PART II

|

|

|

Dakota Real Estate Investment Trust |

|

|

|

|

|

|

|

OFFERING CIRCULAR UNDER REGULATION A

671,140 Class A Voting Shares and 671,140 Class B Non-Voting Shares Offered at:

· $14.90 for new investments and · $13.41 under the Dividend Reinvestment Plan |

The Dakota Real Estate Investment Trust (the “Trust”) is a business trust organized under the laws of North Dakota. Our principal place of business is 3003 32nd Avenue South, Suite 250, Fargo, North Dakota 58103, our telephone number is (701) 239-6879 and our website is www.dakotareit.com. The Trust’s assets consist of a controlling interest in DAKOTA UPREIT LIMITED PARTNERSHIP (the “UPREIT”), a North Dakota limited partnership. The UPREIT utilizes its assets to invest in real estate. The Trust is the General Partner of the UPREIT. The cash proceeds of this offering will be invested in the UPREIT, which will use the proceeds to add to the UPREIT’s working capital to be used for real estate investments. We have prepared this Offering Circular in accordance with Regulation A of the Securities and Exchange Commission.

We are offering (the “Offering”) up to 671,140 of our Class A Voting Shares (the “Class A Shares”) and up to 671,140 shares of our Class B Non-Voting (the “Class B Shares” and collectively with the Class A Shares, the “Shares”). The Shares are offered at $14.90 each; however, shareholders participating in our Dividend Reinvestment Plan may apply dividends payable to them for the purchase Shares at a price of $13.41 per share.

You should not purchase Shares if you cannot afford a complete loss of your investment. Investing in the Shares involves material risks (See “RISK FACTORS” beginning on page 3).

The offering will commence as of the date of this Circular and terminate at the earlier of sale of all of the Shares or twelve months after date of this Circular.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (“SEC”) DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF THIS OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES COMMISION OF ANY STATE NOR HAS THE ACCURACY OR ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

|

|

|

Price(1) |

|

Sales Commission(1)(2) |

|

Proceeds to Us(3) |

| |||

|

Per Share |

|

$ |

14.90 |

|

$ |

1.192 |

|

$ |

13.708 |

|

|

671,140 Class A Shares |

|

$ |

9,999,986 |

|

$ |

799,998.88 |

|

$ |

9,199,987.12 |

|

|

671,140 Class B Shares |

|

$ |

9,999,986 |

|

$ |

799,998.88 |

|

$ |

9,199,987.12 |

|

|

Total Offering |

|

$ |

19,999,972 |

|

$ |

1,599,997.76 |

|

$ |

18,399,974.24 |

|

(1) Participants in the Trust’s Dividend Reinvestment Plan may apply dividends due them to purchase Shares at the rate of one share for each $13.41of dividend converted. No commissions will be paid with respect to such issuances of such Shares.

(2) We have engaged three firms which are members of the Financial Industry Regulatory Authority to solicit subscriptions and will pay to such member firms a commission of 8% of the amounts paid by investors in the Shares solicited by such member firms. No commissions will be paid to such firms with respect to the purchases under the Dividend Reinvestment Plan. (See “PLAN OF DISTRIBUTION”)

(3) Before our estimated offering expenses of $121,000. As participants in the Dividend Reinvestment Plan may apply dividends to purchase Shares at the rate of one share for each $13.41, the maximum proceeds we may receive from the Offering will be less than the indicated proceeds as a result of participation in such plan. In 2015 and 2016, respectively we issued approximately 323,453 (250,721 Class A and 72,732 Class B) and 383,772 (256,610 Class A and 127,162 Class B) Shares under such plan. The approximately 256,610 of Class A Shares issued under the plan in 2016 represents approximately 38.2% of the Class A Shares in the Offering and the approximately 127,162 of Class B Shares issued under the plan in 2016 represents approximately 18.9% of the Class B Shares in the Offering.

The date of this Offering Circular is , 2017

WHO MAY INVEST AND MINIMUM AND MAXIMUM INVESTMENT

This Offering Circular does not constitute an offer to sell or a solicitation of an offer to buy any securities offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer.

Required Residence / Domicile to Invest This Offering is available to residents of or entities domiciled in the states of Arizona, Maryland, Minnesota, Nebraska, North Dakota or South Dakota. Individuals are residents of the state in which they maintain their principal residence. A corporation, partnership, trust or other entity is domiciled in the state where the principal office of the entity is located.

Required Income or Net Worth for New Investors to Invest The Trust will require new investors in the Trust to have either (i) a minimum annual gross income of at least $70,000 and a minimum net worth (exclusive of home, home furnishings and automobiles “Net Worth”) of $70,000 or (ii) a Net Worth of at least $250,000. Assets included in the computation of net worth are to be valued at fair market value. Gross annual income is based upon actual income an investor had during the last tax year, or is estimated to have during the current tax year.

Required Minimum Investment Investors in the Offering who or which do not hold Shares of the class being subscribed for must invest a minimum of $50,000 for the purchase of Class A Shares and $25,000 for the purchase of Class B Shares.

Limitation on Amount Invested Except with respect to purchases under the Dividend Reinvestment Plan and any purchaser who is an “accredited investor” as such term is defined by Rule 501 of the SEC, the amount invested may not exceed ten percent of an investor’s Net Worth.

Subscription Agreements to Confirm Satisfaction of Criteria To participate in the Offering, investors must complete a Subscription Agreement which will include a certification by the subscriber that they meet the residency / domicile, income / net worth and minimum investment requirements. Subscribers purchasing through broker/dealers will also confirm certain additional information regarding investment suitability standards.

The Shares are offered subject to acceptance of subscriptions, prior sale, and withdrawal or cancellation of the Offering at any time without prior notice. The Trust reserves the right to terminate the Offering of either the Class A or the Class B Shares and continue the Offering of the other class of Shares.

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully read the information in this Offering Circular and any supplements thereto. You should rely only upon the information in this Offering Circular as we have not authorized anyone to provide any different information regarding us or this offering.

Offering Statement This Offering Circular is part of an offering statement we have filed with the Securities and Exchange Commission (the “SEC”). We contemplate this being a “continuous offering” and thus we anticipate that we will prepare and distribute supplements to reflect material developments to add or change information contained in this Offering Circular. The offering statement we filed with the SEC includes exhibits that provide detailed information or documents discussed in this Offering Circular. You may access such information through the electronic data gathering, analysis and retrieval system found at https://www.sec.gov/edgar.

Cautionary Note Regarding Forward Looking Statements This Offering Circular contains forward-looking statements. All Statements other than statements of historical fact contained in this Offering Circular, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward looking-statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements are subject to risks and uncertainties, certain of which are beyond our control. Actual results could differ materially as a result of the factors described in “Risk Factors” in this Offering Circular.

The following summary is qualified in its entirety by the detailed information appearing elsewhere in this Offering Circular.

SHARES BEING OFFERED

The Trust is offering up to 671,140 Class A Shares and up to 671,140 Class B Shares of the Trust at $14.90 per Share. Provided, however, shareholders of the Trust that have chosen to reinvest their dividends to purchase Shares (See “SECURITIES BEING OFFERED — Dividend Reinvestment Plan”) may apply their dividends to purchase Shares at a price of $13.41 per share.

There is no minimum number of Shares required to be sold in this Offering; however, investors in the Offering who or which do not hold Shares of the class being subscribed for must invest a minimum of $50,000 for the purchase of Class A Shares or $25,000 for the purchase of Class B Shares.

The Trust is authorized by its Sixth Amended and Restated Declaration of Trust dated as of June 13, 2017 (the “Declaration of Trust”) to issue Class A and Class B Shares. The primary distinction between Class A and Class B Shares is that Class B Shares do not have the voting rights which the Class A Shares have. As of December 31, 2016, there were 5,787,466 Class A Shares and 1,527,330 Class B Shares outstanding.

PLAN OF DISTRIBUTION

The Trust has entered into selling agreements with Capital Financial Services, Inc. (“Capital Financial”), Gardner Financial Services, Inc. (“Gardner Financial”) and Garry Pierce Financial Services, LLP (“Pierce Financial”), each of which is a broker/dealer registered with Financial Industry Regulatory Authority (“FINRA”) under which such broker/dealers would solicit subscriptions for Shares in the Offering, other than under the Dividend Reinstatement Reinvestment Plan referred to above. Such broker/dealers would be paid an 8% commission on subscriptions they solicit which are accepted by the Trust. No commissions are to be paid with respect to issuance of Shares pursuant to the Trust’s Dividend Reinvestment Plan or with respect to subscriptions solicited by George Gaukler or Jim Knutson, respectively the President and the Executive Vice President of the Trust, for investors who do not have a relationship with a broker/dealer to the extent permitted by applicable law (See “PLAN OF DISTRIBUTION”).

THE TRUST

The Trust began business operations in 1997. The Trust is an unincorporated, but registered business trust under North Dakota law. The Trust has a term of existence consistent with North Dakota law. The Trust is the sole general partner of the UPREIT and makes all of the investment decisions of the UPREIT. The Trust will invest in properties that the Board of Trustees considers suitable investments. Properties can and may include commercial properties and multi-family residential properties, such as apartment buildings. The Trust has had no business activities other than the ownership of real estate and interests in entities owning real estate.

The Trust is registered as required by the laws of North Dakota and is structured to comply with the requirements under Internal Revenue Code Section 856 which requires that 75% of the assets of a real estate investment trust must consist of real estate assets and that 75% of its gross income must be derived from real estate. The Trust believes it qualifies as a real estate investment trust but has not received confirmation of its qualification from the Internal Revenue Service. (See “FEDERAL INCOME TAX CONSIDERATIONS”).

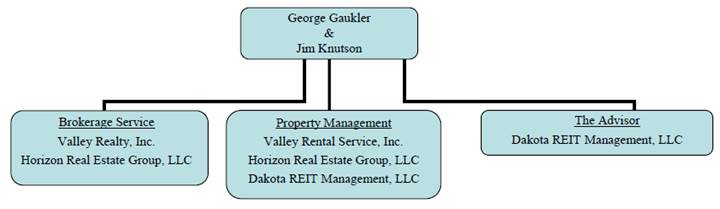

ADVISOR

The advisor of the Trust is Dakota REIT Management, LLC (the “Advisor”), which was formed for such purpose in April 2008. The Advisor manages the affairs of the Trust, subject to the review and overall control of the Board of Trustees, who may remove the Advisor without cause.

THE UPREIT

The Trust’s assets consist almost entirely of our general partnership interest in Dakota UPREIT Limited Partnership (the “UPREIT”), a North Dakota limited partnership. The UPREIT utilizes its assets to invest either directly in real estate properties or in ownership interests in entities that hold real estate properties. The Trust is the general partner of the UPREIT. The net proceeds of this Offering will be contributed to the working capital of the UPREIT and will result in an

increase in the Trust’s ownership interest in UPREIT (See “USE OF PROCEEDS”). As of December 31, 2016 our interest in the UPREIT represented an approximately 54% ownership interest with the remaining interests being held by 143 holders of limited partnership interests.

INVESTMENT OBJECTIVES

The Trust’s investment objectives are (i) to preserve, protect and return shareholder capital, (ii) provide cash dividends on a quarterly basis at the discretion of the Board of Trustees, a portion of which (due to depreciation) may not constitute current taxable income, and (iii) provide growth of capital investment through potential appreciation in the value of the Trust’s properties. There is no assurance that such objectives will be attained.

THE PROPERTIES

As of December 31, 2016, UPREIT held residential apartment projects comprising a total of 3,113 apartment units, 122 residential rental townhome units and 1,747,539 square feet of commercial rental property. Such interests are directly owned or held in an entity solely owned by UPREIT. It is anticipated that UPREIT will continue to seek to acquire properties or interests in properties involving both residential and commercial real estate (See “DESCRIPTION OF PROPERTIES”).

SUMMARY OF RISK FACTORS

Investing in this Offering involves significant risks. A more detailed listing of risk factors you should consider prior to investing in the Shares is set out in the section entitled “RISK FACTORS.”

· There is currently no trading market for our Shares and we do not anticipate one developing as a result of this Offering. While all of our currently issued and outstanding Shares were issued pursuant to exemptions from registration under the Securities Act of 1933 such that they were subject to some restrictions on a holder’s resale or other transfer of their Shares, most of the restrictions have expired. The Shares issued in this Offering will be pursuant to Regulation A of the Securities and Exchange Commission and thus are eligible for resale or transfer, but there can be no assurance that a holder will be able to identify a buyer for their Shares. In order to provide shareholders with liquidity, shareholders who have held their Shares for at least one year may request to have redeemed up to $150,000 of their Shares in any twelve month period, in accordance with the procedures of our Share Redemption Program, which involves a redemption fee of 10% of the then applicable offering price for Shares. We generally take tenders for redemption on a “first-come first-served” basis. There can be no assurance as to the funds the Board of Trustees allocate for redemption in the future, that the Share Redemption Program will remain in effect or that we will not change its terms.

· The offering prices of $14.90 for new investors and $13.41 for participants in the Dividend Reinvestment Plan has been arbitrarily determined by the Board of Trustees. The estimated book value of the Trust as of December 31, 2016 was approximately $6.78 per share. Accordingly, the offering price is substantially greater than the book value per share.

· The Trust invests in real estate and thus an investment in the Trust involves all of the risks associated with making real estate investments. In making its investments, the Trust uses substantial amounts of borrowed funds. As of December 31, 2016, we owed approximately $332,106,000 under notes secured by mortgages on our properties.

· Dakota REIT Management, LLC (the “Advisor”) acts as an advisor to the Trust under an agreement between the Advisor and the Trust. The Advisor and its affiliates will receive various fees for performing property management and other services, and the determination of such compensation has been made without the benefit of arm’s-length negotiations with the Board of Trustees (See “COMPENSATION PAID TO ADVISOR AND OTHER PROPERTY MANAGERS”).

· Members of our management or their affiliates are subject to conflicts of interest in respect to their relationships and agreements with the Trust (See “INTERESTS OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS”).

· There is no guarantee that the shareholders will receive cash dividends for their investments.

· Economic conditions, which the Trust cannot predict or control, may have a negative impact on the value of the Trust’s assets.

· The Trust will be taxed as a corporation if it fails to qualify as a REIT.

The purchase of Shares in the Offering involves various risks. Prospective investors in the Shares should carefully consider the following risks, among others, before making a decision to purchase Shares and become investors in the Trust. An investment in the Shares is speculative and involves a high degree of risk, and should be considered only by persons who can afford the loss of their entire investment.

RISKS RELATED TO INVESTING IN THE TRUST AND IN THIS OFFERING

The UPREIT Has Not Identified Properties to Acquire in the Future

The future real estate investments and properties to be acquired by the UPREIT are yet to be determined. Because future acquisitions have not been identified, the prospective investor will have no information to assist in his or her investment decision based on the identification or location of, or as to the operating histories of, or other relevant economic and financial data pertaining to, the properties to be purchased by the UPREIT with the cash proceeds from this Offering, and must rely entirely on the investment judgment of the Advisor and the Board of Trustees (See “USE OF PROCEEDS”).

The Shares Are an Illiquid Investment

There is currently no trading market for the Shares and we do not anticipate such a market will develop as a result of this Offering and we have no intention to seek to list the Shares upon any stock exchange. Without the benefit of an established public trading market, the Shares are likely to remain illiquid and not readily accepted as loan collateral. Consequently, the purchase of Shares should be considered only as a long-term investment. Furthermore, even if a market for the sale of Shares were to develop, no assurance can be given as to the value which a shareholder could receive for his or her Shares.

The Trust has no plans to liquidate. The Amended and Restated Declaration of Trust allows for a majority vote of Class A shareholders to require liquidation, but absent such a vote, the Trust is to continue until twenty-one years after the death of the last survivor of the original Board of Trustees. Accordingly, an investor in the Shares offered hereby, should not anticipate liquidity from the liquidation of the Trust.

Shareholders Must Rely on Management to Act on Their Behalf

The Advisor and the Trustees are accountable to the Trust as fiduciaries and must exercise good faith and integrity in handling Trust affairs. The Trustees have the authority to approve or disapprove all investments recommended to the UPREIT by the Advisor. The Trustees will have ultimate control over the management of the Trust and the conduct of Trust affairs, including management of the business of the UPREIT and the acquisition and disposition of the UPREIT’s assets. Shareholders have no right or power to take part in the direct management of the Trust or the UPREIT and the success of the Trust and UPREIT will depend, to a large extent, on the services and performance of the Advisor. Holders of Class A Shares will also have the right to vote regarding amendments to Declaration of Trust, most changes to the Bylaws, election of Trustees, liquidation, roll-up transactions, sale of the Trust, and the term of the Trust. Holders of Class A Shares also have the right to demand a special meeting of shareholders.

Subject to some conditions and limitations, the Declaration of Trust limits the liability of, and provides for the Trust to indemnify, the Trustees, the Advisor and their affiliates, and to provide insurance coverage and pay for all premiums thereon to protect the Board of Trustees while acting for and on behalf of the Trust (See “BOARD OF TRUSTEES, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES — Organizational Structure”).

None of the Officers appointed by the Trust or members of the Board of Trustees devote their full time and attention to the operation of the Trust. Each has their own businesses and investments, and in some instances, employment which places demands upon their available time.

RISKS RELATED TO OUR INVESTMENTS

Borrowing Risks

The UPREIT makes extensive use of borrowed funds in connection with its investments, generally seeking to maintain a level of financing equal to 75% of the appraised value of our properties. As of December 31, 2016 the mortgage notes payable were approximately $332,106,000. Use of borrowed funds permits the UPREIT to acquire additional

properties than what might otherwise have been acquired only with available cash; however, should the value of the acquired property decrease, we may owe more on the borrowing than we can realize from the operation or sale of the property.

Certain of the borrowing used to finance acquisition of properties is under longer term fixed rate arrangements, but substantial portions of our borrowing involves “balloon payments” where the loan amount is not fully amortized prior to the maturity date or periodic readjustment of the interest rates. If general borrowing conditions result in a rise in interest rate or if lenders perceive lending to us has grown in risk, we may face increased interest rates or other adverse changes to the terms under which we may borrow funds that may impair our operating results. In connection with your consideration of these risks you may wish to know that we have the following loans maturing this year and in the next two calendar years:

· Eight loans came or will be due in 2017 with an estimated principal at maturity of approximately $18,160,940;

· Eleven loans will be due in 2018 with an estimated principal at maturity of approximately $32,346,397; and

· Fourteen loans will be due in 2019 with an estimated principal at maturity of approximately $38,287,036.

Risk That Tenants Will Not Renew Their Leases

Tenants of our residential real estate typically lease their apartment or townhome for an initial term of from six to twelve months with month-to-month terms thereafter. There can be no assurance that our residential tenants will renew their leases with us at the end of the term of their lease. Opportunities for purchase of residential properties by those residing in our apartments and townhome properties and tenants relocating outside of the area due to reduced employment opportunities may affect the choice by our tenants to continue their occupancy. As well, tenants may view newer properties or those with different amenities or lower rents as attractive. In addition to loss of revenues while a residential unit is vacant, a vacancy typically results in additional operating expenses associated with preparing the unit for rental and in the marketing of the unit.

Our commercial properties are typically leased for terms from one to twenty years with options to renew the term. Of the approximately 325 leases currently in effect for the approximately 1,780,500 square feet of commercial real estate, seven for an aggregate of approximately 6,000 square feet are under month to month terms, one for 1,600 square feet of space is on a year to year term and 287 leases for an aggregate of approximately 1,305,500 square feet the scheduled through to expire in accordance with the following table:

|

Year of |

|

Number |

|

Approximate Square |

|

|

2017 |

|

45 |

|

112,250 |

|

|

2018 |

|

71 |

|

321,500 |

|

|

2019 |

|

49 |

|

205,800 |

|

|

2020 |

|

38 |

|

137,200 |

|

|

2021 |

|

44 |

|

289,000 |

|

|

2022 |

|

40 |

|

239,500 |

|

In general, commercial real estate requires additional costs to secure a new tenant or the renewal of a tenant’s lease when compared with residential real estate due to the granting of concessions to the tenant for undertaking the lease of the property. Such concessions include abatement of rent for periods of time and contributions to costs of the tenant making improvements or relocating its operations. For example, in 2015, we reimbursed Shopko Stores Operating Co. approximately $435,750 with respect to two stores they leased from us.

As well, certain commercial property may be for specialized uses that are not compatible with the needs of replacement tenants. This may cause a delay in locating a subsequent tenant or require substantial contributions to a tenant’s cost of modification of the property to meet their needs.

Our Investment in Real Estate will be Subject to General Risks Associated with Real Estate Investments

The real estate properties and interests in entities holding real estate properties invested in by the UPREIT will be subject to risks typically associated with real estate, including:

· natural disasters such as storms and floods;

· adverse changes in national, regional or local economic or real estate conditions;

· oversupply or reductions in demand for rental properties which may adversely affect renewals of leases by existing tenants (See discussion of vacancy rate increases in “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — Results of Operation”);

· uninsured or under insured casualty losses;

· unanticipated costs to maintain properties (See discussion of improvements and related matters in “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — Capital Expenditures”); and

· tenants who are unable to pay rent as agreed or who or which fail to comply with their obligations to properly use and care for the property they lease

The Trust’s Assets are not Diversified and have Limited Liquidity

Through the UPREIT, the Trust invests in real estate. All real estate investments are subject to some degree of risk. Such investments will be subject to risks such as adverse changes in general and local economic conditions or local conditions such as excessive building resulting in an oversupply of existing space or a decrease in employment reducing the demand for space. Such investments will also be subject to other factors affecting real estate values, including (i) possible federal, state or local regulations and controls affecting lending, rents, price of goods, fuel and energy consumption and prices, water, and environmental restrictions affecting new construction, (ii) increasing labor and material costs, (iii) the attractiveness of the property to tenants in the neighborhood, and (iv) state and federal income tax liability. Economic conditions, which the Trust cannot predict or control, may have a negative impact on the value of the UPREIT’s assets.

We currently own properties in the states of Iowa, Minnesota, Nebraska, North Dakota, South Dakota and Wisconsin (See “DESCRIPTION OF PROPERTIES”). As of December 31, 2016, most of our holdings were located in North Dakota (19 residential properties with 2,119 units and 19 commercial properties with 888,722 square feet of space of the total holdings of 31 residential properties with 3,235 units and 1,747,539 square feet of commercial space). Accordingly, you should view our investment in real property as concentrated within a limited geographic area.

Our real estate investments have primarily been in residential rental properties; however, we have increased our holdings of commercial real estate. Of the 1,747,539 square feet of commercial real estate held on December 31, 2016, approximately 48.3% was retail space, approximately 23.5% was industrial space and approximately 28.2% was office space.

The Trust will have very little opportunity to vary its portfolio promptly in response to changing economic, financial and investment conditions.

Significant Increases in Property Taxes Could Adversely Affect the Trust

With respect to some of our commercial real estate, we pass through to the tenant the obligation to pay property taxes assessed upon the property subject to their lease; however, most of our leases (most notably our residential leases) do not provide for such shifting of the risk of increased property taxes to the tenants. Accordingly, significant increases in property taxes payable with respect to our properties could have a material adverse effect on our operating results. Further, as a significant increase in taxes payable with respect to our properties would reduce the operating profitability, the values we may obtain from a sale of properties subject to the increased tax burden would be reduced.

Regulations and Public and Private Use Restrictions on Our Properties May Affect our Operations

Local governmental agencies may impose controls or restrictions on rental charges or otherwise adopt regulations which could have a material adverse effect upon our operations. In addition, costs of compliance with regulations such as those pertaining to environmental matters or accessibility to those with physical disabilities (such as the American with Disabilities Act) may also adversely affect our operations.

In addition to regulations, zoning and other use restrictions of local governmental agencies as well as covenants that may be established by private parties that apply to our properties. These public and private restrictions may include the types of uses that may be made with the property as well as impose operating conditions, such as numbers of required parking spaces that must be maintained based on the size of the property and the appearance (“architectural controls”) of the property.

Such taxes, regulations and controls may impair the operating profitability of our properties and thus the values we obtain from a sale of such properties would be reduced.

Real Estate Investments of the UPREIT Face Competition From Other Real Estate Properties

The results of operation of the Trust will depend upon the availability of suitable real estate investment opportunities for the UPREIT, and on the yields available from time to time on real estate and other investments, which, in turn, depends to a large extent on the type of investment involved, the condition of the money markets, the nature and geographic location of the property, and competition and other factors, none of which can be predicted with certainty. Even though the Advisor and its Affiliates have years of experience of acquiring properties suitable for investment, the UPREIT will be competing for acceptable investments with private investors and other real estate investment programs. Many of these competitors have greater experience and resources than the UPREIT.

Ownership of Real Estate Carries Risk of Uninsured Losses and Environmental Liabilities

The Trust intends to maintain what it believes to be adequate property damage, flood, fire loss and liability insurance. However, there are certain types of losses (generally of a catastrophic nature), which may be uninsurable or which may be economically unfeasible to insure. Such excluded risks may include war, earthquake, hurricane, terrorism, certain environmental hazards and floods. Should such events occur, (i) the UPREIT and the Trust might suffer a loss of capital invested, (ii) tenants of spaces may suffer losses and may be unable to pay rent for the spaces, and (iii) UPREIT and the Trust may suffer loss of profits which might be anticipated from one or more properties.

Federal law (and the laws of some states in which the UPREIT holds or may acquire properties) imposes liability on a landowner for the presence on the premises of hazardous substances or wastes (as defined by present and future federal and state laws and regulations). This liability is without regard to fault or knowledge of the presence of such substances and may be imposed jointly and severally upon all succeeding landowners. If such hazardous substances are discovered on a property owned by UPREIT, UPREIT could incur liability for the removal of the substances and the cleanup of the property. There can be no assurance that UPREIT would have effective remedies against prior owners of the property. In addition, UPREIT may be liable to tenants and may find it difficult or impossible to sell the property either prior to or following any such cleanup.

We Rely Upon Services of Property Management Companies

We engage the Advisor and various independent property management companies to manage our real estate properties (See “DESCRIPTION OF BUSINESS — ADVISOR AND PROPERTY MANAGERS”). In 2015 we paid $1,630,670 and in 2016 we paid $1,864,082 in property management fees to our property managers (including $155,998 and $169,621 to the Advisor). We also paid to the Advisor advisory management fees of $1,125,590 in 2015 and $1,364,400 in 2016 for administrative services (See “COMPENSATION PAID TO ADVISOR AND OTHER PROPERTY MANAGERS”).

While the Advisor does not act as a property manager for any other property owners, the rest of the property management companies we use do manage properties for other parties which properties will compete for tenants with our properties. While we seek to monitor the effectiveness of our property managers, there can be no assurance that owners of competing properties may receive better services than do we. While we have rights to terminate the agreements, we are also subject to termination of the property management agreements by the managers upon very limited notice.

Increases in Expenses May Reduce Cash Flow and Thus Funds Available for the Making of Dividend Payments and for Additional Acquisitions of Investments

Our net income from operations in 2016 was approximately $6.2 million and in 2015 such income was approximately $5.6 million. Such income represents income from the rental of our residential and commercial properties less the expenses from our operations and the costs of administration of the Trust. As is stated in the Statement of Cash Flows in our Consolidated Financial Statements, we paid dividends to our shareholders of $288,412 in 2016 and $1,060,605 in 2015 while the UPREIT paid distributions of $4,405,371 and $3,249,571 and we invested more than $15.4 and $3.8 million in purchasing additional properties in those years (See pages F-8 and F-9 of our Financial Statements for our Consolidated Statement of Cash Flows for 2016 and 2015).

If our operating expenses or the cost of the administration of the Trust increase without corresponding increases in our income from rental of our properties, our operating net income would decrease and our ability to continue to make the dividend and distribution payments and our ability to use cash flows from operation to invest in additional properties could be impaired. In connection with that, the amount of the cash dividends paid to shareholders by the Trust is affected by the level of participation in the Dividend Reinvestment Plan. Of the dividends declared for payment in each of 2016 and 2015, respectively, approximately 94.4% and 76.8% were satisfied by issuance of shares to shareholders that elected to participate

in the Dividend Reinvestment Plan. Under the terms of such plan, participants may revoke their election and choose to receive cash payment of their dividends. Reductions in our operating income may affect a shareholder’s determination to participate in the plan.

Delays in Connection With Construction of Improvements to Our Properties

It has been our practice to acquire properties that have been in operation rather than undertaking to build and develop properties. As such, we have had limited exposure to risks associated with uncertainties in the development of real estate properties, such as unanticipated delays in the completion of construction of the improvements due to issues with suppliers of the materials or services used in the construction of the property.

We have, however, invested in properties under development through the making of loans to or acquisition of non-controlling equity interests in a property developer constructing a property. In addition, from time to time, we engage in the renovation or improvement of our properties (See the discussion of improvements and maintenance expenditures in “MANAGEMENT’S DISCUSSION AND ANYALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” — “Capital Expenditures”).

Delays in completion of improvements to our properties may arise for a variety of reasons over which we will have no control. Such delays may result in additional costs being incurred as well as in loss of income due to the delay in completion of the improvements.

RISKS RELATED TO ADVISOR AND CONFLICTS OF INTEREST

We are Dependent on the Advisor, the Principals of which have other Business Interests

The Advisor is responsible for the day to day management of the operation of the Trust and of the UPREIT. As such, we are dependent upon the services of the Advisor. George Gaukler and Jim Knutson, who are officers of the Trust and members of the Trust’s Board of Trustees, are the owners and principal managers of the Advisor, but neither devotes their full time to the business of the Advisor (See the biographical information for Mr. Gaukler and Mr. Knutson under “BOARD OF TRUSTEES, EXECUTIVE OFFICERS AND SIGNFICANT EMPLOYEES” for information related to those other interests).

We estimate that Mr. Gaukler and Mr. Knutson devote an average of approximately 25 hours and 30 hours per week respectively in performing their functions as the principal managers of the Advisor. Such time does not include the time they devote to their duties as officers of the Trust, members of the Trust’s Board of Trustees or as principals of property management firms (Valley Rental Service, Inc. and Horizon Real Estate Group, LLC) or any other service provider to the Trust they may have an interest in (see “INTERESTS OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS”). In connection with their other business interests, Mr. Gaukler and Mr. Knutson rely upon the management teams they have in place for those companies and are not involved in the day to day operations of those other companies.

While many of the employees of the Advisor have been with the Advisor for extended periods of time, there can be no assurance that they will continue their employment or that the Advisor would be successful in retaining services of successors should existing staff no longer continue their employment. Neither the Trust nor the Advisor maintains “key person” life insurance policies on any members of the staff of the Advisor. Accordingly, in the event of the death of a key staff member of the Advisor, we and the Advisor would not receive proceeds of a life insurance policy to assist in covering costs which might be incurred in connection with securing a replacement for the loss of a deceased key staff member.

Conflicts of Interest in General

Various conflicts of interest exist — and will arise in the future — as a result of the transactions between the Trust and: (i) the Advisor; (ii) members of the Board of Trustees; or (iii) affiliates of a Trustee (See “INTERESTS OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS”). These conflicts present the risk to holders of Shares that the transactions between the Trust and such parties have not been negotiated at arm’s-length. As a consequence, agreements between related parties do not carry the indicia of fairness that a transaction negotiated between unrelated parties would have, and bear closer scrutiny by investors.

No Assurances that Transactions between the Trust and Affiliated Parties will be as Favorable to the Trust as those not with Affiliated Parties

The UPREIT has engaged in transactions with members of the Board of Trustees or their affiliates (See “COMPENSATION PAID TO ADVISOR AND OTHER PROPERTY MANAGERS — Affiliates of the Trust Participating in Service Providers” and “INTERESTS OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS” for information regarding such transactions). The transactions have included: (i) provision of property management services to the Trust; (ii) provision of real estate brokerage services to the Trust; (iii) the acquisition of real estate from such affiliates (iv) the making of loans to finance real estate developments by the affiliates; and (v) the acquisition of equity interests in entities owned or controlled by such affiliates.

While in each instance, the member of the Board of Trustees who is engaging directly or (through an affiliate) indirectly with the UPREIT is required to disclose their interest in the transaction to the Board of Trustees and, under the Declaration of Trust, by a majority vote of the Independent Trustees, it must be determined that:

· the transactions is fair and reasonable;

· the transaction involves terms no less favorable to the Trust as available in an arm’s length transaction; and

· (if property is being acquired by the Trust) the appraised value of property being acquired is at least equal to if not greater than the consideration being paid for the property by the UPREIT;

there can be no assurance that past and future transactions are not as favorable to the Trust as might have been or be obtained in a transaction with a completely independent party rather than with an affiliate of one of our Trustees.

Affiliates Managing Our Properties. Of the ten property managers we currently engage to manage our properties, five are affiliated with members of our Board of Trustees. George Gaukler and Jim Knutson are the owners of Valley Rental Services, Inc., Horizon Real Estate Group, LLC and the Advisor. Kevin Christianson is the owner of Property Resources Group, Inc. Craig Lloyd is an owner of Lloyd Property Management Company. In 2015 and 2016, we paid $1,630,670 and $1,864,082 in management fees. Of those fees, the above named management companies affiliated with Trustees (please note that since Mr. Lloyd was first elected as a Trustee in June 2017, his company was not an affiliate of a Trustee in 2015 or 2016, but the payments made to such company are set out below) were:

|

Management Company |

|

Fees in 2015 |

|

Fees in 2016 |

| ||

|

Valley Rental Service, Inc. |

|

$ |

803,307 |

|

$ |

867,979 |

|

|

Lloyd Property Management Company |

|

$ |

173,292 |

|

$ |

182,547 |

|

|

Dakota REIT Management, LLC |

|

$ |

155,998 |

|

$ |

169,621 |

|

|

Property Resources Group, LLC |

|

$ |

142,615 |

|

$ |

142,699 |

|

|

Horizon Real Estate Group, LLC |

|

$ |

83,402 |

|

$ |

87,070 |

|

Affiliates Compensated for Commercial Leasing. In 2015 and 2016, we paid commissions of $240,990 and $295,278 to real estate brokers in connection with their having participated in the long term leasing of space in our commercial properties. Three of such brokers are affiliates of current members of our Board of Trustees. They were, Lloyd Property Management (an affiliate of Craig Lloyd - who was not a Trustee until June 2017), Horizon Real Estate Group, LLC (an affiliate of George Gaukler and Jim Knutson) and Property Resources Group (an affiliate of Kevin Christianson). The fees paid to such brokers for services in leasing of space in our commercial properties in 2015 and 2016 were:

|

Real Estate Broker |

|

Fees in 2015 |

|

Fees in 2016 |

| ||

|

Lloyd Property Management |

|

$ |

81,026 |

|

$ |

81,026 |

|

|

Horizon Real Estate Group, LLC |

|

$ |

73,692 |

|

$ |

57,216 |

|

|

Property Resources Group, LLC |

|

$ |

25,347 |

|

$ |

5,544 |

|

Properties Acquired from Affiliates. Of the 70 properties we currently own, 29 (or approximately 41.4%) were acquired from a member of our Board of Trustees or from an entity owned - at least in part - by a member of our Board of Trustees (See tables listing our properties and the column indicating acquisition from a Trustee under “DESCRIPTION OF PROPERTIES” for information related to which of our properties were so acquired). In 2014, we acquired 13 properties for approximately $71.4 million (six involving approximately $28.5 million from Trustees or their affiliates). In 2015, we acquired seven properties for approximately $105.5 million (two involving approximately $53.9 million from Trustees or their affiliates). In 2016, we acquired seven properties for approximately $76.2 million (one involving approximately $6.9

million from an affiliate of a Trustee). In 2017, we have acquired two properties for approximately $21.5 million (one involving approximately $7.1 million from an affiliate of a Trustee). For information regarding the acquisitions from affiliates since 2013, see “Acquisitions from Affiliates” in “INTERESTS OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS.”

Loans to Affiliates. Since January 1, 2014, we have had outstanding three loans to affiliates of members of our Board of Trustees in connection with real estate development. We contemplate that we may continue to make such loans. In January 2013, we loaned $750,000 to Dakota Roseland Apartments I, LLLP, an affiliate of George Gaukler and Jim Knutson which was converted into equity in connection with the acquisition by the UPREIT of interests in such limited partnership in January 2014. In April 2014, we loaned $2.5 million to another affiliate of George Gaukler and Jim Knutson, Dakota Roseland Apartments IX-XII, LLLP which was also converted into membership interests in January 2017. In November 2016, we loaned $1.5 million to an affiliate of Kevin Christianson to assist in the financing of the Azool Retail Center which we acquired in January 2017.

Investment in Affiliates. We currently own interests in five limited liability companies or limited partnerships (See table in the “General Overview” section of “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” for identification of the entities and our ownership interests in them), each of which has George Gaukler as one of its other owners. Each operates apartment buildings located in Williston, North Dakota. We have invested an aggregate of $6.275 million in such entities. We also were an owner of One Oak II Limited Liability Limited Partnership and thereby had an indirect interest in another limited liability limited partnership which was developing the One Oak Place senior living facility in Fargo, North Dakota, but in August 2015, the UPREIT acquired ownership of the property for a purchase price of $45.7 million and we effectively converted our $2.5 million investment in the property into a full ownership position.

RISKS RELATED TO ECONOMIC CONDITIONS

Economic Conditions May Limit the Ability of the UPREIT to Purchase Properties or of Tenants to Pay Rent

Periods of tight credit and high interest rates may adversely affect the ability of the UPREIT to acquire or sell properties. The inability of the UPREIT to acquire new properties or to sell certain of its existing properties further constrains the Trust’s diversification and growth. During times of economic recession the ability of tenants to rent spaces from the UPREIT and timely pay rent when due may be adversely affected. This would limit the income available to the UPREIT for distribution to the Trust and, consequently, limit the Trust’s ability to make distributions to our shareholders.

There may be future shortages or increased costs of fuel, natural gas, water, or electric power, or allocations thereof by suppliers or governmental regulatory bodies in the areas where property purchased by the UPREIT is located. In the event that any such shortages, price increases or allocations occur, the financial condition of tenants of the UPREIT may be adversely affected. The Trust is unable to predict the extent, if any, to which such shortages, increased prices or allocations would influence the ability of tenants to make rent payments and the Trust to make cash distributions to shareholders.

Risk of Downturn in Real Estate Market

While we are exposed to risks of adverse development in the economy in general, the real estate market we participate may have its own adverse economic developments. Due to numerous conditions over which we will have no control, the market values of properties we own may decrease. Such decreases will adversely affect our abilities to refinance mortgage indebtedness on such properties (See footnotes to the “DESCRIPTION OF PROPERTIES” for information regarding mortgage indebtedness against our properties) which could provide significant issues for properties we have financed on terms involving “balloon payments” of the unpaid principal balance at a maturity date which occurs prior to complete payment of the debt based upon the payment schedule.

If such downturns in the real estate markets occur, we may find that we are unable to sell properties we determine to sell or, if we are able to sell a property, we may receive an amount which is less than we have invested in acquiring and operating the property. We may even find that the debt we owe at the time of sale, exceeds the amount we can obtain from a purchaser.

Risks of Disruptions in the Financial Markets

The success of our business is significantly related to general economic conditions, but in particular, we are dependent upon the condition of the banking and financial markets. Rising interest rates and the decreasing availability of

funding for real estate investments could have a materially adverse effect on our operations and on our abilities to acquire additional properties, refinance mortgage indebtedness and sell properties we hold.

Tenant Bankruptcies

Economic conditions affecting tenants leasing our properties may result in filing of bankruptcy by tenants. In particular, this may have a more significant adverse impact on our operations and financial condition with respect to our commercial real estate where the properties have fewer tenants than are associated with our residential rental real estate. In addition, we may incur legal fees and other costs in seeking to protect our interests in the event of a filing of bankruptcy by a tenant.

RISKS RELATED TO OUR STRUCTURE AND THE OFFERING

There is No Minimum Amount of Money Required to be Received in this Offering and the Sale of only a Small Portion of the Shares Will Limit the UPREIT’s Ability to Invest in New Properties

There is no assurance that the Trust will sell the maximum amount of Shares it is intending on selling at the present time. The failure to raise adequate funding could jeopardize the potential profitability of the Trust and its ability to diversify the UPREIT’s acquisitions, both geographically and by size of properties purchased. Diversification of the UPREIT’s assets provides a measure of safety, because in the event certain investments become unprofitable, the UPREIT may be able to rely on other properties to avoid operating losses. Additionally, there may be delay in the time an investor makes his or her investment and the time the UPREIT is able to identify and purchase a suitable investment. This delay may hinder the ability of the UPREIT to achieve income from a property during the time of the delay.

There is No Assurance That Shareholders Will Receive Cash Dividends or Property Appreciation

While we have had a history of paying quarterly dividends, there is no assurance as to whether cash dividends can continue to be available for distribution to shareholders (See “SECURITIES BEING OFFERED — Distribution” for dividend declared and paid since 2008). There is no assurance that the Trust will operate at a profit or that any properties acquired by the UPREIT will appreciate in value or can ever be sold at a profit. The value and marketability of the UPREIT’s properties will depend upon many factors beyond the control of the Trust or the UPREIT, and there is no assurance that there will be a ready market for the properties owned by the UPREIT since investments in real property are generally non-liquid. Operating expenses of the Trust, including certain compensation to the Advisor will be incurred and must be paid irrespective of the Trust’s profitability.

Even if the Trust operates on a profitable basis, our ability to pay cash dividends may be impaired. In each of 2015 and 2016 we declared payment of dividends of $4,577,619 and $5,191,546 compared to net cash from operating activities of $11,816,865 and $16,134,430, respectively (See “Consolidated Statement of Cash Flows” on pages F-8 and F-9). The actual net cash required to pay the dividends was substantially reduced by participation in the Dividend Reinvestment Plan (See “SECURITIES BEING OFFERED — Dividend and Distribution Reinvestment Plans”). Shareholders participating in reinvestment of their dividends may terminate such participation with minimal notice and such termination by a substantial number of the participants could require us to use cash rather than our Shares to satisfy the rights to dividends.

Further, if we were not successful in refinancing our mortgage indebtedness when the loans mature, we would need to use net operating cash flow to satisfy the “balloon payments” due at the maturities of our loans. For information regarding the amounts coming due under our mortgage indebtedness see the footnotes to the table of our “DESCRIPTION OF PROPERTIES.” In connection with your consideration of these risks you may wish to know that we have the following loans maturing this year and in the next two calendar years:

· Eight loans came or will be due in 2017 with an estimated principal at maturity of approximately $18,160,940;

· Eleven loans will be due in 2018 with an estimated principal at maturity of approximately $32,346,397; and

· Fourteen loans will be due in 2019 with an estimated principal at maturity of approximately $38,287,036.

Investments in the Trust are Subject to Dilution by Future Sales of Securities by Both the Trust and the UPREIT

Under the terms of the UPREIT Limited Partnership Agreement, the UPREIT is authorized to issue limited partnership interests in the UPREIT in exchange for real estate or interests in real estate. Such exchanges have occurred and

are expected to continue to occur during and after the Offering. We intend for the UPREIT to continue to seek contributions of property in exchange for Partnership Interests in the UPREIT. Additionally, the Trust will, continue to seek investors in this Offering and may also engage in subsequent securities offerings. These additional investments will dilute the percentage ownership interests of current investors of the Trust and investors in this Offering.

No Assurance that we will Continue our Share Redemption Plan

To provide shareholders with an opportunity for liquidity with respect to our Shares, we have offered to shareholders who have held their Shares for at least one year the right to request the redemption of up to $150,000 of their Shares each year. The redemption price has been the then current price at which the Shares are offered by the Trust for sale to new investors, subject to a redemption fee of 10%. If there is no then current public offering price for the Shares to be redeemed at the time of a requested redemption, then the Board of Trustees may establish a redemption price. It is within the discretion of the Board of Trustees as to the funds to be committed to redemption of Shares.

Consideration by the Board of Trustees of Share redemption requests will generally be made on a first-come, first-served basis. The Trust cannot guarantee that it will have sufficient available cash flow to accommodate all requests when made. If the Trust does not have such sufficient funds available, at the time when redemption is requested, the shareholder requesting redemption may (i) withdraw their request for redemption or (ii) ask that the Trust honor their request at such time, if ever, when sufficient funds become available. Such pending requests will generally be honored on a first-come, first-served basis.

Broker-Dealers Soliciting Investment in the Offering May Participate in Other Offerings

We have entered into agreements with broker-dealers to solicit subscriptions in the Offering. Our agreements with such broker-dealers do not require them to refrain from participation in offerings by other real estate investment trusts or other real estate investment programs (See “PLAN OF DISTRIBUTION”). Accordingly, there can be no assurance as to the efforts the broker-dealers we engage will devote to solicitation of subscriptions in this Offering.

RISKS RELATED TO OUR STATUS AS A REAL ESTATE INVESTMENT TRUST

The Trust May Limit Ownership of Shares in Order to Remain Qualified as a REIT

In order for the Trust to qualify as a REIT, no more than 50% of the outstanding Shares may be owned, directly or indirectly, by five or fewer individuals at any time during the last half of the Trust’s taxable year. To ensure that the Trust will not fail to qualify as a REIT under this test, the Declaration of Trust authorizes the Trustees to take such actions as may be required to preserve its qualification as a REIT, and limits any person to direct or indirect ownership of no more than a limited percentage of the outstanding Shares of the Trust. While these restrictions are designed to prevent any five individuals from owning more than 50% of the Shares, they would also make virtually impossible a change of control of the Trust. The restrictions and provisions may also (i) deter individuals and entities from making tender offers for Shares, which offers may be attractive to shareholders, or (ii) limit the opportunity for shareholders to receive a premium for their Shares in the event an investor is making purchases of Shares in order to acquire a block of Shares.

Compliance with REIT Qualification Requirements may Impair our Operations

The Declaration of Trust directs the Board of Trustees to maintain our qualification under applicable law as a REIT. It is possible that the requirements may limit the investments which may be pursued by the Trust or even require a liquidation of investments the Board of Trustees views as being attractive.

If the Trust Fails to Qualify as a Real Estate Investment Trust, the Trust and Investors May Suffer Adverse Tax Consequences. The Trust and Investors May Also Suffer Adverse Tax Consequences from Other Unanticipated Events

Although management believes that the Trust has been organized and operated to qualify as a REIT under the Code, no assurance can be given that the Trust has in fact operated or will be able to continue to operate in a manner to qualify or remain so qualified. Qualification as a REIT involves the application of highly technical and complex Code provisions for which there are only limited judicial or administrative interpretations, and the determination of various factual matters and circumstances not entirely within the Trust’s control (See — “Requirements for Qualification — General,”

“Income Tests,” “Asset Tests” and “Annual Distribution Requirements” under “FEDERAL INCOME TAX CONSIDERATIONS”). For example, in order to qualify as a REIT: the Trust must be owned by at least 100 or more persons; at least 95% of the Trust’s taxable gross income in any year must be derived from qualifying sources; the Trust must make distributions to shareholders aggregating annually at least 90% of its REIT taxable income (excluding net capital gains); and at least 75% of our assets must be “real estate assets,” cash or U.S. government securities. To the extent we fail these requirements, unless certain relief provisions apply, we may have a loss of our status. Such a loss could have a material adverse effect on the Trust and its ability to make distributions to you and to pay amounts due on its debt. Additionally, to the extent UPREIT was determined to be taxable as a corporation, the Trust would not qualify as a REIT, which could have a material adverse effect on the Trust and its ability to make distributions to you and to pay amounts due on its debt. Finally, no assurance can be given that new legislation, new regulations, administrative interpretations or court decisions will not change the tax laws with respect to qualification as a REIT or the federal income tax consequences of such qualification.

If the Trust fails to qualify as a REIT, it will be subject to federal income tax (including any applicable alternative minimum tax) on its taxable income at corporate rates, which would likely have a material adverse effect on the Trust and its ability to make distributions to shareholders and to pay amounts due on its debt. In addition, unless entitled to relief under certain statutory provisions, the Trust would also be disqualified from treatment as a REIT for the four taxable years following the year during which qualification is lost. This treatment would reduce funds available for investment or distributions to shareholders because of the additional tax liability to the Trust for the year or years involved. In addition, the Trust would no longer be required to make distributions to shareholders. To the extent that distributions to shareholders would have been made in anticipation of qualifying as a REIT, the Trust might be required to borrow funds or to liquidate certain investments to pay the applicable tax.

For a further discussion of income tax issues, see “FEDERAL INCOME TAX CONSIDERATIONS.”

This Offering is being made under Regulation A of the SEC and pursuant to registration of the offer and issuance of the Shares with the securities administrators for the states of Arizona, Maryland, Minnesota, Nebraska, North Dakota and South Dakota. With respect to Arizona, Maryland, Nebraska and South Dakota, there is a limitation on the number of Shares which may be sold to investors who reside or are domiciled in those states and the Trust may need to decline to accept subscriptions if it would exceed the number of Shares for which an effective registration has been issued.

Investors in the Offering who or which do not hold Shares of the class being subscribed for must invest a minimum of $50,000 for the purchase of Class A Shares and $25,000 for the purchase of Class B Shares. Proceeds may be used or invested immediately by the Trust and will not be placed in an escrow account. Such minimum purchase levels will not, however, be applied to shareholders acquiring Shares under the Trust’s Dividend Reinvestment Plan. The Trust reserves the right to accept a subscription for less than the amount subscribed for.

This Offering will end on the earlier of one year from the date of this Offering Circular or when all the Shares have been sold. We may, however, elect to terminate the offering of either or both of the Class A or Class B Shares. The Shares are offered on an “any or all” basis. There is no minimum level of Shares which must be sold in connection with the Offering.

The Trust will directly, without the engagement of broker/dealers, offer Shares in this Offering under the Trust’s Dividend Reinvestment Plan (See “SECURITIES BEING OFFERED — Dividend Reinvestment Plan”). Under such reinvestment plan, participants may elect to purchase Shares with dividends payable to them by the Trust.

The Trust has entered into selling agreements with Capital Financial Services, Inc. (“Capital Financial”), Gardner Financial Services, Inc. (“Gardner Financial”) and Garry Pierce Financial Services, LLP (“Pierce Financial”), each of which is a broker/dealer registered with FINRA. Such broker/dealers would be paid an 8% commission on subscriptions they solicit from investors who purchase their Shares at the $14.90 offering price upon acceptance of the subscription by the Trust. We have engaged Intuition, Inc. of Henderson, Nevada to prepare a “due diligence investigation” with respect to the Offering and to issue a report to each of the broker-dealers participating in the offering. The cost of such investigation was $10,500 and we have also paid to Capital Financial a due diligence fee of $750. Other than the 8% commission, the $10,500 we paid to Intuition, Inc. and the $750 we paid to Capital Financial, no additional compensation will be paid to such participating broker/dealers nor will any expense of such participating broker/dealers be paid by the Trust. We will not engage broker/dealers to solicit participation in our Dividend Reinvestment Plan.

To the extent the Trust receives expressions from current shareholders, limited partners in the UPREIT or from others who do not have a relationship with a broker/dealer which has entered into a selling agreement with the Trust of interest to acquire Shares; George Gaukler or Jim Knutson, respectively, the President and the Executive Vice President of the Trust, may solicit those expressing interest in acquiring Shares to subscribe. Mr. Gaukler and Mr. Knutson will receive no additional compensation for such solicitation efforts. To the extent, however, the laws and regulations of the state of residence or domicile of the investor will not permit Mr. Gaukler or Mr. Knutson to engage in such activities, then they will not solicit such investment.

Investors, in the Offering, other than pursuant to the Trust’s Dividend Reinvestment Plan, are required to complete a Subscription Agreement in the form provided for that purpose by the Trust. The Trust will require new investors in the Trust to have either (i) a minimum annual gross income of at least $70,000 and a minimum net worth (exclusive of home, home furnishings and automobiles, a “Net Worth”) of $70,000 or (ii) a Net Worth of at least $250,000. Assets included in the computation of Net Worth are to be valued at fair market value. Gross annual income is based upon actual income an investor had during the last tax year, or is estimated to have during the current tax year.

Except with respect to purchases under the Dividend Reinvestment Plan and any purchaser who is an “accredited investor” as such term is defined by Rule 501 of the SEC, the amount invested may not exceed ten percent of an investor’s Net Worth. An individual is an “accredited investor” under the SEC’s Rule 501if he or she, alone or with their spouse has a net worth of more than $1,000,000 (exclusive of the value of the person’s primary residence) or who has, without the income of the person’s spouse, an annual income of more than $200,000 in each of the last two years and an expectation of such level of income in the current year, or a joint income with their spouse for such periods in excess of $300,000. For an entity to be an “accredited investor” it must have all of its owners be accredited investors or not have been formed to invest in the Offering and have total assets in excess of $5,000,000.

In addition to the income and or net worth requirements contemplated by the Subscription Agreements discussed above, the representative of the broker/dealer and Mr. Gaukler or Mr. Knutson (if applicable) soliciting a subscription in the Offering are to confirm that:

· the investment is suitable for the investor based on the investor’s overall investment objectives;

· the investor is able to bear the risks of making the investment;

· the investor understands the lack of liquidity of the investment, the risks associated with making the investment, including the risk of loss of the entire amount invested, and the tax consequences of investing in a REIT;

The party making the solicitation may have additional requirements it applies as a condition to solicitation of an investment related to having information related to the investor for purposes of confirming the foregoing matters.

After payment of costs of this Offering and certain administrative expenses of the Trust, the cash proceeds received by the Trust from the sale of Shares will be contributed by the Trust to the UPREIT and result in an increase in the ownership by the Trust of the UPREIT. The Trust will control the UPREIT’s use of the funds and we intend to use the funds to acquire additional real estate properties; however, we have not identified any specific real estate or real estate investments to be acquired with the proceeds of this Offering at this time. Pending application by the UPREIT in connection with its real estate investment activities, the funds will be applied to reduce outstanding balances on our lines of credit or be invested in short-term deposits at banks.

As of the date of this Offering Circular, we have not identified any specific property or properties we will seek to acquire with the net cash proceeds of the Offering. Acquisitions and investments by the UPREIT will be determined by the Board of Trustees of the Trust and we anticipate that we will continue our ongoing efforts to use capital from the issuance of Shares and proceeds from borrowings to invest in real estate (See “DESCRIPTION OF BUSINESS — Investment Policies and Objectives of the Trust”).

We have invested in a variety of types of properties (See “DESCRIPTION OF PROPERTIES”) and our more recent acquisitions may serve as a guide to the types of investments we may make. The following table identifies the dollar amount of our acquisitions in each of 2012 through 2016 and the number and the totals of expenditures in each year to acquire properties and the number and amounts expended for either commercial or residential properties (please note, however, that the $21,550,000 acquisition of the Donegal Centre and the Donegal Pointe Apartments was in a single transaction involving a 153 unit apartment complex and the three story Donegal Centre involving 17,354 feet of commercial space on the first floor of the property and 38 apartment units and the second and third floor and we have deemed 100% of the acquisition as being of residential properties).

|

|

|

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

|

Total Acquisitions |

|

6 Properties |

|

8 Properties |

|

17 Properties |

|

7 Properties |

|

8 Properties |

|

|

|

|

$31,830,000 |

|

$39,728,500 |

|

$60,420,557 |

|

$91,054,633 |

|

$92,575,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Properties |

|

2 Properties |

|

4 Properties |

|

4 Properties |

|

1 Property |

|

7 Properties |

|

|

|

|

$3,020,000 |

|

$17,288,500 |

|

$17,425,000 |

|

$4,500,000 |

|

$85,675,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential Properties |

|

4 Properties |

|

4 Properties |

|

13 Properties |

|

6 Properties |

|

1 Property |

|

|

|

|

$28,810,000 |

|

$22,440,000 |

|

$42,995,557 |

|

$86,554,633 |

|

$6,900,000 |

|

It is difficult to estimate the net cash proceeds we will receive from the Offering as there is no minimum level of subscriptions that must be received as a condition to our accepting subscriptions in this Offering and Shares sold under the Trust’s Dividend Reinvestment Plan will reduce the Shares we may sell at $14.90 per share and we anticipate that a substantial portion of the Shares in this Offering will be issued under the reinvestment plans and not for cash payments of $14.90 per share (See “SECURITIES BEING OFFERED — Dividend and Distribution Reinvestment Plans”).

Further, we will incur certain expenses in connection with the Offering. The 8% commissions we may pay to participating broker/dealers will effectively reduce the proceeds we receive from sale of Shares at $14.90 to $13.708 per share. We also will incur or have incurred approximately:

· $10,500 in costs of obtaining a “due diligence” investigation report by an independent analyst to be provided to participating broker/dealers in connection with their participation in this offer and $750 to Capital Financial as its own due diligence fee;

· $10,000 in fees for having our auditors review the Offering Circular;

· $11,000 in filing fees paid to the various state regulators of the offer and sale of securities, and FINRA (which requires its review of the terms and arrangements for its member firm’s participation in public offerings of securities);

· $24,000 in costs of printing and distributing this Offering Circular; and

· $65,000 in fees for legal counsel in assisting us in the preparation of this Offering Circular and filing the Offering Statement with the SEC, various state regulators and FINRA’s Corporate Finance Division of the offer and sale of securities.

For purposes of estimating the potential net cash proceeds we may receive from the Offering, we assume that 400,000 of the 1,342,280 Shares (671,140 of Class A and an additional 671,140 of Class B) will be applied to fulfilling issuances to shareholders who elect to participate in the Dividend Reinvestment Plan. Accordingly, we are assuming for

purposes of estimating the potential net cash proceeds only 942,280 of the 1,342,280 total combined number of Shares in the Offering will be available for sale at the $14.90 offering price. We base this assumption on the 323,453 Shares (250,721 Class A and 72,732 Class B) and 383,772 Shares (256,610 Class A and 127,162 Class B) issued under our Dividend Reinvestment Plan in 2015 and 2016, respectively. The tables below then assumes, in the alternative, sales of one-third, one-half and all of such remaining Shares at the $14.90 price and that the 8% commission payable to participating broker-dealers are paid with respect to such sales:

|

|

|

Assuming Sale of |

|

Assuming Sale of |

|

Assuming Sale of |

| |||

|

Gross Proceeds |

|

$ |

4,679,985.70 |

|

$ |

7,019,986.00 |

|

$ |

14,039,986.90 |

|

|

Less 8% Commission |

|

(374,398.86 |

) |

(561,598.88 |

) |

(1,123,198.95 |

) | |||

|

Less Other Offering Expenses |

|

(121,250.00 |

) |

(121,250.00 |

) |

(121,250.00 |

) | |||

|

Potential Net Proceeds |

|

$ |

4,211,336.84 |

|

$ |

6,337,137.12 |

|

$ |

12,795,537.95 |

|

As noted above, however, there is no minimum level of subscriptions which must be tendered for us to accept subscriptions in the Offering. Thus, there is no assurance that we will sell the one third of the remaining Shares after reserving Shares for issuance under the Dividend Reinvestment Plan.

Should we be able to secure mortgage financing of 75% of the acquisition cost of properties (as has been our practice in the past See “DESCRIPTION OF BUSINESS — Investment Policies and Objectives of the Trust”), the foregoing net cash proceeds would permit the acquisition of from approximately $16.8 million to $51.2 million in additional properties. Further, in our acquisition of properties, we have had instances where the UPREIT has issued limited partnership interests to certain of the parties selling their interest in an entity owning property we are acquiring which would reduce the level of cash necessary to make an acquisition and thereby increase the assets which may be acquired with the net cash proceeds of this Offering.

THE TRUST

The Trust is an unincorporated registered business trust under the laws of North Dakota and is set up to meet the requirements under Internal Revenue Code Section 856 as a real estate investment trust (a “REIT”). Internal Revenue Code Section 856 requires that 75% of the assets of a REIT, either directly or indirectly, must consist of real estate assets and that 75% of its gross income must be derived from real estate. As a REIT, the Trust is generally not subject to U.S. federal corporate income tax on its net taxable income that is distributed to the shareholders of the Trust.