Preliminary Offering Circular Dated October 24, 2016

An offering statement pursuant to Regulation A relating to these securities has been filed with the U.S. Securities and Exchange Commission, which we refer to as the Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

Energy Hunter Resources, Inc.

Common Stock

This offering circular (the “Offering Circular”) relates to the initial public offering of our common stock, par value $0.0001 per share (the “Common Stock”).

Prior to this offering, there has been no public market for our securities. The initial public offering price is expected to be between $[•] and $[•] per share. The maximum amount of securities expected to be sold in this offering is [•]. We intend to apply to list our Common Stock on the NYSE MKT under the symbol “EHX.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and as such, we have elected to take advantage of certain reduced public company reporting requirements for this Offering Circular and future filings. See “Risk Factors” and “Offering Circular Summary—Implications of Being an ‘Emerging Growth Company’.” This Offering Circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

These securities are speculative and involve a high degree of risk. You should purchase shares of Common Stock only if you can afford the complete loss of your investment. See “Risk Factors” beginning on page 9, to read about the risks you should consider before buying shares of our Common Stock.

The offering is being underwritten on a firm commitment basis. We have granted the underwriters an option to buy up to an additional [•] shares of Common Stock to cover over-allotments. The underwriters may exercise this option at any time and from time to time during the 30-day period from the date of this Offering Circular.

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to Issuer |

|||||||

Per Share |

$ | $ | $ | ||||||

Total |

$ | $ | $ | ||||||

| (1) | In addition, we have agreed to reimburse the underwriters for certain expenses. See “Underwriting” on page 66 of this Offering Circular for additional information. |

Delivery of the shares of Common Stock will be made on or about , 2016.

The Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

FBR

The date of this Offering Circular is , 2016.

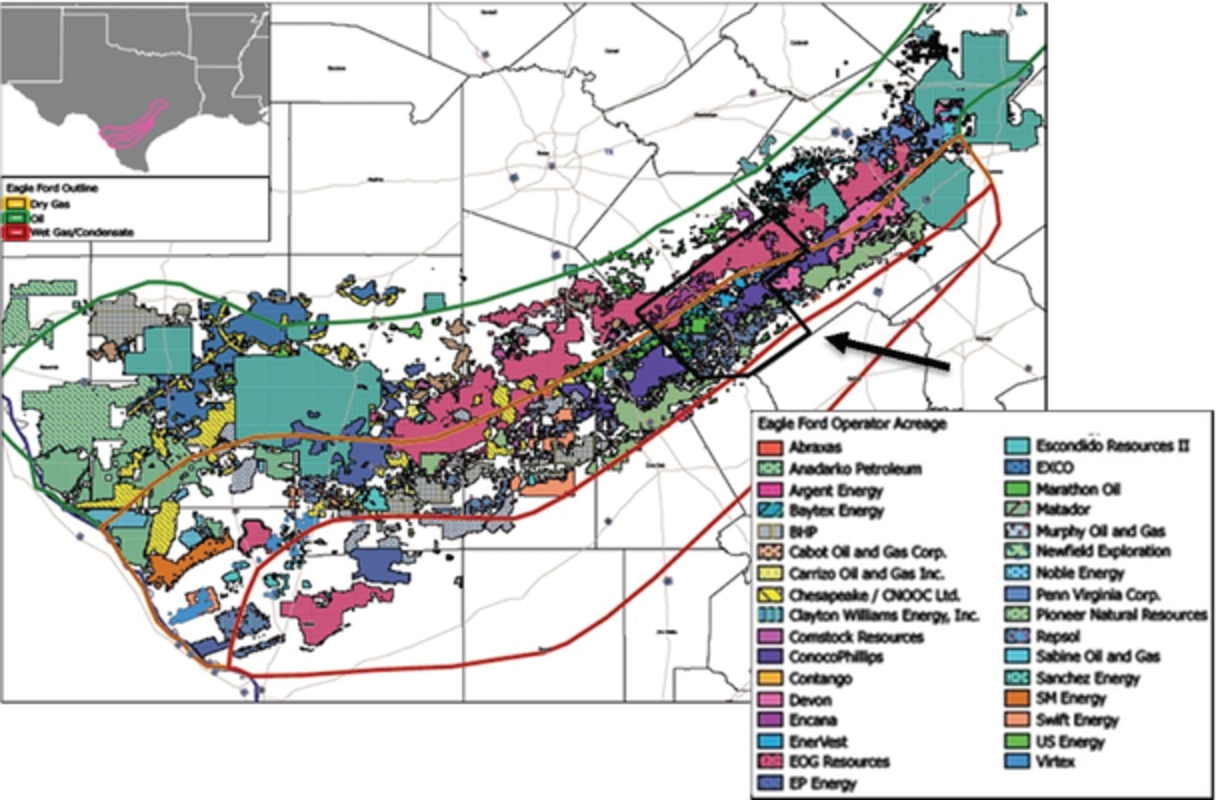

Eagle Ford Play Operator Lease Acreage Positions. Arrows points to Karnes County, TX outlined in black.(1)

| (1) | Map provided by www.shaleexperts.com. Data through September 2016. |

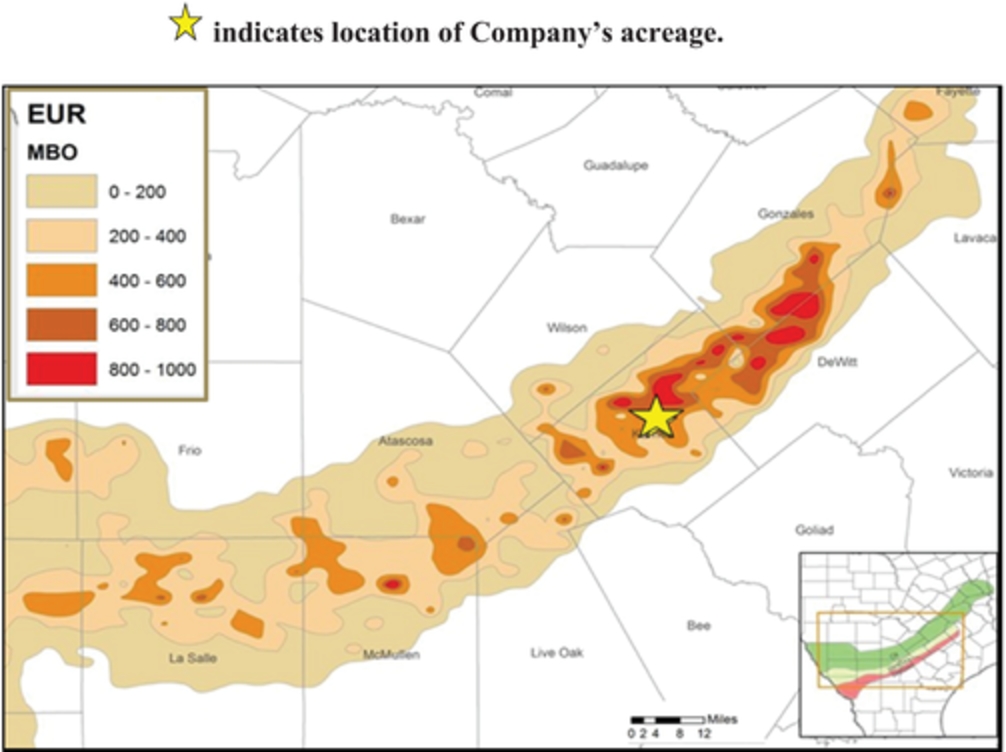

Estimated Ultimate Recoveries (EUR), average per producing well in Eagle Ford Shale.

Industry and Market Data

The market data and certain other statistical information used throughout this Offering Circular are based on independent industry publications, government publications and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

Oil and Natural Gas Reserves Data

We present oil and natural gas reserve data in barrels of oil equivalent, or Boe, amounts. For purposes of computing such units, a conversion rate of one Boe to six Mcf of natural gas or one Bbl of oil is used. The conversion ratio is an energy content correlation and does not reflect a volume or price relationship between the commodities. Boe amounts may be misleading, particularly if considered in isolation.

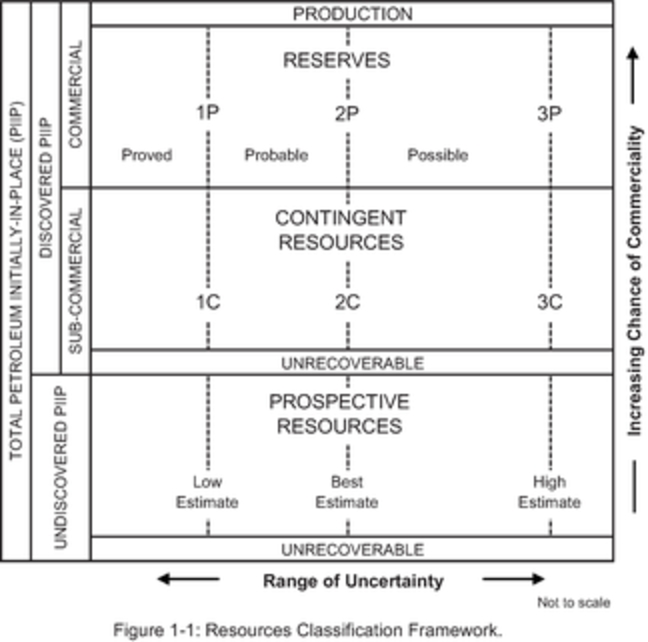

Our estimated net probable undeveloped reserves disclosed in this Offering Circular are based on reserve reports prepared by Netherland, Sewell & Associates, Inc. (“NSAI”), our independent petroleum engineer, included elsewhere in this Offering Circular. See “Business—Oil and Natural Gas Data.” Unless otherwise indicated, our estimates of probable undeveloped reserves and future net revenues therefrom are presented in accordance with the rules and definitions promulgated by the Securities and Exchange Commission (“Commission”).

The information contained in this Offering Circular relating to our reserves and future net revenues represent estimates only and constitute forward-looking statements that are subject to risks and uncertainties. See “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Trademarks and Trade Names

From time to time, we own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This Offering Circular may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this Offering Circular is not intended to, and does not imply, a relationship with us or an endorsement or sponsorship by or of us. Solely for convenience, the trademarks, service marks and trade names referred to in this Offering Circular may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Additional Information

You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with additional information or information different from that contained in this Offering Circular filed with the Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this Offering Circular is accurate only as of the date of this document, regardless of the time of delivery of this Offering Circular or any sale of shares of our Common Stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

This summary highlights information contained elsewhere in this Offering Circular and does not contain all of the information that may be important to you. You should read this entire Offering Circular carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical financial statements and related notes included elsewhere in this Offering Circular. In this Offering Circular, unless otherwise noted, the terms “the Company,” “we,” “us,” and “our” refer to Energy Hunter Resources, Inc. The information presented in this Offering Circular assumes (i) an initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this Offering Circular) and (ii) unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of Common Stock.

This Offering Circular, including any supplement to this Offering Circular, includes “forward-looking statements.” To the extent that the information presented in this Offering Circular discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “should”, “may”, “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section in this Offering Circular.

This Offering Circular includes certain terms commonly used in the oil and natural gas industry, which are defined in Annex A to this Offering Circular, “Glossary of Oil and Natural Gas Terms.”

Business Overview

We are an independent oil and gas company focused on the acquisition, drilling and production of oil and natural gas properties and prospects within the United States. We were founded in May 2016 by our Chairman and Chief Executive Officer, Gary C. Evans, to take advantage of what we believe to be a unique and timely opportunity within the oil and gas industry due to the severe downturn which began in November 2014.

We believe that several key factors have contributed to a favorable landscape whereby there exists significant potential to achieve attractive returns by acquiring and developing oil and natural gas assets in proven basins with limited geological risks. These factors include:

| • | The recent decline of commodity prices had an immediate and meaningful impact on the cash flows of oil and gas exploration and production (“E&P”) companies, creating a need for many firms to sell assets to stay in business. |

| • | The recent decline of commodity prices has also substantially reduced E&P asset valuations, resulting in quality assets being available at severely depressed levels. |

| • | Many existing leases are expiring without extension of their primary term due to the lack of capital being deployed. |

| • | Drilling and completion costs have fallen significantly, resulting in opportunities to acquire acreage that was previously viewed as marginal, but is now economic due to a lower cost to develop. |

| • | Although commodity prices will continue to be volatile and subject to cyclical fluctuations, we believe that crude oil oversupply will lessen and that crude oil demand will grow, which should encourage increased prices, in the medium to long term. Natural gas demand is also expected to increase in the long term. |

| • | E&P companies operating in the U.S. enjoy certain advantages, including access to industry-leading technologies and expertise, top-tier oil and gas-producing basins, established infrastructure and favorable legal and political policies relative to other regions. |

Our business strategy aims to maximize stockholder value through a balanced program of acquisitions and low-risk development and exploitation. We intend to leverage our management team’s long history in the oil and gas industry and operational expertise to identify and acquire ownership interests in producing, proved developed, proved undeveloped, and probable properties with a particular emphasis on distressed assets and smaller acquisition

1

opportunities not generally known in the marketplace. We will look to target low-risk projects that offer meaningful potential production and reserve growth from stacked pay opportunities, and whenever possible, will seek to serve as operator for the properties in which we acquire interests. The Company will initially concentrate these activities in the Eagle Ford Shale, located in South Texas, and the Permian Basin of West Texas and Southeast New Mexico. We may also seek to acquire mineral rights in the Marcellus and Utica shale formations primarily located in Ohio, West Virginia, and Pennsylvania.

As of July 31, 2016, our portfolio consisted of approximately 427 gross (400 net) acres located in two separate lease blocks in the heart of the Eagle Ford Shale play overlying the Edwards Trend in Karnes County, Texas. The total acreage position is prospective for both the lower and upper Eagle Ford Shale, as well as the Austin Chalk formation. There are no drilling commitments on this acreage until March 2017. The Company currently owns 93.75% of the working interest in these properties and will be the operator of record on all new wells drilled. We estimate that approximately 14 wells can be drilled in the lower Eagle Ford formation between the two prospects, as well as an additional 10 wells in the upper Eagle Ford formation for a total of 24 potential well locations, excluding the Austin Chalk formation and potential drilling sites therein.

Potential Well Locations(1)(2)

Zones |

Total |

||

Upper Eagle Ford |

10 | ||

Lower Eagle Ford |

14 | ||

Total Locations |

24 | ||

| (1) | We have 24 total identified drilling locations which include six potential locations in the lower Eagle Ford associated with probable undeveloped reserves as of July 31, 2016. We have estimated our drilling locations based on well spacing assumptions and upon the evaluation of other operators in our area, combined with our interpretation of available geologic and engineering data. The drilling locations that we actually drill will depend on the availability of capital, regulatory approvals, commodity prices, costs, actual drilling results and other factors. Any drilling activities we are able to conduct on these identified locations may not be successful and may not result in our ability to reclassify any probable undeveloped reserves as Proved Reserves or to add Proved Reserves or additional Probable Reserves to our existing probable undeveloped reserves. |

| (2) | Our drilling location count assumes 350-400 foot spacing. |

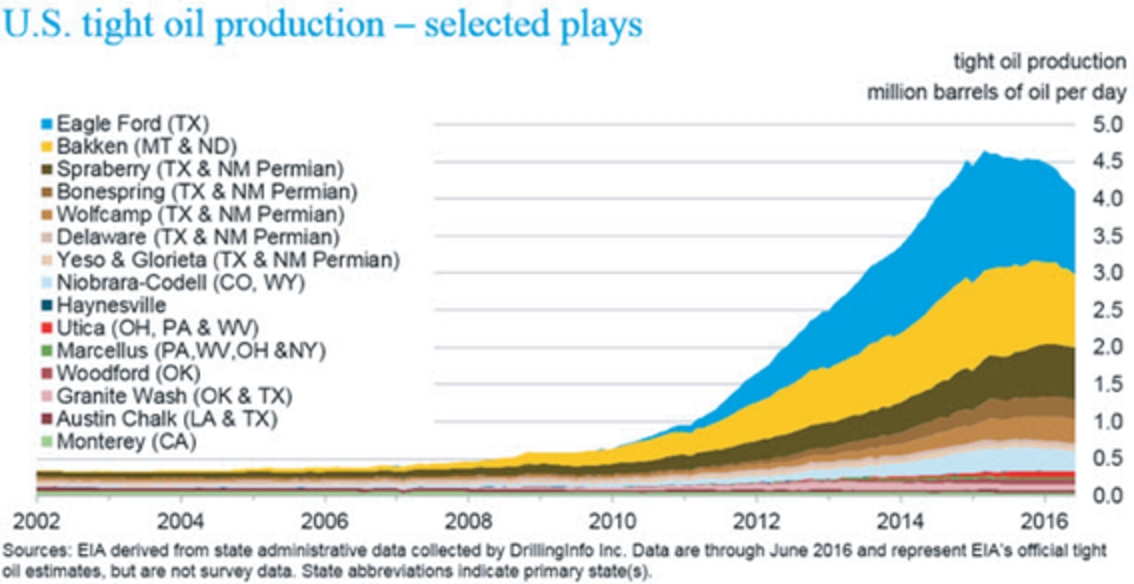

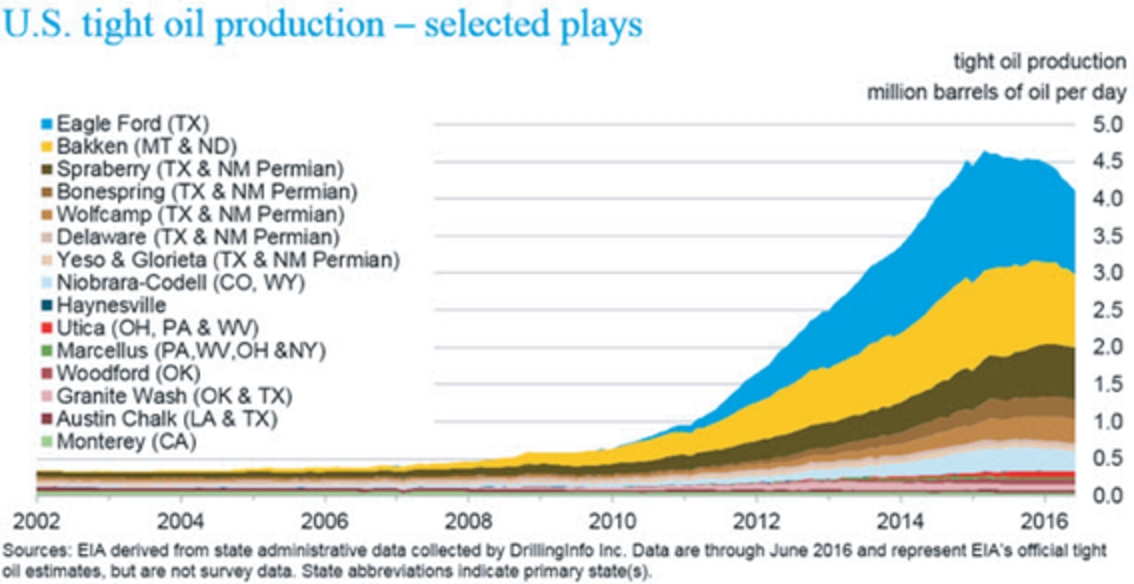

The Eagle Ford Shale is an attractive operating area given its organic-rich source rock, high liquids yields, stacked pay potential and low supply costs. Additionally, we believe management’s extensive operating history and prior success in the Eagle Ford make it an ideal initial target play. Birthed by advancements in horizontal drilling and hydraulic fracturing in 2009, the Eagle Ford Shale has become one of the most prolific liquids producers in the U.S. According to the Energy Information Administration of the U.S. Department of Energy (the “EIA”), the Eagle Ford Shale is the largest producer of tight oil (oil produced from low-permeability formations, such as shale) in the United States, accounting for 30% of total U.S. tight oil production during the twelve-month period ended June 30, 2016. According to monthly production data compiled by the Railroad Commission of Texas, Karnes County, Texas, where all of our current assets are located, is also the top crude oil producing county during the nine-month period ending September 30, 2016 in the State of Texas by volume.

2

Summary Oil and Natural Gas Data

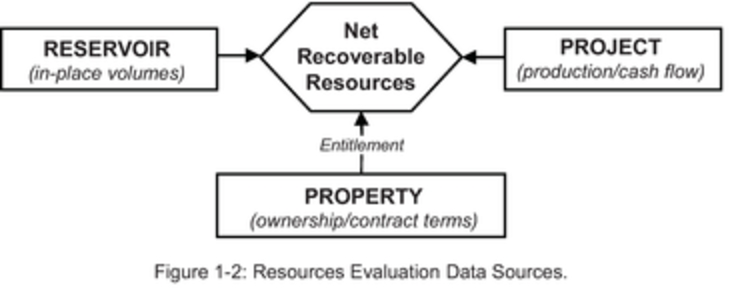

The following table provides summary information regarding our probable undeveloped reserves as of July 31, 2016, based on a reserve report prepared by NSAI, our independent petroleum engineer, in accordance with the definitions and guidelines set forth in the Petroleum Resources Management System approved by the Society of Petroleum Engineers, or SPE, and using NYMEX Futures Strip Pricing for the period of 2016-2020, as described in the footnotes to the table below. Estimates of reserves and future net revenue using the SPE definitions and guidelines and NYMEX Futures Strip Pricing differ from estimates prepared in accordance with the definitions and pricing methodology approved by the Commission. See “Business—Sensitivity of Reserves to Prices By Principal Product Type and Price Scenario.”

Estimated Net Probable Undeveloped Reserves |

Future Net Revenue ($ in thousands) |

||||||||||||||

Price Case(1)(2) |

Oil (MBbl) |

Gas (MMcf) |

Total (MBoe) |

Total |

PV10(3) |

||||||||||

NYMEX Futures Strip Pricing |

1,475.5 | 5,727.7 | 2,430.2 | 37,863.1 | 18,749.3 | ||||||||||

| (1) | Data in this table are calculated based upon NYMEX Futures Strip Pricing for oil and natural gas for the five-year period 2016-2020 as set forth in the table under the caption “Business—Sensitivity of Reserves to Prices By Principal Product Type and Price Scenario.” |

| (2) | For the price, costs, and assumptions on which these alternate reserves estimates are based see “Business—Sensitivity of Reserves to Prices By Principal Product Type and Price Scenario.” |

| (3) | Present Value Discounted at 10%, commonly referred to as PV10, is a non-generally accepted accounting principle (“GAAP”) financial measure and represents the present value of estimated future cash inflows from crude oil and natural gas reserves, less estimated future development and production costs, discounted at 10% per annum to reflect timing of future cash inflows. PV10 is typically calculated using the unweighted arithmetic average of the first-day-of-the-month price for each of the 12 months preceding the date of the report in which the calculation is presented, which is the pricing methodology required by the Commission for oil and gas reserve calculations, which we refer to as SEC Pricing. The PV10 presented in this table instead uses NYMEX Futures Strip prices as stated in footnote 1. Given that commodity prices over the past 12 months have been depressed compared to historical averages and are lower than the estimated future prices reflected in the NYMEX Futures Strip price deck, this results in an increase of approximately 223% in the PV10 presented in this table compared to the PV10 of our probable undeveloped reserves determined using SEC Pricing. If the Commission’s definitions and SEC Pricing were used, the table would show estimated net probable undeveloped reserves of 1,443.9 MBbl of oil and 5,600.0 MMcf of natural gas, or 2,377.3 MBoe of total net probable undeveloped reserves; total future net revenue of $16,925,200; and PV10 of the future net revenue of $5,804,400. See “Business—Oil and Natural Gas Data—Summary of Oil and Natural Gas Reserves.” Regardless of the pricing methodology used, PV10 should not be construed as representing the fair market value of oil and natural gas properties. |

Management

We believe our management team is in a prime position to take advantage of opportunities within the oil and gas industry and to create value for our stockholders. Our management team has a deep knowledge of the industry and a well-established network of relationships with both public and private oil and gas companies, equity sponsors, lending institutions, landowners, and service providers from which we believe we can generate attractive acquisition opportunities. Our management also has a substantial history operating together as a team.

3

Gary C. Evans, Chairman & CEO: After serving nine years as a banker concentrating in the energy industry, he founded Magnum Hunter Resources Inc. (“MHRI”) in 1985, and served as Chairman & CEO for 20 years before selling to Cimarex Energy (Symbol: XEC) in 2005, overseeing the growth of a company he started with a $1,000 initial investment into an eventual $2.2 billion enterprise at the time of sale. Most recently he served as Chairman and CEO of Magnum Hunter Resources Corp. (“MHRC”), which he took from $0.35/share upon joining the company in 2009 to $9.16/share at its peak before the crash in commodity prices in 2014 and its eventual plan of reorganization under the U.S. Bankruptcy Code completed in May, 2016. Mr. Evans also founded mid-stream gas gathering company Eureka Midstream Holdings in 2010, which we believe has an approximate current value of over $1.0 billion.

H. C. “Kip” Ferguson, Executive Vice President, Exploration / Development: Mr. Ferguson brings more than 28 years of exploration, development and operational experience in many of the major oil and gas basins within the U.S. Mr. Ferguson uses his broad oil and gas experience to assess opportunities within our core Eagle Ford and Permian focus. Mr. Ferguson has a proven management track record of successful grassroots development and execution within unconventional plays. Mr. Ferguson most recently served as Executive Vice President of Exploration for MHRC from 2009 to July 2016, where he managed the Eagle Ford Shale division and was in charge of the exploration and development of its Eagle Ford Shale properties. This led to the successful divestment of those properties for $401 million. Prior to that, Mr. Ferguson was President and Director of Sharon Resources, Inc. and Sharon Energy Ltd., which was acquired by MHRC in 2009 as its entry point into the Eagle Ford Shale play. Mr. Ferguson has a Bachelors of Science in Geology, with a minor in Petroleum Engineering, from the University of Texas. Additionally, Mr. Ferguson has co-authored and written case studies, papers and articles for SPE International magazine, Unconventional Resources Technology Conference, and E&P magazine regarding successful uses of different unconventional technologies.

Brian Burgher, Senior Vice President, Land: Mr. Burgher has more than 30 years of experience in the oil and gas industry, with an emphasis on leases and land acquisitions. He was previously SVP of Land for MHRC from 2009 to 2015, where he served as land manager for its Eagle Ford assets, which were assembled, developed and sold under his oversight. Across his time at MHRC, Mr. Burgher personally oversaw the acquisition, due diligence and subsequent divesture of over $1.0 billion of leases and wells. Mr. Burgher has worked in all facets of field operations and management over the course of his career.

Jason Wilson, Manager, Geology: Mr. Wilson has more than 20 years of experience in geology and operations across all of our target areas. From 2009 to 2013 he was a member of the MHRC Eagle Ford operations team that successfully executed the grassroots development of the Gonzales/Lavaca county acreage in South Texas that was eventually sold for $401 million. After leaving MHRC, Mr. Wilson worked for one year as a senior geologist for New Standard Energy. Following his post at New Standard Energy until joining the Company, Mr. Wilson worked as an independent consultant for EnCap Investments, L.P. Mr. Wilson also worked previously in similar capacities for Anadarko and Sharon Resources. Mr. Wilson has a Bachelors of Science and a Masters of Science in Geology from Texas A&M University.

Brada Wilson, Controller and Corporate Secretary: Ms. Wilson presently serves as our Controller and Corporate Secretary. Ms. Wilson previously worked for MHRC for the five years prior to joining the Company. Prior to that, Ms. Wilson served as Controller for CWF Energy, Inc. in Dallas and Henry Energy Corporation, a public company based in Arlington, Texas. Ms. Wilson holds a Master of Professional Accounting degree from the University of Texas at Arlington and a Bachelor of Science degree from Texas Tech University. Ms. Wilson brings over 20 years of experience in all phases of oil and gas accounting.

Business Strategy

Exploit Initial Asset Portfolio — We intend to focus on the initial drilling and future development of our properties in the Eagle Ford Shale. As of July 31, 2016, we have approximately 427 gross (400 net) acres and 24 identified potential drilling locations, with current plans to commence initial drilling efforts in late 2016 upon completion of this offering. This includes six potential locations in the lower Eagle Ford associated with our probable undeveloped reserves as of July 31, 2016.

Leverage Acquisition Pipeline — We intend to opportunistically acquire additional acreage and reserves. We believe we can leverage our management’s extensive industry network and operational expertise to identify and execute on many opportunities before they are generally available to industry competitors.

4

Focus on Assets that are Currently Economic — We plan to focus on acquisitions and low-risk horizontal development opportunities within the regions that continue to generate exceptional returns even in today’s lower commodity price environment.

Seek Out Smaller Acreage Blocks — Due to the recent downturn in the industry, the larger firms with better access to capital have been the recent acquirers of larger acreage blocks. Because of scale, these bigger firms have been interested in purchasing large, contiguous blocks of acreage as opposed to smaller unique opportunities. We believe this has led to significant price increases for properly situated lease acreage within larger blocks versus smaller blocks where there is less competition, even if the resource economics per acre are similar. The Company will target buying these smaller parcels where we believe the price per acre is attractive relative to larger acreage packages.

Purchase Mineral Rights Underlying Familiar Properties — We will seek to purchase mineral rights underneath acreage in the Marcellus Formation in West Virginia and Ohio held by MHRC. Our management team is very familiar with these properties. Following its recent reorganization, we expect MHRC, or its successor, will eventually actively drill these regions, where MHRC holds a significant leasehold acreage position in both West Virginia and Ohio.

Maintain Operating Control — We believe that operatorship provides the ability to maximize the value of our assets by allowing our experienced management team to control the timing of drilling expenditures, manage operational costs and enhance production volumes. Other than with respect to mineral interests we may acquire underneath the Marcellus acreage held by MHRC, we will, whenever possible, seek to serve as operator for the properties in which we acquire interests.

Employ State of the Art Technologies — We intend to utilize advanced technologies that should allow us to enhance our drilling and completion performance. Our technical team continually reviews the most current technologies and will apply those to our reserve base for the effective development of our project inventory. Our technical team intends to leverage management’s prior experience in the Eagle Ford and other unconventional plays, by using horizontal drilling and advanced frac completion methods in order to maximize value and return on investment.

Maintain Conservatively Capitalized Balance Sheet with Strong Liquidity Position — After giving effect to this offering, we will have approximately $ million of cash on the balance sheet. We have no debt. We currently intend to maintain a conservative approach to capitalizing our business and feel our lack of leverage will provide us a significant advantage in the current market environment.

Our Competitive Strengths

We believe that the following strengths will help us achieve our business goals:

Experienced and Incentivized Management Team — With decades of experience, our management team has a proven track record of building and operating businesses focused on the development and acquisition of oil and natural gas properties. We believe our team’s deep knowledge of the major resource plays and operational expertise provides us with a distinct competitive advantage. Additionally, our management’s extensive industry network provides us with access to top-tier industry partners, land owners and financial sponsors to help us identify and execute on attractive opportunities not generally known by others. Members of our senior management team have a significant economic interest in us, which will provide us a meaningful incentive to increase the value of our business for the benefit of all stockholders.

Attractive Initial Acreage Position — All of our current acreage is located in Karnes County, Texas along the Edwards Trend in the heart of the Eagle Ford Shale play. According to monthly production data compiled by the Railroad Commission of Texas, Karnes County is the top crude oil producing county in the State of Texas by volume. The Eagle Ford Shale play overlying the Edwards Trend is currently one of the most prolific liquids producers and currently generates some of the best economics in the Eagle Ford, even at recent commodity prices. Our assets provide development opportunities in a relatively mature, well-understood shale trend (as compared to other unconventional resource plays).

Stacked Pay Opportunities — We have identified 24 potential undeveloped horizontal drilling locations across our acreage position prospective for both the lower and upper Eagle Ford Shale formations, which includes six potential locations in the Lower Eagle Ford associated with our probable undeveloped reserves as of July 31, 2016. The lower Eagle Ford is approximately 185 feet thick with an average net pay thickness of 155 feet. The upper Eagle Ford is 67 feet thick with approximately 38 feet of net pay thickness. We also see the potential for additional locations in the Austin Chalk, which has yet to be evaluated by NSAI or our management.

5

Proven Horizontal Drilling Expertise and Technical Acumen in the Eagle Ford — Management has previously had success acquiring, developing, operating, and producing acreage in the region as well as others. Several members of our management team were integral in the grass roots development of an Eagle Ford project located just one county over from our current acreage position. Members of our team were key decision-makers at MHRC in growing an initial 2,000-net acre package into a 19,000-net acre asset through their knowledge of the specific land and geology, and relationships with landowners throughout the area. Ultimately, this asset produced 14,260 gross/5,277 net BOE/D at peak production for MHRC and was subsequently sold to a competitor.

Recent Events

Karnes County Leasehold Acquisitions

In July 2016, we closed on an acquisition of two separate lease blocks totaling approximately 427 gross (400 net) undeveloped acres located in the heart of the Eagle Ford Shale play overlying the Edwards Trend in Karnes County, Texas. The cost of the acquisition was $1,070,000. The total acreage position is prospective for both the lower and upper Eagle Ford Shale, as well as the Austin Chalk formation. There are no drilling commitments on this acreage until March 2017. The Company currently owns 93.75% of the working interest in these properties and will be the operator of record on all new wells drilled.

Implications of Being an “Emerging Growth Company”

As an issuer with less than $1 billion in total annual gross revenues during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act (the “JOBS Act”). An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| • | are not required to obtain an auditor attestation on our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| • | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); |

| • | are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

| • | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| • | may present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations, or MD&A; and |

| • | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify as a “smaller reporting company” under the Commission’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on our assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective

6

under the Securities Act of 1933, as amended (the “Securities Act”), or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1 billion in annual revenues, have more than $700 million in market value of our Common Stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period. Furthermore, under current Commission rules we will continue to qualify as a “smaller reporting company” for so long as we have a public float (i.e., the market value of common equity held by non-affiliates) of less than $75 million as of the last business day of our most recently completed second fiscal quarter.

Company and Other Information

The Company was formed in the State of Delaware on May 11, 2016. The Company’s principal executive office is located at 1048 Texan Trail, Grapevine, Texas 76051. Our telephone number is 469-440-8868. Our Internet address is www.energyhunter.energy. We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website a part of this Offering Circular.

7

We currently intend to use up to $34,000,000 of the net proceeds from this offering to fund our 2016 and 2017 capital expenditures on existing assets, including the drilling, development, and completion of initial wells on our Karnes County, Texas acreage. Additionally, we may use a portion of the proceeds to acquire additional acreage leaseholds, acquire additional producing properties and associated leaseholds, or for general corporate purposes.

8

Investing in our Common Stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this Offering Circular, before purchasing shares of our Common Stock. The risks set out below are not the only risks we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us might also impair our operations and performance. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our Common Stock, if a trading market develops, could decline and investors in our Common Stock could lose all or part of their investment.

Risks Related to our Company

We will require substantial additional capital in order to achieve commercial success and, if necessary, to finance future losses from operations as we endeavor to build our asset and revenue base, but we do not have any commitments to obtain such capital and we cannot assure you that we will be able to obtain adequate capital as and when required.

The business of oil and gas acquisition, drilling and development is very capital intensive and the level of operations attainable by an oil and gas company is directly linked to and limited by the amount of available capital. We believe that cash generated from oil and gas operations will not be sufficient to allow us to achieve our growth and other business objectives. Our ability to achieve commercial success and our continued growth will be dependent on our continued access to capital either through the additional sale of our equity securities, project financing, or joint ventures. Future equity financings may be dilutive to our stockholders and may involve preferred stock that has preferences or rights superior to our Common Stock. Project financings may involve a pledge of assets, and any debt we may incur will rank senior to our Common Stock. We cannot assure you that we will be able to raise additional capital from external sources, or enter into joint ventures or strategic partnerships, on satisfactory terms subsequent to this offering. Failure to raise additional capital subsequent to this offering, on favorable terms or at all, will have a material adverse effect on our development plans and operations and will likely cause us to curtail our planned operations.

We do not have a significant operating history and, as a result, there is a limited amount of information about us on which to base an investment decision.

In considering whether to invest in our Common Stock, you should consider that there is only limited historical financial and operating information available on which to base your evaluation of our performance. The Company was formed in May 2016 and, as a result, although our management team has significant experience in our industry, we have limited financial and operating information available.

We face challenges and uncertainties in financial planning as a result of the unavailability of historical data and uncertainties regarding the nature, scope and results of future activities. We may not be successful in implementing business strategies or in completing the development of the infrastructure necessary to conduct business as planned. In the event that our development plan is not completed or is delayed, operating results will be adversely affected and operations will differ materially from currently anticipated activities. As a result of industry factors or factors relating specifically to us, we may have to change our method of conducting business, which may cause a material adverse effect on results of operations and financial condition.

We have no proved reserves, and drilling operations may not yield any oil or natural gas in commercial quantities or quality. We intend to grow our business in part through the acquisition and development of additional exploratory oil and gas prospects, which is a highly risky method of establishing oil and gas reserves.

To date, we have acquired only approximately 427 gross (400 net) acres of prospective oil and gas properties. The estimated reserves on these properties consist of approximately 2,377.3 MBOE of oil and natural gas, all of which are classified as probable undeveloped reserves. Substantial exploration and development efforts will be required to establish the presence of proved reserves on these properties, and such efforts may not be successful. Moreover, we intend to grow our business by acquiring, drilling and developing additional exploratory oil and gas prospects, in addition to opportunistic acquisitions of producing properties or properties containing proved developed or proved undeveloped reserves that we believe have the potential for profitable production. Developing exploratory oil and gas properties requires significant capital expenditures and involves a high degree of financial risk. The budgeted costs of drilling, completing, and operating exploratory wells are often exceeded and can increase significantly when drilling costs rise. Drilling may be unsuccessful for many reasons, including title problems, unexpected drilling

9

conditions, weather conditions, delays by project participants, compliance with governmental requirements, shortages or delays in the delivery of equipment and services, cost overruns, and mechanical difficulties. Moreover, the successful drilling or completion of an exploratory oil or gas well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. We cannot assure you that any of the wells we drill will be productive or that we will recover all or any portion of our investment. If we are unable to successfully acquire and develop exploratory oil and gas prospects, our results of operations, financial condition and stock price will be materially adversely affected.

We may not act as an operator on many of our future prospects, which means we will be dependent on third parties for the exploration, development and production of any such leasehold interests.

An oil and gas operator is the party that takes primary responsibility for management of the day-to-day exploration, development and production activity relating to an oil and gas prospect. Part of our business strategy is to acquire operating interests in oil and natural gas properties whenever feasible. We will not always be able to do so. We anticipate that an industry partner will function as the operator for many of the oil and natural gas properties we acquire in the future. Our reliance on third party operators for the exploration, development and production of property interests subjects us to a number of risks, including our inability to control the amount and timing of costs and expenses of exploration, development and production and the risk that we may not be able to properly control the timing and quality of work conducted with respect to our projects.

We have limited management and staff and may be more dependent upon partnering arrangements.

As of September 1, 2016, we have six employees, including our executive officers. We intend to use the services of independent consultants and contractors to perform various professional services, including reservoir engineering, accounting, land, legal, environmental and tax services. We also intend to pursue alliances with partners in the areas of geological and geophysical services and prospect generation, evaluation and prospect leasing. Our planned dependence on third party consultants and service providers creates a number of risks, including but not limited to:

| • | the possibility that such third parties may not be available to us as and when needed; and |

| • | the risk that we may not be able to properly control the timing and quality of work conducted with respect to our projects. |

If we experience significant delays in obtaining the services of such third parties or poor performance by such parties, our results of operations and stock price may be materially adversely affected.

The loss of any of our executive officers could adversely affect us.

We currently have only six employees, including our four executive officers. We are dependent on the extensive experience of our executive officers to implement our acquisition and growth strategy. The loss of the services of any of our executive officers could have a negative impact on our operations and our ability to implement our business plan.

Our success is dependent on the prices of oil and natural gas. Low oil or natural gas prices and the substantial volatility in these prices may adversely affect our financial condition and ability to meet certain capital expenditure requirements and financial obligations.

The prices we will receive for oil and natural gas will heavily influence our revenue, profitability, cash flow available for capital expenditures and access to new capital and future rate of growth. Oil and natural gas are commodities and, therefore, their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile, and prices have declined significantly in recent periods. For example, during the period from January 1, 2014 through August 31, 2016, the WTI spot price for oil has declined from a high of $107.62 per Bbl on July 23, 2014 to $26.21 per Bbl on February 11, 2016, and the Henry Hub spot price for natural gas has declined from a high of $7.92 per MMBtu on March 4, 2014 to a low of $1.49 per MMBtu on March 4, 2016. We believe that these markets will likely continue to be volatile in the future. The prices received for production, and the levels of production, depend on numerous factors. These factors include the following:

| • | worldwide and regional economic conditions impacting the global supply and demand for oil and natural gas; |

| • | the prices and availability of competitors’ supplies of oil and natural gas; |

10

| • | the actions of the Organization of Petroleum Exporting Countries, or OPEC, and state-controlled oil companies relating to oil price and production controls; |

| • | the price and quantity of foreign imports; |

| • | the impact of U.S. dollar exchange rates on oil and natural gas prices; |

| • | domestic and foreign governmental regulations and taxes; |

| • | speculative trading of oil and natural gas futures contracts; |

| • | the availability, proximity and capacity of gathering and transportation systems for natural gas; |

| • | the availability of refining capacity in proximity to company assets; |

| • | the prices and availability of alternative fuel sources; |

| • | weather conditions and natural disasters; |

| • | political conditions in or affecting oil and natural gas producing regions, including the Middle East and South America; |

| • | the continued threat of terrorism and the impact of military action and civil unrest; |

| • | public pressure on, and legislative and regulatory interest within, federal, state and local governments to stop, significantly limit or regulate hydraulic fracturing activities; |

| • | the level of both U.S. and global oil and natural gas inventories and exploration and production activity; |

| • | the impact of energy conservation efforts; |

| • | technological advances affecting energy consumption; and |

| • | overall worldwide economic conditions. |

In the second half of 2014, oil prices began a rapid and significant decline as the global oil supply began to outpace demand. During 2015 and thus far in 2016, the global oil supply has continued to outpace demand, resulting in a sustained decline in realized prices for oil production. In general, this imbalance between supply and demand reflects the significant supply growth achieved in the United States as a result of shale drilling and oil production increases by certain other countries, including Russia and Saudi Arabia, as part of an effort to retain market share, combined with only modest demand growth in the United States and less-than-expected demand in other parts of the world, particularly in Europe and China. Although there has been a dramatic decrease in drilling activity in the industry, oil storage levels in the United States remain at historically high levels. Until supply and demand balance and the overhang in storage levels begins to decline, prices are expected to remain under pressure. In addition, the lifting of economic sanctions on Iran has resulted in increasing supplies of oil from Iran, adding further downward pressure to oil prices. Prices for domestic natural gas began to decline during the third quarter of 2014 and have continued to be weak throughout 2015 and thus far in 2016. The declines in natural gas prices are primarily due to a significant imbalance between supply and demand across North America. The duration and magnitude of the commodity price declines cannot be accurately predicted.

Lower oil and natural gas prices will reduce our future cash flows, borrowing ability and the present value of estimated reserves. Exploration, development and exploitation projects require substantial capital expenditures, and, if prices are lower, we may be unable to obtain needed capital or financing on satisfactory terms, which could lead to expiration of leases or a decline in oil and natural gas reserves. Lower oil and natural gas prices may also reduce the amount of oil and natural gas that we can produce economically and may affect any estimated proved reserves we are ultimately able to establish. The present value of future net revenues from estimated proved reserves will not necessarily be the same as the current market value of estimated oil and natural gas reserves.

Drilling for oil and natural gas is a speculative activity and involves numerous risks and substantial and uncertain costs that could adversely affect us.

Our success will depend on the success of our drilling program. There is no way to predict in advance of drilling and testing whether any particular prospect will yield oil or natural gas in sufficient quantities to recover drilling or completion costs or to be economically viable. The use of seismic data and other technologies and the study of producing fields in the same area will not enable us to know conclusively prior to drilling whether oil or natural gas

11

will be present or, if present, whether oil or natural gas will be present in commercial quantities. We cannot assure you that the analogies drawn from available data from other wells, more fully explored prospects or producing fields will be applicable to current drilling prospects.

The budgeted costs of planning, drilling, completing and operating wells are often exceeded and such costs can increase significantly due to various complications that may arise during the drilling and operating processes. Before a well is spud, we may incur significant geological and geophysical (seismic) costs, which are incurred regardless of whether a well eventually produces commercial quantities of hydrocarbons, or is drilled at all. Exploration wells endure a much greater risk of loss than development wells. The analogies drawn from available data from other wells, more fully explored locations or producing fields may not be applicable to current drilling locations. If actual drilling and development costs are significantly more than the current estimated costs, we may not be able to continue operations as proposed and could be forced to modify drilling plans accordingly. Drilling for oil and natural gas involves numerous risks, including the risk that no commercially productive oil or natural gas reservoirs will be discovered. The cost of drilling, completing, and operating wells is substantial and uncertain, and drilling operations may be curtailed, delayed, or canceled as a result of a variety of factors beyond our control, including:

| • | unexpected or adverse drilling conditions; |

| • | elevated pressure or irregularities in geologic formations; |

| • | equipment failures or accidents; |

| • | adverse weather conditions; |

| • | compliance with governmental requirements; and |

| • | shortages or delays in the availability of drilling rigs, crews, and equipment. |

We may purchase oil and natural gas properties with liabilities or risks that we do not know about or that we do not assess correctly, and, as a result, could be subject to liabilities that could adversely affect results of operations.

Before acquiring oil and natural gas properties, we estimate the reserves, future oil and natural gas prices, and operating costs. We also review land records which affect ownership, potential environmental liabilities and other factors relating to the properties. However, this review involves many assumptions and estimates, and their accuracy is inherently uncertain. As a result, we may not discover all existing or potential problems associated with the properties being purchased. We may not become sufficiently familiar with the properties to assess fully the deficiencies and capabilities. We do not generally perform inspections on every well or property, and therefore may not be able to observe mechanical and environmental problems even when an inspection is conducted. The seller may not be willing or financially able to give contractual protection against any identified problems, and we may decide to assume land, environmental and other liabilities in connection with properties acquired. If we acquire properties with risks or liabilities that were unknown or not assessed correctly, our financial condition, results of operations and cash flows could be adversely affected as claims are settled and cleanup costs related to these liabilities are incurred.

Our reserve estimates depend, and our future reserve estimates will depend, on many assumptions that may turn out to be inaccurate. Any material inaccuracies in our reserve estimates or underlying assumptions will materially affect the quantities and present value of our reserves.

The process of estimating oil and natural gas reserves is complex. It requires interpretations of available technical data and many assumptions, including assumptions relating to economic factors. Any significant inaccuracies in these interpretations or assumptions could materially affect the estimated quantities and the calculation of the present value of reserves shown in these estimates.

In order to prepare reserve estimates in our reports, we will typically engage an independent petroleum consultant. The consultant will need to project production rates and timing of development expenditures. Our independent petroleum consultants will also analyze available geological, geophysical, production and engineering data. The extent, quality and reliability of this data can vary and may not be in our control. The process also requires economic assumptions about matters such as oil and natural gas prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. Therefore, estimates of oil and natural gas reserves are inherently imprecise.

Actual future production, oil and natural gas prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil and natural gas reserves will most likely vary from our estimates. Any significant

12

variance could materially affect the estimated quantities and present value of our reserves. In addition, our independent petroleum consultants may adjust estimates of proved reserves to reflect production history, drilling results, prevailing oil and natural gas prices and other factors, many of which are beyond our control.

The marketability of our future production is dependent upon oil and natural gas gathering and transportation facilities owned and operated by third parties, and the unavailability of satisfactory oil and natural gas transportation arrangements would have a material adverse effect on revenue.

The unavailability of satisfactory oil and natural gas transportation arrangements may hinder our access to oil and natural gas markets or delay production from wells. The availability of a ready market for our oil and natural gas production depends on a number of factors, including the demand for, and supply of, oil and natural gas and the proximity of estimated reserves to pipelines and terminal facilities. Our ability to market production depends in substantial part on the quality of our oil and gas production, availability and capacity of gathering systems, pipelines and processing facilities owned and operated by third parties. Failure to obtain these services on acceptable terms could materially harm our business. As a result, we may be required to shut in wells for lack of a market or because of inadequacy or unavailability of pipeline or gathering system capacity. If that were to occur, we would be unable to realize revenue from those wells until arrangements were made to deliver production to market. Furthermore, if we were required to shut in wells we might also be obligated to pay shut-in royalties to certain mineral interest owners in order to maintain our leases. The disruption of third party facilities due to maintenance and/or weather could negatively impact our ability to market and deliver our products. These third parties may control when or if such facilities are restored and what prices will be charged.

Hedging transactions may limit our potential gains or result in losses.

In order to manage our exposure to price risks in the marketing of our oil and natural gas, we intend from time to time to enter into financial oil and gas price hedging arrangements with respect to a portion of our future proved, developed-producing production. While these contracts are intended to reduce the effects of volatile oil and natural gas prices, they may also limit our potential gains if oil and natural gas prices were to rise substantially over the price established by the contract. In addition, such transactions may expose us to the risk of financial loss in certain circumstances, including instances in which:

| • | there is a change in the expected differential between the underlying price in the hedging agreement and actual prices received; |

| • | our production and/or sales of oil or natural gas are less than expected; |

| • | payments owed under derivative hedging contracts come due prior to receipt of the hedged month’s production revenue; or |

| • | the other party to the hedging contract defaults on its contract obligations. |

We cannot assure you that any financial hedging transactions we may enter into will adequately protect us from declines in the prices of oil and natural gas. On the other hand, where we choose not to engage in hedging transactions in the future, we may be more adversely affected by adverse changes in oil and natural gas prices than our competitors who engage in hedging transactions. In addition, the counterparties under our derivatives contracts may fail to fulfill their contractual obligations to us.

We may have difficulty managing growth in our business, which could adversely affect our financial condition and results of operations.

We are a start-up company with few assets and very limited operating history. We will have to grow significantly to achieve our business plan. If we are able to achieve significant growth in the size and scope of our operations, that could place a strain on our financial, technical, operational and management resources. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrences of unexpected expansion difficulties, including the failure to recruit and retain experienced managers, geologists, engineers and other professionals in the oil and gas industry, could have a material adverse effect on our business, financial condition and results of operations and our ability to timely execute our business plans.

13

We are exposed to operating hazards and uninsured risks. Our operations are subject to the risks inherent in the oil and natural gas industry, including the risks of:

| • | fire, explosions and blowouts; |

| • | pipe failure; |

| • | abnormally pressured formations; and |

| • | environmental accidents such as oil spills, natural gas leaks, ruptures or discharges of toxic gases, brine or well fluids into the environment (including groundwater contamination). |

These events may result in substantial losses to us from:

| • | injury or loss of life; |

| • | severe damage to or destruction of property, natural resources and equipment; |

| • | pollution or other environmental damage; |

| • | clean-up responsibilities; |

| • | regulatory investigation; |

| • | penalties and suspension of operations; or |

| • | attorneys’ fees and other expenses incurred in the prosecution or defense of litigation. |

As is customary in our industry, we intend to maintain insurance against some, but not all, of these risks. We cannot assure you that our insurance will be adequate to cover these losses or liabilities. We do not intend to carry business interruption insurance. Losses and liabilities arising from uninsured or underinsured events may have a material adverse effect on our financial condition and operations.

The producing wells in which we will have an interest may occasionally experience reduced or terminated production. These curtailments can result from mechanical failures, contract terms, pipeline and processing plant interruptions, market conditions and weather conditions. These curtailments can last from a few days to many months.

Risks Relating to the Oil and Gas Industry

Our industry is highly competitive, which may adversely affect our performance, including our ability to participate in ready-to-drill prospects in our core areas.

We operate in a highly competitive environment. In addition to capital, the principal resources necessary for the exploration and production of oil and natural gas are:

| • | leasehold prospects under which oil and natural gas reserves may be discovered; |

| • | drilling rigs, hydraulic fracturing equipment, and related equipment to explore for such reserves; and |

| • | knowledgeable personnel to conduct all phases of oil and natural gas operations. |

We must compete for such resources with both major oil and natural gas companies and independent operators. Many of these competitors have financial and other resources substantially greater than ours. We cannot assure you that such materials and resources will be available when needed. If we are unable to access material and resources when needed, we risk suffering a number of adverse consequences, including:

| • | the breach of our obligations under the oil and gas leases by which we hold our prospects and the potential loss of those leasehold interests; |

| • | loss of reputation in the oil and gas community; |

| • | a general slow-down in our operations and decline in revenue; and |

| • | decline in market price of our Common Stock. |

14

We are subject to numerous laws and regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to extensive federal, state and local laws and regulations relating to the exploration, production and sale of oil and natural gas, and operating safety. Future laws or regulations, any adverse change in the interpretation of existing laws and regulations or our failure to comply with existing legal requirements may result in substantial penalties and harm to our business, results of operations and financial condition. We may be required to make large and unanticipated capital expenditures to comply with governmental regulations, such as:

| • | land use restrictions; |

| • | lease permit restrictions; |

| • | drilling bonds and other financial responsibility requirements, such as plugging and abandonment bonds; |

| • | spacing of wells; |

| • | unitization and pooling of properties; |

| • | safety precautions; |

| • | operational reporting; and |

| • | taxation. |

Under these laws and regulations, we could be liable for:

| • | personal injuries; |

| • | property and natural resource damages; |

| • | well reclamation cost; and |

| • | governmental sanctions, such as fines and penalties. |

Our operations could be significantly delayed or curtailed and our cost of operations could significantly increase as a result of regulatory requirements or restrictions. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations. It is also possible that a portion of our oil and gas properties could be subject to eminent domain proceedings or other government takings for which we may not be adequately compensated.

Our operations may incur substantial expenses and resulting liabilities from compliance with environmental laws and regulations. Our oil and natural gas operations are subject to stringent federal, state and local laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. These laws and regulations:

| • | require the acquisition of a permit before construction, drilling, and certain other activities commence; |

| • | restrict the types, quantities and concentration of substances that can be released into the environment in connection with drilling and production activities; |

| • | require the installation of pollution control equipment in connection with operations; |

| • | require remedial measures to mitigate pollution from former and ongoing operations, such as site restoration, pit closure, and plugging of abandoned wells; |

| • | limit or prohibit drilling activities on certain lands lying within wilderness, wetlands , endangered species habitat, and other protected areas; and |

| • | impose substantial liabilities for pollution resulting from our operations. |

Failure to comply with these laws and regulations may result in:

| • | the assessment of administrative, civil and criminal penalties; |

| • | incurrence of investigatory or remedial obligations; and |

| • | the imposition of injunctive relief. |

15

Changes in environmental laws and regulations occur frequently and any changes that result in more stringent or costly waste handling, including water disposal, storage, transport, disposal or cleanup requirements could require us to make significant expenditures to reach and maintain compliance and may otherwise have a material adverse effect on our industry in general and on our own results of operations, competitive position or financial condition. Under these environmental laws and regulations, we could be held strictly liable for the removal or remediation of previously released materials or property contamination. This could occur regardless of whether we were responsible for the release or contamination or if our operations met previous standards in the industry at the time they were performed. Our permits will require that we report any incidents that cause or could cause environmental damages.

The unavailability or high cost of drilling rigs, hydraulic fracturing equipment and crews, or oil field equipment, supplies or personnel could adversely affect our ability to execute our exploration and development plans.

The oil and gas industry is cyclical and, from time to time, there are shortages of drilling rigs, hydraulic fracturing equipment and crews, and oil field equipment, supplies or qualified personnel. During these periods, the costs of rigs, equipment and supplies may increase substantially and their availability may be limited. In addition, the demand for, and wage rates of qualified personnel, including drilling rig or hydraulic fracturing crews, may rise as the number of rigs in service increases. If drilling rigs, equipment, supplies or qualified personnel are unavailable to us due to excessive costs or demand or otherwise, our ability to execute our exploration and development plans and, as a result, our financial condition and results of operations, could be materially and adversely affected.

Current water regulation relating to hydraulic fracturing, particularly water source and groundwater regulation, could result in increased operational costs, operating restrictions and delays.

Hydraulic fracturing uses large amounts of water. It can require between three to five million gallons of water per horizontal well. We may face regulatory concerns in both the sourcing and the disposal of water used in hydraulic fracturing. In addition, hydraulic fracturing produces water that must be treated and disposed of in accordance with applicable regulatory requirements.

First, as to sourcing water for hydraulic fracturing, we will need to secure water from the local water supply or make alternative arrangements. In order to source water from the local water supply for hydraulic fracturing, we may need to pay premium rates and be subject to a lower priority if the local area becomes subject to water restrictions. We may also seek water from alternative providers supporting the hydraulic fracturing industry. If we have an insufficient water supply, we may be unable to engage in hydraulic fracturing until such supply is located.

Second, hydraulic fracturing produces water that must be treated and disposed of in accordance with applicable regulatory requirements. Environmental regulations governing the withdrawal, storage and use of surface water or groundwater necessary for hydraulic fracturing may increase operating costs and cause delays, interruptions or termination of operations, the extent of which cannot be predicted, all of which could have an adverse effect on operations and financial performance. Our ability to remove and dispose of water will affect production, and the cost of water treatment and disposal may affect our ability to achieve or maintain profitability. The imposition of new environmental initiatives and regulations could also include restrictions on our ability to conduct hydraulic fracturing or disposal of produced water, drilling fluids and other substances associated with the exploration, development and production of oil and natural gas.

Federal and state legislation and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays.

Hydraulic fracturing involves the injection of water, sand or other propping agents and chemicals under pressure into rock formations to stimulate hydrocarbon production. We intend to routinely use hydraulic fracturing to produce commercial quantities of oil, liquids and natural gas. Sponsors of bills before the Senate and House of Representatives have asserted that chemicals used in the fracturing process could adversely affect drinking water supplies. Such legislation, if adopted, could increase the possibility of litigation and establish an additional level of regulation at both the federal and state levels that could lead to operational delays or increased operating costs and could, and in all likelihood would, result in additional regulatory burdens, making it more difficult to perform hydraulic fracturing operations and increasing our costs of compliance. Moreover, the Environmental Protection Agency (the “EPA”) is conducting a comprehensive research study on the potential adverse impacts that hydraulic fracturing may have on drinking water and groundwater. Consequently, even if federal legislation is not adopted soon or at all, the results of the hydraulic fracturing study by the EPA, or the results of other similar studies, could spur further action at a later date towards federal legislation and regulation of hydraulic fracturing or similar production operations.

16

In addition, a number of states or local municipalities are considering or have implemented more stringent regulatory requirements applicable to fracturing, which could include a moratorium on drilling and effectively prohibit further production of oil, liquids or natural gas through the use of hydraulic fracturing or similar operations.

The adoption of new laws or regulations imposing reporting obligations on, or otherwise limiting, the hydraulic fracturing process could make it more difficult to complete oil and natural gas wells. In addition, if hydraulic fracturing becomes regulated at the federal level as a result of federal legislation or regulatory initiatives by the EPA, fracturing activities could become subject to additional permitting requirements, and also to attendant permitting delays and potential increases in cost, which could adversely affect business and results of operations.

Proposed tax and other legislation may materially impact our financial performance.

On February 9, 2016, the Obama Administration released its 2017 Budget Proposal. Targeted tax changes include: (i) a $10.25 per barrel tax on crude oil; (ii) increases in the oil spill liability trust fund financing; (iii) reinstatement of superfund taxes; (iv) the elimination of certain fossil fuel tax preferences, such as the enhanced oil recovery credit, the credit for oil and gas produced from marginal wells, expensing of intangible drilling costs, the deduction for tertiary injectants, percentage depletion for oil and natural gas wells, and the domestic manufacturing deduction for oil and natural gas production; and (v) increasing the geological and geophysical amortization period for independent producers to seven years. It is unclear whether these or similar changes will be enacted and, if enacted, how soon any such changes could become effective. Any of these proposed, or similar, changes, if enacted by Congress, could have a material impact on our financial performance and negatively impact the value of an investment in our Common Stock.

Risks Relating to our Common Stock

There has been no public market for our Common Stock prior to this offering, and an active market in which investors can resell their shares may not develop.

Prior to this offering, there has been no public market for our Common Stock. We cannot predict the extent to which an active market for our Common Stock will develop or be sustained after this offering, or how the development of such a market might affect the market price of our Common Stock. The initial offering price of our Common Stock in this offering has been agreed to between us and the underwriters based on a number of factors, including market conditions in effect around the time of this offering, and it may not be in any way indicative of the price at which our shares of Common Stock will trade following the completion of this offering. Even if a trading market develops, investors may not be able to resell their shares of Common Stock at or above the initial offering price.

We do not anticipate an immediate market for our shares.

We have not yet obtained an exchange listing or an over-the-counter quotation, which are pre-requisites to liquidity for our Common Stock. We intend to apply to have our Common Stock listed on the NYSE MKT market, but there is no assurance that this exchange will approve our Common Stock for listing.

Our Chairman and Chief Executive Officer beneficially owns a significant percentage of our stock and will be able to exert significant influence over matters subject to stockholder approval.

As of the date of this Offering Circular, our Chairman and Chief Executive Officer beneficially owns 50% of our outstanding Common Stock and will continue to own more than [ ]% after the offering. See “Principal Stockholders.” Therefore, he will have the ability to influence us through this ownership position. Our Chairman and Chief Executive Officer may be able to significantly affect matters requiring stockholder approval, including elections of directors, amendments of our organizational documents, and approval of any merger, sale of assets, or other major corporate transaction. This may prevent or discourage unsolicited acquisition proposals or offers for our Common Stock that you may believe are in your best interest as one of our stockholders.

You will experience immediate and substantial dilution as a result of this offering.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of our Common Stock in this offering at an assumed public offering price of $ per share, which is the midpoint of the range set forth on the cover page of this Offering Circular, and after deducting the underwriting discount and commissions and estimated offering expenses payable by us, investors in this offering can expect an immediate dilution of $ per share. See “Dilution.”

17

We may not be able to satisfy listing requirements of the NYSE MKT to maintain a listing of our Common Stock.

If our Common Stock is listed on the NYSE MKT, we must meet certain financial and liquidity criteria to maintain such listing. If we fail to meet any of the NYSE MKT’s listing standards, our Common Stock may be delisted. In addition, our board may determine that the cost of maintaining our listing on a national securities exchange outweighs the benefits of such listing. A delisting of our Common Stock from the NYSE MKT may materially impair our stockholders’ ability to buy and sell our Common Stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our Common Stock. In addition, the delisting of our Common Stock could significantly impair our ability to raise capital.