Q2 of last year.

- Rent prices in the bottom tier continued to grow. The median rent price in Manhattan rose by 1.2 percent since Q2 of last year to $2,971, and rose by 1.4 percent among the most affordable segment of the market.

According to the Q2 2017 Douglas Elliman Report Quarterly Survey of Manhattan Co-op & Condo Sales, or the Elliman Report, the average sales price for an apartment in Manhattan increased during the second quarter of 2017 by 4.0% to $2,189,037 and 7.9% year-over-year, however, the average price per square foot declined by 14.9% during the second quarter and increased by 0.8% year over year. The overall median sales price of a Manhattan apartment increased 8.1% during the second quarter of 2017 to $1,189,011 and 7.3% year-over-year. The Elliman Report states that the absorption rate improved during the second quarter of 2017 to 6.0 months from 6.1 months in the first quarter of 2017 and the market share of sales above list price dropped to 14.4% in the second quarter of 2017, 1.7% less than the year-ago period. The Elliman Report also points out that the average number of days to sell apartments that closed during the second quarter 2017 was 19 days slower than the same period in 2016. Listing discount, the percentage difference between the list price at the time of sale and the sales price increased to 6.1% from 2.2% in the prior year quarter as sellers worked harder to meet buyers on price.

Q2 2017 Douglas Elliman Report Quarterly Survey of Manhattan Co-op & Condo Sales

| 8 |

Stock Listing or Quotation

There is presently no public market for our common shares. Prior to the completion of the offering, we intend to apply either (a) to list our common shares on the NASDAQ or the NYSE, or (b) for the quotation of our common shares with the OTC. If we apply to list our common shares on the NASDAQ or the NYSE, there is no guarantee that we will meet the listing standards of either organization. We are not currently structured to comply with such listing standards. In order to apply for listing, we would need to materially change our corporate governance. Among other changes, material changes would include establishing a board of directors with a majority of independent directors and setting up audit, nominating/corporate governance and compensation committees, each populated by independent directors and governed by a charter. Under our operating agreement, our Manager may effect any of or all these changes at any time in its sole discretion.

If we choose to apply for quotation of our common shares on the OTC, our common shares may be quoted only to the extent that there is interest by broker-dealers in acting as a market maker. Despite our best efforts, we may not be able to convince any broker-dealers to act as market makers and make quotations with the OTC.

Our Manager

Commencement NY LLC, our Manager, manages our day-to-day operations. Our Manager is a wholly owned subsidiary of our sponsor. Experienced real estate professionals, acting through our Manager, will make all the decisions regarding the selection, negotiation, financing and disposition of our investments, subject to the limitations in our operating agreement. Our Manager will also provide asset management, marketing, investor relations and other administrative services on our behalf with the goal of maximizing our operating cash flow and preserving our invested capital. Commencement Capital LLC, our sponsor, is able to exercise significant control over our business.

Jesse Stein is the Chief Executive Officer of our sponsor and our Manager. Mr. Stein is responsible for overseeing the day-to-day operations of Commencement Capital LLC and its affiliates.

Our Structure

| 9 |

Management Compensation

Our Manager and the members of our advisory board will receive fees and expense reimbursements for services relating to this offering and the investment and management of our assets. The items of compensation are summarized in the following table.

|

Form of Compensation |

Description |

Estimated Amount of Compensation |

||

|

|

|

|

|

|

|

Offering and Organization Stage: |

|

|

|

|

|

Organization and Offering Expenses: |

|

To date, our Manager has incurred approximately $100,000 in organization and offering expenses on our behalf. We will reimburse our Manager for these costs and future organization and offering expenses it may incur on our behalf up to a maximum of $500,000. |

|

$150,000-$500,000 |

|

Operating Stage: |

|

|

|

|

|

Asset Management Fee: |

|

We will pay our Manager a quarterly asset management fee equal to 0.125% (0.50% annually) of the market value of our common shares, payable quarterly in arrears in cash. |

|

Impractical to determine at this time. |

|

Acquisition Fee: |

|

Our Manager will be entitled to 1.0% of the purchase price of each property purchased from non-affiliated, third party sellers for identifying, reviewing, evaluating and purchasing such property. |

|

Actual amounts are dependent upon the offering proceeds we raise (and any leverage we deploy). Assuming that we raise the maximum offering amount, resulting in $46,500,000 in net proceeds (assuming the payment of the maximum sales commissions of 6.0% of gross offering proceeds), and that we buy properties using our maximum leverage of 60%, we anticipate that acquisition fees of approximately $1,162,500 will be paid to our Manager. |

|

Reimbursement of Expenses: |

|

We will reimburse our Manager for out-of-pocket expenses in connection with our operations and the acquisition of our investments and in connection with third parties providing services to us. This does not include our sponsor’s overhead, employee costs borne by our sponsor, utilities or technology costs. |

|

Impractical to determine at this time. |

|

Awards Under Our Stock Incentive Plan: |

|

We have adopted a stock incentive plan, pursuant to which our advisory board members, officers and employees, employees of our Manager and other affiliates, certain of our consultants and certain consultants to our Manager and other affiliates who directly or indirectly provide consulting services to us may be granted equity incentive awards in the form of stock options, stock appreciation rights, restricted stock, performance shares and other stock-based awards. Our Manager will determine all awards under our stock incentive plan and the vesting schedule for the grants. |

|

The aggregate number of common shares that may be issued or used for reference purposes or with respect to which awards may be granted under our stock incentive plan will not exceed 5% of our outstanding common shares on a fully diluted basis at any time (subject to adjustment for stock splits, combinations, reclassifications, reorganizations and certain other specified events pursuant to the stock incentive plan), which we refer to as the 5% limit. |

|

Compensation of Advisory Board Members: |

|

Pursuant to our stock incentive plan, and subject to the 5% limit, we intend to grant each of the members of our advisory board (1) as soon as practicable after the commencement of this offering, 5,000 common shares, and (2) annually thereafter, 2,500 common shares. |

|

Assuming a value of $10.00 per common share, and assuming that the 5% limit has not been reached, $200,000 represents the aggregate value of the initial grant of restricted common shares, and $100,000 represents the aggregate value of each annual grant of restricted common shares. |

|

Exit Stage: |

|

|

|

|

|

Exit Fee: |

|

If our company (or all or substantially all the assets of our company) is sold or merged with another company including a company affiliated with or sponsored or managed by our sponsor or its affiliates, our Manager will be entitled to a fee equal to 2.0% of the company’s total capitalization at the time of sale or merger, to be paid in cash. For purposes of calculating the exit fee, total capitalization is equal to the sum of the company’s total debt and shareholders’ equity. The exit fee will not be paid to our Manager if the net proceeds to shareholders results in an amount per share less than $10, subject to adjustments in the event of share splits. |

|

Impractical to determine at this time |

| 10 |

Summary of Risk Factors

Investing in our common shares involves a high degree of risk. You should carefully review the “Risk Factors” section of this offering circular, beginning on page 15, which contains a detailed discussion of the material risks that you should consider before you invest in our common shares.

Conflicts of Interest

Our Manager and its affiliates will experience conflicts of interest in connection with the management of our business. Some of the material conflicts that our Manager and its affiliates will face include the following:

● Our sponsor’s real estate professionals acting on behalf of our Manager must determine which investment opportunities to recommend to us and such other Commencement Capital entities as may exist in the future from time to time. Our sponsor may organize one or more similar programs with investment criteria that compete with us.

● Our sponsor’s real estate professionals will have to allocate their time among us, our sponsor’s business and other programs and activities in which they are involved.

● The terms of our operating agreement (including our Manager’s rights and obligations and the compensation payable to our Manager and its affiliates) were not negotiated at arm’s length.

● We do not have a policy that expressly prohibits our officers, advisory board members, security holders or affiliates from engaging for their own account in business activities of the types conducted by us.

● Our shareholders may only remove our Manager for “cause” following the affirmative vote of shareholders holding two-thirds of the outstanding common shares. Unsatisfactory financial performance does not constitute “cause” under the operating agreement. Other than accrued fees payable to our Manager, no additional compensation will be paid to our Manager in the event of the removal of our Manager.

● At some future date after we have acquired a substantial investment portfolio that our Manager determines would be most effectively managed by our own personnel, we may seek shareholder approval to internalize our management by acquiring assets and employing the key real estate professionals performing services to us on behalf of our Manager for consideration that would be negotiated at that time. The payment of such consideration could result in dilution to your interest in us and could reduce the net income per share and funds from operations per share attributable to your investment. Additionally, in an internalization transaction, our sponsor’s real estate professionals who become our employees may receive more compensation than they previously received from our sponsor or its affiliates. These possibilities may provide incentives to these individuals to pursue an internalization transaction, even if an alternative strategy might otherwise be in our shareholders’ best interests.

| 11 |

● Our Manager may, without shareholder consent unless otherwise required by law, determine that we should sell all or substantially all our assets to, or merge or consolidate through a roll-up or other similar transaction with other entities, including entities affiliated with or sponsored or managed by our sponsor or its affiliates.

● Our advisory board members are incentivized to recommend their own services (or actions that otherwise may financially benefit them) and to maximize their estimation of our need for such services or actions which otherwise benefit them, and as a result, they face conflicts of interest.

Distributions

Once we begin to make distributions, we expect that our Manager will declare and make them on a quarterly basis in arrears. Any distributions we make will be at the discretion of our Manager, and will be based on, among other factors, our present and reasonably projected future cash flow. We expect that our Manager will set the rate of distributions at a level that will be reasonably consistent and sustainable over time. Distributions will be paid to shareholders as of the record dates selected by our Manager. See “Description of Our Common Shares — Distributions.”

While our goal is to pay distributions from our cash flow from operations, we may use other sources to fund distributions. Until the proceeds from our public offering are invested and generating operating cash flow, some or all of our distributions may be paid from other sources, including the net proceeds of this offering, cash advances by our Manager, cash resulting from a waiver of fees or reimbursements due to our Manager, borrowings in anticipation of future operating cash flow and the issuance of additional securities. Use of some of or all these sources may reduce the amount of capital we invest in assets and negatively impact the return on your investment and the value of your investment. We have not established a limit on the amount of proceeds we may use to fund distributions. We can provide no assurances that future cash flow will support payment of distributions or maintaining distributions at any particular level or at all.

Our distributions will constitute a return of capital to the extent that they exceed our current and accumulated earnings and profits as determined for U.S. federal income tax purposes. To the extent that a distribution is treated as a return of capital for U.S. federal income tax purposes, it will reduce a holder’s adjusted tax basis in the holder’s shares, and to the extent that it exceeds the holder’s adjusted tax basis will be treated as gain resulting from a sale or exchange of such shares.

Leverage Policy

We intend to employ leverage in order to provide additional funds to support our investment activities. Our target portfolio-wide leverage after we have acquired an initial substantial portfolio of diversified investments is between 30-60% of the greater of cost (before deducting depreciation or other non-cash reserves) and fair market value of our assets. During the period when we are beginning our operations and growing our portfolio, we may employ greater leverage on individual assets (that will also result in greater leverage of the interim portfolio) in order to quickly build a diversified portfolio of assets. Our Manager may from time to time modify our leverage policy in its discretion in light of then-current economic conditions, relative costs of debt and equity capital, market values of our properties, general conditions in the market for debt and equity securities, growth and acquisition opportunities or other factors. However, other than during our initial period of operations, it is our policy to not borrow more than 60% of the greater of cost (before deducting depreciation or other non-cash reserves) and fair market value of our assets. We cannot exceed the leverage limit of our leverage policy unless any excess in borrowing over such level is approved by our Manager. See “Investment Objectives and Strategy” for more details regarding our leverage policies.

Status of our Offering

We commenced our offering on May 3, 2017. Our common shares were initially being offered by our executive officers and certain members of our advisory board, on a best-efforts basis, in reliance on an exemption from registration as broker-dealers under provisions of Rule 3a4-1 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. On June 15, 2017, in contemplation of our possible engagement of a managing underwriter for the offering, we paused our offering and have made no sales of common shares since that date. The gross proceeds of our offering through that date currently reside in an escrow account with Prime Trust. Having engaged the Underwriter, we are resuming our offering as of the date of this offering circular.

Our Financing Strategy

We may use moderate leverage to enhance total cash flow and capital appreciation to our shareholders. We will target an appropriate loan-to-value ratio for our properties based on (i) the purchase price of the property or the fair market value of the property at the time that the financing is obtained and (ii) the cash flow that the property is generating and the resulting debt service coverage ratio.

We may obtain a line of credit or other financing that will be secured by one or more of our assets. We will consider a number of factors when evaluating the company’s aggregate level of indebtedness and making financial decisions, including, among others, the following:

| ● | the interest rate of the proposed financing; | |

| ● | the extent to which the financing impacts the flexibility to manage the properties; | |

| ● | prepayment penalties, defeasance and restrictions on refinancing; | |

| ● | our long-term objectives with respect to the financing; | |

| ● | the ability of the property to generate cash flow sufficient to cover budgeted capital expenditures, ongoing maintenance and expected debt service payments; | |

| ● | our overall level of consolidated indebtedness; | |

| ● | timing of debt maturities; | |

| ● | provisions that require recourse; | |

| ● | our company-level credit ratios; and | |

| ● | the overall ratio of fixed- and variable-rate debt. |

| 12 |

Voting Rights

Our shareholders will have voting rights only with respect to certain matters, primarily relating to amendments to our operating agreement that would affect our shareholders disproportionately or materially adversely affects our shareholders’ rights, and removal of our Manager for “cause.” Each outstanding common share entitles the holder to one vote on all matters submitted to a vote of common shareholders. Our shareholders do not elect or vote on our Manager, and, unlike the holders of common shares in a corporation, have only limited voting rights on matters affecting our business, and therefore limited ability to influence decisions regarding our business. For additional information, see “Description of Our Common Shares—Voting Rights.”

Other Governance Matters

Other than the limited shareholder voting rights described above, our operating agreement vests most other decisions relating to our assets and to the business of our company, including decisions relating to acquisitions and dispositions, the engagement of property managers, the issuance of securities in our company including additional common shares, mergers, dispositions, roll-up transactions, and other decisions relating to our business, in our Manager. See “Management” for more information about the rights and responsibilities of our Manager.

Investment Company Act Considerations

We intend to conduct our operations so that neither we, nor any of our subsidiaries, is required to register as investment companies under the Investment Company Act of 1940, as amended, or the Investment Company Act. Section 3(a)(1)(A) of the Investment Company Act defines an investment company as any issuer that is or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities. Section 3(a)(1)(C) of the Investment Company Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. Government securities and cash items) on an unconsolidated basis, which we refer to as the 40% test. Excluded from the term “investment securities,” among other things, are U.S. Government securities and securities issued by majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company set forth in Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act.

We anticipate that we will hold real estate (i) directly, (ii) through wholly-owned subsidiaries, (iii) through majority-owned joint venture subsidiaries, and, (iv) to a lesser extent, through minority-owned joint venture subsidiaries.

We intend, directly or through our subsidiaries, to invest in and manage a diversified portfolio of residential real estate investments. We expect to use substantially all the net proceeds from this offering to acquire and structure a diversified portfolio of residential real estate properties.

We will monitor our compliance with the 40% test and the holdings of our subsidiaries to ensure that each of our subsidiaries is in compliance with an applicable exemption or exclusion from registration as an investment company under the Investment Company Act.

The securities issued by any wholly-owned or majority-owned subsidiary that we may form and that are excluded from the definition of “investment company” based on Section 3(c)(1) or 3(c)(7) of the Investment Company Act, together with any other investment securities we may own, may not have a value in excess of 40% of the value of our total assets on an unconsolidated basis.

The Investment Company Act defines a majority-owned subsidiary of a person as a company 50% or more of the outstanding voting securities of which are owned by such person, or by another company which is a majority-owned subsidiary of such person. We treat companies in which we own at least a majority of the outstanding voting securities as majority-owned subsidiaries for purposes of the 40% test. The determination of whether an entity is a majority-owned subsidiary of our company is made by us. We also treat subsidiaries of which we or our wholly-owned or majority-owned subsidiary is the manager (in a manager-managed entity) or managing member (in a member-managed entity) or in which our agreement or the agreement of our wholly-owned or majority-owned subsidiary is required for all major decisions affecting the subsidiaries (referred to herein as “Controlled Subsidiaries”), as majority-owned subsidiaries even though some of or all the interests issued by such Controlled Subsidiaries may not meet the definition of voting securities under the Investment Company Act. We reached our conclusion on the basis that our interests in the Controlled Subsidiaries are the functional equivalent of voting securities. We have not asked the SEC staff for concurrence with our analysis and it is possible that the SEC staff could disagree with any of our determinations. If the SEC staff were to disagree with our treatment of one or more companies as majority-owned subsidiaries, we would need to adjust our strategy and our assets. Any such adjustment in our strategy could have a material adverse effect on us.

| 13 |

We believe that neither we nor certain of our subsidiaries will be considered investment companies for purposes of Section 3(a)(1)(A) of the Investment Company Act because we and they will not engage primarily or hold themselves out as being primarily in the business of investing, reinvesting or trading in securities. Rather, we and such subsidiaries will be primarily engaged in non-investment company businesses related to real estate. Consequently, we and our subsidiaries expect to be able to conduct our operations such that none will be required to register as an investment company under the Investment Company Act.

A change in the value of any of our assets could cause us or one or more of our wholly or majority-owned subsidiaries to fall within the definition of “investment company” and negatively affect our ability to maintain our exemption from regulation under the Investment Company Act. To avoid being required to register the company or any of its subsidiaries as an investment company under the Investment Company Act, we may be unable to sell assets we would otherwise want to sell and may need to sell assets we would otherwise wish to retain. In addition, we may have to acquire additional income- or loss-generating assets that we might not otherwise have acquired or may have to forgo opportunities to acquire interests in companies that we would otherwise want to acquire and would be important to our investment strategy. Our Manager will continually review our investment activity to attempt to ensure that we will not be regulated as an investment company.

To the extent that the SEC staff provides more specific guidance regarding any of the matters bearing upon the definition of “investment company” and the exceptions to that definition, we may be required to adjust our investment strategy accordingly. Additional guidance from the SEC staff could provide additional flexibility to us, or it could further inhibit our ability to pursue the investment strategy we have chosen.

The loss of our exclusion from regulation pursuant to the Investment Company Act could require us to restructure our operations, sell certain of our assets or abstain from the purchase of certain assets, which could have an adverse effect on our financial condition and results of operations. See “Risk Factors—Risks related to Our Organizational Structure—Maintenance of our Investment Company Act exemption imposes limits on our operations, which may adversely affect our operations.”

| 14 |

An investment in our common shares involves substantial risks. You should carefully consider the following risk factors in addition to the other information contained in this offering circular before purchasing shares. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this offering circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Statements Regarding Forward-Looking Information.”

Risks Related to an Investment in NY Residential REIT, LLC

Both we and our Manager are newly-formed entities with no operating history.

Both we and our Manager are newly formed entities, with no operating history. You should consider an investment in our common shares in light of the risks, uncertainties and difficulties frequently encountered by other newly formed companies with similar objectives. To be successful in this market, we and our Manager must, among other things:

| ● | identify and acquire real estate assets consistent with our investment strategies; | |

| ● | increase awareness of our name within the investment products market; | |

| ● | attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations; and | |

| ● | build and expand our operations structure to support our business. |

There can be no assurance that we will achieve our investment objectives.

The report of our independent auditor contains an emphasis of matter paragraph questioning our ability to continue as a going concern.

As of the date of this offering circular, we have not commenced operations and have not generated revenues or profits since inception. We are currently dependent on our ability to raise capital from shareholders or other sources.The report of our independent auditor on our financial statements contained in this offering circular contains an emphasis of matter paragraph questioning our ability to continue as a going concern. The paragraph indicates that our not having commenced operations and not having generated revenues or profits, among other factors, raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty, nor is our independent auditor’s opinion modified with respect to this matter. If we do not successfully raise capital and generate revenues or profits, we will be unable to effectuate our business plan, which could materially adversely affect the value of our common shares.

Because there is no public trading market for our common shares, you may not be able to resell your common shares.

There is presently no public market for our common shares. Prior to the completion of the offering, we intend to apply either (a) to list our common shares on the NASDAQ or the NYSE, or (b) for the quotation of our common shares with the OTC. If we apply to list our common shares and be eligible for listing on the NASDAQ or the NYSE, there is no guarantee that we will meet the listing standards of either organization and be eligible for listing. If we choose to apply for quotation of our common shares with the OTC, our common shares may be quoted only to the extent that there is interest by broker-dealers in acting as a market maker. Despite our best efforts, we may not be able to convince any broker-dealers to act as market makers and make quotations with the OTC.

If our common shares become listed or quoted and a market for the stock develops, the actual price of our common shares will be determined by prevailing market prices at the time of the sale. We cannot assure you that there will be a market in the future for our common shares. The trading of securities of companies with a small market capitalization is often sporadic and investors may have difficulty buying and selling our common shares or obtaining market quotations for them, which may have a negative effect on the market price of our common shares. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you should consider an investment in our common shares to be extremely illiquid.

Investing in our company may result in an immediate loss because buyers may pay more for our common shares than the pro rata portion of the assets are worth.

We have only been recently formed and have only a limited operating history with no earnings; therefore, the price of the offered shares is not based on any data. The offering price and other terms and conditions regarding our shares have been arbitrarily determined and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. No investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares. The offering price will not change for the duration of the offering even if we obtain either (a) the listing of our common shares on the NASDAQ or the NYSE, or (b) the quotation of our common shares with the OTC.

Because the offering price is not based upon any independent valuation, the offering price may not be indicative of the proceeds that you would receive upon liquidation. Further, the offering price may be significantly more than the price at which the shares will trade if we succeed in becoming actively traded by broker-dealers.

Additionally, we are obligated to reimburse our Manager for the organization and offering expenses that our Manager has paid or will pay on our behalf, up to a maximum of $500,000. Organization and offering expenses may be substantial, and will be due and payable by us upon the achievement of the minimum offering amount. While our Manager may in its discretion choose to defer or waive the requirement that we reimburse any portion of the organization and offering expenses, our Manager is under no obligation to do so, and we do not anticipate that it will do so. If we reimburse our Manager for organization and offering expenses in an amount that is substantial in relation to the net proceeds raised, our company may incur an immediate loss and the value of your common shares will be immediately and substantially reduced.

A portion of the offering proceeds will be used to pay the Underwriter Fee of up to 6.0% of the gross offering proceeds to the Underwriter, which it may re-allow in part and pay to Selling Group Members, and to reimburse certain offering expenses to our Underwriter. Thus, a portion of the gross amount of the offering proceeds will not be available for investment by the Company.

| 15 |

If we are unable to find suitable investments, we may not be able to achieve our investment objectives or pay distributions.

Our ability to achieve our investment objectives and to pay distributions depends upon the performance of our Manager in the acquisition of our investments and the ability of our Manager to source investment opportunities for us. The more money we raise in this offering, the greater our challenge will be to invest all the net offering proceeds on attractive terms. We cannot assure you that our Manager will be successful in obtaining suitable investments on financially attractive terms or that, if our Manager makes investments on our behalf, our objectives will be achieved. If we, through our Manager, are unable to find suitable investments promptly, we will hold the proceeds from this offering in an interest-bearing account or invest the proceeds in short-term assets. If we would continue to be unsuccessful in locating suitable investments, we may ultimately decide to liquidate. In the event we are unable to timely locate suitable investments, we may be unable or limited in our ability to pay distributions and we may not be able to meet our investment objectives.

We expect that our real estate investments will be concentrated in New York City, making us dependent upon the economic climate in New York City, including increased competition, and potentially more vulnerable economically than if our investments were geographically diversified.