An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

Ronn Motor Group, Inc. |

(Exact name of registrant as specified in its charter) |

ASU SkySong Innovation and Research Center

1475 S. Scottsdale Road

Suite 200

Scottsdale, Arizona 85257

480-884-1602)

January [ ], 2017

(Date of offering circular)

Up to 20,000,000 Shares of Common Stock

Ronn Motor Group, Inc. (the “Company”, “we” or “our”) is offering 18,500,000 shares of our common stock, par value $0.001 per share (the “Common Stock”) to be sold in this Offering. The selling stockholder identified in this offering circular, who is our chief executive officer and sole director is offering 1,500,000 shares of Common Stock to be sold in this Offering, for a total of 20,000,000 shares of Common Stock (the “Shares”). The Shares are being offered at a purchase price of $2.50 per Share, up to an aggregate purchase price of $50,000,000, before deduction of offering expenses. [See [“Securities Being Offered”] beginning on page [___] of this offering circular for more information regarding the securities.]

This Offering is being conducted on a "best efforts" basis by our officers, directors and employees, and may be offered through broker-dealers who are registered with the Financial Industry Regulatory Authority ("FINRA"), or through other independent referral sources. As of the date of this offering circular, (i) no selling agreements had been entered into by us with any broker-dealer firms, although we expect to enter into an administrative agreement with a FINRA registered broker-dealer, and (ii) no posting agreements had been entered into by us with any crowdfunding websites, although we expect to enter into a posting agreement with a similar service provider selected by our management (such service provider is referred to as “Portal Provider”). Selling commissions may be paid to broker-dealers who are members of FINRA with respect to sales of shares made by them and compensation may be paid to consultants in connection with the offering of shares. We may also pay incentive compensation to registered broker-dealers in the form of common stock and warrants in us. We will indemnify participating broker-dealers and others with respect to disclosures made in the offering circular. Our executive officers, directors and employees will not receive any commission or any other remuneration for any sales of Shares. In offering Shares on our behalf, our executive officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934. If all Shares are purchased, the aggregate gross proceeds to us will be $46,250,000. However, since the Offering is being conducted on a "best efforts" basis, there is no minimum number of Shares that must be sold. Accordingly, all funds raised in this Offering will become immediately available to us and the selling stockholder, and may be used as they are accepted. Investors will not be entitled to a refund and could lose their entire investment.

|

| Price to Public |

|

| Underwriting Discount and Commissions(1) |

|

| Proceeds to issuer(2) |

|

| Proceeds to Other persons(3) |

| ||||

Per share: |

| $ | 2.50 |

|

| $ | 0.00 |

|

| $ | 2.50 |

|

| $ | 2.50 |

|

Total Maximum: |

| $ | 50,000,000 |

|

| $ | 3,500,000 |

|

| $ | 42,717,000 |

|

| $ | 3,750,000 |

|

Total Minimum: |

| $ | 0.00 |

|

| $ | 0.00 |

|

| $ | 0.00 |

|

| $ | 0.00 |

|

___________

| (1) | This Offering is being conducted on a "best efforts" basis by our officers, directors and employees, and may be offered through broker-dealers who are registered with the Financial Industry Regulatory Authority ("FINRA"), or through other independent referral sources. As of the date of this offering circular, (i) no selling agreements had been entered into by us with any broker-dealer firms, although we expect to enter into an administrative agreement with a FINRA registered broker-dealer, and (ii) no posting agreements had been entered into by us with any crowdfunding websites, although we expect to enter into a posting agreement with a Portal Provider. Selling commissions may be paid to broker-dealers who are members of FINRA with respect to sales of shares made by them and compensation may be paid to consultants in connection with the offering of shares. We may also pay incentive compensation to registered broker-dealers in the form of common stock and warrants in us. We will indemnify participating broker-dealers and others with respect to disclosures made in the offering circular. |

|

|

| (2) | After deducting expenses of the Offering, which are estimated to be approximately $33,000 and are in addition to the estimated underwriting discounts and commissions of $3,500,000. We will receive the proceeds from the sale of 18,500,000 shares of common stock if all Shares are sold. |

|

|

| (3) | Our chief executive officer and sole director is offering 1,500,000 shares of common stock to be sold in this Offering. |

We will continue the Offering until Shares with an aggregate sales price of $50,000,000 has been sold or until December 31, 2017, whichever is earlier. [See “Plan of Distribution and Selling Securityholders” beginning on page [___] of this offering circular for more information regarding these arrangements.]

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Our business and an investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page [___] of this offering circular for a discussion of information that you should consider before investing in our securities.

This offering circular is in the disclosure format required by Form 1-A (17 CFR 239.90) for securities offerings made pursuant to Regulation A (17 CFR 230.251 et seq.)

Approximate date of commencement of proposed sale to the public: January [___], 2017.

| 1 |

|

| Page |

| |

|

|

|

| |

|

| 3 |

| |

|

|

|

|

|

|

| 13 |

| |

|

|

|

|

|

|

| 15 |

| |

|

|

|

|

|

|

| 16 |

| |

|

|

|

|

|

|

| 19 |

| |

|

|

|

|

|

Cautionary Note Regarding Forward-Looking Statements and Industry Data |

|

| 20 |

|

|

|

|

|

|

|

| 20 |

| |

|

|

|

|

|

|

| 27 |

| |

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| 27 |

|

|

|

|

|

|

|

| 29 |

| |

|

|

|

|

|

|

| 31 |

| |

|

|

|

|

|

Security Ownership of Management and Certain Securityholders |

|

| 32 |

|

|

|

|

|

|

|

| 32 |

| |

|

|

|

|

|

|

| 33 |

| |

|

|

|

|

|

|

| 34 |

| |

|

|

|

|

|

|

| 35 |

| |

|

|

|

|

|

Description of Exhibits |

|

|

|

|

| 2 |

Any investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this offering circular before deciding whether to purchase our common stock. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This offering circular also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this offering circular.

Risks Related to Our Business and Industry

We have a limited operating history and a history of operating losses, and expect to incur significant additional operating losses.

We are an early stage company and there is limited historical financial information upon which to base an evaluation of our performance. Our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in their early stages of operations. We have generated net losses since we began operations, and have not generated any revenue. We expect to incur substantial additional net expenses over the next several years as our research, development and commercial activities increase. The amount of future losses and when, if ever, we will achieve profitability are uncertain. Our ability to generate revenue and achieve profitability will depend on, among other things, successful completion of the Phoenix (see “Description of the Business – Ronn Motor Group, Inc.” beginning on page [_] of this offering circular for information about the Phoenix) and our other planned products; successfully developing technologies and entering into agreements for use of other parties’ technologies or products; successfully negotiating with automobile and automobile parts manufacturers; entering into successful manufacturing, sales and marketing arrangements; and raising sufficient funds to finance our activities. If we are unsuccessful at some or all of these undertakings, our business, prospects and results of operations may be materially adversely affected.

We are an early-stage company with an unproven business strategy and may never achieve commercialization of our proposed products or profitability.

We are at an early stage of development and commercialization of our technologies and product candidates. We have not yet fully developed any of our proposed products, or technologies, and we have not begun to market any products or technologies, and, accordingly, have not begun to generate revenues. Our products and technologies will require significant additional testing and investment prior to commercialization. A commitment of substantial resources by ourselves and, potentially, our partners to conduct time-consuming research and testing will be required if we are to complete the development of our products and technologies. There can be no assurance that our products will meet applicable regulatory standards, obtain required regulatory approvals, be capable of being produced in commercial quantities at reasonable costs or be successfully marketed.

If we are unable to keep up with rapid technological changes in our field or compete effectively, we will be unable to operate profitably.

We are engaged in a rapidly changing field. Other products that will compete directly with the products that we are seeking to develop and market currently exist or are being developed. Competition from fully integrated automobile manufacturers and related technology companies is intense and is expected to increase. Most of these companies have significantly greater financial resources and expertise in discovery, development, testing, manufacturing and marketing than us. Smaller companies may also prove to be significant competitors, particularly through collaborative arrangements with large automobile manufacturers and related technology companies. Many of these competitors have significant products that are developed or at an advanced stage of development and operate large, well-funded technology discovery and development programs. There is no assurance that our competitors will not develop more efficient, effective or more affordable products, or achieve earlier patent protection or product commercialization, than our own.

| 3 |

| Table of Contents |

If we are unable to establish sales, marketing and distribution capabilities or enter into acceptable sales, marketing and distribution arrangements with third parties, we may not be successful in commercializing any products that we may develop.

We do not have a sales, marketing or distribution infrastructure and have limited experience in the sale, marketing or distribution of our planned products. To achieve commercial success for any products we develop, we must develop a sales and marketing organization, outsource these functions to third parties, or license our products to others. We may not be able license our products on reasonable terms, if at all. The development of sales, marketing and distribution capabilities will require substantial resources, will be time-consuming and could delay any product launch. If the commercial launch of any products for which we recruit a sales force and establish marketing and distribution capabilities is delayed or does not occur for any reason, we could have prematurely or unnecessarily incurred these commercialization costs. Such a delay may be costly, and our investment could be lost if we cannot retain or reposition our sales and marketing personnel.

We expect to seek one or more strategic partners for commercialization of our products outside the United States. As a result of entering into arrangements with third parties to perform manufacturing, sales, marketing and distribution services, our product revenues or the profitability of these product revenues may be lower, perhaps substantially lower, than if we were to directly manufacture market and sell products in those markets. Furthermore, we may be unsuccessful in entering into the necessary arrangements with third parties or may be unable to do so on terms that are favorable to us. In addition, we may have little or no control over such third parties, and any of them may fail to devote the necessary resources and attention to manufacture, sell and market our products effectively.

If we do not establish manufacturing, sales and marketing capabilities, either on our own or in collaboration with third parties, we will not be successful in commercializing our products.

We face substantial competition from other automobile companies and our operating results may suffer if we fail to compete effectively.

The development and commercialization of new automotive technologies is highly competitive. We expect that we will face significant competition from major automotive companies and specialty automotive companies worldwide with respect to any of our product candidates that we may seek to develop or commercialize in the future.

We rely on key personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

We are dependent on the performance of Ronal Maxwell, who is our chief executive officer, sole director, and controlling stockholder. The loss of his services could have a material adverse effect on the Company’s business and prospects. Our chief financial officer is an independent contractor, not an employee, and devotes approximately twenty (20) hours per week to the Company’s business.

We currently have (1) full time employee. Our ability to manage growth effectively will require us to implement management systems and to recruit and train new employees. Although we expect to do so in the future, there can be no assurance that we will be able to successfully attract and retain skilled and experienced personnel.

Our success depends in large part upon our ability to attract and retain highly qualified personnel. We compete in our hiring efforts with other automobile technology companies, and we may have to pay higher salaries to attract and retain personnel, which would be very costly.

Our executive officers and directors may allocate their time to other businesses thereby causing conflicts of interest in their determination as to how much time to devote to our affairs. This conflict of interest could have a negative impact on our business and planned operations.

The Company is dependent on a receiving working capital through this offering to ensure that it is able to compensate its key executive officers to focus on our operations and business. Inability to compensate them would result in them either having to allocate their time to other sources of income outside the business or expose the Company to the risk that they will accept other full time employment. Our directors are not required to, and may not, commit their full time to our affairs, which may result in a conflict of interest in allocating their time between our operations and their other businesses. We estimate that our officers will dedicate an average of 40 hours per week to our affairs, but they may dedicate substantially less time to our affairs if the Company is not able to compensate them due to a lack of working capital. Each of our executive officers and directors may be engaged in several other business endeavors for which he may be entitled to substantial compensation and our executive officers are not obligated to contribute any specific number of hours per week to our affairs. If our executive officers are unable to devote substantial amounts of time to our affairs, it may have a negative impact on our business and planned operations.

| 4 |

| Table of Contents |

We may seek to enter into collaborations with third parties for the development and commercialization of our products. If we fail to enter into such collaborations, or such collaborations are not successful, we may not be able to capitalize on the market potential of our products.

We may seek third-party collaborators for development and commercialization of our products. Our likely collaborators for any marketing, distribution, development, licensing or broader collaboration arrangements include large and mid-size automobile and parts manufacturers, and specialty automobile and parts manufacturers. If we enter into any such arrangements, we may have limited control over the amount and timing of resources that our collaborators dedicate to the development or commercialization of our products. Our ability to generate revenues from these arrangements will depend on our collaborators’ abilities to successfully perform the functions assigned to them in these arrangements.

Our future success will be dependent upon our ability to design and achieve market acceptance of new vehicle models, and specifically the Phoenix EV.

Ronal Maxwell has allowed the use of the Scorpion to the Company so that we can create our new planned Next Generation Electric vehicle, which is not expected to be in production until the 3rd quarter of 2018 and requires significant investment prior to introduction, and may never be successfully developed or commercially successful. There can be no assurance that we will be able to design future models of performance eco-exotic vehicles, or other vehicles, that will meet the expectations of potential customers or that our future planned models will become commercially viable. In particular, it is common in the automotive industry for the production vehicle to have a styling and design different from that of the concept vehicle, which may happen with the Phoenix. To the extent that we are not able to build the production automobile to the expectations created by the early prototype and our anticipated specifications, future sales could be harmed. Additionally, historically, automobile customers have come to expect new and improved vehicle models to be introduced frequently. In order to meet these expectations, we may in the future be required to introduce on a regular basis new vehicle models as well as enhanced versions of existing vehicle models. As technologies change in the future for automobiles in general and performance eco-exotic and alternative fuel vehicles specifically, we will be expected to upgrade or adapt our vehicles and introduce new models in order to continue to provide vehicles with the latest technology.

We may experience significant delays in the design, manufacture, launch and financing of the Phoenix which could harm our business and prospects.

We currently intend to introduce our Phoenix in the third quarter of 2018. Any delay in the financing, design, manufacture and launch of the Phoenix could materially damage our brand, business, prospects, financial condition and operating results. Automobile manufacturers often experience delays in the design, manufacture and release of new vehicle models. We are in the initial design and development stages and currently do not have a drivable early prototype of the Phoenix or a manufacturing plan. Furthermore, we have not yet begun to evaluate, qualify or select suppliers of all the parts for the planned production of the Phoenix. We may not be able to engage suppliers for the components in a timely manner, at an acceptable price or in the necessary quantities. We will also need to do extensive testing to ensure that the Phoenix is in compliance with applicable National Highway Traffic Safety Administration (NHTSA) safety regulations and United States Environmental Protection Agency (EPA) emission regulations. If we are not able to manufacture and deliver our Phoenix in a timely manner and consistent with our budget and cost projections, our business, prospects, operating results and financial condition will be negatively impacted and our ability to grow our business will be harmed.

| 5 |

| Table of Contents |

If we are unable to adequately control the costs associated with operating our business, including our costs of manufacturing, sales and materials, our business, financial condition, operating results and prospects will suffer.

If we are unable to maintain a sufficiently low level of costs for designing, manufacturing, marketing, selling and distributing and servicing our vehicles, our operating results, gross margins, business and prospects could be materially and adversely impacted. We will be required to make significant investments for the design, manufacture and sales of our vehicles. There can be no assurances that our costs of producing and delivering the Phoenix will be less than the revenue we generate from sales of the Phoenix.

We will incur significant costs related to procuring the raw materials required to manufacture our high-performance cars, assembling vehicles and compensating our personnel. Additionally, in the future we may be required to incur substantial marketing costs and expenses to promote our vehicles, including through the use of traditional media such as television, radio and print. If we are unable to keep our operating costs aligned with the level of revenues we generate, our operating results, business and prospects will be harmed. Many of the factors that impact our operating costs are beyond our control. For example, the costs of our raw materials and components used in our vehicles could increase due to shortages as global demand for these products increases.

We are dependent on suppliers, some of which are single or limited source suppliers, and the inability of these suppliers to deliver, or their refusal to deliver, necessary components of our vehicles at prices and volumes acceptable to us would have a material adverse effect on our business, prospects and operating results.

While we expect to obtain components from multiple sources whenever possible, similar to other automobile manufacturers, many of the components used in our vehicles may be purchased by us from a single source. We refer to these component suppliers as our single source suppliers. To date we have not qualified alternative sources for most of the single sourced components expected to be used in our vehicles.

While we believe that we may be able to establish alternate supply relationships and can obtain or engineer replacement components for our single source components, we may be unable to do so in the short term or at all at prices or costs that are favorable to us.

Changes in business conditions, wars, governmental changes and other factors beyond our control or which we do not presently anticipate, could also affect suppliers’ ability to deliver components to us on a timely basis. Furthermore, if we experience significant increased demand, or need to replace our existing suppliers, there can be no assurance that additional supplies of component parts will be available when required on terms that are favorable to us, at all, or that any supplier would allocate sufficient supplies to us in order to meet our requirements or fill our orders in a timely manner. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to delays in vehicle deliveries to our customers, which could hurt our relationships with our customers and also materially adversely affect our business, prospects and operating results.

Our growth is dependent upon consumers’ willingness to adopt our vehicles and products.

Our growth is highly dependent upon the adoption by consumers of, and we are subject to an elevated risk of any reduced demand for, alternative fuel vehicles in general. If the market for our vehicles or products does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be harmed. The market for alternative fuel vehicles and related products is relatively new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements and changing consumer demands and behaviors. The influence of any of the factors described above may cause potential customers not to purchase our vehicles or products, which would materially adversely affect our business, operating results, financial condition and prospects.

| 6 |

| Table of Contents |

The operation of our vehicles is different from existing internal combustion engine vehicles and our customers may experience difficulty operating them properly.

The design of our vehicles may cause them to behave in ways that are unfamiliar to drivers of existing internal combustion vehicles and there can be no assurance that our customers will operate the vehicles properly. Any accidents resulting from such failure to operate our vehicles properly could harm our brand and reputation, result in adverse publicity and product liability claims, and have a material adverse effect on our business, prospects, financial condition and operating results. In addition, if consumers dislike these features, they may choose not to buy additional cars or products from us who could also harm our business and prospects.

Developments in alternative technologies or improvements in the internal combustion engine may materially adversely affect the demand for our vehicles and products.

Significant developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect our business and prospects in ways we do not currently anticipate. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of vehicles, which could result in the loss of competitiveness of our vehicles, decreased revenue and a loss of market share to competitors.

If we are unable to keep up with advances in vehicle technology, we may suffer a decline in our competitive position.

We may be unable to keep up with changes in vehicle technology and, as a result, may suffer a decline in our competitive position, if any. Any failure to keep up with advances in vehicle technology would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition. Our research and development efforts may not be sufficient to adapt to changes in vehicle technology. As technologies change, we plan to upgrade or adapt our planned vehicles and introduce new models in order to provide vehicles with the latest technology. However, our vehicles may not compete effectively with alternative vehicles if we are not able to source and integrate the latest technology into our vehicles.

If we are unable to design, develop market and sell vehicles and products that address additional market opportunities, our business, prospects and operating results will suffer.

We may not be able to successfully develop new vehicles, products and services, address new market segments or develop a customer base. To date, we have focused our business on the development and sale of high-performance vehicles and have targeted affluent consumers. We will need to address additional markets and expand our targeted customer demographic in order to grow our business. In particular, we intend the planned conversion kits to appeal to a broader base of potential customers. We have not completed the design, component sourcing or manufacturing process for the planned conversion kits, so it is difficult to forecast their eventual cost, manufacturability or quality. Therefore, there can be no assurance that we will be able to deliver the conversion kits that are ultimately competitive in the marketplace. Our failure to address additional market opportunities would harm our business, prospects, financial condition and operating results.

The automotive market is highly competitive, and we may not be successful in competing in this industry. We currently face competition from established competitors and expect to face competition from others in the future.

The worldwide automotive market, particularly for alternative fuel vehicles, is highly competitive today and we expect it will become even more so in the future. With respect to the Phoenix, we currently face strong competition from established automobile manufacturers, including manufacturers of high-performance vehicles.

| 7 |

| Table of Contents |

Most of our current and potential competitors have significantly greater financial, technical, manufacturing, marketing and other resources than we do and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale and support of their products. In addition, almost all of our competitors have longer operating histories and greater name recognition than we do. Our competitors are in a stronger position to respond quickly to new technologies and may be able to design, develop, market and sell their products more effectively.

We expect competition in our industry to intensify in the future in light of increased demand for alternative fuel vehicles, continuing globalization and consolidation in the worldwide automotive industry. Factors affecting

competition include product quality and features, innovation and development time, pricing, reliability, safety, fuel economy, customer service and financing terms. Increased competition may lead to lower vehicle unit sales and increased inventory, which may result in a further downward price pressure and adversely affect our business, financial condition, operating results and prospects. Our ability to successfully compete in our industry will be fundamental to our future success in existing and new markets and our market share. There can be no assurances that we will be able to compete successfully in our markets and planned markets. If our competitors introduce new cars or services that compete with or surpass the quality, price or performance of our planned cars or services, we may be unable to attract customers.

Demand in the automobile industry is highly volatile.

Volatility of demand in the automobile industry may materially and adversely affect our business, prospects, operating results and financial condition. The markets in which we plan to compete have been subject to considerable volatility in demand in recent periods. Demand for automobiles depends to a large extent on general, economic, political and social conditions in a given market and the introduction of new vehicles and technologies. As a new automobile manufacturer and low volume producer, we have less financial resources than more established automobile manufacturers to withstand changes in the market and disruptions in demand. Economic conditions and trends in other countries and regions where we plan to sell our vehicles will impact our business, prospects and operating results as well. Volatility in demand may lead to lower vehicle unit sales, which may result in downward price pressure and adversely affect our business, prospects, financial condition and operating results. These effects may have a more pronounced impact on our business given our smaller scale and financial resources as compared to many incumbent automobile manufacturers.

Difficult economic conditions may affect consumer purchases of luxury items, such as our performance vehicles.

Difficult economic conditions may cause a decline in the demand for our vehicles which could materially harm our business, prospects, financial condition and operating results. Accordingly, any events that have a negative effect on the United States economy or on foreign economies or that negatively affect consumer confidence in the economy, including disruptions in credit and stock markets, and actual or perceived economic slowdowns, may harm our business, prospects, financial condition and operating results.

Our financial results may vary significantly from period-to-period due to the seasonality of our business and fluctuations in our operating costs.

Our operating results may vary significantly from period-to-period due to many factors, including seasonal factors that may have an effect on the demand for our vehicles. Demand for new cars in the automobile industry in general, and for high-performance sports vehicles such as the Phoenix in particular, typically decline over the winter season, while sales are generally higher as compared to the winter season during the spring and summer months. It is difficult for us to judge the exact nature or extent of the seasonality of our business.

| 8 |

| Table of Contents |

If our vehicles fail to perform as expected, our ability to develop, market and sell our vehicles could be harmed.

Our vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. We have no frame of reference by which to evaluate our Phoenix upon which our business prospects depend. There can be no assurance that we will be able to detect and fix any defects in the vehicles prior to their sale to consumers. Any product defects or any other failure of our vehicles to perform as expected could harm our reputation and result in adverse publicity, lost revenue, delivery delays, product recalls, product liability claims, harm to our brand and reputation, and significant warranty and other expenses, and could have a material adverse impact on our business, financial condition, operating results and prospects.

We may not succeed in establishing or maintaining our brand, which would materially and adversely affect customer acceptance of our vehicles and components and our business, revenues and prospects.

Our business and prospects are heavily dependent on our ability to develop, maintain and strengthen our brand. Any failure to develop, maintain and strengthen our brand may materially and adversely affect our ability to sell the Phoenix and planned vehicles and components. If we do not establish, maintain and strengthen our brand, we may lose the opportunity to build a critical mass of customers. Promoting and positioning our brand will likely depend significantly on our ability to provide high quality vehicles. In addition, we expect that our ability to develop, maintain and strengthen our brand will also depend heavily on the success of our marketing efforts. The automobile industry is intensely competitive, and we may not be successful in building, maintaining and strengthening our brand. Many of our current and potential competitors have greater name recognition, broader customer relationships and substantially greater marketing resources than we do. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results will be materially and adversely impacted.

If our vehicle owners customize our vehicles with aftermarket products, the vehicle may not operate properly, which could harm our business.

Automobile enthusiasts may seek to customize our vehicles to modify its performance which could compromise vehicle safety systems. Such unauthorized modifications could reduce the safety of our vehicles and any injuries resulting from such modifications could result in adverse publicity which would negatively affect our brand and harm our business, prospects, financial condition and operating results.

The success of our business depends on attracting and retaining customers. If we are unable to do so, we will not be able to achieve profitability.

Our success depends on attracting potential customers to purchase our vehicles. If our prospective customers do not perceive our vehicles and services to be of sufficiently high value and quality, and appealing in aesthetics or performance, we may not be able to attract customers, and our business and prospects, operating results and financial condition would suffer as a result.

We may not be able to identify adequate strategic relationship opportunities, or form strategic relationships, in the future.

Strategic business relationships will be an important factor in the growth and success of our business. However, there are no assurances that we will be able to identify or secure suitable business relationship opportunities in the future or our competitors may capitalize on such opportunities before we do. If we are unable to successfully source and execute on strategic relationship opportunities in the future, our overall growth could be impaired, and our business, prospects and operating results could be materially adversely affected.

We are subject to various environmental and safety laws and regulations that could impose substantial costs upon us and cause delays in building our planned manufacturing facilities.

As an automobile manufacturer, we and our planned operations, both in the United States and abroad, are subject to national, state, provincial and/or local environmental, health and safety laws and regulations, including laws relating to the use, handling, storage, disposal and human exposure to hazardous materials. Environmental and health and safety laws and regulations can be complex, and we expect that our business and operations will be affected by future amendments to such laws or other new environmental and health and safety laws which may require us to change our operations, potentially resulting in a material adverse effect on our business. These laws can give rise to liability for administrative oversight costs, cleanup costs, property damage, bodily injury and fines and penalties. Capital and operating expenses needed to comply with environmental, health and safety laws and regulations can be significant, and violations may result in substantial fines and penalties, third party damages, suspension of production or a cessation of our operations.

| 9 |

| Table of Contents |

Contamination at properties we may own and operate, and properties to which hazardous substances were, or may be, sent by us, may result in liability for us under environmental laws and regulations, including, but not limited to the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), which can impose liability for the full amount of remediation-related costs without regard to fault, for the investigation and cleanup of contaminated soil and ground water, for building contamination and impacts to human health and for damages to natural resources. The costs of complying with environmental laws and regulations and any claims concerning noncompliance, or liability with respect to contamination in the future, could have a material adverse effect on our financial condition or operating results. We may face unexpected delays in obtaining the necessary permits and approvals required by environmental laws in connection with our planned manufacturing facilities that could require significant time and financial resources and delay our ability to operate these facilities, which would adversely impact our business prospects and operating results.

We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

We may become subject to product liability claims, which could harm our business, prospects, operating results and financial condition. The automobile industry experiences significant product liability claims and we face inherent risk of exposure to claims in the event our vehicles do not perform as expected or malfunction resulting in personal injury or death. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product liability claim could generate substantial negative publicity about our vehicles and business and inhibit or prevent commercialization of our vehicles and future vehicle candidates which would have material adverse effect on our brand, business, prospects and operating results. Any lawsuit seeking significant monetary damages may have a material adverse effect on our reputation, business and financial condition. We may not be able to secure product liability insurance coverage on commercially acceptable terms or at reasonable costs when needed.

We may need to defend ourselves against patent or trademark infringement claims, which may be time-consuming and would cause us to incur substantial costs.

Companies, organizations or individuals, including our competitors, may hold or obtain patents, trademarks or other proprietary rights that would prevent, limit or interfere with our ability to make, use, develop or sell our vehicles or components, which could make it more difficult for us to operate our business. From time to time, we may receive inquiries from holders of patents or trademarks inquiring whether we infringe their proprietary rights. Companies holding patents or other intellectual property rights relating to our vehicles and components may bring suits alleging infringement of such rights or otherwise asserting their rights and seeking licenses. In addition, if we are determined to have infringed upon a third party’s intellectual property rights, we may be required to do one or more of the following:

| · | cease selling, incorporating or using vehicles or components that incorporate the challenged intellectual property; |

| · | pay substantial damages; |

| · | obtain a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms or at all; or |

| · | re-design our vehicles or components. |

In the event of a successful claim of infringement against us and our failure or inability to obtain a license to the infringed technology, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs and diversion of resources and management attention.

| 10 |

| Table of Contents |

Our business will be adversely affected if we are unable to protect our intellectual property rights from unauthorized use or infringement by third parties.

Any failure to protect our proprietary rights adequately could result in our competitors offering similar products, potentially resulting in the loss of some of our competitive advantage and a decrease in our revenue which would adversely affect our business, prospects, financial condition and operating results. Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of trade secrets, including know-how, employee and third party nondisclosure agreements, copyright laws, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology.

The protection provided by the patent laws is and will be important to our future opportunities. However, such patents and agreements and various other measures we take to protect our intellectual property from use by others may not be effective for various reasons, including the following:

| · | any patents, if issued, may not be broad enough to protect our proprietary rights; |

| · | the costs associated with enforcing patents, if issued, confidentiality and invention agreements or other intellectual property rights may make aggressive enforcement impracticable; |

| · | current and future competitors may independently develop similar technology, duplicate our vehicles or components or design new vehicles or components in a way that circumvents our intellectual property rights; and |

| · | any in-licensed patents may be invalidated or the holders of these patents may seek to breach any license arrangements. |

Existing trademark and trade secret laws and confidentiality agreements afford only limited protection. In addition, the laws of some foreign countries do not protect our proprietary rights to the same extent as do the laws of the United States, and policing the unauthorized use of our intellectual property is difficult.

We may not file any patent applications and any patent applications that we may file may not result in issued patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

We cannot be certain that we will file any patent applications. If we do file any patent applications, we cannot be certain that we will be the first creator of inventions covered by any such patent applications or the first to file patent applications on any of these inventions, nor can we be certain that any patent applications we may file will result in issued patents or that any patents issued in the future will afford protection against a competitor. In addition, patent applications filed in foreign countries are subject to laws, rules and procedures that differ from those of the United States, and thus we cannot be certain that foreign patent applications related to issued U.S. patents, if any, will be issued. Furthermore, if these patent applications issue, some foreign countries provide significantly less effective patent enforcement than in the United States.

The status of patents involves complex legal and factual questions and the breadth of claims allowed is uncertain. As a result, we cannot be certain that we will file any patent applications, or that any patent applications that we may file will result in patents being issued, or that any patents that may be issued to us in the future will afford protection against competitors with similar technology. In addition, if any patents are issued to us such patents may be infringed upon or designed around by others and others may obtain patents that we need to license or design around, either of which would increase costs and may adversely affect our business, prospects, financial condition and operating results.

| 11 |

| Table of Contents |

Risks Related to Our Common Stock and This Offering

Voting power of our shareholders is highly concentrated by insiders.

Our officers and directors control, either directly or indirectly, a substantial portion of our voting securities. Upon completion of this offering, including sales by the selling stockholder, our executive officer and director will beneficially own, in the aggregate, 178,500,000 shares of Common Stock, or approximately 89.9% of our 198,500,000 outstanding shares of Common Stock including option pool and treasury, assuming all of the shares offering hereunder are actually sold. Therefore, our management may significantly affect the outcome of all corporate actions and decisions for an indefinite period of time including election of directors, amendment of charter documents and approval of mergers and other significant corporate transactions. In addition, our executive officer and director owns the only issued and outstanding share of Class A Convertible Preferred Stock which entitles him to 51% of the Common votes on any matter requiring a shareholder vote.

We do not intend to pay dividends for the foreseeable future.

We have paid no dividends on our common stock to date and it is not anticipated that any dividends will be paid to holders of our common stock in the foreseeable future. While our future dividend policy will be based on the operating results and capital needs of the business, it is currently anticipated that any earnings will be retained to finance our future expansion and for the implementation of our business plan. As an investor, you should take note of the fact that a lack of a dividend can further affect the value of our common stock, and could significantly affect the value of any investment in our Company.

Our management will have broad discretion over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree.

We currently intend to use the net proceeds from this offering to fund general working capital, development costs, legal and accounting expense, marketing and media expense, reimbursement of affiliates of the Company, and selling costs. See “Use of Proceeds to Issuer” below. We have not allocated specific amounts of the net proceeds from this offering for any of the foregoing purposes. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us or our stockholders. The failure of our management to use such funds effectively could have a material adverse effect on our business, prospects, financial condition, and results of operation.

Raising additional capital may cause dilution to our stockholders, including purchasers of our securities in this offering, restrict our operations or require us to relinquish rights to technologies or products.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of public or private equity offerings, debt financings and/or license and development agreements with collaboration partners. We do not have any committed external source of funds. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest may be materially diluted, and the terms of such securities could include liquidation or other preferences that adversely affect your rights as a common stockholder. Debt financing and preferred equity financing, if available, may involve agreements that include restrictive covenants that limit our ability to take specified actions, such as incurring additional debt, making capital expenditures or declaring dividends. In addition, debt financing would result in fixed payment obligations.

If we raise funds through collaborations, strategic partnerships or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market products that we would otherwise prefer to develop and market ourselves.

| 12 |

| Table of Contents |

Regardless of the amount raised in this offering, we may not have sufficient capital to execute our business strategy.

Regardless of the amount raised in this offering, we may not have sufficient capital to execute on our business strategy the way we have intended. Our ability to obtain additional financing thereafter may have a materially adverse effect on our ability to execute its overall plan and your investment may be lost.

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of 18,500,000 shares and by the selling stockholders of 1,500,000 shares at a price of $2.50 per share, and after deducting $3,533,000 of estimated offering expenses payable by us, investors in this offering can expect an immediate dilution of $(2.285) per share if we and the selling stockholders sell all shares in this offering. If we and the selling stockholders, in the aggregate, sell less than 20,000,000 shares in this offering, the immediate dilution to investors in this offering would be greater than $2.285 and the dilution would depend on the amount of shares sold. We have allocated shares of our common stock to an option pool and may authorize shares to the option pool in the future. In the future, we intend to establish a stock incentive plan pursuant to which stock options and awards may be authorized and granted to our executive officers, directors, employees and key consultants.

There is no liquid trading market for the shares of Common Stock.

There is not a liquid trading market for the Common Stock, and there can be no assurance that any such market will develop or be sustained in the future.

OFFERING CIRCULAR SUMMARY

This summary highlights information contained elsewhere in this offering circular. This summary is not complete and does not contain all of the information you should consider before investing in the Shares.

You should carefully read the entire offering circular, especially concerning the risks associated with investment in the Shares discussed under the “Risk Factors” section.

Unless we state otherwise, the terms “Ronn Motor Group, Inc.”, “Ronn Motor Group”, “RMG”, “we”, “us”, “our”, “Company”, “management” or similar terms collectively refer to Ronn Motor Group, Inc., a Delaware corporation.

The Mission of Ronn Motor Group, Inc., is to produce high quality, premium automobiles that showcase disruptive technologies and state of the art performance and design while maintaining a global conscience. We are an early stage company that specializes in automotive design, assembly, manufacturing, and performance and leading edge technology integration. We believe the Company is positioned to capture market share in the growing global market for innovative transportation, sustainable electric and hydrogen fuel cell technologies.

The Company

RMG is a dynamic automotive design and development company using and developing supporting technologies. Ronn Motor Group’s initial focus will be on; the “Phoenix” an electric version evolved from its flagship “Eco-Exotic” Supercar, the Scorpion. Ronn Motor Group’s initial Supercar design “The Scorpion” is an award winning, sleek, futuristic, aero Supercar which has been featured at top automotive events, recognized as an advanced performance Supercar by top magazines, and endorsed by experts and enthusiast as well as celebrities.

The original Hydrogen assisted Scorpion HX platform was developed to reach production as either an all-wheel drive electric vehicle, powered like Tesla all electric, or following our heritage and incorporating the latest Hydrogen Fuel Cell technology. The goal of the “Phoenix” is to push the edge of style, performance, emissions, materials and fuels. The “Phoenix” will feature electric drive with stellar performance and ultra-high operating efficiencies.

| 13 |

| Table of Contents |

The corporate strategy is to market and brand our Company and automobile using the power of social media, to engage the one of the largest affinity groups “automobile aficionado’s” while continuing the traditional route to build a brand reputation through participation in high-end auto shows, concourse events and display/sponsor F1 events. These activities would be reinforced by media articles and limited direct advertising. The Company’s goal is to build “face to face” exposure with the prospective buyers. Event activity will be used to create brand recognition and to build a reputation, directing sales through marketing venues. Ultimately, the Company must be prudent to not over expose its product, thereby loosing “exclusivity”, yet it must be known by the “right” people to achieve and sustain sales.

The Offering

Issuer | Ronn Motor Group, Inc. | ||

|

| ||

Security Offered | 20,000,000 Shares of Common Stock, par value $.001, in the aggregate. | ||

|

| · | 18,500,000 shares are being offered by the Company for a total of $46,250,000 |

|

| · | 1,500,000 shares are being offered by the selling stockholder for a total of $3,750,000 |

|

| ||

Price | $2.50 per Share | ||

|

| ||

Minimum Offering | None | ||

|

| ||

Maximum Offering | $50,000,000 (a total of 20,000,000 Shares) | ||

|

| ||

Minimum Investment | None | ||

|

| ||

Offering Period | The Offering will commence upon the offering circular filed with the Securities and Exchange Commission being qualified, and will close upon the earlier of (i) the sale of Shares with an aggregate sales price of $50,000,000, or December 31, 2017 the estimated 12 month time period limit. This Offering may be terminated at our election at any time. | ||

|

| ||

Voting Rights | Stockholders will have one vote per share for each Share owned by them in all matters, including the election of Directors, as provided in the Delaware corporation law. However, our executive officer as a result of his ownership of Common Stock and the one (1) share of Class A Convertible Preferred Stock will be able to significantly influence the outcome of any election of Directors or any other vote of the stockholders. The one (1) share of Class A Convertible Preferred Stock is held by Ronal Maxwell, our CEO, and entitles him to 51% of the Common votes on any matter requiring a shareholder vote. | ||

|

| ||

Dividends | We have never paid a dividend on the shares of our Common Stock and do not plan to do so in the foreseeable future. | ||

|

| ||

Selling Stockholder | The selling stockholder is offering to sell 1,500,000 shares of Common Stock in this Offering. See “”Plan of Distribution and Selling Securityholders.” | ||

|

| ||

Use of Proceeds | After deducting the amount payable directly to the selling stockholder and the estimated offering expenses of approximately $3,533,000 Million, that are payable by us, we estimate that the net proceeds to the Company from the sale of the Shares offered pursuant to this offering circular will be approximately $42,717,000 after $3,533,000 in expenses are deducted if all 18,500,000 Shares are sold by the Company. See “Use of Proceeds to Issuer.” | ||

|

| ||

No Trading Market for our Shares | Our Shares are not traded on any stock exchange. | ||

|

| ||

Risk Factors | An investment in the Company is highly speculative and involves substantial risks, Prospective investors should carefully review and consider the factors described under the “Risk Factors” section below. | ||

This Offering is being conducted on a “best efforts” basis.

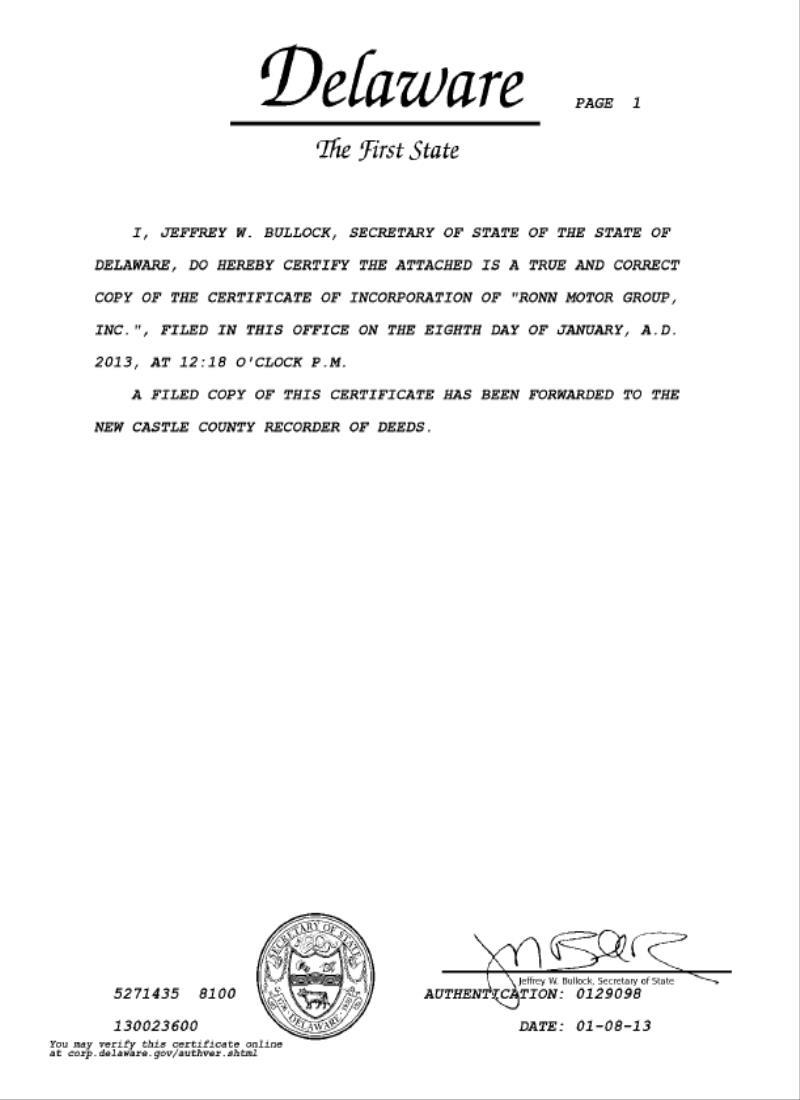

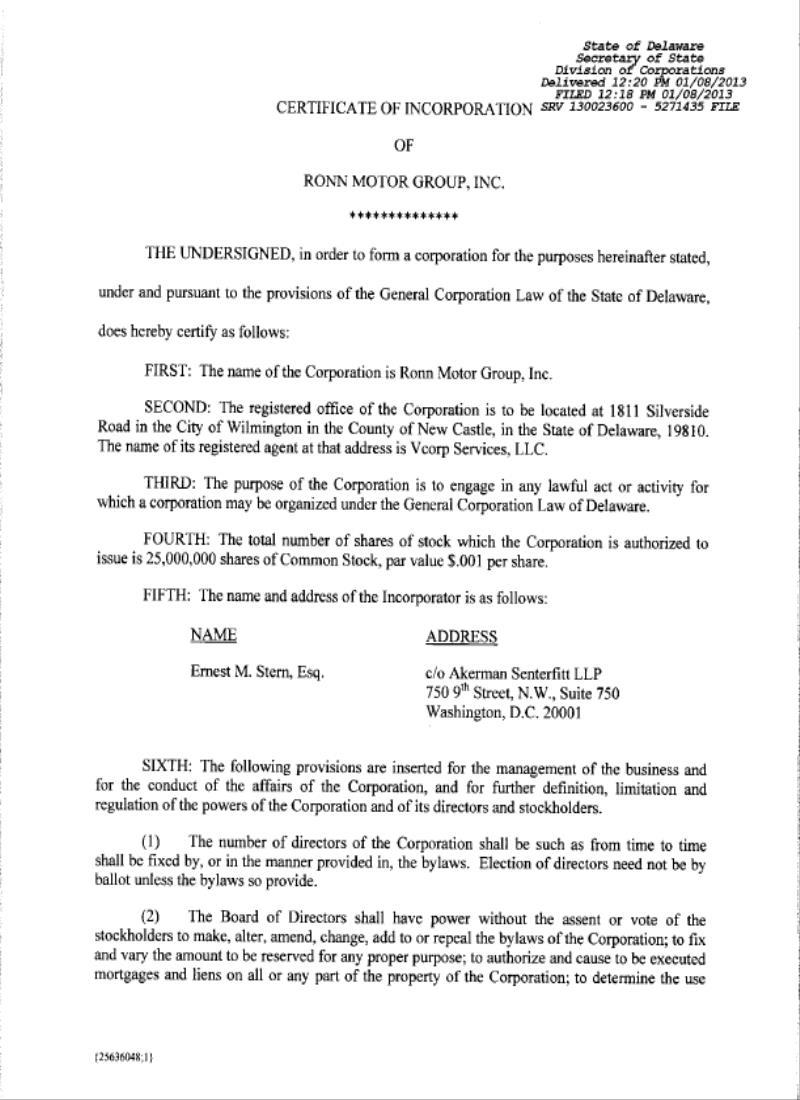

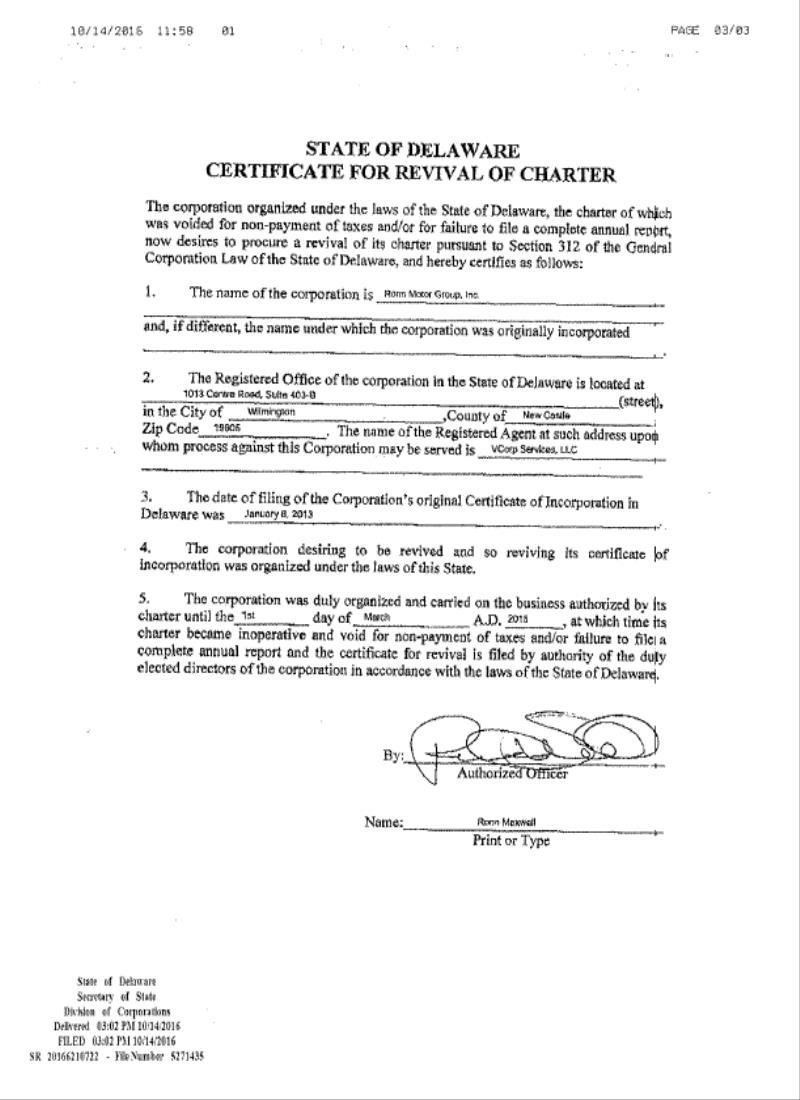

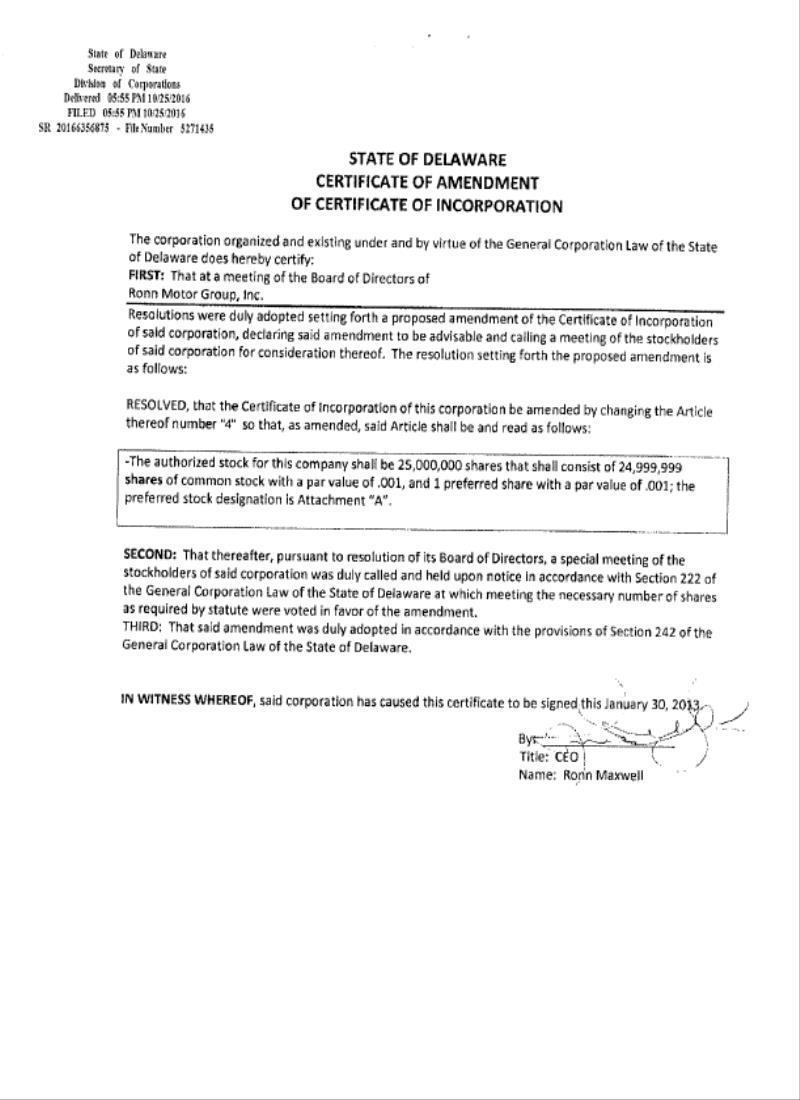

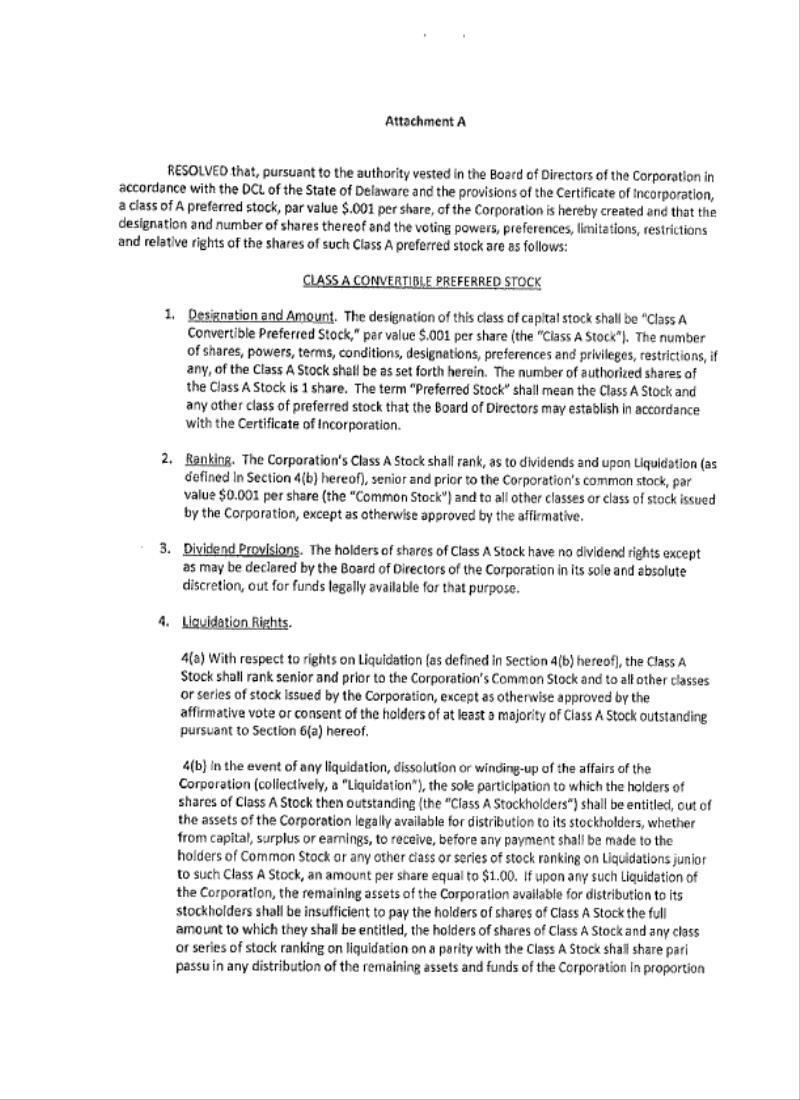

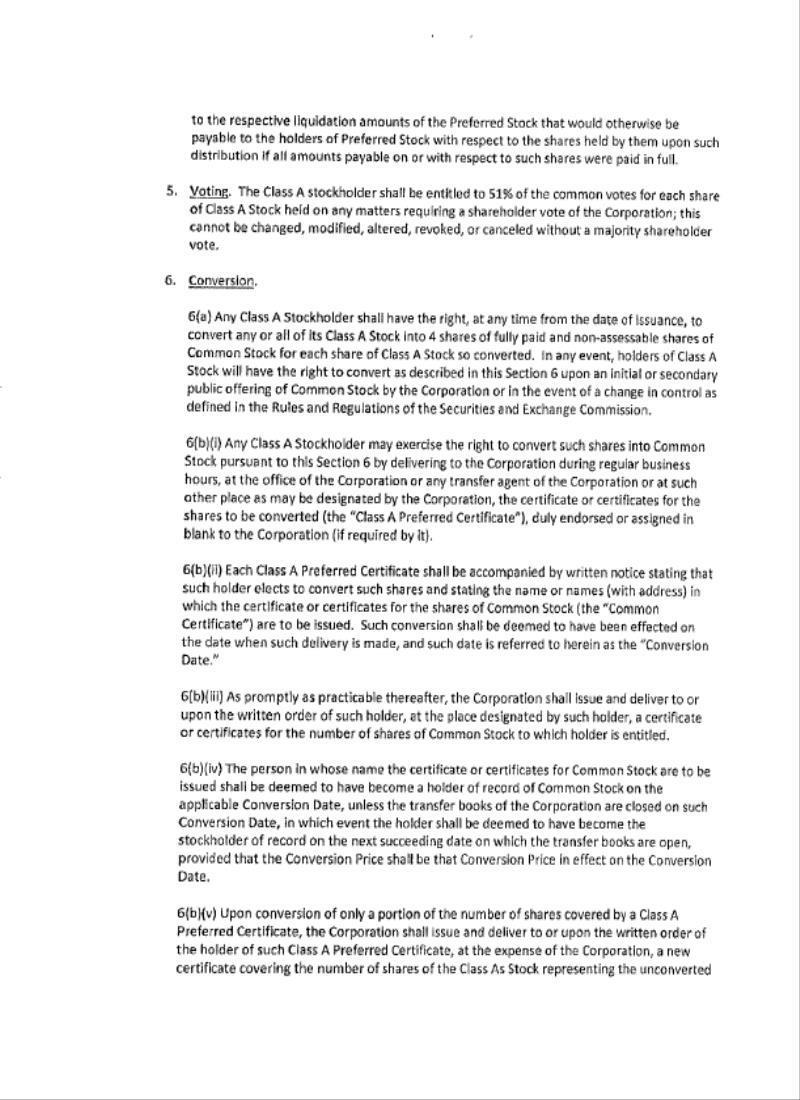

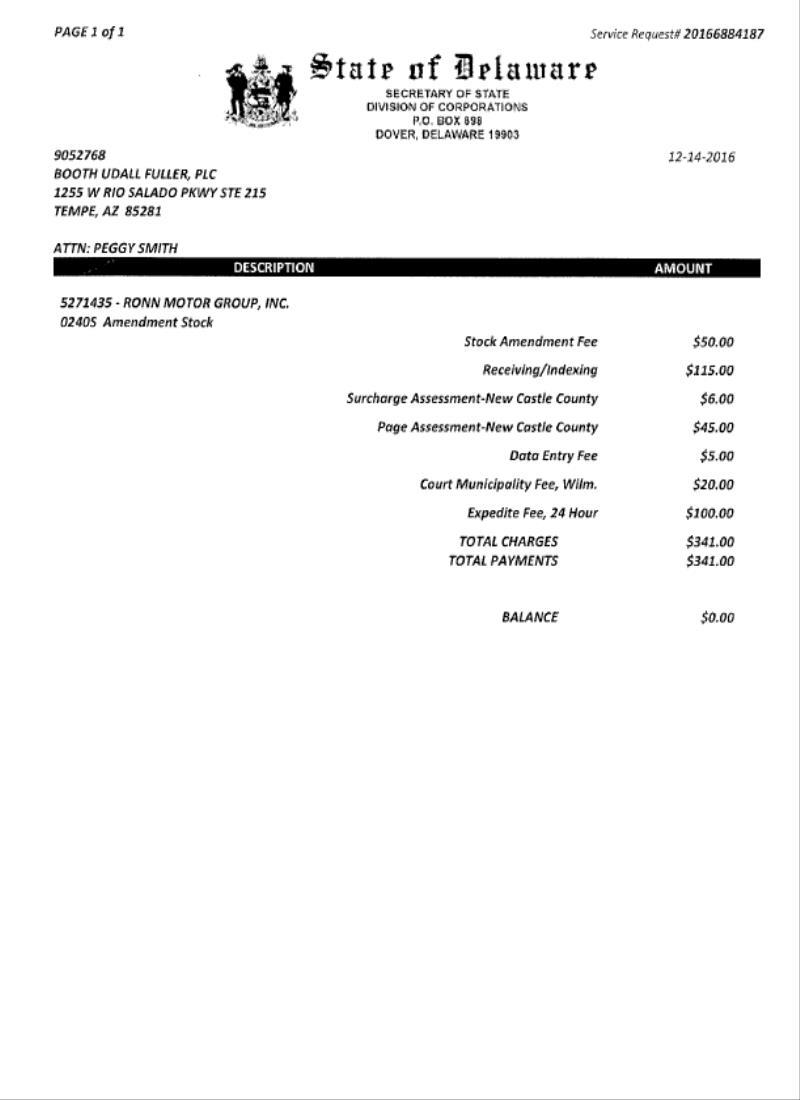

On December 2, 2016, the Company filed an amendment to its Certificate of Incorporation with the Delaware Secretary of State, which increased the number of authorized shares of the Company’s capital stock to 400,000,000, consisting of 399,999,999 shares of common stock with a par value of $0.001, and one (1) preferred share with a par value of $0.001, and effected an 8-for-1 forward stock split of its issued and outstanding shares of common stock. Unless the context indicates otherwise, all share and per-share common stock information in this offering circular gives effect to the 8-for-1 forward stock split.

| 14 |

| Table of Contents |

Dilution is the amount by which the offering price paid by the purchasers of the Shares of Common Stock to be sold in this offering will exceed the net tangible book value per share of Common Stock after this offering. If you invest in our Common Stock your Shares will be diluted to the extent of the difference between the offering price per share of the Shares of our Common Stock and the pro forma net tangible book value per share of our Common Stock after this offering.

Our pro forma net tangible book value as of December 31, 2015 was $(62,980) or $(0.00) per share of our Common Stock. We calculate net tangible book value per share by calculating our total tangible assets less liabilities and dividing it by the number of outstanding shares of our Common Stock.

After giving effect to the sale of 18,500,000 Shares of our Common Stock in this offering at an offering price of $2.50 per Share and after deducting estimated offering expenses of $3,533,000 payable by us, our net tangible book value, which we refer to as our pro forma net tangible book value, as of December 31, 2015 would have been approximately $42,654,020 or $0.215 per share of our Common Stock.

This amount represents an immediate increase in our pro forma net tangible book value of $0.215 per Share to our existing stockholders and an immediate dilution in our pro forma net tangible book value of $2.285 per Share to new investors purchasing Shares of our Common Stock at the offering price. We calculate dilution per Share to new investors by subtracting the pro forma net tangible book value per share from the offering price paid by the new investor. The following table illustrates the dilution to new investors on per Share basis:

Offering Price |

|

|

|

| $ | 2.50 |

| |

Net tangible book value per share as of December 31, 2015 |

| $ | (0.00 | ) |

|

|

|

|

Increase / (Decrease) per share attributable to new investors |

| $ | 0.215 |

|

|

|

|

|

Pro forma net tangible book value per share after this offering |

|

|

|

|

| $ | 0.215 |

|

Dilution per share to new investors |

|

|

|

|

| $ | (2.285 | ) |

The table below sets forth as of December 31, 2016 the number of shares of our Common Stock issued, the total consideration paid and the average price per share paid by our officers as a group and our new investors in this offering, after giving effect to the issuance of 18,500,000 shares of Common Stock by us, and the sale of 1,500,000 shares of Common Stock by the selling stockholder, in this Offering at the offering price of $2.50 per Share before deducting estimated offering expenses of $3,533,000 payable by us.

| Shares Purchased |

| Total Consideration | |||||||||||||

| Number |

| Percent |

| Amount (millions) |

| Percent |

| ||||||||

Post 8-1 Forward Split(1) |

| |||||||||||||||

Officers of the Company as a group(2) |

| 178,500,000 |

| 89.9 | % |

| 0 |

| 0 | % | ||||||

|

|

|

| |||||||||||||

New investors |

| 20,000,000 |

| 10.1 | % |

| $ | 50,000,000 |

| 100 | % | |||||

Total |

| 198,500,000 |

| 100 | % |

| $ | 50,000,000 | ||||||||

______________

(1) | The discussion and tables above do not give effect to a potential stock incentive plan pursuant to which stock options and awards may be authorized and granted to our executive officers, directors, employees and key consultants. |

| |

(2) | These shares were issued to our chief executive officer as compensation for services provided to the Company, and reflect the sale of 1,500,000 shares by him in the offering. |

In the future, we intend to establish a stock incentive plan pursuant to which stock options and awards may be authorized and granted to our executive officers, directors, employees and key consultants. Stock options or a significant equity ownership position in us may be utilized by us in the future to attract one or more new key executives.

| 15 |

| Table of Contents |

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

We are offering a up to a maximum of 18,500,000 Shares of Common Stock, and the selling stockholder identified in this offering circular is offering 1,500,000 shares of Common Stock, on a "best efforts" basis for a purchase price of $2.50 per Share with no minimum purchase requirement. The maximum offering is $50,000,000. We will have the unrestricted right to reject tendered subscriptions for any reason. In the event the shares available for sale are oversubscribed, they will be sold to those investors subscribing first, provided they satisfy the applicable investor suitability standards. See "Investor Suitability Standards." Investors will not be entitled to a refund and could lose their entire investment.

The purchase price for the Shares will be payable in full upon subscription. Subscription funds which are accepted will be deposited into our escrow account maintained by a service provider selected by our management (such service provider is referred to as “Service Provider”). We have no required minimum offering amount for this offering and therefore we may instruct the Service Provider to release funds held in escrow to our operating account at any time.

Since this Offering is being conducted on a best-efforts basis, there is no minimum number of Shares that must be sold, meaning we will retain any proceeds from the sale of the Shares sold by us in this Offering. Accordingly, all funds raised by us in the Offering will become immediately available to us and may be used as they are accepted. Investors will not be entitled to a refund and could lose their entire investment. We will not receive any of the proceeds from the sale of shares being sold by the selling stockholders. The first $2 million of sales will be of the shares offered by the Company. After that, the next $200,000 of sales will be from the shares offered by the Selling Securityholder. This pattern will continue until all of the shares are sold.

Subscription Period

The Offering of shares of Common Stock will terminate on December 31, 2017, unless we extend the offering, or terminate the offering sooner in our sole discretion regardless of the amount of capital raised (the "Sales Termination Date"). The Sales Termination Date may occur prior to December 31, 2017 if subscriptions for the maximum number of Shares of Common Stock have been received and accepted by us before such date. Subscriptions for shares must be received and accepted by us on or before such date to qualify the subscriber for participation in Ronn Motor Group, Inc.

Subscription Procedures

Completed and signed subscription documents and subscription checks should be sent to Service Provider as Agent for Ronn Motor Group, Inc. Escrow Account, at the following address: [__________________, ______________________, _________________, ________________, Reference Ronn Motor Group, Inc. Subscription checks should be made payable to us. If a subscription is rejected, all funds will be returned to subscribers within ten days of such rejection without deduction or interest. Upon acceptance by us of a subscription, a confirmation of such acceptance will be sent to the subscriber.

Investor Suitability Standards

In order to subscribe to purchase the shares, a prospective investor must complete a subscription agreement. Investors must answer certain questions to determine compliance with the investment limitation set forth in Regulation A Rule 251(d)(2)(i)(C) under the Securities Act of 1933, which states that in offerings such as this one, where the securities will not be listed on a registered national securities exchange upon qualification, the aggregate purchase price to be paid by the investor for the securities cannot exceed 10% of the greater of the investor's annual income or net worth. In the case of an investor who is not a natural person, revenues or net assets for the investor's most recently completed fiscal year are used instead.

The investment limitation does not apply to accredited investors, as that term is defined in Regulation D Rule 501 under the Securities Act of 1933. An individual is an accredited investor if he/she meets one of the following criteria:

· | a natural person whose individual net worth, or joint net worth with the undersigned's spouse, excluding the "net value" of his or her primary residence, at the time of this purchase exceeds $1,000,000 and having no reason to believe that net worth will not remain in excess of $1,000,000 for the foreseeable future, with "net value" for such purposes being the fair value of the residence less any mortgage indebtedness or other obligation secured by the residence, but subtracting such indebtedness or obligation only if it is a liability already considered in calculating net worth; or |

· | a natural person who has individual annual income in excess of $200,000 in each of the two most recent years or joint annual income with that person's spouse in excess of $300,000 in each of those years and who reasonably expects an income in excess of those levels in the current year. |

| 16 |

| Table of Contents |

An entity other than a natural person is an accredited investor if it falls within any one of the following categories:

· | an employee benefit plan within the meaning of Title I of the Employee Retirement Income Security Act of 1974, as amended, (i) if the decision to invest is made by a plan fiduciary which is either a bank, savings and loan association, insurance company, or registered investment adviser; (ii) if such employee benefit plan has total assets in excess of $5,000,000; or (iii) if it is a self-directed plan whose investment decisions are made solely by accredited investors; |

· | a tax-exempt organization described in Section 501(c)(3) of the Internal Revenue Code, a corporation, a Massachusetts or similar business trust or a partnership, which was not formed for the specific purpose of acquiring the securities offered and which has total assets in excess of $5,000,000; |

· | a trust, with total assets in excess of $5,000,000, which was not formed for the specific purpose of acquiring the securities offered, whose decision to purchase such securities is directed by a "sophisticated person" as described in Rule 506(b)(2)(ii) under Regulation D; or |

· | certain financial institutions such as banks and savings and loan associations, registered broker-dealers, insurance companies, and registered investment companies. |

Interim Investments

Company funds not needed on an immediate basis to fund our operations may be invested in government securities, money market accounts, deposits or certificates of deposit in commercial banks or savings and loan associations, bank repurchase agreements, funds backed by government securities, short-term commercial paper, or in other similar interim investments.

Transfer Agent and Registrar

____________________, _______________________, ________________, ___________ is the transfer agent and registrant for the shares.

Plan of Distribution

The shares are being offered by us on a best-efforts basis by our officers, directors and employees, with the assistance of independent consultants, and possibly through registered broker-dealers who are members of the Financial Industry Regulatory Authority ("FINRA") and finders. We may pay selling commissions to participating broker-dealers who are members of FINRA for shares sold by them, equal to a percentage of the purchase price of the shares. We may pay finders fees to persons who refer investors to us. We may also pay consulting fees to consultants who assist us with the offering, based on invoices submitted by them for advisory services rendered. Consulting compensation, finders fees and brokerage commissions may be paid in cash, common stock or warrants to purchase our common stock. We may also issue shares and grant stock options or warrants to purchase our common stock to broker-dealers for sales of shares attributable to them, and to finders and consultants, and reimburse them for due diligence and marketing costs on an accountable or nonaccountable basis. We have not entered into selling agreements with any broker-dealers to date, although we plan to engage a registered broker-dealer firm, or a similar service provider selected by our management (such service provider is referred to as “Service Provider”), for offering administrative and escrow services . Participating broker-dealers, if any, and others may be indemnified by us with respect to this offering and the disclosures made in this Offering Circular.

Proposed Administrative Agreement

We plan to engage Service Provider, a broker-dealer registered with the Securities and Exchange Commission and a member of the Financial Industry Regulatory Authority (FINRA), to perform the following administrative functions in connection with this offering in addition to acting as the escrow agent:

· | advise us as to permitted investment limits for investors pursuant to Regulation A+, Tier 2: |

· | communicate with us and/or our agents, if needed, to gather additional information or clarification from investors: |

· | serve as a registered agent where required for state blue sky requirements, but in no circumstance will Service Provider solicit a securities transaction, recommend our securities, or provide investment advice to any prospective investor: and |

· | transmit the subscription information data to our transfer agent. |

| 17 |

| Table of Contents |

As compensation for the services listed above, we anticipate paying Service Provider $2.00 per domestic investor and $5.00 per international investor for each anti-money laundering verification. If we elect to terminate the offering prior to its completion, we have agreed to reimburse Service Provider for its out-of-pocket expenses incurred in connection with the services provided under the proposed engagement (including costs of counsel and related expenses) up to an aggregate maximum of $10,000. In addition, we will pay Service Provider $500 for escrow account set up, $25 per month for so long as the offering is being conducted, and up to $15.00 per investor for processing incoming funds. We may also pay Service Provider a technology service fee for the technology services provided by it or its affiliate, of up to $3.00 for each subscription agreement executed via electronic signature, up to $10.00 for each check processed, up to $15.00 per wire transfer and up to $45.00 for each bad actor check (per entity, including issuer and each associated person). Based on the minimum subscription amount of $2,000.80 (or 610 shares) per investor, we estimate the maximum fee that may be due to Service Provider for the aforementioned internal fees to be $7,000.00 if we achieve the maximum offering proceeds.