File No. 024-12607

As filed with the Securities and Exchange Commission on August 14 , 2025

PART II - INFORMATION REQUIRED IN OFFERING CIRCULAR

Preliminary Offering Circular dated August 14 , 2025

An offering statement pursuant to Regulation A relating to these securities has been filed with the United States Securities and Exchange Commission (the “SEC”). Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the SEC is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

OFFERING CIRCULAR

HNO International, Inc.

Up to 50,000,000 Shares of Common Stock Offered by the Company

Up to 333,33 4 Shares of Common Stock Offered by Selling Shareholder

By this Offering Circular, HNO International, Inc., a Nevada corporation, is offering for sale a maximum of 50,000,000 shares of its common stock (the “Company Offered Shares”) at a fixed price of $ [0.15-1.00] per share, pursuant to Tier 2 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). A minimum purchase of $10,000 of the Company Offered Shares is required in this offering; any additional purchase must be in an amount of at least $1,000. This offering is being conducted on a best-efforts basis, which means that there is no minimum number of Company Offered Shares that must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. All proceeds from sales of Company Offered Shares in this offering will become immediately available to us and may be used as they are accepted. Purchasers of the Company Offered Shares will not be entitled to a refund and could lose their entire investments.

After the qualification of this offering by the SEC, a $45,000 principal amount convertible note, plus accrued interest thereon (the “Subject Convertible Note”), will, by its terms, be eligible for conversion into shares of our common stock (the shares of our common stock issued upon conversion of the Subject Convertible Note are referred to sometimes as the “Conversion Shares” and are also referred to sometimes as the “Selling Shareholder Offered Shares”), at the election of its holder (the “Selling Shareholder”), at the offering price for all of the Offered Shares, $ [0.15-1.00] per share converted. Following each issuance of Conversion Shares, we intend to file a supplement to this Offering Circular pursuant to Rule 253(g)(2), wherein the exact number of Conversion Shares issued in payment of the Subject Convertible Note, including accrued interest thereon, will be disclosed. We will not receive any of the proceeds from the sale of the Selling Shareholder Offered Shares in this offering. A minimum purchase of $10,000 of the Selling Shareholder Offered Shares is required in this offering; any additional purchase must be in an amount of at least $1,000. We will pay all of the expenses of this offering (other than discounts and commissions payable with respect to the Selling Shareholder Offered Shares sold in the offering, if any). Our company will not be involved in any manner in the sales of the Selling Shareholder Offered Shares by the Selling Shareholders. (See “Use of Proceeds,” “Plan of Distribution” and “Selling Shareholders”).

Please see the “Risk Factors” section, beginning on page 5, for a discussion of the risks associated with a purchase of the Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares).

A post-qualification supplement that establishes the fixed offering price for the Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares) will be filed and this offering will commence within two days of its qualification by the SEC. This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering circular being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

| 1 |

Title of Class of Securities Offered and Offering Party |

Number of Offered Shares |

Price to Public |

Commissions(1) |

Proceeds to Offeror of Common Stock |

|||||||||||||

| Common Stock Offered by Our Company |

50,000,000 | (A) | $ | [0.15-1.00] | $ | -0- | $ | 50,000,000 | (2) | ||||||||

| Common Stock Offered by the Selling Shareholder |

333,33 4 | (B)(3)(4) | $ | [0.15-1.00] | $ | -0- | $ | 50,000 | (5)(6) | ||||||||

| Totals | 50,333,33 4 | $ | -0- | $ | 50,050,000 | ||||||||||||

| (A) | These securities are being qualified pursuant to subparagraph (F) of Rule 251(d)(3)(i). | ||||||||||||||||

| (B) | These securities are being qualified pursuant to subparagraph (A) of Rule 251(d)(3)(i). | ||||||||||||||||

| (1) | Our company will not pay any commissions for the sale of Company Offered Shares in this Offering. We do not intend to offer and sell the Company Offered Shares through registered broker-dealers or utilize finders. However, should we determine to employ a registered broker-dealer of finder, information as to any such broker-dealer or finder shall be disclosed in a post-qualification amendment to this Offering Circular. | ||||||||||||||||

| (2) | Does not account for payment of expenses of this offering, which are estimated to not exceed $75,000 and which include, among other expenses, legal fees, accounting costs, administrative services, Blue Sky compliance and actual out-of-pocket expenses incurred by us in selling the Company Offered Shares. We will pay all of the expenses of this offering (other than selling commissions payable with respect to the Selling Shareholder Offered Shares sold in this offering, if any), but we will not receive any of the proceeds from the sales of Selling Shareholder Offered Shares in this offering. (See “Plan of Distribution” and “Selling Shareholders”). | ||||||||||||||||

| (3) | As of the date of this Offering Circular, none of these shares of common stock has been issued. After the qualification of this offering by the SEC, the Subject Convertible Note, including accrued interest thereon, will, by its terms, be eligible for conversion into up to 333,33 4 Selling Shareholder Offered Shares, at the election of the respective Selling Shareholders, at the offering price for all of the Offered Shares, $[0.15-1.00] per share converted. Following such issuance, we intend to file a supplement to this Offering Circular pursuant to Rule 253(g)(2), wherein the exact number of shares of common stock (the Conversion Shares) issued in payment of the Subject Convertible Note, including interest accrued thereon, to be offered by the Selling Shareholder in this offering will be disclosed. (See “Use of Proceeds,” “Plan of Distribution” and “Selling Shareholders”). | ||||||||||||||||

| (4) | This number of shares was determined by adding the principal amount of the Subject Convertible Note, $ 45 ,000, and an assumed $5,000 of accrued interest thereon, then dividing that sum, $50,000, by the minimum price in the price range, $0.15, for a result of 333,33 4 shares. | ||||||||||||||||

| (5) | Because the Subject Convertible Note, including accrued interest thereon, may be converted into Conversion Shares at the offering price in this offering, this amount represents the maximum amount that the Selling Shareholder would be able to derive from the sale of all Selling Shareholder Offered Shares. | ||||||||||||||||

| (6) | We will not receive any of the proceeds from the sale of the Selling Shareholder Offered Shares in this offering. (See “Use of Proceeds” and “Selling Shareholders”). | ||||||||||||||||

There is no escrow established for the proceeds of this offering. (See “Risk Factors—Risks Related to a Purchase of Offered Shares”).

Our common stock is quoted in the over-the-counter market under the symbol “HNOI” in the OTC Pink marketplace of OTC Link. On August 14 , 2025, the closing price of our common stock was $ 0.45 per share.

Investing in the Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares) is speculative and involves substantial risks, including the superior voting rights of our outstanding shares of Series A Preferred Stock (the “Series A Preferred Stock”), which effectively preclude current and future owners of our common stock, including the Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares), from influencing any corporate decision. Each share of Series A Preferred Stock has 55 votes in all matters requiring shareholder approval.

Donald Owens, our President, Chief Executive Officer and Chairman of the Board, is the owner of all outstanding shares of our Series A Preferred Stock. As the owner of all outstanding shares of Series A Preferred Stock, Mr. Owens will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares” and “Security Ownership of Certain Beneficial Owners and Management”).

You should purchase Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares) only if you can afford a complete loss of your investment. See “Risk Factors,” beginning on page 5, for a discussion of certain risks that you should consider before purchasing any of the Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares).

THE SEC DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment in Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares).

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. (See “Plan of Distribution–State Law Exemption and Offerings to ‘Qualified Purchasers’”).

This Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Offering Circular is _______________, 2025.

| 2 |

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes, continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake to update and/or revise any forward-looking statements, whether as a result of new information, future events or otherwise, as may be required under applicable securities laws.

The following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular carefully, including the Risk Factors section and the unaudited consolidated financial statements and the notes thereto. Unless otherwise indicated, the terms we, us and our refer and relate to HNO International, Inc., a Nevada corporation.

Our Company

Our company, HNO International, Inc., was incorporated in the State of Nevada on May 2, 2005, under the name “American Bonanza Resources Limited.” On March 19, 2009, we changed our name to “Clenergen Corporation.” On August 4, 2009, we acquired Clenergen Corporation Limited (UK), a United Kingdom corporation (“Limited”), and succeeded to the business of Limited. In April 2009, Limited acquired the assets of Rootchange Limited, a biofuel and biomass research and development company. On July 8, 2020, we changed our name to Excoin Ltd. And on August 31, 2021, we changed our name to “HNO International, Inc.”

| 3 |

Our Business

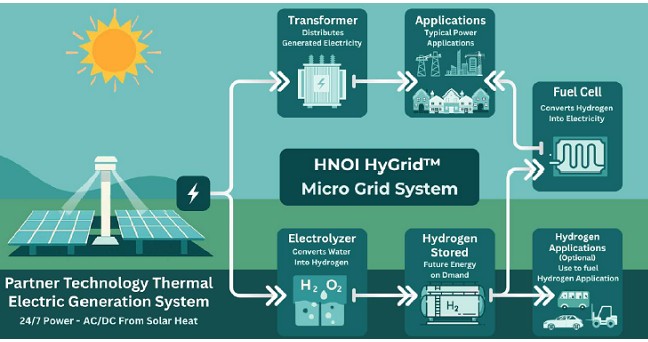

We are at the forefront of developing innovative integrated products that cater to various uses of green hydrogen, both current and future. These include:

| · | Hydrogen refueling and generation systems for Fuel Cell Electric vehicles, such as forklifts, drones, cars, and trucks, as well as for zero-emission heating and cooking applications. |

| · | Small to mid-scale green hydrogen production facilities with a capacity of 100kg/day to 5,000kg/day. These facilities can help decarbonize industrial processes and increase the use of hydrogen and hydrogen-based fuels for transportation and material handling. |

| · | Hydrogen technologies that decrease emissions and maintenance for existing gasoline and diesel internal combustion engines. This can aid companies in decarbonizing their operations in the short term. |

Please see the more extensive discussion about the current status of our products and their current respective statuses under “Business.”

Offering Summary

Securities Offered By Our Company

|

50,000,000 shares of common stock, par value $0.001 (the Company Offered Shares).

| |

| Offering Price |

$0.15-1.00 per Company Offered Share and per Selling Shareholder Offered Share.

| |

|

Shares Outstanding Before This Offering |

95,920,491 shares issued and outstanding as of the date hereof.

| |

|

Shares Outstanding After This Offering |

146,253,824 shares issued and outstanding, assuming the sale of all 50,000,000 Company Offered Shares hereunder and the issuance of all 333,33 4 Conversion Shares to the Selling Shareholder.

| |

Minimum Number of Company Offered Shares to Be Sold in This Offering |

There is no minimum number of Company Offered Shares to be sold in this offering. A minimum purchase of $10,000 of the Offered Shares, whether Company Offered Shares or Selling Shareholder Offered Shares, is required in this offering; any additional purchase must be in an amount of at least $1,000.

| |

|

Securities Offered by the Selling Shareholder |

After the qualification of this offering by the SEC, the $45,000 of principal amount Subject Convertible Note, plus accrued interest thereon, will, by its terms, be eligible for conversion into up to 333,33 4 Conversion Shares, at the election of its holder (the Selling Shareholder), at the offering price for all of the Offered Shares, $[0.15-1.00] per share converted. Following each issuance of Conversion Shares, we intend to file a supplement to this Offering Circular pursuant to Rule 253(g)(2), wherein the exact number of Conversion Shares issued in payment of the Subject Convertible Note, including accrued interest thereon, will be disclosed. We will pay all of the expenses of this offering (other than discounts and commissions payable with respect to the Selling Shareholder Offered Shares sold in the offering, if any). Our company will not be involved in any manner in the sales of the Selling Shareholder Offered Shares by the Selling Shareholders. (See “Use of Proceeds,” “Plan of Distribution” and “Selling Shareholders”).

| |

| Disparate Voting Rights |

Our outstanding shares of Series A Preferred Stock possess superior voting rights, which effectively preclude current and future owners of our common stock, including the Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares), from influencing any corporate decision. Each share of Series A Preferred Stock has 55 votes in all matters requiring shareholder approval. Currently, Donald Owens, our President, Chief Executive Officer and Chairman, is the owner of all outstanding shares of our Series A Preferred Stock. As the owner of all outstanding shares of Series A Preferred Stock, Mr. Owens will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares” and “Security Ownership of Certain Beneficial Owners and Management”).

| |

| Investor Suitability Standards |

The Offered Shares (Company Offered Shares and Selling Shareholder Offered Shares) are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). “Qualified purchasers” include: (a) “accredited investors” under Rule 501(a) of Regulation D and (b) all other investors so long as their investment in the Offered Shares (the Company Offered Shares and the Selling Shareholder Offered Shares) does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons).

| |

|

Market for Our Common Stock |

Our common stock is quoted in the over-the-counter market under the symbol “HNOI” in the OTC Pink marketplace of OTC Link.

| |

| Termination of this Offering | This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering circular being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion.

|

| 4 |

| Use of Proceeds |

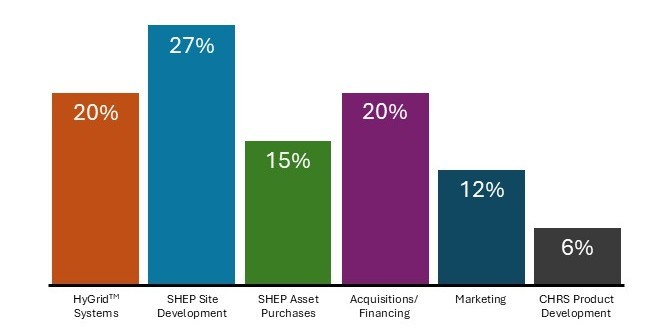

We will apply the proceeds of this offering for marketing expenses, SHEP (Scalable Hydrogen Energy Platform) asset purchases, SHEP site development, CHRS (Compact Hydrogen Refueling System) product development, acquisitions and debt payment. (See “Use of Proceeds”).

| |

| Risk Factors |

An investment in the Offered Shares (Company Offered Shares and Selling Shareholder Offered Shares) involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares (Company Offered Shares and Selling Shareholder Offered Shares).

| |

| Corporate Information | Our principal executive offices are located at 4115 Eastman Drive, Suite B, Murrieta, California 92562; our telephone number is 951-305-8872; our corporate website is located at www.hnointernational.com. No information found on our company’s website is part of this Offering Circular. |

Continuing Reporting Requirements Under Regulation A

We are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Securities Exchange Act of 1934. Our continuing reporting obligations under Regulation A are deemed to be satisfied, as long as we comply with our Section 13(a) reporting requirements.

[Note: References in this Risk Factors section to “Offered Shares” include the Company Offered Shares and the Selling Shareholder Offered Shares, unless specifically indicated otherwise.]

An investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to the other information contained in this Offering Circular, before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. (See “Cautionary Statement Regarding Forward-Looking Statements”).

Risks Related to Our Company

There is substantial doubt about the entity’s ability to continue as a going concern. Our financial statements have been prepared on a going-concern basis which assumes our company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. We incurred a net loss of $1,104,404 (unaudited) for the six months ended April 30, 2025, and, as of April 30, 2025, had an accumulated deficit of $45,430,730 (unaudited) and had a negative working capital position of $2,627,780 (unaudited). We incurred net losses of $2,230,222 and $1,927,494 for the years ended October 31, 2024 and 2023, respectively, have incurred losses since inception resulting in an accumulated deficit of $44,326,326 as of October 31, 2024, and had a negative working capital position of $1,969,965 as of October 31, 2024. We anticipate further losses in the development of our business.

The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. The Company’s ability to raise additional capital through the future issuances of debt or equity is unknown. The obtainment of additional financing, the successful development of the Company’s contemplated plan of operations, or its attainment of profitable operations are necessary for the Company to continue operations. The ability to successfully resolve these factors raises substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements of the Company do not include any adjustments that may result from the outcome of these described uncertainties.

We have had operating losses since formation and expect to continue to incur net losses for the near term. We currently have a working capital deficit and our current and projected revenues are not sufficient to fund our anticipated operating needs. We incurred a net loss of $1,104,404 (unaudited) for the six months ended April 30, 2025, and net losses of $2,230,222 and $1,927,494 for the years ended October 31, 2024 and 2023, respectively. Unless our sales increase substantially in the near future, we will continue to incur net losses in the near term, and we may never be able to achieve profitability. In order to achieve profitable operations, we need to significantly increase our revenues from the sales of our water products. We cannot be certain that our business will ever be successful or that we will generate significant revenues and become profitable. As a result, an investment in our company is highly speculative and no assurance can be given that our business model will be successful and, therefore, that our shareholders will realize any return on their investment or that they will not lose their entire investment.

In the past, we have not filed our periodic reports in a timely manner. In recent reporting periods, including for the year ended October 31, 2024, and the three months ended January 31, 2025, our company did not timely file all required periodic reports with the SEC. Our management intends to remain in compliance our filing obligations in the future. However, there is no assurance that we will be successful in this regard.

| 5 |

Should we fail to remain current in our filing obligations, investors in our common stock would be deprived of important current information concerning our company upon which to evaluate their investments, including, without limitation:

| · | our financial condition and operating results; | |

| · | our ongoing and anticipated future business operations and plans; | |

| · | changes to our management personnel; | |

| · | changes to our capital structure, including changes to shareholder voting rights; and | |

| · | transactions between our company and our affiliates. |

In addition, should we fail to remain current in our filing obligations, investors in our common stock could experience significant diminution in the value of their shares. This loss of value could be experienced in a number of ways, which include:

| · | A loss of market liquidity for our common stock due to being designated a “limited information” company by OTC Markets, as indicated by a “YIELD” or “STOP” sign on OTCMarkets.com, or being relegated to the “Expert Market” by OTC Markets. | |

| · | An inability of an investor in our common stock to sell such investor’s shares through a brokerage account, due to our company’s having been designated a "limited information" company by OTC Markets. |

In these or similar circumstances, an investor in our common stock could lose such investor’s entire investment.

We may be unable to obtain sufficient capital to implement our full plan of business. Currently, we do not have sufficient financial resources with which to establish our business strategies. There is no assurance that we will be able to obtain sources of financing, including in this offering, in order to satisfy our working capital needs.

There are risks and uncertainties encountered by under-capitalized companies. As an under-capitalized company, we are unable to offer assurance that we will be able to overcome our lack of capital, among other challenges.

In the past, we have not filed our periodic reports in a timely manner. From time to time in the past, including during 2024 and 2025, our company did not timely file all required periodic reports pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”) with the SEC. As of the date of this Offering Circular, however, we have filed all required periodic reports required by the Exchange Act with the SEC and our management intends to remain in compliance our filing obligations in the future. However, there is no assurance that we will be successful in this regard.

Should we fail to remain current in our filing obligations, investors in our common stock would be deprived of important current information concerning our company upon which to evaluate their investments, including, without limitation:

| • | our financial condition and operating results; | |

| • | our ongoing and anticipated future business operations and plans; | |

| • | changes to our management personnel; | |

| • | changes to our capital structure, including changes to shareholder voting rights; and | |

| • | transactions between our company and our affiliates. |

In addition, should we fail to remain current in our filing obligations, investors in our common stock could experience significant diminution in the value of their shares. This loss of value could be experienced in a number of ways, which include:

| • | A loss of market liquidity for our common stock due to being designated a “limited information” company by OTC Markets, as indicated by a “YIELD” or “STOP” sign on OTCMarkets.com, or being relegated permanently to the “Expert Market” by OTC Markets. | |

| • | An inability of an investor in our common stock to sell such investor’s shares through a brokerage account, due to our company’s having been designated a “limited information” company by OTC Markets. |

In these or similar circumstances, an investor in our common stock could lose such investor’s entire investment.

If we are unable to manage future expansion effectively, our business may be adversely impacted. In the future, we may experience rapid growth in our business, which could place a significant strain on our company’s infrastructure, in general, and our internal controls and other managerial, operating and financial resources, in particular. If we are unable to manage future expansion effectively, our business would be harmed. There is, of course, no assurance that we will enjoy rapid development in our business.

| 6 |

We currently depend on the efforts of our Chief Executive Officer; the loss of this person could disrupt our operations and adversely affect the development of our business. Our future success will depend, primarily, on the continued service of our Chief Executive Officer, Donald Owens. We have not entered into an employment agreement with Mr. Owens. The loss of service of Mr. Owens, for any reason, could seriously impair our ability to execute our business plan, which could have a materially adverse effect on our business and future results of operations. We have not purchased any key-man life insurance.

If we are unable to recruit and retain key personnel, our business may be harmed. If we are unable to attract and retain key personnel, our business may be harmed. Our failure to enable the effective transfer of knowledge and facilitate smooth transitions with regard to our key employees could adversely affect our long-term strategic planning and execution.

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results. The United States generally accepted accounting principles and related pronouncements, implementation guidelines and interpretations with regard to a wide variety of matters that are relevant to our business, such as, but not limited to, stock-based compensation, trade spend and promotions, and income taxes are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes to these rules or their interpretation or changes in underlying assumptions, estimates or judgments by our management could significantly change our reported results.

If we are unable to maintain effective disclosure controls and procedures and internal control over financial reporting, our stock price and investor confidence could be materially and adversely affected. We are required to maintain both disclosure controls and procedures and internal control over financial reporting that are effective. Because of their inherent limitations, internal control over financial reporting, however well designed and operated, can only provide reasonable, and not absolute, assurance that the controls will prevent or detect misstatements. Because of these and other inherent limitations of control systems, there is only the reasonable assurance that our controls will succeed in achieving their goals under all potential future conditions. The failure of controls by design deficiencies or absence of adequate controls could result in a material adverse effect on our business and financial results, which could also negatively impact our stock price and investor confidence.

Our business plan is not based on independent market studies. We have not commissioned any independent market studies with respect to the hydrogen fuel industry in which we operate. Rather, our operating plans and strategies are based on the experience, judgment and assumptions of our management. If these assumptions prove to be incorrect, we may not be successful in achieving profitability.

We will face risks relating to any future business acquisitions. We intend to acquire (including business combinations, acquisitions and dispositions of businesses, technologies, services, products and other assets, as well as strategic investments, joint ventures and alliances) businesses involved in the hydrogen fuel industry, as part of our business strategy. At any given time, we may be engaged in discussing or negotiating a range of these types of transactions. These transactions involve significant challenges and risks, including:

| · | difficulties in, and significant and unanticipated additional costs and expenses resulting from, integrating into our business the large number of personnel, operations, products, services, technology, internal controls and financial reporting of the businesses we acquire; |

| · | disruption of our ongoing business, distraction of and significant time and attention required from our management and employees and increases in our expenses; |

| · | departure of skilled professionals and proven management teams of acquired businesses, as well as the loss of established client relationships of those businesses we invest in or acquire; |

| · | for investments over which we may not obtain management and operational control, we may lack influence over the controlling partners or shareholders, or may not have aligned interests with those of our partners or other shareholders; |

| · | actual or alleged misconduct, unscrupulous business practices or non-compliance by us or any company we acquire or invest in or by its affiliates or current or former employees, whether before, during or after our acquisition or investments; |

| · | difficulties in identifying and selecting appropriate targets and strategic partners, including potential loss of opportunities for strategic transactions; and |

| · | difficulties in conducting sufficient and effective due diligence on potential targets and unforeseen or hidden liabilities or additional incidences of non-compliance, operating losses, costs and expenses that may adversely affect us following our acquisitions or investments or other strategic transactions. |

These and other risks could force us to incur significant additional expenses and allocate significant management and human resources to address any such risks. As we pursue our acquisition strategy, we will continue to face significant challenges, including unanticipated challenges, in integrating any acquired business into our existing business. We cannot assure you that we will be successful in this regard.

Expenses required to operate as a public company will reduce funds available to develop our business and could negatively affect our stock price and adversely affect our results of operations, cash flow and financial condition. Operating as a public company is more expensive than operating as a private company, including additional funds required to obtain outside assistance from legal, accounting, investor relations, or other professionals that could be more costly than planned. We may also be required to hire additional staff to comply with SEC reporting requirements. We anticipate that these costs will be approximately $100,000 annually. Our failure to comply with reporting requirements and other provisions of securities laws could negatively affect our results of operations, cash flow and financial condition.

| 7 |

Our growth depends on external sources of capital, which may not be available on favorable terms or at all. In addition, investors, banks and other financial institutions may be reluctant to enter into any lending or financial transactions with us, because we intend to enter into a mining excavation operation that could have environmental impacts if not managed properly. If any of the source of funding is unavailable to us, our growth may be limited, and our operating profit may be impaired. We may not be in a position to take advantage of attractive investment opportunities for growth if we are unable, due to global or regional economic uncertainty, changes in the provincial or federal regulatory environment relating to the extraction, processing and distribution of our products or otherwise, to access capital markets on a timely basis and on favorable terms or at all. Because we intend to grow our business, this limitation may require us to raise additional equity or incur debt at a time when it may be disadvantageous to do so.

Our access to capital will depend upon several factors over which we have little or no control, including general market conditions and the market’s perception of our current and potential future earnings. If general economic instability or downturn leads to an inability to obtain capital to finance, the operation could be negatively impacted. In addition, investors, banks and other financial institutions may be reluctant to enter into financing transactions with us, because we intend to operate a mining excavation operation. If this source of funding is unavailable to us, our growth may be limited.

Our ability to raise funding is subject to all the above factors and will also be affected by our future financial position, results of operations and cash flows. All these events would have a material adverse effect on our business, financial condition, liquidity, and results of operations.

Any future indebtedness reduces cash available for distribution and may expose us to the risk of default under debt obligations that we may incur in the future. Payments of principal and interest on borrowings that we may incur in the future may leave us with insufficient cash resources to operate the business. Our level of debt and the limitations imposed on us by debt agreements could have significant material and adverse consequences, including the following:

| · | our cash flow may be insufficient to meet our required principal and interest payments; | |

| · | we may be unable to borrow additional funds as needed or on favorable terms; | |

| · | we may be unable to refinance our indebtedness at maturity or the refinancing terms may be less favorable than the terms of our original indebtedness; | |

| · | to the extent we borrow debt that bears interest at variable rates, increases in interest rates could materially increase our interest expense; | |

| · | we may default on our obligations or violate restrictive covenants; in which case the lenders may accelerate these debt obligations; and | |

| · | default under any loan with cross default provisions could result in a default on other indebtedness. |

If any one of these events were to occur, our financial condition, results of operations, cash flow, and our ability to make distributions to our shareholders could be materially and adversely affected.

Our Board of Directors may change our policies without shareholder approval. Our policies, including any policies with respect to investments, leverage, financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegates such authority. Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders. Our Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies, which policy changes may have a material adverse effect on our financial condition and results of operations.

Risks Related to Our Business

We operate in a highly competitive industry. The climate and carbon treatment business is highly competitive and constantly changing. Our competitors include not only other large multinational companies, but also smaller entities that operate in local or regional markets as well as new forms of market participants.

Competitive challenges also arise from rapidly-evolving and new technologies in the carbon capture space, creating opportunities for new and existing competitors and a need for continued significant investment in research and development.

A number of our existing or potential competitors may have substantially greater financial, technical, and marketing resources, larger investor bases, greater name recognition, and more established relationships with their investors, and more established sources of deal flow and investment opportunities than we do. This may enable our competitors to: develop and expand their services and develop infrastructure more quickly and achieve greater scale and cost efficiencies; adapt more quickly to new or emerging markets and opportunities, strategies, techniques, technologies, and changing investor needs; take advantage of acquisitions and other market opportunities more readily; establish operations in new markets more rapidly; devote greater resources to the marketing and sale of their products and services; adopt more aggressive pricing policies; and provide clients with additional benefits at lower overall costs in order to gain market share. If our competitive advantages are not compelling or sustainable and we are not able to effectively compete with larger competitors, then we may not be able to increase or sustain cash flow.

| 8 |

Our results of operations are highly susceptible to unfavorable economic conditions. We are exposed to risks associated with weak or uncertain regional or global economic conditions and disruption in the financial markets. The global economy continues to be challenging in some markets. Uncertainty about the strength of the global economy generally, or economic conditions in certain regions or market sectors, and a degree of caution on the part of some marketers, can have an effect on the demand for advertising and marketing communication services. In addition, market conditions can be adversely affected by natural and human disruptions, such as natural disasters, severe weather events, military conflict or public health crises. Our industry can be affected more severely than other sectors by an economic downturn and can recover more slowly than the economy in general. In the past, some clients have responded to weak economic and financial conditions by reducing their marketing budgets, which include discretionary components that are easier to reduce in the short term than other operating expenses. This pattern may recur in the future. Furthermore, unexpected revenue shortfalls can result in misalignments of costs and revenues, resulting in a negative impact to our operating margins. If our business is significantly adversely affected by unfavorable economic conditions or other market disruptions that adversely affect client spending, the negative impact on our revenue could pose a challenge to our operating income and cash generation from operations.

We may be unable to successfully execute and operate our green hydrogen production projects and such projects may cost more and take longer to complete than we expect. As part of our vertical integration strategy, we are developing and constructing green hydrogen production facilities at locations across the United States and Canada. Our ability to successfully complete and operate these projects is not guaranteed. These projects will impact our ability to meet and supplement the hydrogen demands for our products and services, for both existing and prospective customers. Our hydrogen production projects are dependent, in part, upon our ability to meet our internal demand for electrolyzers required for such projects. Electrolyzer demand by external customers may concurrently affect our ability to meet the internal electrolyzer demand from our hydrogen production projects. The timing and cost to complete the construction of our hydrogen production projects are subject to a number of factors outside of our control and such projects may take longer and cost more to complete and become operational than we expect.

Furthermore, the viability and competitiveness of our green hydrogen production facilities will depend, in part, upon favorable laws, regulations, and policies related to hydrogen production. Some of these laws, regulations, policies are nascent, and there is no guarantee that they will be favorable to our projects. Additionally, our facilities will be subject to numerous and new permitting, regulations, laws, and policies, many of which might vary by jurisdiction. Hydrogen production facilities are also subject to robust competition from well-established multi-national companies in the energy industry. There is no guarantee that our hydrogen production strategy will be successful, amidst this competitive environment.

We will continue to be dependent on certain third-party key suppliers for components in our products. The failure of a supplier to develop and supply components in a timely manner or at all, or our inability to obtain substitute sources of these components on a timely basis or on terms acceptable to us, could impair our ability to manufacture our products or could increase our cost of production. We rely on certain key suppliers for critical components in our products, and there are numerous other components for our products that are sole sourced. If we fail to maintain our relationships with our suppliers or build relationships with new suppliers, or if suppliers are unable to meet our demand, we may be unable to manufacture our products, or our products may be available only at a higher cost or after a delay. In addition, to the extent that our supply partners use technology or manufacturing processes that are proprietary, we may be unable to obtain comparable components from alternative sources. Furthermore, we may become increasingly subject to domestic content sourcing requirements and Buy America preferences, as required under certain United States federal infrastructure funding sources. Domestic content preferences and Buy America requirements potential mandate that we source certain components and materials from within the United States. Conformity with these provisions potentially depends upon our ability to increasingly source components or certain materials from within the United States. An inability to meet these requirements could have a material adverse effect on our ability to successfully compete for certain projects or awards utilizing federal funds subject to such mandates.

The failure of a supplier to develop and supply components in a timely manner or at all, or to develop or supply components that meet our quality, quantity and cost requirements, or our inability to obtain substitute sources of these components on a timely basis or on terms acceptable to us, could impair our ability to manufacture our products or could increase our cost of production. If we cannot obtain substitute materials or components on a timely basis or on acceptable terms, we could be prevented from delivering our products to our customers within required timeframes. Any such delays could result in sales and installation delays, cancellations, penalty payments or loss of revenue and market share, any of which could have a material adverse effect on our business, results of operations, and financial condition.

Our products and services face intense competition. The markets for energy products, including PEM fuel cells, electrolyzers, and hydrogen production are intensely competitive. Some of our competitors are much larger than we are and may have the manufacturing, marketing and sales capabilities to complete research, development, and commercialization of profitable, commercially viable products more quickly and effectively than we can. There are many companies engaged in all areas of traditional and alternative energy generation in the United States and abroad, including, among others, major electric, oil, chemical, natural gas, battery, generator and specialized electronics firms, as well as universities, research institutions and foreign government-sponsored companies. These firms are engaged in forms of power generation such as advanced battery technologies, generator sets, fast charged technologies and other types of fuel cell technologies. Well established companies might similarly seek to expand into new types of energy products, including PEM fuel cells, electrolyzers, or hydrogen production. Additionally, some competitors may rely on other different competing technologies for fuel cells, electrolyzers, or hydrogen production. We believe our technologies have many advantages. In the near future, we expect the demand for these products – electrolyzers in particular – to largely offset any hypothetical market preference for competing technologies. However, changes in customer preferences, the marketplace, or government policies could favor competing technologies. The primary current value proposition for our fuel cell customers stems from productivity gains in using our solutions. Longer term, given evolving market dynamics and changes in alternative energy tax credits, if we are unable to successfully develop future products that are competitive with competing technologies in terms of price, reliability and longevity, customers may not buy our products. Technological advances in alternative energy products, battery systems or other fuel cell, electrolyzer, or hydrogen technologies may make our products less attractive or render them obsolete.

| 9 |

Applicable state and international laws may prevent us from maximizing our potential income. Depending on the laws of each particular State, we may not be able to fully realize our potential to generate profit. Furthermore, cities and counties are being given broad discretion to use other carbon capture methodologies. Depending on the laws of international countries and the States, we might not be able to fully realize our potential to generate profit.

Risks Related to a Purchase of the Offered Shares

Our Amended and Restated Bylaws contain an “exclusive forum” provision, which may serve to limit or discourage our shareholders, including purchasers of Company Offered Shares and Selling Shareholder Offered Shares, ability to bring a claim against our company. Our Amended and Restated Bylaws contain an exclusive forum provision (Section 9.2), as follows: “To the fullest extent permitted by law, and unless the Corporation consents in writing to the selection of an alternative forum, the Eighth Judicial District Court of Clark County, Nevada, shall, to the fullest extent permitted by law, be the sole and exclusive forum for each of the following: (a) any derivative action or proceeding brought in the name or right of the Corporation or on its behalf, (b) any action asserting a claim for breach of any fiduciary duty owed by any director, officer, employee or agent of the Corporation to the Corporation or the Corporation’s stockholders, (c) any action arising or asserting a claim arising pursuant to any provision of NRS Chapters 78 or 92A or any provision of the Articles of Incorporation or these By-laws or (d) any action asserting a claim governed by the internal affairs doctrine, including, without limitation, any action to interpret, apply, enforce or determine the validity of the Articles of Incorporation or these By-laws. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the corporation shall be deemed to have notice of and consented to the provisions of this Section 9.2. Actions arising under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, shall not be governed by this provision.”

This exclusive forum provision requires that shareholders bring claims against our company in the Eighth Judicial District Court of Clark County, Nevada, which could have the following effects: (a) increased costs of bringing a claim as compared to bringing a claim in otherwise available forums; (b) the elimination of a shareholder’s ability to bring a claim in a forum that is perceived as more favorable to shareholders; and (c) even if a claim is successful, the awarded damages may be substantially lower than would have been in otherwise available forums.

A prospective purchaser of Company Offered Shares and Selling Shareholder Offered Shares in this offering should not choose make such a purchase, unless such prospective purchaser is willing to accept the potential negative impacts of the exclusive forum provision in our Amended and Restated Bylaws.

We are selling this offering on a best-efforts basis and may be unable to sell any Company Offered Shares. This offering is being conducted on a best-efforts basis, that is, this offering is not a firm-commitment, underwritten offering. Rather, we intend to sell the Company Offered Shares through the efforts of our executive officers and directors, who will receive no commissions. There is no guarantee that our executive officers and directors or any other person will be able to sell any of the Company Offered Shares. None of our executive officers and directors has any experience conducting a best-efforts offering. (See “Plan of Distribution”).

There is no minimum offering and no person has committed to purchase any of the Company Offered Shares. We have not established a minimum offering hereunder, which means that we will be able to accept even a nominal amount of proceeds, even if such amount of proceeds is not sufficient to permit us to achieve any of our business objectives. In this regard, there is no assurance that we will sell any of the Company Offered Shares or that we will sell enough of the Company Offered Shares necessary to achieve any of our business objectives. Additionally, no person is committed to purchase any of the Company Offered Shares.

There is no escrow established for the proceeds of this offering. Because there is no escrow established for the proceeds of this offering, proceeds derived from sales of Company Offered Shares will be deposited directly into our operating account, will be available for immediate use by our company and will be immediately subject to any claims of our creditors.

The outstanding shares of our Series A Preferred Stock effectively preclude current and future owners of our common stock from influencing any corporate decision. Donald Owens, our President, Chief Executive Officer and Chairman of the Board, is the owner of 100% of the outstanding shares of our Series A Preferred Stock. Each share of Series A Preferred Stock is entitled to 55 votes on all matters requiring the approval of our shareholders. As the owner of 100% of the outstanding shares of Series A Preferred Stock, Mr. Owens will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. His ownership of all outstanding shares of our Series A Preferred Stock may also delay or prevent a future change of control of our company at a premium price, if he opposes it.

We may seek additional capital that may result in shareholder dilution or that may have rights senior to those of our common stock. From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on, among other factors, our business plans, operating performance and condition of the capital markets. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of our common stock, which could negatively affect the market price of our common stock or cause our shareholders to experience dilution.

You may never realize any economic benefit from a purchase of Offered Shares. Because the market for our common stock is volatile, there is no assurance that you will ever realize any economic benefit from your purchase of Offered Shares.

We do not intend to pay dividends on our common stock. We intend to retain earnings, if any, to provide funds for the implementation of our business strategy. We do not intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance that holders of our common stock will receive cash, stock or other dividends on their shares of our common stock, until we have funds which our Board of Directors determines can be allocated to dividends.

| 10 |

Our shares of common stock are Penny Stock, which may impair trading liquidity. Disclosure requirements pertaining to penny stocks may reduce the level of trading activity in the market for our common stock and investors may find it difficult to sell their shares. Trades of our common stock will be subject to Rule 15g-9 of the SEC, which rule imposes certain requirements on broker-dealers who sell securities subject to the rule to persons other than established customers and accredited investors. For transactions covered by the rule, broker-dealers must make a special suitability determination for purchasers of the securities and receive the purchaser's written agreement to the transaction prior to sale. The SEC also has rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation.

Our common stock is thinly traded and its market price may become highly volatile. There is currently only a limited market for our common stock. A limited market is characterized by a relatively limited number of shares in the public float, relatively low trading volume and a small number of brokerage firms acting as market makers. The market for low priced securities is generally less liquid and more volatile than securities traded on national stock markets. Wide fluctuations in market prices are not uncommon. No assurance can be given that the market for our common stock will continue. The price of our common stock may be subject to wide fluctuations in response to factors such as the following, some of which are beyond our control:

| · | quarterly variations in our operating results; | |

| · | operating results that vary from the expectations of investors; | |

| · | changes in expectations as to our future financial performance, including financial estimates by investors; | |

| · | reaction to our periodic filings, or presentations by executives at investor and industry conferences; | |

| · | changes in our capital structure; | |

| · | announcements of innovations or new services by us or our competitors; | |

| · | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; | |

| · | lack of success in the expansion of our business operations; | |

| · | announcements by third parties of significant claims or proceedings against our company or adverse developments in pending proceedings; | |

| · | additions or departures of key personnel; | |

| · | asset impairment; | |

| · | temporary or permanent inability to offer products or services; and | |

| · | rumors or public speculation about any of the above factors. |

The terms of this offering were determined arbitrarily. The terms of this offering were determined arbitrarily by us. The offering price for the Offered Shares does not necessarily bear any relationship to our company's assets, book value, earnings or other established criteria of valuation. Accordingly, the offering price of the Offered Shares should not be considered as an indication of any intrinsic value of such securities. (See “Dilution”).

You will suffer dilution in the net tangible book value of the Offered Shares you purchase in this offering. If you acquire any Offered Shares, you will suffer immediate dilution, due to the lower book value per share of our common stock compared to the purchase price of the Offered Shares in this offering. (See “Dilution”).

As an issuer of penny stock, the protection provided by the federal securities laws relating to forward looking statements does not apply to us. Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

[Note: References in this Ownership Dilution section to “Offered Shares” include the Company Offered Shares and the Selling Shareholder Offered Shares, unless specifically indicated otherwise.]

Dilution in net tangible book value per share to purchasers of our common stock in this offering represents the difference between the amount per share paid by purchasers of the Company Offered Shares in this offering and the net tangible book value per share immediately after completion of this offering. In this offering, dilution is attributable primarily to our negative net tangible book value per share.

If you purchase Company Offered Shares in this offering, your investment will be diluted to the extent of the difference between your purchase price per Company Offered Share and the net tangible book value of our common stock after this offering. Our net tangible book value as of April 30, 2025, was $(1,787,289) (unaudited), or $(0.02) (unaudited) per share. Net tangible book value per share is equal to total assets ($1,641,095) minus the sum of total liabilities ($3,334,888) and intangible assets ($93,496) divided by the total number of shares outstanding at April 30, 2025 (80,150,491).

| 11 |

Without taking into account issuances of shares of our common stock occurring after March 31, 2025, after deducting estimated offering expenses payable by us of $75,000, the tables below illustrate the dilution to purchasers of Company Offered Shares in this offering, on a pro forma basis, assuming 100%, 75%, 50% and 25% of the Company Offered Shares are sold at a per share price of $1.00.

| Assuming the Sale of 100% of the Company Offered Shares | ||||

| Assumed offering price per share | $ | 1.00 | ||

| Net tangible book value per share as of April 30, 2025 | $ | (0.02 | ) | |

| Increase in net tangible book value per share after giving effect to this offering | $ | 0.39 | ||

| Pro forma net tangible book value per share as of April 30, 2025 | $ | 0.37 | ||

| Dilution in net tangible book value per share to purchasers of Company Offered Shares in this offering | $ | 0.63 | ||

| Assuming the Sale of 75% of the Company Offered Shares | ||||

| Assumed offering price per share | $ | 1.00 | ||

| Net tangible book value per share as of April 30, 2025 | $ | (0.02 | ) | |

| Increase in net tangible book value per share after giving effect to this offering | $ | 0.32 | ||

| Pro forma net tangible book value per share as of April 30, 2025 | $ | 0.30 | ||

| Dilution in net tangible book value per share to purchasers of Company Offered Shares in this offering | $ | 0.70 | ||

| Assuming the Sale of 50% of the Company Offered Shares | ||||

| Assumed offering price per share | $ | 1.00 | ||

| Net tangible book value per share as of April 30, 2025 | $ | (0.02 | ) | |

| Increase in net tangible book value per share after giving effect to this offering | $ | 0.24 | ||

| Pro forma net tangible book value per share as of April 30, 2025 | $ | 0.22 | ||

| Dilution in net tangible book value per share to purchasers of Company Offered Shares in this offering | $ | 0.78 | ||

| Assuming the Sale of 25% of the Company Offered Shares | ||||

| Assumed offering price per share | $ | 1.00 | ||

| Net tangible book value per share as of April 30, 2025 | $ | (0.02 | ) | |

| Increase in net tangible book value per share after giving effect to this offering | $ | 0.13 | ||

| Pro forma net tangible book value per share as of April 30, 2025 | $ | 0.11 | ||

| Dilution in net tangible book value per share to purchasers of Company Offered Shares in this offering | $ | 0.89 | ||

The table below sets forth the estimated proceeds we would derive from this offering, assuming (1) the sale of 25%, 50%, 75% and 100% of the Company Offered Shares, (b) assuming an offering price of $1.00 per share and (c) after deducting estimated offering expenses payable by us of $75,000. There is, of course, no guaranty that we will be successful in selling any of the Company Offered Shares in this offering.

| Assumed Percentage of Company Offered Shares Sold in This Offering | ||||||||||||||||

| 25% | 50% | 75% | 100% | |||||||||||||

| Number of Offered Shares Sold | 12,500,000 | 25,000,000 | 37,500,000 | 50,000,000 | ||||||||||||

| Gross Proceeds | $ | 12,500,000 | $ | 25,000,000 | $ | 37,500,000 | $ | 50,000,000 | ||||||||

| Offering Expenses(1) | 75,000 | 75,000 | 75,000 | 75,000 | ||||||||||||

| Net Proceeds | $ | 12,425,000 | $ | 24,925,000 | $ | 37,425,000 | $ | 49,925,000 | ||||||||

(1) Offering expenses include the following items, certain of which are estimated for purposes of this table: administrative expenses, legal and accounting fees, publishing/EDGAR and Blue-Sky compliance.

The table below sets forth the proceeds we would derive from the sale of Company Offered Shares, assuming the sale of 25%, 50%, 75% and 100% of the Company Offered Shares at a per share price of $1.00, assuming the payment of no sales commissions or finder’s fees and assuming the payment of expenses associated with this offering of $75,000. There is, of course, no guaranty that we will be successful in selling any of the Company Offered Shares. All amounts set forth below are estimates.

| 12 |

Use of Proceeds for Assumed Percentage of Company Offered Shares Sold in This Offering | |||||||

| 25% | 50% | 75% | 100% | ||||

HyGridTM Systems SHEP Site Development SHEP Asset Purchases Acquisitions/Financing(1) Marketing CHRS Product Development |

$ 2,500,000 3,848,000 2,174,000 1,431,000 1,744,000 728,000 |

$ 5,000,000 7,723,000 3,361,500 3,931,000 3,494,000 1,415,500 |

$ 7,500,000 10,098,000 5,049,000 7,431,000 5,244,000 2,103,000 |

$ 10,000,000 13,473,000 7,736,500 9,931,000 5,994,000 2,790,500 | |||

| $ 12,425,000 | $ 24,925,000 | $ 37,425,000 | $ 49,925,000 | ||||

| (1) | Currently, we have not entered into any agreement, oral or written, or other understanding with respect to the acquisition of any going business and/or assets. There is no assurance that we will be able to acquire any going business and/or assets. To the extent we are unable to so-acquire a going business and/or assets, proceeds allocated for such use would be applied to HyGridTM System sales and marketing. |

| (2) | On April 7, 2025, we issued a $45,000 principal amount convertible promissory note , as amended, to Newlan Law Firm, PLLC our legal counsel, that bears interest at 8% per annum, is due on April 7, 2026, and is convertible at this holder’s election, into Conversion Shares. This convertible promissory note was issued in payment of legal services. (See “Plan of Distribution” and “Selling Shareholder”). |

We intend to apply the proceeds of this offering in the manner described below and in the approximate percentages depicted in the chart above.

| 13 |

HyGridTM Systems Our HyGridTM System is a solar/hydrogen powered micro-grid designed to provide power to a specific industrial development or residential community, for example, independent of the legacy power grid. With the proceeds of this offering allocated to this item of expenditure, we intend to establish 40 HyGridTM Systems for customers.

| |

SHEP (Scalable Hydrogen Energy Platform) Site Development SHEP is an innovative scalable, modular hydrogen energy system that efficiently produces, stores, and dispenses green hydrogen made from water. With the proceeds of this offering allocated to this item of expenditure, we intend to acquire and develop, including permitting and engineering, between 25 and 50 parcels of land for SHEP sites.

| |

SHEP Asset Purchases With the proceeds of this offering allocated to this item of expenditure, we intend to acquire the assets and equipment required for our first two 500kg/day SHEP sites.

| |

Acquisitions/Financing The proceeds of this offering allocated to this item of expenditure are intended for use in acquisitions of technologies, the establishment of strategic partnerships with hydrogen fuel industry participants and for financing hydrogen off-take agreements.

| |

Marketing With the proceeds of this offering allocated to this item of expenditure, we intend to implement a marketing strategy designed to attract customers to our SHEP sites.

| |

CHRS (Compact Hydrogen Refueling System) Product Development CHRS is a solution for rapidly deploying hydrogen production in the 50kg to 200kg per day range. It has a dispensing system that can be adapted for vehicles (trucks, buses, etc.), warehouse equipment (forklifts), or other fuel cell applications, including power generation. With the proceeds of this offering allocated to this item of expenditure, we intend to continue testing and improving of our CHRS product, as well as develop new related product lines. |

We reserve the right to change the foregoing use of proceeds, should our management believe it to be in the best interest of our company. The allocations of the proceeds of this offering presented above constitute the current estimates of our management and are based on our current plans, assumptions made with respect to our business, general economic conditions and our future revenue and expenditure estimates.

Investors are cautioned that expenditures may vary substantially from the estimates presented above. Investors must rely on the judgment of our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and the rate of our growth. We may find it necessary or advisable to use portions of the proceeds of this offering for other purposes.

In the event we do not obtain the entire offering amount hereunder, we may attempt to obtain additional funds through private offerings of our securities or by borrowing funds. Currently, we do not have any committed sources of financing.

In General

Our company is offering a maximum of 50,000,000 Company Offered Shares on a best-efforts basis, at a fixed price of $[0.15-1.00] per Company Offered Share; any funds derived from this offering will be immediately available to us for our use. There will be no refunds. This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion.

In addition, the Selling Shareholder is offering up to 333,33 4 Selling Shareholder Offered Shares. We will not receive any of the proceeds from the sale of the Selling Shareholder Offered Shares in this offering. We will pay all of the expenses of the offering (other than the discounts and commissions payable with respect to the Selling Shareholder Offered Shares sold in the offering). Our company will not be involved in any manner in the sales of the Selling Shareholder Offered Shares by the Selling Shareholder. (See “Selling Shareholder”).

Beyond the $10,000 minimum subscription amount described below, there is no minimum number of Company Offered Shares that we are required to sell in this offering. All funds derived by us from this offering will be immediately available for use by us, in accordance with the uses set forth in the Use of Proceeds section of this Offering Circular. No funds will be placed in an escrow account during the offering period and no funds will be returned, once an investor’s subscription agreement has been accepted by us.

| 14 |

We intend to sell the Company Offered Shares in this offering through the efforts of our Chief Executive Officer, Donald Owens. Mr. Owens will not receive any compensation for offering or selling the Offered Shares. We believe that Mr. Owens is exempt from registration as a broker-dealers under the provisions of Rule 3a4-1 promulgated under the Exchange Act. In particular, Mr. Owens:

| · | is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities Act; and | |

| · | is not to be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and | |

| · | is not an associated person of a broker or dealer; and | |

| · | meets the conditions of the following: | |

| · | primarily performs, and will perform at the end of this offering, substantial duties for us or on our behalf otherwise than in connection with transactions in securities; and | |

| · | was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months; and | |

| · | did not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraphs (a)(4)(i) or (iii) of Rule 3a4-1 under the Exchange Act. |

As of the date of this Offering Circular, we have not entered into any agreements with selling agents for the sale of the Company Offered Shares. However, we reserve the right to engage FINRA-member broker-dealers. In the event we engage FINRA-member broker-dealers, we expect to pay sales commissions of up to 8.0% of the gross offering proceeds from their sales of the Company Offered Shares. In connection with our appointment of a selling broker-dealer, we intend to enter into a standard selling agent agreement with the broker-dealer pursuant to which the broker-dealer would act as our non-exclusive sales agent in consideration of our payment of commissions of up to 8.0% on the sale of Offered Shares effected by the broker-dealer. Should we so-engage a FINRA-member broker-dealer, we shall file a post-qualification amendment to the Offering Statement of which this Offering Circular forms a part, to disclose the identity of such broker-dealer and to file our agreement with each such broker-dealer.