PART II - OFFERING CIRCULAR

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. The Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

Preliminary Offering Circular Subject to Completion

Dated February 10, 2025

| MED-X, INC. |

| 8236 Remmet Avenue Canoga Park, California 91304 (818) 349-2870 www.MEDX-RX.com |

$10,000,000

2,500,000 Shares of Common Stock at $4.00 per Share by the Company

Minimum Investment: $600.00

FORM 1-A: TIER 2

FOR SOPHISTICATED INVESTORS ONLY

Med-X, Inc. (the “Company,” “Med-X,” “we,” “us,” and “our”) is offering up to 2,500,000 shares of common stock, $0.001 par value per share, for $4.00 per share (the “Offering Price”), for gross proceeds to the Company of up to $10,000,000, before deduction of offering expenses, assuming all shares are sold. The Offering Price has been arbitrarily determined by the Company and is not based on book value, assets, earnings or any other recognizable standard of value. This offering will begin as soon as practicable after this offering circular has been qualified by the United States Securities and Exchange Commission (the “SEC” or the “Commission”). As of February 7, 2025, the Company had 20,507,443 shares of common stock outstanding.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION, HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A FOR GENERAL INFORMATION ON INVESTING. WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

|

|

| Price to Public |

|

| Underwriter Discount and Commissions (1) |

|

| Proceeds to Issuer(2) |

| |||

| Per share |

| $ | 4.00 |

|

| $ | 0.18 |

|

| $ | 3.35 |

|

| Total Maximum of Offering |

| $ | 10,000,000 |

|

| $ | 450,000 |

|

| $ | 9,550,000 |

|

The offering will terminate on the first to occur of (i) the date on which all 2,500,000 shares have been sold, (ii) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion, with respect to the Company’s shares offered in this offering, regardless of the amount of capital raised (in each case, the “Termination Date There is no minimum capital required from this offering, and therefore an initial closing and release of funds from the subscription escrow account established for the offering may occur at any funding amount. Funds released from escrow will be deposited directly into the Company’s operating account for immediate use.

___________________

| (1) | The Company has engaged Dealmaker Securities LLC (“Broker”) to act as lead selling agent (the “Selling Agent”) to offer the shares of our common stock, par value $0.001, to prospective investors in this offering on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be received by the Company in this offering. Broker is not purchasing the shares of common stock offered by us and is not required to sell any specific number or dollar amount of shares in this offering before a closing occurs. The Company will pay a cash commission of 4.5% to Broker on sales of the shares of common stock in this, and a one-time advance of accountable expenses not to exceed $12,500. There is also other compensation paid to Broker affiliates as part of this offering that is not included in the table above but constitute part of the underwriting compensation. See “Plan of Distribution” on page 61 for details of compensation payable to the Selling Agent in connection with the offering. The maximum underwriting compensation to be paid to Broker and affiliates is $852,500 (8.53%) of the Offering total . Further, the Company confirms that the 2% payment processing fee is not provided to DealMaker Securities LLC, but rather, is provided to unaffiliated third-party payment providers. |

|

|

|

| (2) | Does not account for the expenses of the offering. The Company expects that the amount of expenses of the offering that it will pay will be approximately $440,000 at the maximum offering amount, not including state filing fees. |

| ii |

THIS OFFERING IS HIGHLY SPECULATIVE AND THESE SECURITIES INVOLVE A HIGH DEGREE OF RISK AND SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” ON PAGE 33.

THIS OFFERING CIRCULAR IS NOT KNOWN TO CONTAIN AN UNTRUE STATEMENT OF A MATERIAL FACT, NOR TO OMIT MATERIAL FACTS WHICH IF OMITTED, WOULD MAKE THE STATEMENTS HEREIN MISLEADING. IT CONTAINS A FAIR SUMMARY OF THE MATERIAL TERMS OF DOCUMENTS PURPORTED TO BE SUMMARIZED HEREIN. HOWEVER, THIS IS A SUMMARY ONLY AND DOES NOT PURPORT TO BE COMPLETE. ACCORDINGLY, REFERENCE SHOULD BE MADE TO THE CERTIFICATION OF RIGHTS, PREFERENCES AND PRIVILEGES AND OTHER DOCUMENTS REFERRED TO HEREIN, COPIES OF WHICH ARE ATTACHED HERETO OR WILL BE SUPPLIED UPON REQUEST, FOR THE EXACT TERMS OF SUCH AGREEMENTS AND DOCUMENTS.

_____________________________________

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

_____________________________________

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE. EACH INVESTOR SHOULD CONSULT HIS OWN COUNSEL, ACCOUNTANT AND OTHER PROFESSIONAL ADVISORS AS TO LEGAL, TAX AND OTHER RELATED MATTERS CONCERNING HIS INVESTMENT.

JURISDICTIONAL (NASAA) LEGENDS

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED "BLUE SKY" LAWS).

This Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

| iii |

|

| 1 |

| |

|

| 2 |

| |

|

| 22 |

| |

|

| 23 |

| |

|

| 24 |

| |

|

| 25 |

| |

|

| 12 |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

| 40 |

|

|

| 47 |

| |

|

| 48 |

| |

|

| 49 |

| |

|

| 50 |

| |

|

| 57 |

| |

|

| 59 |

| |

|

| 61 |

| |

|

| 62 |

| |

|

| 63 |

| |

|

| 66 |

| |

|

| 66 |

| |

|

| 66 |

| |

|

| F-1 |

| |

|

|

|

|

|

| EXHIBITS |

|

|

|

|

|

|

|

|

|

| 4.1 |

|

| iv |

| Table of Contents |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This offering circular contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts are forward-looking statements. The forward-looking statements are contained principally in, but not limited to, the sections entitled “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | our goals and strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | expected changes in our revenue, costs or expenditures; |

| ● | growth of and competition trends in our industry; |

| ● | our expectations regarding demand for, and market acceptance of, our products and services; |

| ● | our expectations regarding our relationships with investors, institutional funding partners and other parties we collaborate with; |

| ● | our expectation regarding the use of proceeds from this offering; |

| ● | fluctuations in general economic and business conditions in the market in which we operate; and |

| ● | relevant government policies and regulations relating to our industry. |

In some cases, you can identify forward-looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk Factors” and elsewhere in this offering statement. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

The forward-looking statements made in this offering circular relate only to events or information as of the date on which the statements are made in this offering circular. Although we will become a public company after this offering and have ongoing disclosure obligations under U.S. federal securities laws, we do not intend to update or otherwise revise the forward-looking statements in this offering circular, whether as a result of new information, future events or otherwise.

| -1- |

| Table of Contents |

This summary highlights information contained elsewhere in this offering circular. It does not include all of the information you should consider before investing. You should read the entire offering circular carefully, including the "Risk Factors" section beginning on page 33 and the financial statements and notes.

Overview

Med-X, Inc., a Nevada corporation founded in 2014, focuses on developing, marketing, and distributing natural, eco-friendly products. The company is dedicated to providing innovative solutions in pest control, pain management, and natural wellness, addressing the growing demand for sustainable alternatives across industries. Our product lines include Nature-Cide®, Thermal-Aid®, and Malibu Brands, each targeting unique market needs. Additionally, Med-X operates The MJT Network®, an online media platform providing cannabis-related content and advertising opportunities.Our business model leverages strategic partnerships, e-commerce platforms, and direct sales to generate revenue. By combining innovative product development with an emphasis on environmentally conscious practices, Med-X is positioned to capitalize on expanding market opportunities in the natural products sector.

| -2- |

| Table of Contents |

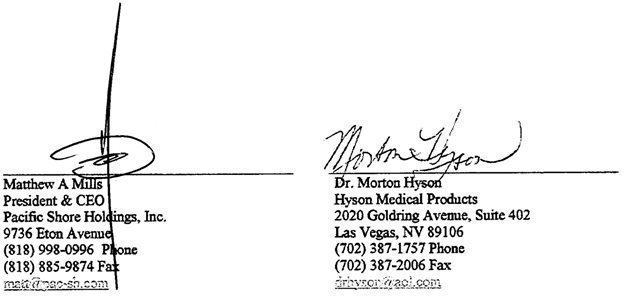

Acquisition of Pacific Shore.

In 2018, Med-X completed its acquisition of Pacific Shore Holdings, Inc., a California-based company. This acquisition integrated Pacific Shore’s existing product portfolio, distribution networks, and intellectual property into Med-X’s operations, significantly enhancing the company’s capacity to innovate and scale its product lines.

As part of the merger, Pacific Shore became a wholly owned subsidiary of Med-X. To protect shareholder value, Matthew Mills, Med-X’s Chairman and CEO, tendered a substantial number of shares, ensuring minimal dilution for existing shareholders. Pacific Shore’s contribution includes a strong distribution network for its Nature-Cide products, an established presence in the pest control and wellness markets, and a pipeline of innovations aligned with Med-X’s vision. The acquisition has been instrumental in expanding Med-X’s reach and operational capabilities, particularly in leveraging Pacific Shore’s pest control expertise and regulatory compliance frameworks.

| -3- |

| Table of Contents |

Nature-Cide.

Nature-Cide is Med-X’s flagship product line of all-natural pest control solutions. These products, developed in collaboration with Pacific Shore, are designed to provide effective, chemical-free alternatives to traditional pesticides. Comprising essential oils like cedar, cinnamon, and citronella, Nature-Cide products are safe for humans and pets, making them ideal for residential, commercial, and agricultural use.

Nature-Cide’s product range includes:

|

| · | All-Purpose Insecticide: Effective against ants, cockroaches, fleas, and more. |

|

| · | Pest Management X2: A professional-grade solution for pest control operators. |

|

| · | Granular and Dust Formulations: Designed for agricultural use, including cannabis cultivation. |

Nature-Cide products are classified as minimum risk pesticides under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), exempting them from federal registration. The products are registered in multiple states and distributed nationally through partnerships with pest control distributors such as Target Specialty Products (TSP) and Veseris (VES).Additionally, Nature-Cide has a growing presence in international markets, including the Caribbean and parts of Asia. The product’s appeal is bolstered by increasing regulatory restrictions on toxic pesticides, driving demand for safer, natural alternatives. Med-X continues to invest in research and development to expand Nature-Cide’s applications and market reach.

| -4- |

| Table of Contents |

Thermal-Aid

Thermal-Aid is a line of therapeutic heating and cooling products targeting pain relief for humans and animals. The product range includes:

|

| · | Thermal-Aid Zoo®: Child-friendly, animal-shaped heating and cooling packs. |

|

| · | Thermal-Aid Headache Relief System®: A patented solution for migraines and tension headaches. |

|

| · | Traditional Thermal-Aid Packs: For arthritis, sports injuries, and general pain management. |

Thermal-Aid products are made from 100% natural materials, including a patented corn-based filler that retains temperature for extended periods. Clinical trials have demonstrated their efficacy in reducing pain and the need for medication.The Thermal-Aid line is distributed through e-commerce platforms like Amazon, retail chains such as Kroger, and healthcare-focused distributors. Med-X continues to explore new applications and consumer-friendly designs to enhance the product line’s appeal.

| -5- |

| Table of Contents |

The MJT Network

The MJT Network® is Med-X, Inc.'s online media platform hosted on www.marijuanatimes.org, which has been publishing cannabis and hemp industry news since July 2015. The platform generates revenue from advertisers and traffic optimization strategies and provides content covering a broad range of topics, including news, current events, business, financial, legislative, legal, cultural, medical, scientific, and technological aspects of the cannabis and hemp industries, both nationally and internationally.Content is contributed by consultants, freelance and staff writers, Med-X personnel, and public news sources. The MJT Network is accessible through web, smartphone, and tablet applications, with its original content distributed via digital platforms like iOS apps, Vimeo Video, YouTube, Apple Podcasts, and Apple NewsMed-X plans to integrate e-commerce into the MJT Network in 2024-2025, enabling the sale of branded industry products from third-party suppliers and its own product lines, subject to federal and state compliance. However, the timeline for adding e-commerce capabilities remains uncertain.

Distributors

Med-X generates most of its revenue through large distributors, with its Nature-Cide products distributed by several pest control distributors, including VES, TSP, PV, PCS, ENX, and FOR. These products are also available through major marketplaces such as Amazon, Kroger, and Walmart, and they are increasingly supplied to TSP's parent company, Rentokil Initial International, as well as through ENX in countries like Singapore and Hong Kong.

For the year ending December 31, 2023, Med-X derived 18% of its revenue from a single customer, Target Specialty Products. In 2022, 32% of revenue came from two customers, with 19% from Target Specialty Products and 13% from Veseris. Med-X’s relationships with distributors are demand-driven, operating as a supplier within their distribution systems without written agreements. The lack of formal contracts introduces uncertainty, as any significant reduction in purchases by major customers could materially impact the company’s financial performance. This revenue concentration is expected to persist for the foreseeable future, and the company acknowledges the potential risks associated with this dependency.

Vendors

Med-X relies on single supplier relationships for raw materials and filling capacity due to the unique formulation and components of its product lines. This reliance poses a business risk, as operational issues or supply disruptions from these vendors could adversely affect the company’s operations.

In 2023, two vendors accounted for 78% of total purchases:

|

| · | Berje: 45% |

|

| · | Actions & Company: 33% |

In 2022, two vendors similarly accounted for 77% of total purchases:

|

| · | Berje: 57% |

|

| · | Actions & Company: 20% |

While Med-X recognizes the risks associated with this vendor concentration, the company believes that alternative suppliers are available to provide comparable inventory if significant vendors become unable or unwilling to deliver on time.

| -6- |

| Table of Contents |

Our chairman and founder, Mr. Mills, has licensed two trademarks to the Company on a royalty free basis that he acquired for “Thermal-Aid” and “Nature’s Therapeutic Source.” He also owns two patents related to Thermal-Aid which have since expired in 2023. The first is a patent for a thermal device for applying thermal energy to the body of a person, animal, or other surface utilizing segmented organic filler. The second is for a thermal device and ornamental design for applying thermal energy to the body of a person, animal, or other surface utilizing segmented organic filler that may have the general appearance of a child’s toy or other configuration. Our chairman and founder Matthew Mills, has granted us an exclusive worldwide royalty-free license to utilize and sublicense these trademarks to market, distribute, and sell Thermal-Aid, for which he was issued 4,605,337 shares of PSH-CA’s common stock which he subsequently exchanged for shares of our common stock (the “License Agreement”). Mr. Mills has not received any payments to date under this License Agreement. There are no milestones and no royalty rate associated with the License Agreement. The License Agreement was entered into as of January 15, 2010 (the “Effective Date”) and the initial term of the License Agreement was for a period of one year from the Effective Date. Thereafter, the License Agreement automatically renews each year for an additional year unless terminated in writing by either party to the License Agreement at least 30 days prior to the termination of the then current term. The license has been renewed every year since 2010. During the term, the license is exclusive to the Company. There have been no payments made to date and there are no milestones payments in the License Agreement.

On June 22, 2012, we entered into an exclusive license agreement with Dr. Hyson, d.b.a. Hyson Medical Products, pursuant to which we were granted an exclusive license to utilize three patents currently owned by Dr. Hyson: (1) Device and Method for Treatment of Headache – 5,700,238 (December 23, 1997), (2) Medicated Wrap – 6,313,370 (November 6, 2001), and (3) Medicated Wrap – 7,186,260 (March 6, 2007). The patents have since expired and we are using the technology and case study covered by these patents to market additional private label consumer products under our brand to address headache pain relief, both migraine and tension. Dr. Hyson already sells his own line of headache pain relief and medicated wrap products for consumers. We have a license to utilize these patents for any branded products developed by us during the term of the license agreement. For such branded products, Dr. Hyson receives a license fee equal to 5% of net sales made by us of those products. There are no milestone payments associated with this license agreement. We will own the intellectual property to all of our branded products developed under this license agreement. The initial term of the license agreement is five (5) years with options exercisable for one-year extensions, subject to termination after two (2) years if by then we have not brought a branded product to market. We commercialized this technology within two (2) years by the launch of our Thermal-Aid Headache Relief System and have extended the one-year(1) extensions since the original five (5) license agreement expired.

Recent Developments

Med-X has undertaken several strategic initiatives to strengthen its market position and operational capabilities:

|

| 1. | International Expansion of Nature-Cide: In 2023, Med-X entered into a distribution agreement with Ensystex to expand Nature-Cide’s reach into 29 international territories, including Australia, Southeast Asia, and parts of Africa. Ensystex is responsible for obtaining regulatory approvals, facilitating entry into these markets. |

|

| 2. | Development of New Products: Med-X is working on next-generation formulations of Nature-Cide, including an insecticidal paint additive designed to repel pests. The product is undergoing efficacy testing and is expected to launch in 2025. |

|

| 3. | Reg CF Offering and Reverse Stock Split: To align with investor expectations and facilitate access to public markets, Med-X implemented a 1-for-16 reverse stock split in April 2024. The company is also currently conducting a Regulation Crowdfunding (Reg CF) offering to raise additional capital prior to the Company’s launch of an anticipated qualification of its Regulation A+ offering contemplated in this offering circular. Furthermore, the Company plans to close its current Reg CF prior to the launch of its contemplated Regulation A+ mentioned in this offering circular. |

|

| 4. | Partnership with Dealmaker Securities: Med-X has engaged Dealmaker Securities LLC as the lead selling agent for its Regulation A offering. This partnership supports the company’s efforts to reach a broad investor base while maintaining compliance with regulatory standards. |

|

| 5. | Advisory Agreement with Maxim Group: In July 2024, Med-X entered into an agreement with Maxim Group for investment banking and financial advisory services. The agreement aligns with Med-X’s strategic focus on scaling its operations and pursuing growth opportunities. |

|

| 6. | Operational Efficiencies: Med-X has streamlined its production and distribution processes to meet rising demand for Nature-Cide and Thermal-Aid products. The company continues to work closely with key distributors to optimize inventory management and customer outreach. |

|

| 7.

| On April 15, 2024, the Board of Med-X, Inc. approved a 1-for-16 reverse stock split of its outstanding common stock, effective April 16, 2024. This decision was made to establish a valuation that the Company believes will be attractive to potential investors in connection with a proposed Regulation Crowdfunding (Reg CF) offering. The reverse stock split will not change the number of authorized shares, which will remain at 300,000,000. Med-X has retained DealMaker Securities LLC as the intermediary for the Reg CF offering. DealMaker will receive fees totaling 8.5% of the securities sold, which include payment processing fees, a one-time activation fee of $32,500 (covering onboarding, due diligence, and asset creation costs), and a monthly subscription fee of $2,000 after the offering's effective date. Additionally, Med-X will pay $10,000 per month for marketing services provided by DealMaker. |

| -7- |

| Table of Contents |

Patents and Trademarks

Below is a list of the Company’s patents and trademarks as of February 7, 2025:

Med-X Patent and Trademark Summary

| Country | Official No. | Title | Case Status | Property Type |

| USA | 88/218348 | THE MARIJUANA TIMES IC 41 | Pending | Trademark |

| USA | 88/218390 | M. THE MARIJUANA TIMES (stylized) IC 41 | Pending | Trademark |

| USA | 88/243436 | MALIBU BRANDS (logo) IC 5 | Pending | Trademark |

| USA | 88/243444 | MALIBU BRANDS (logo) IC 25 | Pending | Trademark |

| Canada | 2931915 | SOIL BLENDS CONTAINING AN INSECTICIDE AND METHODS FOR PRODUCTION AND USE THEREOF | Published | Patent application; Anticipated expiration date May 31, 2036; Composition of matter and method patent |

| USA | 11,147,266 | SOIL BLENDS CONTAINING AN INSECTICIDE AND METHODS FOR PRODUCTION AND USE THEREOF (non-provisional) | Issued | Patent; Expiration date May 31, 2036; Composition of matter and method patent |

| USA | 62/170320 | SOIL BLENDS CONTAINING AN INSECTICIDE AND METHODS FOR PRODUCTION AND USE THEREOF (provisional) | Expired | Provisional Patent Application |

| USA | 17/502228 | SOIL BLENDS CONTAINING AN INSECTICIDE AND METHODS FOR PRODUCTION AND USE THEREOF (non-provisional) | Published | Patent No. 12,022,824 B2 Anticipated expiration date May 31, 2036; Composition of matter and method patent |

All of the trademarks listed above are owned by the Company.

Below is a list of Pacific Shore Holdings’ patents and trademarks as of February 7, 2025:

Pacific Shore Holdings Patent and Trademark Summary

| Country | Official No. | Title | Case Status | Property Type |

| Australia | 1366146 | ENERGY-X IC 3 | Registered | Trademark |

| Australia | 1366144 | BURNER BALM IC 3 | Registered | Trademark |

| Canada | 1788556 | NATURE-CIDE IC5 (owner: Matthew Mills) | Allowed | Trademark |

| China | 21017818 | NATURE-CIDE IC5 (owner: Matthew Mills) | Registered | Trademark |

| China | 7911478 | BURNER BALM IC 3 | Registered | Trademark |

| China | 1559469 | THERMAL AID ZOO (stylized) IC 10* | Registered | Trademark |

| China | 15519468 | THERMAL AID logo IC 5 & 10* | Registered | Trademark |

| EU | 0085884203 | PERFORMANCE-X IC 3, 5 & 35 | Registered | Trademark |

| EU | 008583932 | BURNER BALM IC 3, 5 & 35 | Registered | Trademark |

| EU | 008584088 | ENERY-X IC 3, 5 &35 | Registered | Trademark |

| Japan | 5318604 | ENERY-X IC 3 | Registered | Trademark |

| Japan | 5329859 | BURNER BALM IC 3 | Registered | Trademark |

| Korea | 40-855739 | ENERY-X IC 3 | Registered | Trademark |

| Korea | 40-0855633 | BURNER BALM IC 3 | Registered | Trademark |

| New Zealand | 825514 | BURNER BALM IC 3 | Registered | Trademark |

| New Zealand | 825515 | ENERGY-X IC 3 | Registered | Trademark |

| Thailand | 756974 | BURNER BALM IC 3 | Registered | Trademark |

| USA | 3753893 | BURNER BALM IC 3 & 5 | Registered | Trademark |

| USA | 3777982 | ENERGY-X IC 3 | Registered | Trademark |

| USA | 3628026 | NATURE-CIDE IC 5 (owner: Matthew Mills) | Registered | Trademark |

| USA | 3777984 | ENERGY-X IC 5 (lip balm) | Registered | Trademark |

| USA | 4444076 | ENERGY-X IC 30 | Registered | Trademark |

| USA | 3064560 | THERMAL AID IC 10 (suppl. Reg.)* | Registered | Trademark |

| USA | 4190596 | ENERGY X IC 5 (gum)* | Registered | Trademark |

| USA | 6074312 | THERMAL-AID* | Registered | Trademark |

| USA | 7182777 | THERMAL DEVICE AND METHOD | Issued | Patent; Expiration date Feb. 9, 2024; Composition of matter patent |

| USA | 7179280 | THERMAL DEVICE | Issued | Patent; Expiration date Feb. 9, 2024; Composition of matter patent |

*These patents have been licensed to the Company by our Chief Executive Officer, Matthew Mills.

| -8- |

| Table of Contents |

The market for insecticides and related products for both business and consumer customers is highly competitive, with low barriers to entry. Existing and new competitors can easily launch products, intensifying competition. Med-X competes or may compete with large, well-resourced companies like Bayer, Ecolabs, Envincio, and Essentra, which already benefit from strong brand recognition and significant human and financial resources. The company also faces competition for readers and advertisers on its online news platform, The MJT Network®. Nature-Cide encounters intense competition from both chemical-based and all-natural pesticides, many of which have been established in the market for years, particularly in agricultural sectors like cannabis cultivation. While management believes that Med-X can compete effectively, there is no guarantee that competition will not impact the company's ability to maintain and grow its planned business operations.

Government Regulation

Med-X is subject to various federal, state, and local regulations that increase costs and potentially impact business operations. These include employment laws covering wages, safety, and working conditions; environmental laws applicable to farming; advertising regulations enforced by the Federal Trade Commission (FTC); and safety and labeling rules governed by the Food and Drug Administration (FDA).

Federal Regulations

The United States regulates cannabis primarily through the Controlled Substances Act (CSA). Marijuana, classified as a Schedule I controlled substance, is deemed to have high potential for abuse and no accepted medical use. Cannabis with THC concentrations above 0.3% is classified as marijuana, while cannabis with THC levels below 0.3% is defined as hemp. This classification conflicts with the medical and recreational use of marijuana legalized in at least 36 states and the District of Columbia, creating regulatory ambiguity. Despite these conflicts, 15 states and the District of Columbia have legalized adult-use cannabis. However, state laws remain vulnerable to legal challenges and federal enforcement under the CSA, which prohibits the possession, use, cultivation, and transfer of marijuana.

Evolving Federal Policy

In 2013, the Cole Memorandum issued by the Department of Justice (DOJ) outlined enforcement priorities for marijuana-related activities in states where it was legalized. These priorities included preventing underage sales, diversion to illegal markets, and public health issues like drugged driving. However, the Cole Memorandum was rescinded in 2018 by the Sessions Memorandum, which provided no specific marijuana enforcement guidance, leaving federal prosecutors to use their discretion.

Under the Biden administration, Attorney General Merrick Garland has suggested that prosecuting marijuana activities in compliant states is not an effective use of federal resources. However, no formal marijuana enforcement policy has been announced, leaving regulatory uncertainty.

State Regulations

Unlike Canada, which regulates cannabis federally, marijuana laws in the U.S. vary by state. Businesses must comply with state and local licensing requirements. In California, where medicinal cannabis has been legal since 1996, cannabis is now permitted for both medicinal and recreational use. Federal enforcement remains a risk until Congress amends the CSA to address marijuana's legal status. Med-X's compliance with state laws does not eliminate the risk of federal prosecution, and the lack of uniform federal guidance continues to pose challenges for the cannabis industry.

| -9- |

| Table of Contents |

California Cannabis Regulations and Federal Challenges

California’s Medicinal and Adult Use Cannabis Regulation and Safety Act (MAUCRSA) provides the framework for cannabis licensing, oversight, and enforcement. Regulations by the California Department of Cannabis Control cover licensing procedures, operational rules, product safety, packaging, and enforcement actions. Some cities and counties offer equity programs to support individuals impacted by historical drug laws, providing faster licensing, operational assistance, and financial aid. The cannabis industry faces significant regulatory challenges, with evolving laws at the local, state, and federal levels. Compliance requires substantial resources, and violations—or allegations of violations—could disrupt operations. Future regulatory changes could also impact federal tax policies, potentially limiting deductions for cannabis-related businesses. At the federal level, the Rohrabacher-Blumenauer Amendment restricts the Department of Justice (DOJ) from interfering with state-legal medical cannabis programs but requires annual renewal and expired in 2022. Proposed reforms, such as the CARERS Act to reclassify cannabis and the Respect State Marijuana Laws Act to protect state-compliant businesses, have not passed. This regulatory uncertainty creates operational risks for Med-X, but the company is committed to compliance with applicable state and local laws to mitigate these challenges.

Relevant California Regulations

The California Department of Cannabis Control makes regulations for cannabis businesses. These regulations specify:

|

| · | License application procedures; |

|

| · | Rules for running a cannabis business; |

|

| · | What can and cannot be made into a cannabis product, and what ingredients can and cannot be used; |

|

| · | Packaging requirements to prevent contamination and to inform consumers about what’s inside; |

|

| · | The testing that each product must pass before it can be sold; and |

|

| · | Enforcement actions that may be taken if a business is not following the rules. |

Equity Ordinances in California

Some cities and counties in California have ordinances for equity programs to help people negatively affected by the federal” war on drugs” policies from the 1970s and create a more inclusive marketplace. Each ordinance supports equity applicants in different ways, such as:

|

| · | Faster application processes; |

|

| · | Assistance during the licensing process; |

|

| · | Help with operating your business; and |

|

| · | Direct financial support |

Laws and regulations affecting the adult-use marijuana industry are constantly changing, which could detrimentally affect our proposed operations. Local, state, and federal adult-use marijuana laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter our business plan. In addition, violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our operations. It is also possible that regulations may be enacted in the future that will be directly applicable to our business. These ever-changing regulations could even affect federal tax policies that may make it difficult to claim tax deductions on our returns. We cannot predict the nature of any future laws, regulations, interpretations, or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

In 2014, the United States House of Representatives passed an amendment (the “Rohrabacher-Blumenauer Amendment”) to the Commerce, Justice, Science, and Related Agencies Appropriations Bill, which funds DOJ. The Rohrabacher-Blumenauer Amendment prohibits the DOJ from using funds to prevent states with medical cannabis laws from implementing such laws. In August 2016, the Ninth Circuit Court of Appeals ruled in United States v. McIntosh that the Rohrabacher-Blumenauer Amendment bars the DOJ from spending funds on the prosecution of conduct that is allowed by state legislation titled the Compassionate Access, Research Expansion, and Respect States Act (the “CARERS Act”) was introduced, proposing to allow states to regulate the medical use of cannabis by changing applicable federal law, including by reclassifying cannabis under the Controlled Substances Act to a Schedule II controlled substance and thereby changing the plant from a federally-criminalized substance to one that has recognized medical issues. More recently, the Respect State Marijuana Laws Act of 2017 has been introduced in the U.S. House of Representatives, which proposes to exclude persons who produce, possess, distribute, dispense, administer or deliver marijuana in compliance with state laws from the regulatory controls and administrative, civil and criminal penalties of the CSA. These developments previously were met with a certain amount of optimism in the cannabis industry, but, as of the date of the filing of this registration statement of which this prospectus is a part, (i) neither the CARERS Act nor the Respect State Marijuana Laws Act of 2017 have yet been adopted, and (ii) the Rohrabacher-Blumenauer Amendment, being an amendment to an appropriations Bill that must be renewed annually, has not currently been renewed beyond February 18, 2022.

| -10- |

| Table of Contents |

Regulatory Considerations

Nature-Cide products are classified as minimum risk pesticides under EPA guidelines, exempting them from registration under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). While the EPA does not regulate these products, producers are responsible for ensuring compliance with minimum risk criteria. State-level regulations, however, require product label registration. Nature-Cide products are registered in 40+ states, including California, Florida, Texas, and New York.An international distribution agreement with Ensystex, Inc. has been established for Nature-Cide products. Licensing is required on a country-by-country basis, with Ensystex managing costs and administrative processes. Licenses are expected to be obtained by mid-2024, but delays may postpone sales in international markets.

Thermal-Aid and Malibu Brands

|

| · | Thermal-Aid: Exempt from FDA registration as it functions as a heating and cooling pack. |

|

| · | Malibu Brands: Classified as a homeopathic cream, also not requiring FDA registration. |

MJT Network

The MJT Network serves as a media platform featuring cannabis-related industry content. It does not produce or sell products and is not subject to government regulations.

Employees

As of February 7, 2025, we had sixteen (16) full-time employees, five of whom are executive officers of Med-X. We plan to actively hire employees at such time as we have sufficient capital or financing to fund the expanded launch of its business plan.

Property

Effective October 15, 2020, Pacific Shore along with Med-X entered into the 1st Amendment to the Lease of 8236 Remmet Avenue Canoga Park, CA 91304 in order to extend the term of the lease for an additional five years, or until October 14, 2025. The facility is approximately 30,000 square feet of which Med-X currently occupies approximately 2,500 square feet of office space. Pacific Shore leases that space from an unaffiliated landlord pursuant to a five-year commercial lease that was renewed for an additional five years in October 2020 in an arms-length transaction. The lease is subject to an annual adjustment based upon an increase in the Consumer Price Index in the Los Angeles Area. We currently pay $29,938.00 a month for rent for this facility.

Seasonality

Our operations may be materially affected by seasonality for outdoor cultivation operations. Nature-Cide is likely to have high sales volumes during the spring and summer months when insects and pests are more likely to be present and agricultural operations are at their peak. Lower sales volumes may be experienced at other times during the year.

| -11- |

| Table of Contents |

Credit Facilities

Crestmark Bank

On November 27, 2012 the Company entered into a Loan and Security Agreement (the “Loan Agreement”) and a promissory note (the “Note”) with Crestmark Bank. The maximum amount that can be borrowed under the Promissory Note is $1,500,000. The Loan Agreement establishes the collateral and required terms for establishing a factoring of Accounts Receivable. Accounts Receivable are collected 87% up-front from Crestmark Bank, 13% collected upon customer payment, and deduction of fees by Crestmark Bank are paid as a deduction against factored amounts remitted to the Company. Interest on the outstanding balance is calculated at two (2%) percent above Prime Rate. At no time will the rate be lower than five and one quarter (5.25%) percent per annum. As of December 31, 2023 and 2022 the outstanding balance was $20,635 and $45,587 respectively.

The Loan Agreement calls for a security interest in the assets of the Company such as Accounts, Goods, Inventory, Equipment, Chattel Paper, Instruments, Investment Property, specifically identified Commercial Tort Claims, Documents, Deposit Accounts, Letter of Credit Rights, General Intangibles, Contract Rights, customer lists, furniture and fixtures, books and records and supporting obligations for any of the foregoing.

The Company also agreed to certain fees such as loan fees, late reporting fees, lockbox fees, documentation fees, maintenance fees and an exit fee.

Line of Credit Agreement

On August 6, 2022, the Company entered into a Line of Credit Agreement with two of its Executive Officers. The line of credit provides for advances as needed up to a maximum of $500,000 for working capital. The amount outstanding on the Line of Credit shall be due and payable on the earlier to occur of (a) Event of Default or (b) the effective date the Company lists on a public stock exchange or one year from the Execution Date. Events of default under the terms of the agreement include nonpayment of principal or interest, when due, subject to a five (5) day cure period; voluntary or involuntary bankruptcy or receivership or declaration of insolvency; misrepresentation in the Line of Credit agreement or documentation; material defaults under any term of the Line of Credit which has been noticed and remains uncured for thirty (30) days. As of December 31, 2023 and December 31, 2022, the Company has drawn $499,666 and $500,000, respectively against the Line of Credit Agreement and had interest payable of $2,787 and $2,744, respectively.

Corporate Information

We were formed in February 2014 in Nevada. Our subsidiaries consist of Pacific Shore Holdings, Inc., a Delaware corporation, and Pacific Shore Holdings, Inc., a California corporation. Our executive offices are located at 8236 Remmet Avenue, Canoga Park, California 91304 and our telephone number is (818) 349-2870. Our website address is www.MEDX-RX.com. Information contained on, or accessible through, our website is not a part of this offering statement.

The purchase of shares of our common stock involves substantial risks. You should carefully consider the risks described below, together with all of the other information included in this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. See “Cautionary Statement Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Offering Circular. Each prospective investor should carefully consider the following risk factors, in addition to any other risks associated with this investment and should consult with his own legal and financial advisors.

Risk Factors

Investing in the Securities involves a high degree of risk and may result in the loss of your entire investment. Before making an investment decision with respect to the Securities, The Company urges you to carefully consider the risks described in this section and other factors set forth in this offering circular. In addition to the risks specified below, the Company is subject to same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies are inherently riskier than more developed companies. Prospective Investors should consult with their legal, tax and financial advisors prior to making an investment in the Securities. The Securities should only be purchased by persons who can afford to lose all of their investment.

| -12- |

| Table of Contents |

Risks Related to the Company's Business and Industry

Med-X, Inc. has a limited operating history, which makes it difficult to accurately evaluate our business prospects.

We were formed in February 2014 to originally engage in the business of (a) publishing content about the cannabis industry, primarily online, for industry participants and the general public, (b) growing and selling cannabis on a wholesale basis, initially for the California medical cannabis market, which the Company may engage in if the federal government declares it legal to do so, (c) supplying related agricultural products to other commercial cannabis growers which the Company may already be engaged in by supplying its Nature-Cide pest control products to cannabis and hemp cultivators through the Company's national distribution venues, and (d) developing and selling commercial medicinal supplements based on beneficial compounds extracted from cannabis if the federal government declares it legal to do so. Because the federal government has not legalized marijuana and the FDA has not clarified its position with respect to CBD products, the Company has not moved forward with engaging in the CBD or marijuana businesses. We launched our cannabis news website, and commenced marketing Nature-Cide, but have not yet launched the other components of our original business plan.

The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

We may not have adequate capital to fund our business.

We will have limited capital available to us, to the extent that we raise capital from this offering. If our entire original capital is fully expended and additional costs cannot be funded from borrowings or capital from other sources, then our financial condition, results of operations, and business performance would be materially adversely affected. We may not be able to raise needed additional capital or financing due to market conditions or for regulatory or other reasons. We cannot assure that we will have adequate capital to conduct our business.

Our ability to protect our intellectual property is uncertain.

We have filed several applications with the United States Patent and Trademark Office for service marks and trademarks. While we have been granted several service marks and trademarks, we still have applications pending for other marks. We cannot assure that we will be successful in obtaining the service marks or trademarks, that these applications will not be challenged, that others will not attempt to infringe upon our marks, or that these marks will afford us any protection or competitive advantages. If we are unable to protect our rights to our trademarks or if such marks infringe on the rights of others, our business could be materially adversely affected. In addition to the Thermal-Aid patents licensed to us by our president, we currently have two patents pending with the United States Patent and Trademark Office, one related to our Nature Cide infused soil and one related to our lip balm products. We cannot assure that we will be successful in obtaining patents, that these applications will not be challenged, that others will not attempt to infringe upon our patents should they be awarded, or that these patents will afford us any protection or competitive advantages. The existing expired patents (held by Matthew Mills, our chairman, who has licensed them to us) covering Thermal-Aid may not protect us from legal challenges by competitors or infringement by third parties.

| -13- |

| Table of Contents |

We may not be able to successfully compete against companies with substantially greater resources.

The health and medical therapy, essential oils, and insecticide industries are intensely competitive, and we expect competition to intensify further in the future. We are also subject to intense competition from chemical insecticides, as well as other all-natural insect repellents utilizing cedar wood oil, which have been on the market longer than Nature-Cide and which are manufactured and marketed by competitors with more resources and brand recognition than us. We cannot assure that Nature-Cide will compete effectively and experience continuing and growing sales. As a supplier of other products, we compete with several larger and better-known companies that specialize in supplying and distributing a vast array of consumer goods to retailers. We cannot assure that we will continue to obtain supply contracts with Walmart.com, Ralphs, or from any other retailers. Barriers to entry are relatively low, and current and new competitors can launch new products that compete in the marketplace. We currently or potentially compete with a number of other companies. We face competition from a number of large health and medical therapy, essential oil, and insecticide brand name manufacturers that have greater financial and managerial resources, more experience in developing products, and greater name recognition than we have.

We may incur uninsured losses.

Although we maintain modest theft, casualty, liability, and property insurance coverage, along with workmen’s compensation and related insurance, we cannot assure that we will not incur uninsured liabilities and losses as a result of the conduct of our business. In particular, we may incur liability if Nature-Cide, Pacific Pain Relief Cream, Thermal-Aid, Home Spa Shower Spray, Energy-X, Burner Balm, or one of our other products is deemed to have caused a personal injury. Should uninsured losses occur, the holders of our common stock could lose their invested capital.

Our business is subject to various government regulations.

We are subject to various federal, state and local laws affecting therapeutic medical and insecticide products. The Federal Trade Commission, the Federal Food and Drug Administration and equivalent state agencies regulate advertising and representations made by businesses in the sale of products, which apply to us. We may be required to obtain permits from various states in order to ship certain of our products to those states. We are also subject to government laws and regulations governing health, safety, working conditions, employee relations, wrongful termination, wages, taxes and other matters applicable to businesses in general.

Cannabis is categorized under federal law as a Schedule 1 drug. Accordingly, the cultivation, production, transport, export, import, distribution, sale, marketing and use of cannabis are prohibited under federal law. Certain activities that comply with state law, such as medical cannabis in states where it has been legalized, are treated by the federal government with a non-enforcement policy under the internal guidelines of the “Cole Memorandum” published by the US Department of Justice. We may be required to obtain permits from various states in order to produce, supply and sell cannabis and certain of our other products in those states. We currently have no government permits to grow or sell cannabis in any jurisdiction. Even if cannabis is generally legalized at the federal and state government levels, commerce in cannabis is still expected to be heavily regulated and taxed, which will have a material effect on our operating results, financial condition and business performance. We expect to be required to apply for licenses in California, even though it is generally legalized in that state, and there is no assurance that those licenses will be granted to us. Furthermore, because cannabis remains illegal under federal law, banking, certain advertising, and trademark registration services, among other services, are generally not available to the cannabis industry.

We are not currently subject to direct federal, state or local regulation, or laws or regulations applicable to access to or commerce on the Internet, other than regulations applicable to businesses generally. Due to the increasing popularity and use of the Internet and other online services, and recent controversial breaches of cyber security, it is possible that a number of laws and regulations may be adopted with respect to the Internet or other online services covering issues such as user privacy, freedom of expression, pricing, content and quality of products and services, taxation, advertising, intellectual property rights and information security. Although sections of the Communications Decency Act of 1996 were held to be unconstitutional by the U.S. Supreme Court, we cannot assure that similar laws will not be proposed and adopted in the future. In addition, applicability to the Internet of existing laws governing issues such as property ownership, copyrights and other intellectual property issues, taxation, libel, obscenity and personal privacy is uncertain. The vast majority of such laws was adopted prior to the advent of the Internet and, as a result, do not contemplate or address the unique issues of the Internet and related technologies. In addition, numerous states, including the State of California in which our headquarters are located, have regulations regarding the manner in which “wholesalers/retailers” may conduct business and the liability of “wholesalers/retailers” in conducting such business. We cannot assure that any state will not attempt to impose additional regulations upon us in the future or that such imposition will not have a material adverse effect on our business, results of operations, and financial condition.

| -14- |

| Table of Contents |

Several states have also proposed legislation that would limit the uses of personal user information gathered online or require online services to establish privacy policies. The Federal Trade Commission has also settled a proceeding with one online service regarding the manner in which personal information is collected from users and provided to third parties. Changes to existing laws or the passage of new laws intended to address these issues, including some recently proposed changes, could create uncertainty in the marketplace that could reduce demand for our services or increase the cost of doing business as a result of litigation costs or increased service delivery costs, or could in some other manner have a material adverse effect on our business, results of operations, and financial condition. In addition, because our services are accessible worldwide, and we make sales of goods to users worldwide, other jurisdictions may claim that we are required to qualify to do business as a foreign corporation in a particular state or foreign country. We are qualified to do business in two states in the United States, Nevada and California, and our failure to qualify as a foreign corporation in a jurisdiction where it is required to do so could subject us to taxes and penalties for the failure to qualify, resulting in our inability to enforce contracts in such jurisdictions. Any such new legislation or regulation, or the application of laws or regulations from jurisdictions whose laws do not currently apply to our business, could have a material adverse effect on our business, results of operations, and financial condition.

We may acquire businesses, intellectual property or products, or form strategic alliances in the future, and we may not realize the benefits of such acquisitions.

We may acquire additional businesses, intellectual property or products, form strategic alliances or create joint ventures with third parties that we believe will complement or augment our existing business. If we acquire businesses with promising markets or technologies, we may not be able to realize the benefit of acquiring such businesses if we are unable to successfully integrate them with our existing operations and Company culture. We may encounter numerous difficulties in developing, manufacturing and marketing any new products resulting from a strategic alliance or acquisition. Such difficulties may delay or prevent us from realizing the expected benefits or enhancements to our business from such transaction. We cannot assure you that, following any such acquisition, we will achieve the expected synergies to justify the transaction.

Global crises such as COVID-19 can have a significant effect on The Company's business operations and revenue projections.

There is an ongoing outbreak of a novel and highly contagious form of coronavims ("COVID- 19"), which the World Health Organization declared a global pandemic on March 11, 2020. The outbreak of COVID-19 has caused a worldwide public health emergency with a substantial number of hospitalizations and deaths and has significantly adversely impacted global commercial activity and contributed to both volatility and material declines in equity and debt markets. The global impact of the outbreak is rapidly evolving, and many national, state, and local governments have reacted by instituting mandatory or voluntary quarantines, travel prohibitions and restrictions, closures or reductions of offices, businesses, schools, retail stores, restaurants, and other public venues and/or cancellations, suspensions and/or postponements of certain events and activities, including certain non-essential government and regulatory activities. Businesses are also implementing their own precautionary measures, such as voluntary closures, temporary or permanent reductions in work force, remote working arrangements and emergency contingency plans.

| -15- |

| Table of Contents |

Such measures, as well as the general uncertainty surrounding the dangers, duration, and impact of COVID-19, are creating significant disruption to supply chains and economic activity, impacting consumer confidence and contributing to significant market losses, including by having particularly adverse impacts on transportation, hospitality, healthcare, tourism, sports, entertainment and other industries dependent upon physical presence. Technological infrastructure has, and will likely continue to be, strained for so long as mandatory or voluntary quarantines are instituted, which will change, and potentially disrupt, the operations of the Company. As COVID-19 continues to spread, potential additional adverse impacts, including a global, regional or other economic recession of indeterminate duration, are increasingly likely and difficult to assess and, if the spread of COVID- 19 is prolonged, it could adversely affect many economies, global financial markets and the Company even after COVID-19 is contained.

The extent of the impact of COVID-19 on the Company's operational and financial performance will depend on many factors, all of which are highly uncertain and cannot be predicted. Those factors include the duration and scope of the resulting public health emergency; the extent of any related restrictions implemented; the impact of such public health emergency on overall supply and demand, goods and services, investor liquidity, consumer confidence and levels of economic activity; and the extent of its disruption to important global, regional and local supply chains and economic markets. The effects of the COVID-19 pandemic may materially and adversely impact the value, performance and liquidity of the Company.

In addition, COVID-19 and the resulting changes to global businesses and economies likely will adversely impact the business and operations of the Company and therefore the business and operations of the Company. Certain businesses and activities may be temporarily or permanently halted as a result of government or other quarantine measures, voluntary and precautionary restrictions on travel or meetings and other factors, including the potential adverse impact of COVID-19 on the health of key personnel.

Like most manufacturers and sellers of consumer goods, and companies that raise capital, we are subject to potential litigation.

As a manufacturer and seller of consumer goods, and a company that raises capital, we are exposed to the risk of litigation for a variety of reasons, including product liability lawsuits, employee lawsuits, commercial contract disputes, defects in supplies and products, government investigations and enforcement actions, shareholder and investor lawsuits and other legal proceedings. We cannot assure that future litigation in which we may become involved will not have a material adverse effect on our financial condition, operating results, business performance, and business reputation.

Directors and officers have limited liability.

Our bylaws provide that we will indemnify and hold harmless our officers and directors against claims arising from our activities, to the maximum extent permitted by Nevada law, and, in the case of PSH-CA, California law, and in the case of Pacific Shore, Delaware law. If we were called upon to perform under our indemnification obligations, (we have not yet signed individual separate indemnification agreements with each one of our directors and officers), then the portion of our assets expended for such purpose would reduce the amount otherwise available for our business.

If we are unable to hire, retain or motivate qualified personnel, consultants, independent contractors, and advisors, we may not be able to grow effectively.

Our performance will be largely dependent on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly qualified personnel for all areas of our organization. Competition for such qualified employees is intense. If we do not succeed in attracting excellent personnel or in retaining or motivating them, we may be unable to grow effectively. In addition, our future success will depend in large part on our ability to retain key consultants and advisors. We cannot assure that any skilled individuals will agree to become an employee, consultant, or independent contractor of the Company or Pacific Shore. Our inability to retain their services could negatively impact our business and our ability to execute our business strategy.

| -16- |

| Table of Contents |

We cannot assure that we will have the resources to repay all of our liabilities in the future.

We have liabilities and may in the future have other liabilities to affiliated or unaffiliated lenders. These liabilities represent fixed costs, which are required to be paid regardless of the level of business or profitability experienced by us. We cannot assure that we will not incur debt in the future, that we will have sufficient funds to repay our indebtedness or that we will not default on our debt, jeopardizing our business viability. Furthermore, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct our business. We often utilize purchase order financing from third party lenders when we are supplying or distributing consumer goods, which increases our costs and the risks that we may incur a default, which would harm its business reputation and financial condition. We cannot assure that we will be able to pay all of our liabilities, or that we will not experience a default on our indebtedness.

Financial projections which may be included with this Offering Circular may prove to be inaccurate.

Financial projections concerning our estimated operating results may be included with the Offering Circular. Any projections would be based on certain assumptions which could prove to be inaccurate and which would be subject to future conditions, which may be beyond our control, such as general industry conditions. We may experience unanticipated costs, or anticipated revenues may not materialize, resulting in lower operating results than forecasted. We cannot assure that the results illustrated in any financial projections will in fact be realized by us. Any financial projections would be prepared by our management and would not be examined or compiled by independent certified public accountants. Counsel to us has had no participation in the preparation or review of any financial projections prepared by us. Accordingly, neither the independent certified public accountants nor our counsel would be able to provide any level of assurance on them. We cannot assure that we will earn net profits. We cannot assure that we will be able to raise capital in this offering of common stock, or that we will have sufficient capital to fund our business operations. We cannot assure that we could obtain additional financing or capital from any source, or that such financing or capital would be available to us on terms acceptable to us.

Our bylaws may be amended by our board and our articles and bylaws may be amended by a majority vote of our shareholders.

Under the Nevada Corporations Law, a corporation’s articles of incorporation may be amended by the affirmative vote of the holders of a majority of the outstanding shares entitled to vote, and a majority of the outstanding shares of each class entitled to vote as a class, unless the certificate requires the vote of a larger percentage of shares. Our Articles of Incorporation, as amended, do not require the vote of a larger percentage of shares. As permitted under the Nevada Corporations Law, our bylaws give our board of directors the power to adopt, amend, or repeal our bylaws. Our shareholders entitled to vote have concurrent power to adopt, amend, or repeal our bylaws.

Regulatory changes and uncertainties.

The Company operates in a highly regulated industry subject to substantial change. In addition, both its labor and customer base are licensed and regulated by local, state, and federal governments. Policies may be changed for several reasons including, but not limited to economic conditions, public safety, socio-political factors, and such. As policy changes are made by regulators, there is no guarantee that the company will be able to provide services in its current form, which may place a substantial hardship on operations, causing an Investor to lose all or a portion of their investment.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company's current business plan.

In order to achieve the Company's near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If The Company is not able to raise sufficient capital in the future, it may not be able to execute its business plan, The Company's continued operations may require a significant pivot in strategy and execution, which could cause an Investor to lose all or a portion of their investment.

| -17- |

| Table of Contents |

The Company may face potential difficulties in obtaining capital.

The Company may have difficulty raising needed capital in the future as a result of, among other factors, its lack of revenue, as well as the inherent business risks associated with The Company and present and future market conditions.

The Company's success depends on the experience and skill of its management and other key personnel.

In particular, The Company is dependent on its management team. The loss of the principals or any other key personnel could harm the Company's business, financial condition, cash flow and performance. Accordingly, you should not invest in the Company unless you are willing to entrust all aspects of the management of the Company and the investment decisions they make on behalf of the Company.

Damage to The Company's reputation could negatively impact the business, financial condition and results of operations.

The Company's reputation and the quality of its brand are critical to its business success and will be critical to its success as it forms and advises new markets. Any incident that erodes confidence in the brand could significantly reduce the Company's value and damage the business. The Company may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to its interests or may be inaccurate, each of which may harm The Company's performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correct.

| -18- |

| Table of Contents |

Risks Related to the Offering

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered Offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this offering statement and the accompanying exhibits.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company's management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

The Company has the right to limit individual Investor commitment amounts based on the Company's determination of an Investor's sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company's determination of the Investor's sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company's determination and not in line with relevant investment limits set forth by the Regulation A rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company's determination.

| -19- |

| Table of Contents |

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on all the proceeds cleared of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

There is no minimum capitalization required in this offering.

We cannot assure that all or a significant number of shares of common stock will be sold in this offering. Investors’ subscription funds will be used by us as soon as they are deposited into the Company’s operating account, and no refunds will be given if an inadequate amount of money is raised from this offering to enable us to conduct our business. Management has no obligation to purchase shares of common stock. If we raise less than the entire amount that we are seeking in the offering, then we may not have sufficient capital to meet our operating requirements. We cannot assure that we could obtain additional financing or capital from any source, or that such financing or capital would be available to us on terms acceptable to us. Under such circumstances, investors in our common stock could lose their investment in us. Furthermore, investors who subscribe for shares in the earlier stages of the offering will assume a greater risk than investors who subscribe for shares later in the offering as subscriptions approach the maximum amount.

We determined the price of the shares arbitrarily.

The offering price of the shares of common stock has been determined by management, and bears no relationship to our assets, book value, potential earnings, net worth or any other recognized criteria of value. We cannot assure that price of the shares is the fair market value of the shares or that investors will earn any profit on them.

After the completion of this offering, we may be at an increased risk of securities class action litigation.

Historically, securities class action litigation has often been brought against a company following a decline in the market price of its securities. This risk is especially relevant for us because technology and new product companies have experienced significant stock price volatility in recent years. If we were to be sued, it could result in substantial costs and a diversion of management’s attention and resources, which could harm our business.

Risks Related to the Securities

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant certain restrictions. It is not currently contemplated that registration under the Securities Act or other securities laws will be affected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Although Investors will have no right to voluntarily withdraw capital from the Company or withdraw their Securities, in certain circumstances they may be forced to withdraw from the Company.